Coinbase opened its doors in June 2012 with two laptops and one rented desk; thirteen years later it reports quarterly revenue north of 4.2 billion USD and clears trades for 119 million verified accounts. Daily spot volume averages 1.6 billion USD, while the company safeguards 278 billion USD in custodial and self-directed balances.

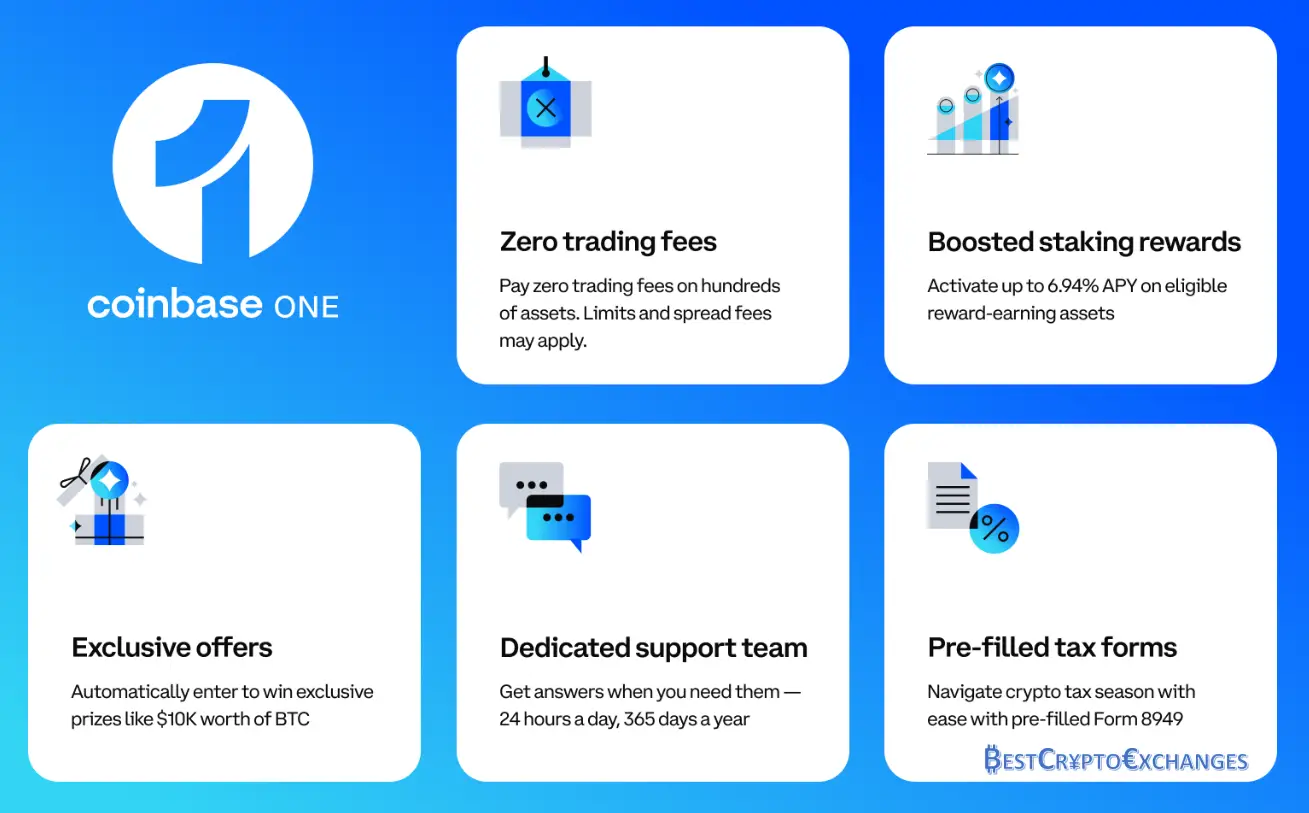

This deep-dive Coinbase review inspects fee tiers, the dual-layer wallet system, advanced charting on Coinbase Advanced, and the zero trading fees bundle offered through Coinbase One, giving readers the data needed to judge whether opening or upgrading a Coinbase account matches personal strategy.

What impressed us

-

Accepts fiat in 60 currencies and pays staking rewards on a dozen networks

-

Integrated debit card converts crypto to cash at 90 million Visa merchants

-

Coinbase Advanced offers stop-limit orders, real-time market depth, and API keys

-

Quarterly proof-of-reserve reports and SOC-2 audits raise confidence levels

-

Coinbase One eliminates maker and taker fees on the first 10 k USD monthly volume

What fell short of ideal

-

Base tier transaction fees sit above the industry median

-

Strict KYC removes privacy and may deter users in restrictive regions

-

Priority customer support sometimes lags during extreme market conditions

-

Purchase ceilings annoy traders who move six-figure amounts per day

-

Listing policy excludes many micro-cap tokens sought by speculative players

A direct Nasdaq listing in April 2021 pushed transparency to Wall Street standards, and in May 2025 the firm joined the S&P 500. Today the exchange supports 290 tradable crypto assets, sixty-plus fiat rails, and an FDIC-insured cash sweep for eligible U.S. customers.

Pros

-

Instant identity checks approve most applicants within ten minutes

-

Broad fiat on-ramps—ACH, SEPA, Faster Payments, PayPal, debit, wire—cover global users

-

Ninety-eight percent of crypto stored offline; hot wallets insured against theft

-

Coinbase One offers zero trading fees and heightened customer support

-

In-app learning hub pairs tax advice with reward-earning quizzes

Cons

-

Standard maker at 60 bps and taker at 40 bps punish low-volume traders

-

Mandatory document uploads negate anonymity prized by some crypto veterans

-

Ticket backlog during high volatility can stretch first response to several hours

-

Daily ACH deposit cap of 25 k USD restricts big buyers unless extra vetting supplied

-

Only 290 coins available, while competitors list 600 plus

Coinbase balances bank-level safety, regulatory clarity, and a famously user-friendly layout, making it a top gateway for newcomers and institutions alike. Still, anyone chasing rock-bottom costs or speculative micro-caps might favor exchanges with broader token menus and lower taker charges. Match the platform to your priorities before wiring funds.

Coinbase Review: Platform Explained

Coinbase functions as both exchange and broker, letting customers tilt between cash and crypto in seconds. More than sixty fiat rails—from ACH and SEPA to Faster Payments—feed into an order book that lists two-hundred-ninety-plus digital assets.

Licences include the BitLicense issued by the New York State Department of Financial Services, forty-six additional state money-transmitter approvals, and a derivatives clearing nod under the Commodity Exchange Act. Eligible U S dollar balances enjoy FDIC pass-through protection up to 250 000 USD, giving Coinbase users a safety net rare in the crypto industry. Institutional desks tap Coinbase Prime for segregated cold custody and algorithmic execution, while retail traders who prefer sovereign control export coins to the stand-alone Coinbase Wallet where private keys stay local.

|

Product name |

Main role |

Highlight features |

Ideal audience |

|---|---|---|---|

|

Coinbase |

Standard exchange |

Instant buy–sell buttons, simple dashboard |

First-time buyers |

|

Coinbase Advanced |

Pro trading interface |

Reduced fees, advanced charting, stop and stop-limit orders |

Day traders and analysts |

|

Coinbase One |

Subscription tier |

Zero trading fees up to 10 k USD monthly, priority chat |

High-frequency retail users |

|

Coinbase Prime |

Institutional suite |

Cold-store custody, deep liquidity, trade algorithms |

Funds, corporates, treasuries |

|

Coinbase Wallet |

Self-custody mobile wallet |

Private key ownership, DeFi and NFT access |

Users who want full control |

|

Coinbase Card |

Visa debit backed by crypto |

Spend assets anywhere Visa is accepted, earn crypto rebates |

Everyday spenders |

Beyond these core tools Coinbase also maintains a live market data terminal that streams quotes on eighteen thousand coins, an Earn hub paying micro-rewards for short lessons, and Coinbase Commerce, a hosted checkout page service that helps merchants accept digital assets without running their own node. Real-time monitoring systems flag unusual behaviour, and anti-phishing codes appear on each official email so clients can verify authenticity. The exchange publishes quarterly attestation reports confirming that customer assets are held one-to-one, and its transparency filings now exceed five hundred pages, covering cold-wallet addresses, insurance limits, and reserve ratios.

Coinbase wins points for its licence stack, near-bank security controls, and a user journey that goes from zero to completed trade in under ten minutes. The platform lists trusted assets only, which limits scam exposure, and cold storage segregation keeps ninety-eight percent of customer funds offline. Add the Coinbase One fee waiver, FDIC pass-through on U S dollars, and a debit card that turns crypto into cash at checkout, and it is clear why many crypto exchanges imitate this blueprint rather than compete on safety alone.

Fortress-Grade Safeguards

Coinbase security begins the moment an email address turns into a Coinbase account. Enrolment forces two factor authentication through SMS, Time-based One-Time Password, or hardware keys such as YubiKey; recovery phrases can be split with Shamir backup for extra resilience. Ninety-eight percent of client crypto assets migrate to geographically dispersed vaults that rely on threshold signature schemes and encrypted shards, so no single location or employee can sign a withdrawal.

Each vault site sits inside a trusted execution environment with biometric doors and armed response. Hot-wallet liquidity remains under two percent and feeds a real-time risk engine that scores every outbound transaction against hundreds of heuristics covering velocity, destination reputation, and market conditions. If an abnormal pattern appears, outbound transfers halt automatically while an investigations team checks logs.

Coinbase maintains a commercial crime policy underwritten by Lloyd’s syndicates, covering the online wallet slice against hacking losses. Annual SOC 1 Type II and SOC 2 Type II audits test both financial reporting controls and cybersecurity posture; the latest reports note zero material weaknesses. Quarterly filings with the Securities and Exchange Commission list cold-wallet addresses, reserve ratios, and insurance limits, permitting institutional Coinbase Prime clients to reconcile their asset balance against chain data. Penetration tests by Mandiant and NCC Group run twice yearly, and a public bug bounty has paid out over seven million dollars since launch. Together these layers justify the label Coinbase safe for both retail holders and large funds.

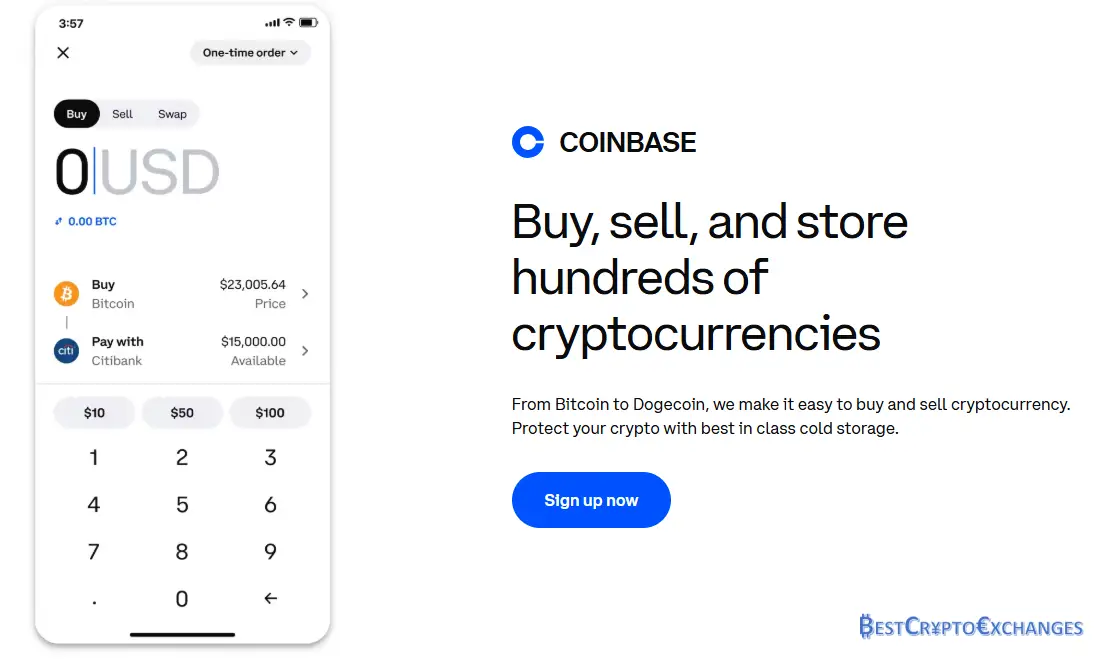

Click-Friendly Layout

The primary dashboard greets newcomers with three panels: portfolio balance, watchlist, and a bright Purchase button. Selecting Buy opens a side card that quotes the current market price, fee, and settlement time, then completes the order in under ten seconds. Tooltips explain each field, so even first-timers find the flow intuitive. When confidence grows, one toggle transports the same user to Coinbase Advanced where candlesticks, depth charts, and stop limit tickets appear, yet colours, fonts, and menu ordering remain identical, keeping the learning curve shallow.

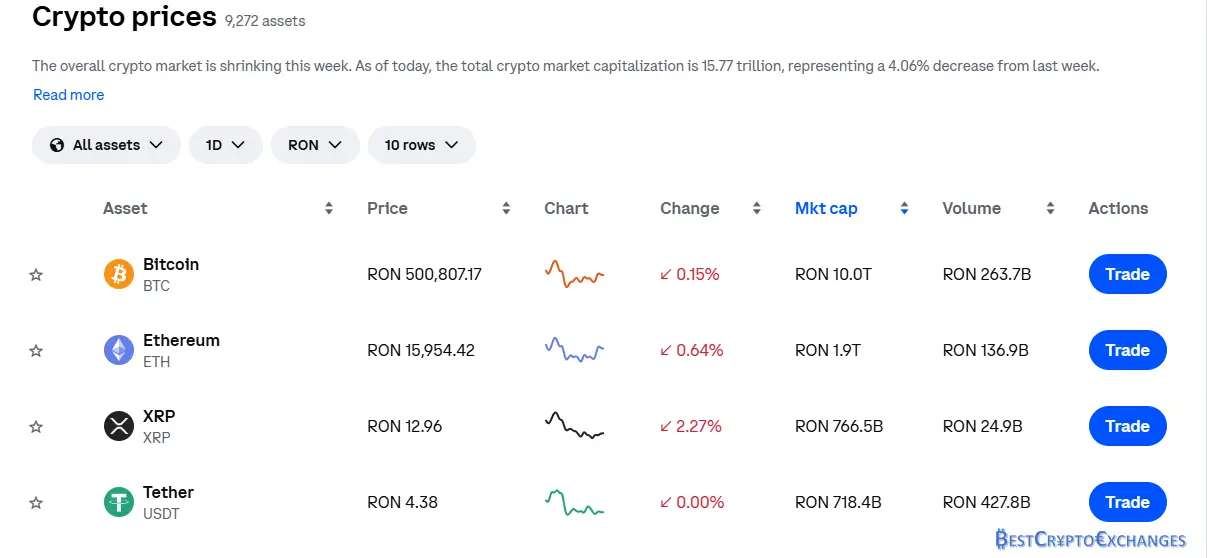

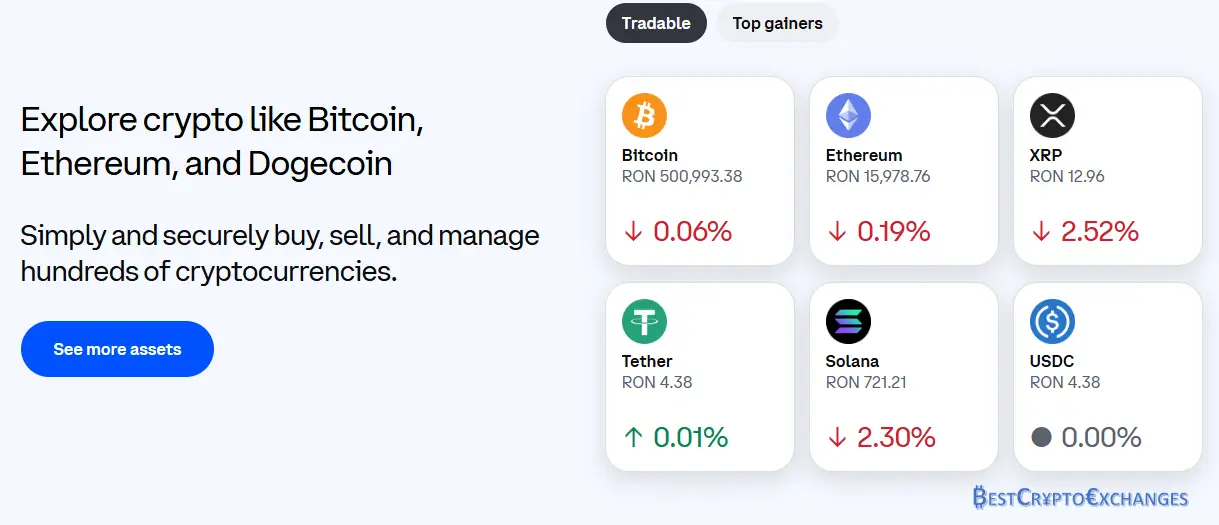

Curated Asset Roster

Coinbase posts two hundred ninety vetted assets, from Bitcoin and Ether to layer-two plays such as Optimism and Arbitrum. A listings committee evaluates every candidate on liquidity, decentralisation, smart-contract risk, and compliance screens; tokens facing active securities questions stay off the platform. This policy shields Coinbase users from sudden delistings triggered by exchange commission actions and makes tax advice simpler because grey-area coins are absent. Liquidity on flagship pairs like BTC USD and ETH USD often exceeds one hundred million dollars in daily trading volume, keeping spreads tight for both taker fees and maker orders.

Broad Fiat On-Ramp

Customers in over one hundred regions fund balances with USD, EUR, GBP, CAD, AUD, SGD, and several Nordic and Latin American units. Supported payment method choices include ACH for zero dollar domestic transfers, Fedwire for large U S deposits that clear the same day, SEPA for euro zone users, Faster Payments for the United Kingdom, and instant card loads on Visa or Mastercard with displayed transaction fees. Merchants can embed Coinbase Commerce buttons on hosted checkout pages to accept crypto but receive settlement in fiat automatically, removing price volatility. All incoming money routes through segregated customer banking accounts, and FDIC pass-through insurance covers eligible U S dollar holdings up to two hundred fifty thousand dollars per person.

Coinbase Card That Spends Coins

The Coinbase Card operates anywhere Visa is accepted. At the register, the card pulls the chosen digital asset from the Coinbase Wallet or exchange balance, converts at the real time market price, then finishes the payment in local currency. Users earn up to three percent back in crypto rewards on every swipe, selectable among assets such as Bitcoin Cash or Stellar.

The mobile app pushes instant notifications detailing spend amount, conversion rate, and remaining rewards quota. There are no annual fees, and ATM withdrawals up to one thousand dollars per month carry zero transaction fees inside the United States. Spending caps, freeze controls, and anti-phishing codes appear inside the same menu where holders manage two factor authentication, creating a single security surface.

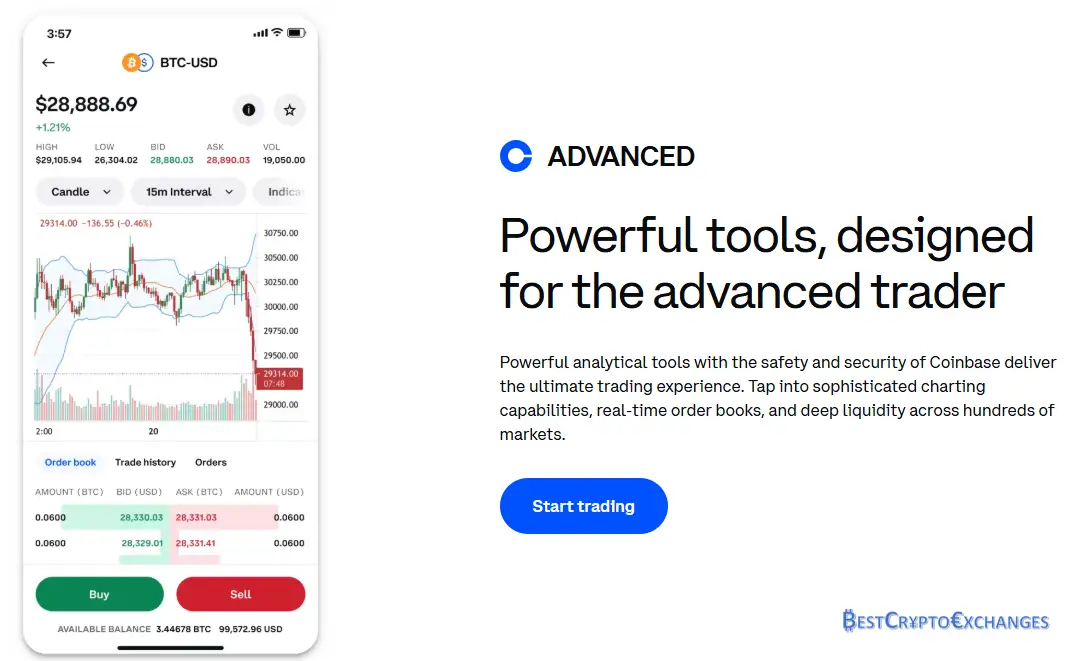

Free Path to Coinbase Advanced

Moving from basic Buy-Sell to the advanced trading platform costs nothing. One click inside the account header reveals depth charts, order book heat-maps, and stop limit forms powered by TradingView. Coinbase Advanced supports ladder orders, iceberg sizing, and Time in Force settings like Good till Cancel or Immediate or Cancel, features previously restricted to Coinbase Pro.

Subscription holders of Coinbase One enjoy zero trading fees up to ten thousand U S dollars per month on Advanced as well, while higher tiers cut taker fees to six basis points. API keys with granular read or trade scopes let algorithmic traders integrate bots without exposing withdrawal rights, and real time market data feeds stream through WebSocket for latency under twenty five milliseconds.

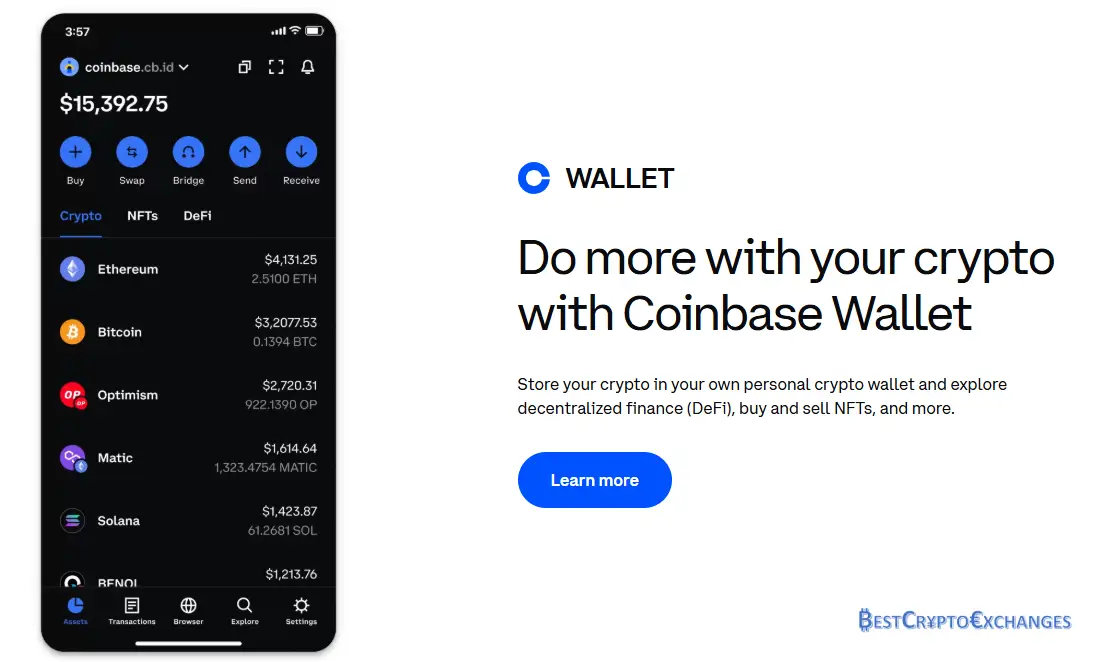

Self-Custody Mobile Vault

Coinbase Wallet is a stand-alone application where private keys live on the user’s phone secured by Secure Enclave and optional biometric lock. It supports thousands of coins across Ethereum, Solana, Arbitrum, Polygon, and Bitcoin plus every ERC-721 and ERC-1155 NFT standard. Built-in browser lets users interact with DeFi lending pools, liquidity mining farms, and decentralised exchanges directly, while transaction previews display network fee, contract address, and slippage before confirmation. Transfers from the hosted Coinbase platform into the wallet route through internal ledger rails, so no blockchain fee applies and funds arrive instantly.

Recovery phrases can be backed up to encrypted iCloud or Google Drive vaults for easier restore, and advanced users may split seed shards among hardware devices. The wallet also supports threshold signature schemes for multisig vaults and integrates with Ledger hardware, allowing large holdings to stay on cold metal while still viewing balances inside the same interface.

Coinbase Review: Pain Points Observed

Although Coinbase stands tall on security, two recurring drawbacks shadow the otherwise polished service. Retail users complain of spending ceilings that throttle larger trades, while privacy advocates dislike the obligatory document trail that accompanies every blockchain transfer. Both issues stem from the same root: Coinbase operates under strict United States compliance rules that keep regulators comfortable but squeeze freedom-minded traders. International competitors often impose fewer checks, yet they rarely match Coinbase safe storage or FDIC pass-through on idle dollars. As a result, investors must weigh tighter limits and data disclosure against the comfort of bank-grade safeguards.

Spending and Withdrawal Ceilings

Coinbase caps how much fiat a newcomer can load or pull each day. Limits depend on verification level, payment method, and rolling transaction size history. A fresh credit card profile might see a three hundred dollar daily purchase ceiling, while the same account linked to ACH could enjoy twenty five thousand. Raising the bar means submitting income evidence such as W-2 forms or recent pay stubs and waiting for automated ageing. High net worth Coinbase users who trade bitcoin in six-figure clips often move to Coinbase Prime, where same-day wires carry no purchase ceiling. Until then, gradual volume growth and spotless compliance behaviour remain the only path to larger tickets.

No Pseudonym Layer

Coinbase collects a government photo ID and selfie at signup, logs every wallet destination, and flags transfers that touch sanctioned addresses maintained by the Treasury Department. Once a suspicious link appears, the compliance desk may freeze the Coinbase account and request additional proofs. All filled orders and staking rewards feed directly into downloadable tax forms, which Coinbase files with the Internal Revenue Service for United States residents.

Enthusiasts who value stealth transactions or wish to hide market sentiment data therefore steer toward decentralised swaps or privacy-oriented blockchains. Coinbase argues that open reporting enables FDIC coverage and partnership with the New York State Department of Financial Services. Still, anonymity seekers must look elsewhere.

Cost Structure on Coinbase

Trading activity follows a tiered maker and taker schedule that shrinks fees as thirty-day volume climbs. Base tier for under ten thousand United States dollars in turnover costs sixty basis points maker and forty basis points taker, which many critics label relatively high fees when compared with zero trading fees offers on smaller venues.

Active desks that post liquidity above four hundred million dollars pay five basis points maker and zero taker, a level attractive to institutional clients executing block orders. Subscription holders of Coinbase One bypass the grid entirely on their first ten thousand dollars per month and receive a twenty five percent rebate beyond that mark. Below is the refreshed ladder for spot pairs.

|

Rolling 30-Day Volume USD |

Maker Rate |

Taker Rate |

|---|---|---|

|

0 – 10 000 |

0.60 percent |

0.40 percent |

|

10 001 – 50 000 |

0.40 percent |

0.25 percent |

|

50 001 – 100 000 |

0.25 percent |

0.15 percent |

|

100 001 – 1 000 000 |

0.20 percent |

0.10 percent |

|

1 000 001 – 15 000 000 |

0.18 percent |

0.08 percent |

|

15 000 001 – 75 000 000 |

0.16 percent |

0.06 percent |

|

75 000 001 – 250 000 000 |

0.12 percent |

0.03 percent |

|

250 000 001 – 400 000 000 |

0.08 percent |

0.00 percent |

|

Above 400 000 000 |

0.05 percent |

0.00 percent |

Extra Details. Card loads incur a three point nine nine percent transaction fee that combines network cost and convenience margin. Instant cash-out to debit card runs at one percent. StablePair trades, which pair a fiat backed stablecoin with another stablecoin, always carry zero maker cost and deeply reduced taker fees topping out at forty five basis points. Advanced trading platform users benefit from stop limit orders without surcharge, and staking rewards flow net of protocol take with no additional Coinbase charges.

Deposit and withdrawal costs vary by rail.

|

Payment Rail |

Deposit Charge |

Withdrawal Charge |

|---|---|---|

|

ACH |

Free |

Free |

|

Wire USD |

Ten dollars |

Twenty five dollars |

|

SEPA EUR |

Fifteen euro cents |

Free |

|

SWIFT GBP |

Free |

One pound |

Takeaway on Coinbase Fees. For light users who place occasional market orders, Coinbase charges can eat a noticeable slice of potential profits, especially when price volatility is modest. High-frequency desks or subscription members, however, can drive effective costs close to zero, especially if their strategy includes posting maker liquidity.

Coinbase Review: How to Join the Ecosystem

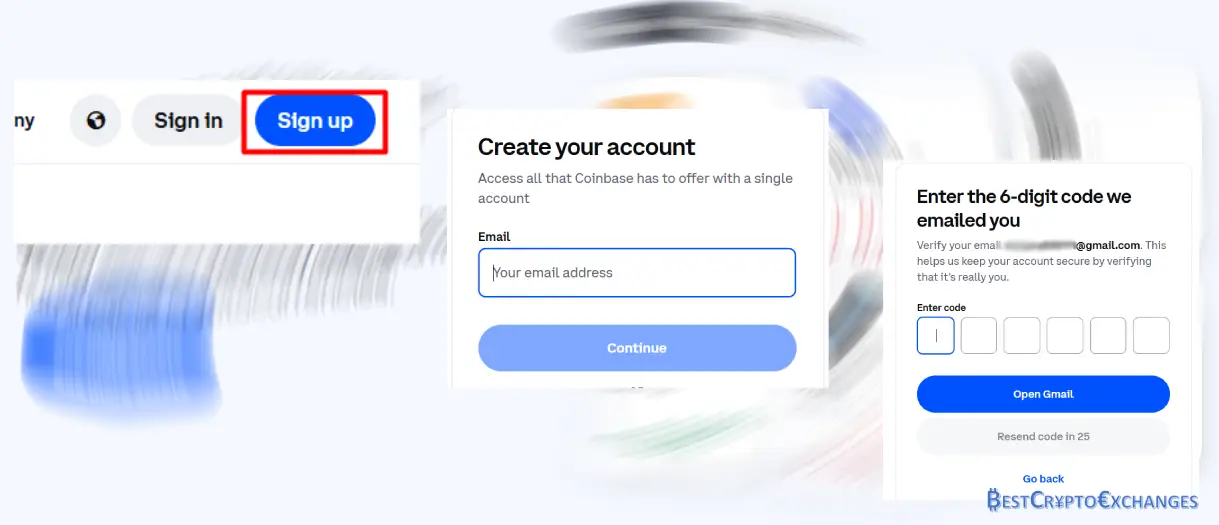

Opening a Coinbase account takes only a few minutes, yet each screen satisfies strict U.S. compliance rules. You will move from email capture to identity verification in one guided flow, after which trading, spending crypto, and earning rewards unlock immediately. Keep a mobile phone, photo ID, and internet-enabled camera nearby before you begin.

-

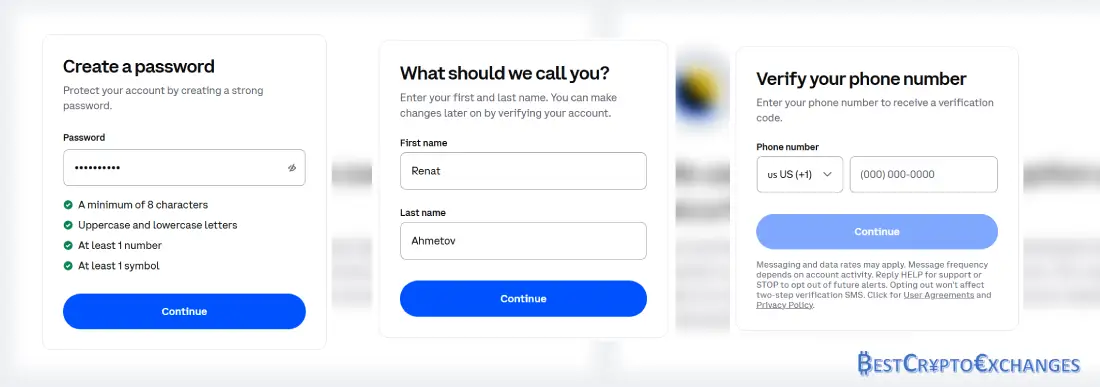

Step 1: Visit coinbase dot com, hit Sign Up, and type a valid email. Create a twelve-character password that mixes upper and lowercase letters, digits, and symbols so automated strength meters register “strong.”

-

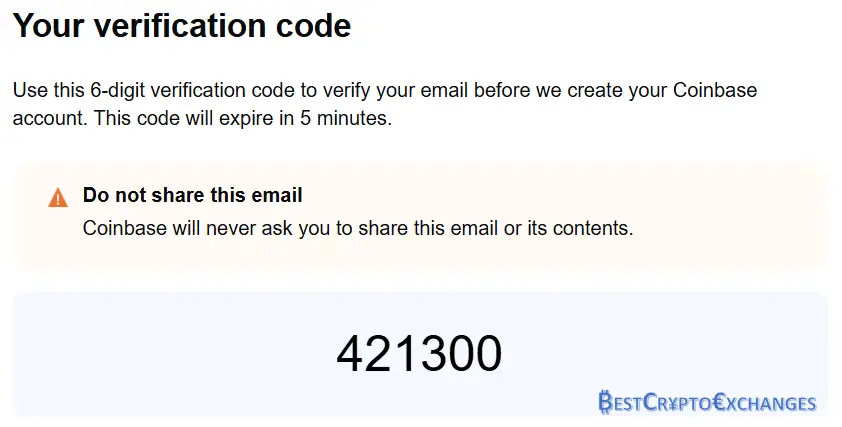

Step 2: Check your inbox; copy the seven-digit verification code Coinbase sends and paste it into the pop-up box. The timer shows four minutes—click “Resend” if the email arrives late.

-

Step 3: Add a mobile number, receive an SMS, and enter the six-digit text code. This step activates two-factor authentication, which Coinbase requires on every log-in and withdrawal.

-

Step 4: Enter your legal first and last name exactly as shown on tax documents, supply date of birth, and choose citizenship. Tick the boxes confirming that you accept Coinbase User Agreement, acknowledge disclosures filed with the New York State Department of Financial Services, and certify the funds you transact are not tied to sanctioned regions. This background attestation supports Coinbase safe-harbour status under multiple state money-transmitter rules.

-

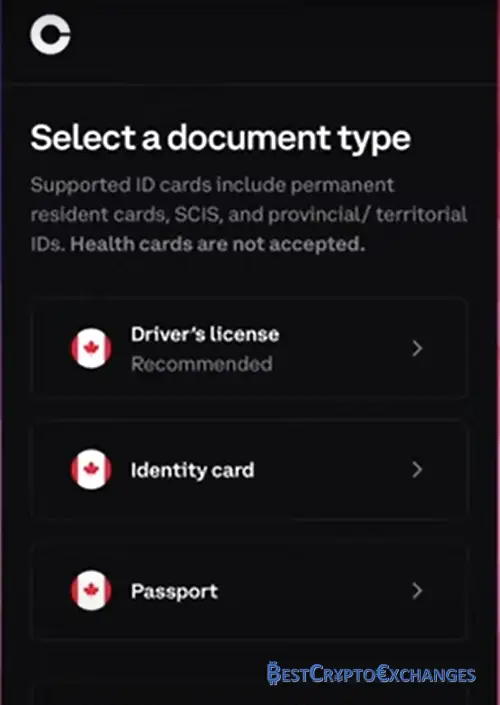

Step 5: Select passport, driver licence, or state ID, then use your webcam or phone camera to capture the front and back images. Machine-vision software checks holograms, expiration date, and security microprint, while biometric comparison matches the portrait to a later selfie. Average processing time is under two minutes during off-peak hours.

-

Step 6: Choose the “Individual” profile when prompted, since institutional and business routes follow separate onboarding that requires EIN documents and enterprise banking proofs. Enter your residential address and Social Security Number (U.S. residents) or national insurance equivalent so Coinbase can run mandatory sanctions screening.

-

Step 7: Supply employment status and rough annual income bracket. Finish the financial-profile questionnaire by estimating how much you expect to deposit each year and whether you plan to use advanced trading platform features such as stop limit orders or Coinbase Prime custody. Accurate answers prevent temporary funding holds later.

-

Step 8: Upload a live selfie video—slowly turn your head left, then right, aligning with on-screen guides. Once the green progress bar completes, submit the clip for KYC review. After approval, link a payment method: ACH bank account, debit card, or PayPal. You are now ready to trade bitcoin, stake ETH, and explore Coinbase Wallet.

Most identity checks clear in under ten minutes, enabling same-day withdrawals, zero trading Coinbase fees on the first ten-thousand-dollar volume for Coinbase One subscribers, and immediate eligibility for on-chain staking rewards.

Matching Coinbase With Your Needs

Coinbase offers a menu of products that appeal to different types of crypto participants, from first-time buyers who want an interface to institutions that insist on trails and segregated cold storage. Before opening a Coinbase account, consider how often you plan to trade, what payment method you prefer, and whether you care more about speed, charting tools, or self-custody. The following categories will help match those priorities with the service.

First-time buyers

If you have never touched bitcoin, Coinbase gives you a bank-style dashboard, plain language tutorials, and payment methods like PayPal or debit card. The simple interface lowers the stress of making a first purchase, while two factor prompts and FDIC pass-through coverage reduce fear of losing funds on day one.

Busy mobile professionals

People who cannot sit in front of a trading screen appreciate the Coinbase mobile app. Instant price notifications, quick withdrawals to a linked bank, and zero downtime during maintenance windows mean you can check an asset balance between meetings, swap USD for ETH, and still catch the train home.

Active chart traders

Those who follow real time market data and need stop limit orders will likely switch to Coinbase Advanced. The venue supplies depth charts, advanced charting functions from TradingView, and lower transaction fees that step down once monthly volume grows, all without forcing you to learn a separate login.

Institutional treasuries and hedge funds

Coinbase Prime combines cold-storage segregation, SOC audit reports, and deep liquidity pools. Large orders route through smart order algorithms that hide size across multiple crypto exchanges, while priority customer support assigns a direct desk number—features critical for firms governed by internal compliance teams.

Long horizon savers

Investors who plan to stash bitcoin for years rather than trade daily can withdraw to Coinbase Wallet in a single tap, maintain control of private keys, and still earn staking rewards on supported proof-of-stake coins. Hardware wallet links add another safeguard without leaving the Coinbase ecosystem.

Coinbase Review: Final Word

Coinbase remains one of the most recognisable names in the crypto industry. Regulatory clarity, insurance on eligible USD balances, and audited cold-storage practices deliver a safety premium that many beginners and institutions are willing to pay. The platform continues to expand, adding staking rewards, Coinbase One rebates, and deeper analytics inside Coinbase Advanced, while keeping the original simple interface for casual investors. Transaction fees sit above certain low-cost rivals, yet the blend of compliance, educational resources, and quick withdrawals still makes Coinbase a reliable bridge between fiat currency and digital assets for millions of users worldwide.

Peer-Reviewed Sources

-

Lo A W, Repin D V 2002 The Psychophysiology of Real-Time Financial Risk Processing

-

Bundi N, Wei C L, Khashanah K 2024 Optimal Trade Execution in Cryptocurrency Markets

Coinbase Review – FAQ

Is Coinbase a legitimate crypto exchange platform?

Coinbase operates under more than forty state money-transmitter registrations, maintains a BitLicense in New York, and files quarterly reports with the Securities and Exchange Commission as a Nasdaq-listed entity. Those layers of oversight, combined with mandatory KYC and routine SOC audits, demonstrate that the company follows strict U.S. financial rules and is widely regarded as legitimate within the crypto industry.

What are the main features of Coinbase?

The Coinbase platform offers a tiered suite: basic buy-sell for beginners, Coinbase Advanced with lower trading fees and chart tools, a self-custody Coinbase Wallet, a Visa debit card that pays crypto rewards, and a subscription called Coinbase One that removes trading fees up to a set monthly cap while adding priority customer support and boosted staking yields.

Is Coinbase exchange available to be used worldwide?

Coinbase supports account creation in more than one hundred countries across North America, Europe, Asia, Latin America, and parts of Africa. Local regulations affect specific features such as bank transfers or staking, so prospective users should review the supported-countries list on the help page and confirm that payment method options and product menus align with regional rules before signing up.

Are there any Coinbase complaints?

Some Coinbase users post negative reviews about relatively high maker and taker fees, withdrawal holds triggered by compliance checks, and slower email responses during periods of heavy market stress. The company states most tickets reach resolution within twenty-four hours and that withdrawal holds clear once requested documents are uploaded, yet fee sensitivity remains a valid concern for high-frequency traders.

Should I use Coinbase?

You may choose Coinbase if you prioritise regulatory safeguards, fiat on-ramps, and a user friendly interface backed by extensive educational resources. Investors who trade large sizes daily or seek the lowest possible taker fees might compare rates on other crypto exchanges first, while privacy-focused traders could prefer decentralised venues that demand no identity verification.

Is Coinbase decentralised?

Coinbase is a centralised exchange that custodies customer assets, manages the order book, and reports transaction data to tax authorities where required. Users who need full autonomy can transfer coins to Coinbase Wallet or an external hardware wallet, but on-platform trading, staking, and debit-card spending remain subject to Coinbase’s compliance and security controls.