Kraken holds a rare position in the cryptocurrency market: it is old enough to carry deep liquidity yet nimble enough to keep rolling out new features such as advanced charting on desktop apps and instant buy inside the Kraken app. Founded in 2013, the exchange grew from a modest West‑Coast start‑up into a global hub that now reaches users in more than one hundred ninety regions. Its longevity means the service has survived multiple crypto winters, significant risk events, and one memorable legal clash with the Securities and Exchange Commission.

This kraken review dissects the entire stack—spot trading, margin trading, trade futures, OTC desks, and wallet custody—so both first‑time buyers chasing financial freedom and experienced crypto investors searching for new investment options can see whether a fresh Kraken account fits their strategy.

What we liked about Kraken and what we didn’t like

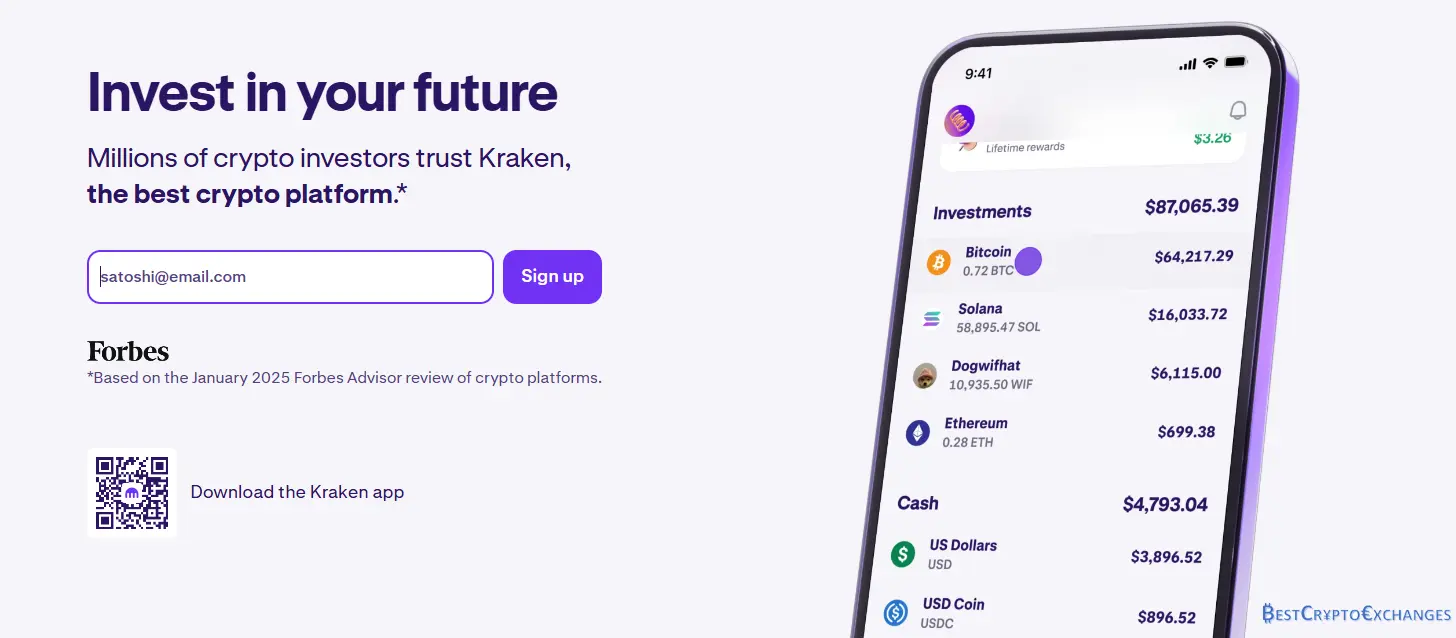

Kraken supports seven fiat currencies, lists more than four hundred thirty digital assets, and backs every trading pair with proof‑of‑reserve audits. The fee ladder starts at zero point four percent taker fees and slides toward zero when trading volumes increase. Maker rebates help active desks hit relatively low fees even during busy sessions. The customer service Kraken division staffs a multilingual support team that answers live chat around the clock, and a searchable support center hosts hundreds of educational materials. Security measures include mandatory two‑factor login, withdrawal address whitelists, and quarterly attestations signed by Armanino.

Still, no exchange escapes criticism. Some kraken users complain about high fees on instant buy, while others log negative reviews when a support ticket number stalls for more than thirty minutes. Regulators have their own concerns, calling the venue an unregistered securities exchange in a high‑profile filing. Keep reading to weigh those trade‑offs in detail.

Pros

-

- Seven fiat currencies accepted through bank accounts, debit card, or Google Pay

- Deep liquidity across hundreds of trading pairs plus OTC blocks for advanced traders

- Margin trading up to 5 × with margin fees that shrink as volumes climb

- Proof‑of‑reserve audits and ninety‑five percent cold storage protect crypto assets

- Customer support Kraken live chat replies in under half an hour on average

Cons

-

- Instant buy can post high fees: 1.5 percent on crypto assets, 0.9 percent on stablecoins

- Active dispute with the Securities and Exchange Commission over unregistered securities allegations creates uncertainty for US products

Kraken blends broad fiat ramps, tight‑spread order books, adjustable 5 × leverage, and audited cold‑storage custody—features that satisfy both first‑time buyers and advanced traders. The trade‑off is premium pricing on Instant Buy and a pending SEC case that may reshape U S margin and staking access, so monitor developments closely.

Kraken Review: The Kraken Timeline

San Francisco developer Jesse Powell first toured the Mt Gox server room in mid‑2011 and saw chaos: open cash drawers, flimsy log files, and staff overwhelmed. The visit convinced him that a cryptocurrency exchange would live or die on trust. Powell flew home, recruited a lean engineering crew, and launched Kraken two years later with one pledge—hold every client coin one‑for‑one and publish cold‑wallet addresses so anyone could verify balances on‑chain.

By 2014 the fledgling desk had secured banking rails in Germany and Japan, letting users deposit money directly in euros or yen. The same year Mt Gox collapsed after losing roughly four hundred sixty million dollars; refugees flocked to Kraken for a safer harbor.

During the 2017 mania, traffic spiked tenfold and latency stretched. Powell chose downtime over half‑measures, closing order books for a full engine rebuild in January 2018. Seven days later Kraken returned faster, with new advanced charting features that later evolved into Kraken Pro. Over the next half‑decade the exchange launched staking, built a regulated futures venue in Europe, and pushed mobile updates that now hold 4.6‑star averages in both stores.

When the exchange commission spotlight intensified in 2023, Kraken claims it had already segregated corporate funds from user balances, yet the Securities and Exchange Commission filed suit alleging commingling and unregistered securities activity. Kraken settled staking counts, denied the larger charge, and kept every kraken account live.

As of July 2025, daily trading volumes often top one billion dollars, fifteen million kraken users have completed KYC, and the firm maintains satellite offices on four continents to support global adoption.

Kraken Exchange Platform 101

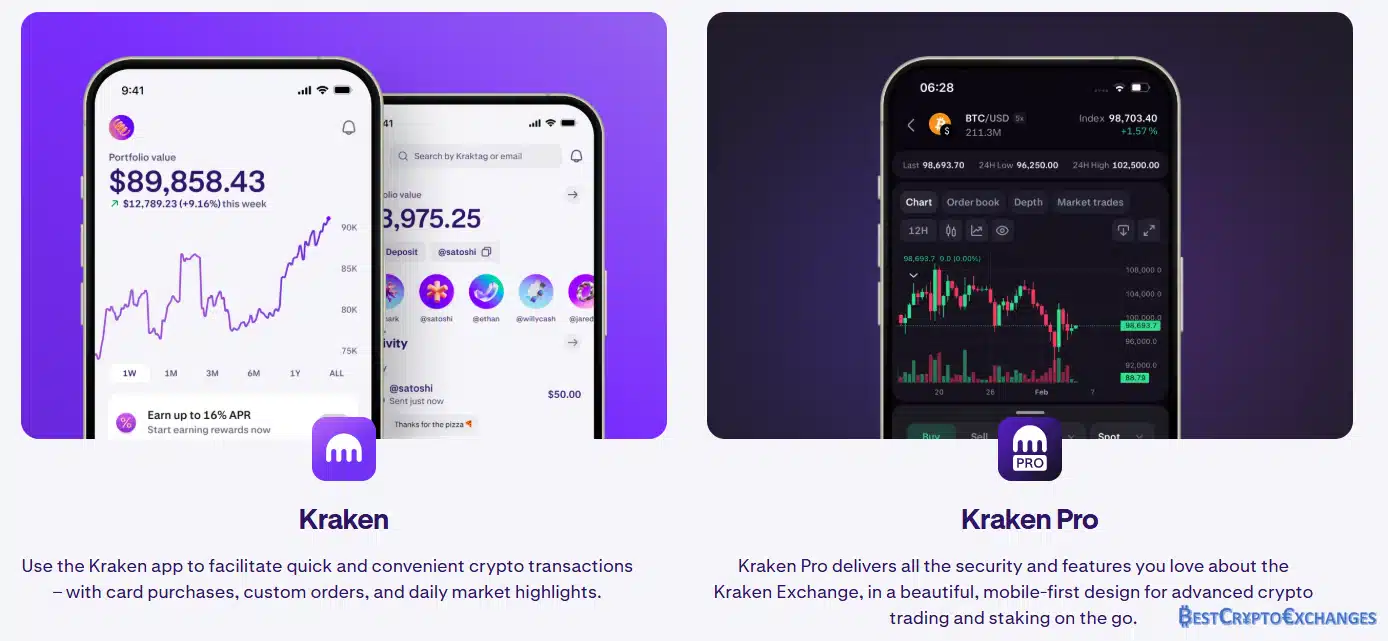

Kraken is a full‑service cryptocurrency exchange that merges brokerage services, an order‑book marketplace, and regulated derivatives under one login. Users may trade crypto against seven fiat currencies via instant buy or traditional limit orders. Advanced traders tap cross or isolated margin up to five times leverage, then roll positions into cash‑settled futures for longer exposure without holding underlying coins. Staking yields on more than twenty networks deliver passive income, while OTC desks quote discreet blocks over one hundred thousand dollars.

The platform runs side‑by‑side modes—Simple for newcomers, Kraken Pro for advanced users. Both versions live in the same mobile and desktop apps, so a new account holder can start trading with a single tap and graduate to advanced charting features later. Security remains strict: two‑factor login is mandatory, withdrawal whitelist exists by default, and cold wallets secure ninety‑five percent of reserves. Because proof‑of‑reserve hashes publish each quarter, crypto investors can confirm that kraken claims match reality. In short, Kraken positions itself as a one‑stop cryptocurrency exchange for spot trading, margin products, and custodial tools.

Kraken Review: Major Selling Points

Kraken’s strengths cluster around five themes: easy fiat ramps, layered security, broad coin coverage, live support, and flexible trading modes. Each pillar helps separate the desk from other crypto exchanges that may excel in one area yet fall short in another.

Fiat Currency Support

Kraken accepts seven fiat currencies, so a new kraken account can load value straight from domestic bank accounts rather than looping through other exchanges that tack on hidden trading fees.

-

- USD arrives by FedWire or ACH; most deposits reach the wallet before the next trading session.

- EUR travels through SEPA and shows up in under sixty minutes.

- GBP moves with Faster Payments; confirmations often appear while the client is still logged in.

- CAD routes through Interac e‑Transfer in minutes.

- AUD, CHF, and JPY flow via local SWIFT partners, usually inside one business day.

Takeaway: multiple native rails eliminate unnecessary conversion spreads and speed the moment a trader can start crypto trading or margin trading, a clear benefit for first‑time users seeking low friction on day one.

High Security Standards

Security on Kraken starts long before a trader clicks the first order button. Two‑factor authentication is mandatory at account creation, and the security tab encourages a twenty‑character passphrase plus optional passkey enrollment. Physical YubiKey devices plug into USB‑C ports and defeat most phishing tricks, while Google Authenticator generates six‑digit codes that refresh every thirty seconds. Any active sessions page shows browser, operating system, and IP; one click terminates every remote login in real time.

Each fresh IP sign‑in delivers a “Lock My Profile” email containing a quick‑freeze link that disables trading and withdrawals until the holder re‑authenticates. Behind the scenes, ninety‑five percent of digital assets sit in multisignature cold wallets distributed across North America and Europe; private keys never touch machines with internet access. Dustico and Trail of Bits conduct scheduled penetration drills, and a public bug‑bounty board rewards white‑hat hackers with up to fifty thousand dollars in BTC for critical discoveries.

All platform email is PGP‑signed to prevent spoofing, and TLS 1.3 encrypts traffic end to end. API keys come with granular rights: read‑only for portfolio trackers, trade‑only for bots, or deposit‑only for payment widgets—withdrawal rights stay off by default. Kraken claims zero successful hot‑wallet hacks since 2013, and quarterly proof‑of‑reserve attestations—most recently verified by Armanino in January 2025—confirm client liabilities remain fully backed. Together these security measures help kraken users trust large transfers without filing constant support ticket numbers with the support team.

Vast Variety of Crypto

Kraken maintains one of the broadest catalogs among major crypto exchanges, with more than four‑hundred‑thirty crypto assets and thousands of trading pairs. Beyond headline names like Bitcoin, Ether, and Solana, the desk lists layer‑two tokens—Arbitrum, Optimism—alongside DeFi staples such as Aave and Uniswap. Spreads on BTC‑USD and ETH‑EUR frequently hold below 0.02 %, even during spikes in trading volume, while mid‑cap pairs like KSM‑EUR or DOGE‑JPY still post double‑digit depth on each side of the book.

A three‑stage listing process screens projects for legal clarity, smart‑contract security, and minimum daily liquidity, reducing wash‑trade risk and flash crashes. For experienced crypto investors balancing portfolios—or newcomers converting small balances—the sheer range means they can chase market rotations without opening new accounts on other platforms. This breadth, combined with margin trading and trade futures on flagship coins, cements Kraken’s appeal to advanced traders seeking quick access to niche assets inside a single kraken account.

24 / 7 Customer Support

Customer service Kraken teams operate nonstop, combining live chat, email, and a searchable support center. Latest transparency data from May 2025 record an eighteen‑minute median wait for chat and under forty for first‑reply email, even when trading volumes increase after major price news. Articles inside the support center cover everyday tasks—bank accounts linking, margin fees, taker fees, security measures—with step‑by‑step screenshots, reducing the need to contact the support team. If escalation is required, each inquiry receives a support ticket number that agents reference until the case closes. Multilingual coverage now spans English, Spanish, French, Japanese, and Portuguese, improving help for Kraken users across global adoption regions.

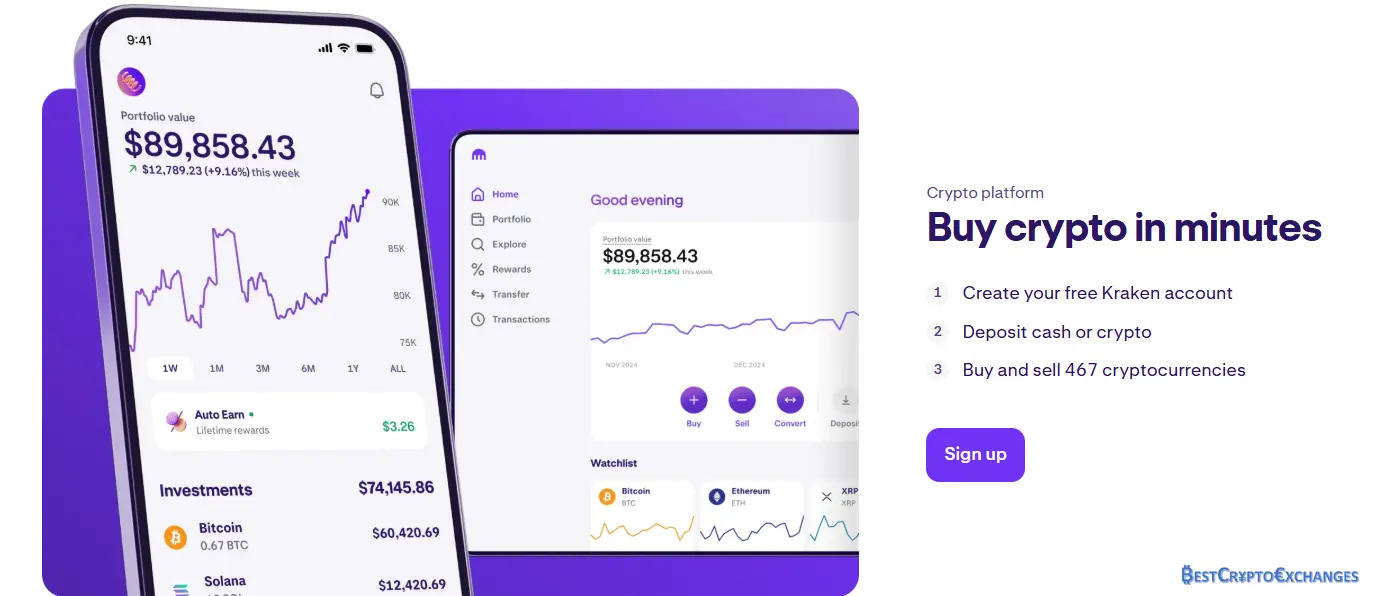

Mobile App Specs

Available on iOS, Android, and recent desktop apps via Progressive Web App, the Kraken app compresses core kraken features into a pocket interface. Buyers can fund with debit card or Google Pay, review displayed fee estimates, and execute spot orders in seconds. A toggle flips between Simple and Pro; Simple shows large buy‑sell buttons, while Pro unlocks advanced charting features, margin position management, and price alerts per watchlist. Touch‑ID or Face‑ID safeguards every login, and in‑app security tab lets users terminate active sessions or raise withdrawal locks without opening a browser.

Multiple Trading Options

Beyond plain spot orders, Kraken layers several avenues for active and passive strategies inside one platform. Margin trading grants up to 5 × leverage on more than forty pairs, with margin fees billed every four hours and clearly shown before confirmation—vital when significant risk accompanies borrowed funds. Futures contracts, settled in USD, cover BTC, ETH, ADA, LTC, and XRP, letting traders hedge portfolio value without moving underlying crypto assets.

Institutional desks can route six‑figure tickets through Kraken’s OTC chat to avoid slippage on the public book, while retail clients lean on Instant Buy or the Convert widget for fast reallocations at a transparent displayed fee. TradingView charts embedded in Kraken Pro provide dozens of indicators—Bollinger Bands, Fibonacci retracements, VWAP—and bracket‑order capability, enabling advanced users to plan entries and exit positions directly from the graph. Combined, these tools give both dollar cost averaging beginners and seasoned algorithmic desks the flexibility to trade crypto, margin trade, or trade futures without juggling multiple crypto exchanges.

Kraken Wallet Advantages

The self‑custody Kraken Wallet, released in 2024 and integrated into the main kraken app, recognises over two‑thousand tokens plus ERC‑721 and ERC‑1155 NFTs, covering Ethereum, Solana, Polygon, and the Bitcoin ordinals layer. Sign‑in relies on the existing kraken account, so moving yield from staking pools or margin collateral back to personal storage avoids duplicate government issued ID checks.

A built‑in dApp browser connects to DeFi lending, bridges, and on‑chain derivative platforms in a few taps, while one‑click hardware‑wallet sync exports keys to Ledger or Trezor for users chasing maximum security measures. Fee‑priority sliders help optimise gas during network congestion, and an optional price alerts module warns holders before large market moves, encouraging smarter financial decisions around when to transfer funds out of hot storage.

Kraken Review: CONS

Kraken’s strengths are substantial, yet a balanced kraken review must highlight drawbacks that surface repeatedly in community forums and support‑center threads. Two pain points dominate most negative reviews: lingering regulatory friction inside the United States and fee structures that penalize light, one‑off transactions. Understanding these limitations helps investors set realistic expectations before wiring funds.

Regulatory Issues in the US

In November 2023 the Securities and Exchange Commission filed a civil complaint alleging Kraken ran an unregistered securities exchange, offered staking as an investment contract, and failed to segregate customer deposits from operating capital. Kraken refunded U.S. staking clients, paid a multimillion‑dollar fine without admitting wrongdoing, and kept spot markets live.

Even so, the unresolved portion of the lawsuit could restrict future brokerage services such as margin trading, trade futures, or particular stocks tokenization for American kraken users. Advanced traders, especially those who rely on leverage or staking yield, must follow docket updates and could face short‑notice adjustments should a court rule that certain crypto assets qualify as securities.

Relatively High Fees

Instant‑buy convenience carries a premium: Kraken displays a 1.5 percent spread on ordinary crypto and 0.9 percent on regulated stablecoins, then layers card‑processor costs if you pay with a debit card or Google Pay. The seemingly small “Convert Small Balances” tool deducts three percent on residual amounts below the minimum trade size, turning pocket change into a noticeable charge.

Margin fees accrue every four hours and can reach 0.02 percent, a figure that compounds during long holds. Although maker rebates kick in once trading volumes increase beyond fifty thousand dollars per rolling thirty days—and advanced traders often recoup costs through tighter spreads—occasional buyers and dollar‑cost‑averaging newcomers may judge Kraken’s other fees higher than those on rival crypto exchanges offering flat 0.1 percent schedules.

Kraken Fees Explained

Kraken recalculates maker‑taker brackets each midnight UTC, scanning your last 30 days of trading volumes to assign a new tier. The entry level starts at 0.25 percent maker and 0.40 percent taker on spot pairs. Fees then step down through five intermediate rungs until a trader posting more than ten million dollars in volume enjoys a zero‑fee maker slot and a 0.10 percent taker rate. For derivatives, futures remain constant at 0.02 percent maker and 0.05 percent taker regardless of size, while margin fees are billed separately every four hours.

Withdrawal costs depend on rails—0.00001 BTC for Bitcoin, 0.0005 ETH for Ether, five dollars for U.S. domestic wires, and thirteen dollars for SWIFT outflows. High‑frequency desks that add liquidity reap rebates and lower average cost; pure market takers or instant buyers face steeper effective charges, making advance planning vital to preserve net gains.

| 30‑Day Volume | Maker | Taker |

|---|---|---|

| ≤ 10 000 USD | 0.25 % | 0.40 % |

| 10 001–50 000 | 0.20 % | 0.35 % |

| 50 001–100 000 | 0.16 % | 0.32 % |

| 100 001–250 000 | 0.12 % | 0.28 % |

| 250 001–500 000 | 0.10 % | 0.24 % |

| 500 001–1 000 000 | 0.08 % | 0.22 % |

| 1 000 001–5 000 000 | 0.05 % | 0.20 % |

| 5 000 001–10 000 000 | 0.02 % | 0.15 % |

| > 10 000 000 | 0.00 % | 0.10 % |

Bottom line: traders who post limit orders and scale volume can drive their effective Kraken fees close to or even below competing crypto exchanges, whereas casual takers should run the numbers beforehand to avoid unpleasant surprises.

Kraken KYC Past & Present

Until early 2021 Kraken operated five separate verification rungs. Tier 0 gave read‑only access, Tier 1 unlocked crypto deposits, and Tiers 2 through 4 stacked extra paperwork to reach six and seven figure fiat limits. Experienced crypto investors complained about the confusing ladder, while regulators signalled a preference for clearer onboarding. Kraken responded by folding the steps into three practical buckets called Intermediate, Pro and Business. The exchange claims the shorter path meets Securities and Exchange Commission guidance on customer identification, yet still keeps bad actors away from digital assets.

| Requirement | Intermediate | Pro | Business |

|---|---|---|---|

| Government ID | Yes | Yes | Officer ID |

| Proof of Address | Yes | Yes | Yes |

| Source of Funds | Optional | Mandatory | Mandatory |

| Fiat Cap | 100 000 USD / m | Higher | Custom |

| OTC Access | No | Yes | Yes |

| API Keys | 16 | 25 | Custom |

Opening a fresh Kraken account now starts with name, date of birth, and mobile number, enough to credit crypto and explore basic crypto trading tools. Upgrading to Intermediate calls for a government issued id, a recent utility bill that matches the residential address, and a live selfie captured inside the verification widget. Once approved, a user can move up to one hundred thousand dollars in and out of linked bank accounts every thirty days, trade futures, and request margin.

Pro caters to advanced traders and family offices. Applicants upload bank statements or payslips that explain where larger sums originate, set up two bank accounts in the same name for fiat rails, and can generate twenty five independent API keys for bots. Manual review usually finishes within forty eight hours, though the support team may request sharper images when file size passes five megabytes.

Corporate treasurers choose Business. Along with articles of incorporation, the company provides a board resolution naming authorised signatories and a chart of ultimate beneficial owners. Once onboard, the desk receives custom fiat limits, white glove support and direct OTC liquidity.

This streamlined trio keeps the paperwork workload realistic for normal traders while still giving regulators a transparent audit trail, helping Kraken remain a trusted venue for global crypto exchanges.

How to Use Kraken Exchange

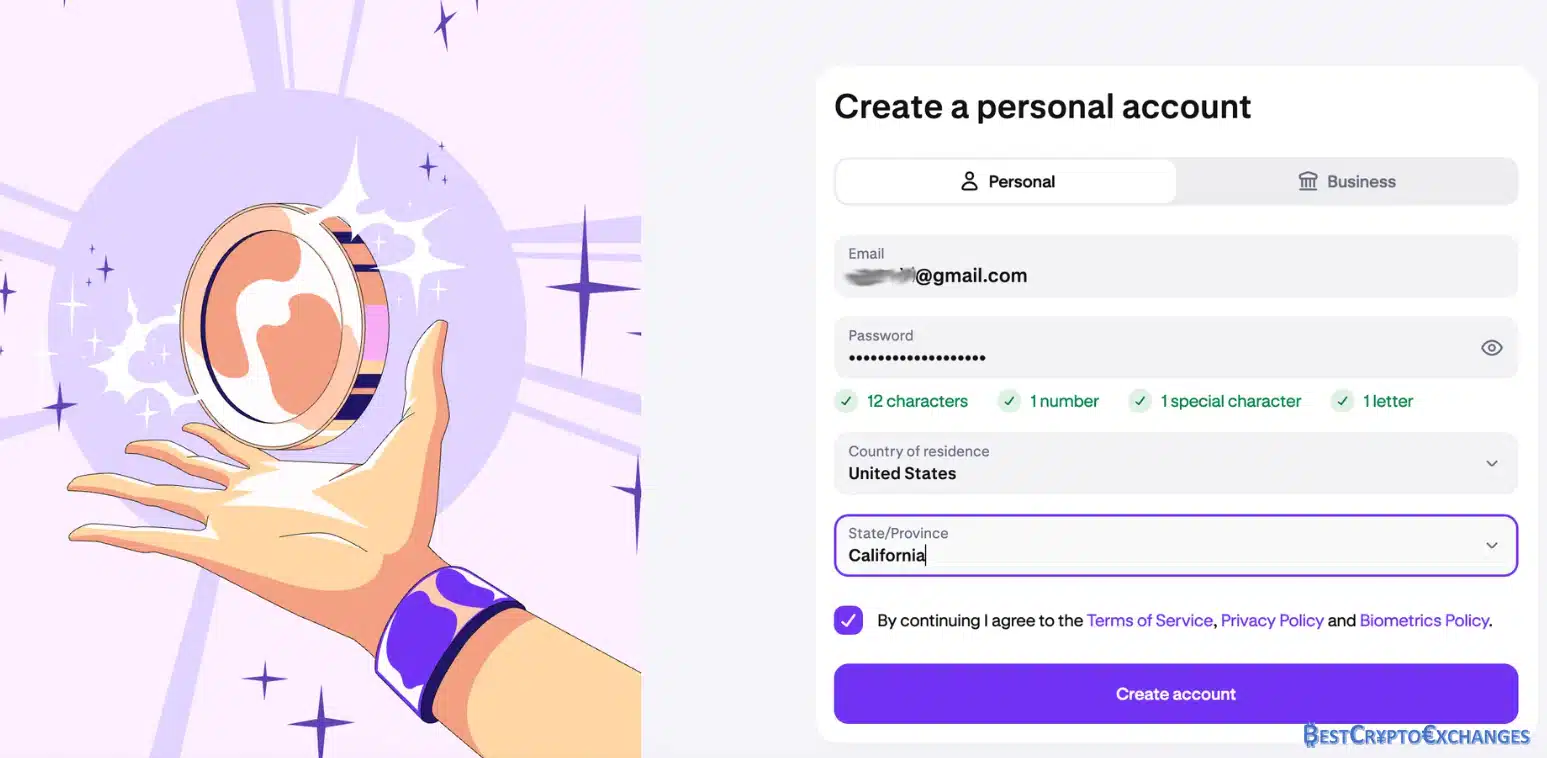

Getting started on Kraken is a straightforward exercise in digital paperwork, designed to satisfy global Know‑Your‑Customer rules without burying newcomers under endless forms. Compared with the hoops a traditional stock brokerage might demand—wet‑ink signatures, mailed copies, days of manual checks—Kraken’s online flow moves quickly.

How to Sign Up on Kraken

The exchange relies on automated document scanning and facial‑recognition tools that usually clear honest applicants in one sitting. As long as your passport or driver license is handy, the entire process from clicking Sign Up to seeing the Intermediate badge can finish well inside a lunch break.

Below, each numbered action walks through the screens you will meet and highlights details that trip up many first‑time crypto investors:

-

- Go to Kraken.com and tap Sign Up. Enter the email address you monitor daily, craft a twelve‑character password with upper‑ and lower‑case letters plus a symbol, and pick the nation that issued your government ID. Avoid work inboxes that might later change, and refrain from recycling an old password—compromised credentials remain a leading cause of lost funds across crypto exchanges. The country field controls which fiat rails appear later, so double‑check before you continue. Finish the page and press Create Account to trigger the confirmation sequence.

- Kraken sends a six‑digit code to your inbox within seconds. Open the message, copy the digits, return to the registration tab, paste them into the Activation field, and click the purple button. If the code expires—each one lasts for twenty minutes—use Resend to obtain a fresh token. Some mail providers filter automated messages, so inspect spam folders if nothing arrives. Successfully entering the code locks your email to the new profile, an important safeguard against phishing attempts that might try swapping addresses later.

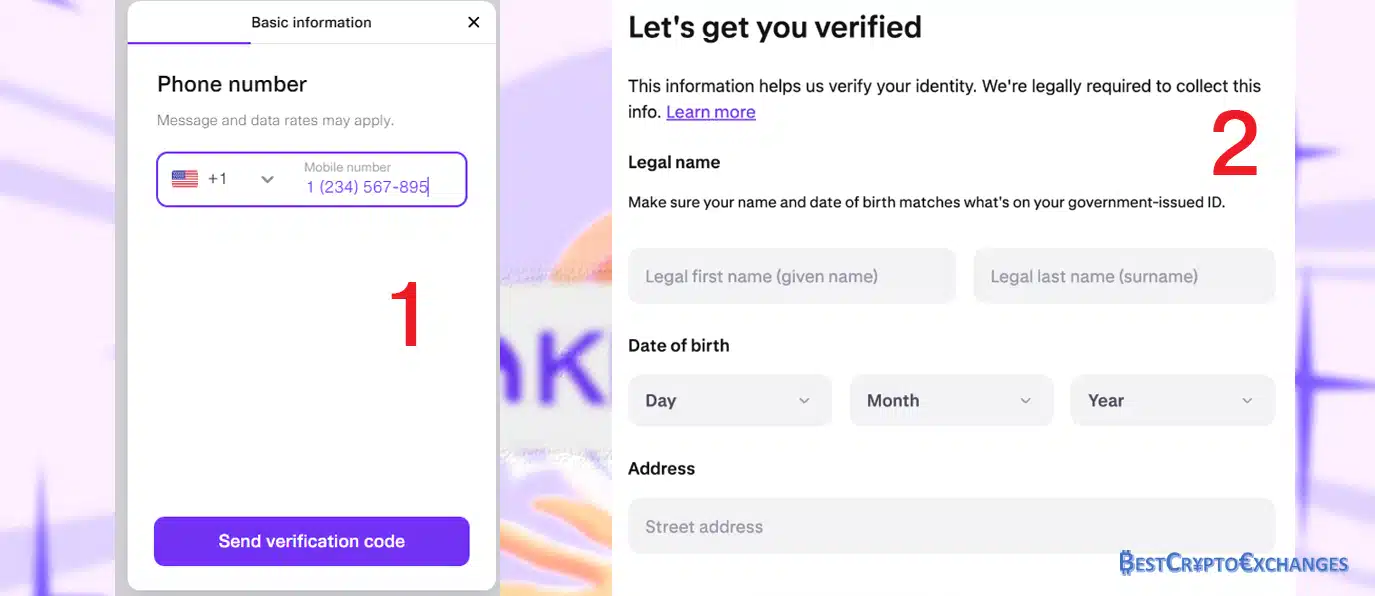

- Fill in your first and last name exactly as printed on your ID, add date of birth, a mobile number capable of receiving SMS verification, and the full residential address that appears on recent utility bills. Post‑office boxes and commercial drop sites are rejected. Enter apartment numbers on the second line to avoid mismatched data. Kraken cross‑checks these fields against third‑party databases; consistency speeds approval and prevents the support team from flagging the application for manual review.

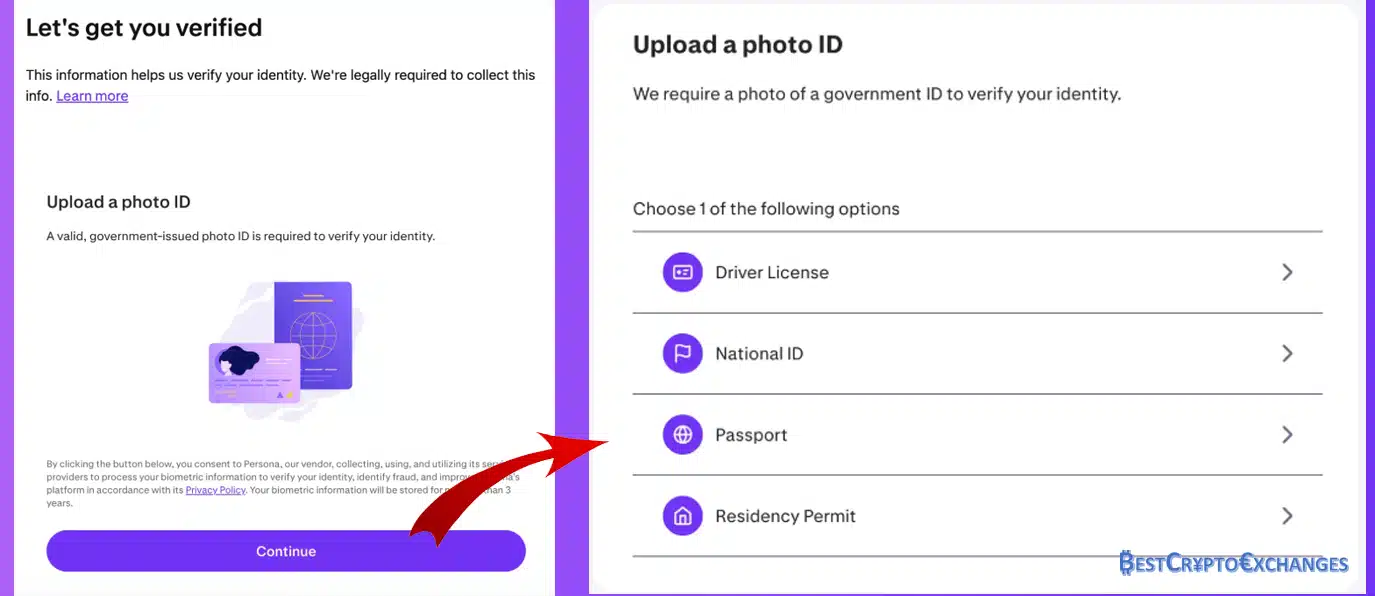

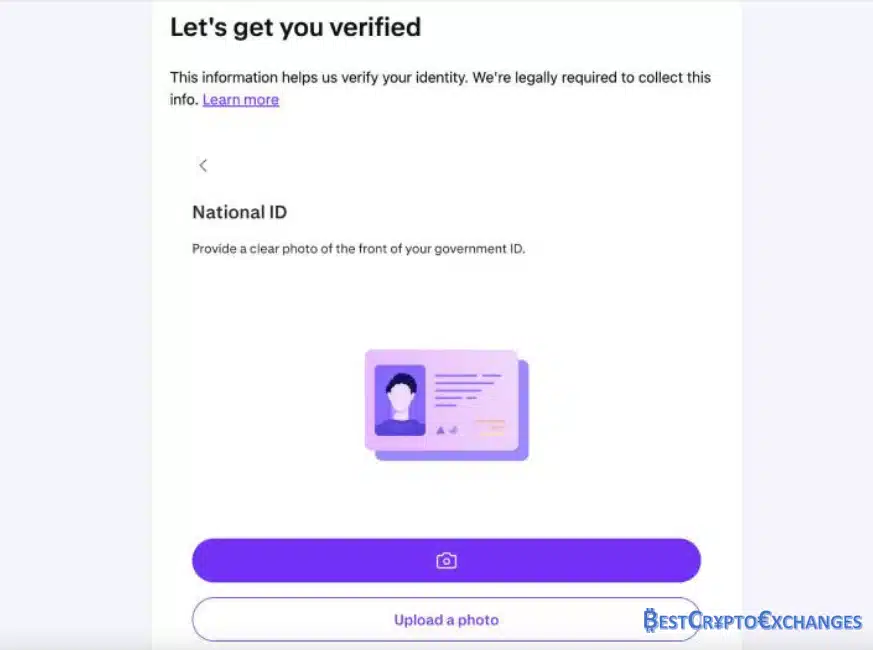

- Choose a document type—passport, driver license, or national identity card—then use the built‑in camera widget or file uploader to submit a clear image of the front side. Place the document on a flat surface under natural light; glare or heavy shadows can cause OCR failure. Remove plastic sleeves and ensure all four corners remain visible. A status bar will show the upload percentage; do not close the browser until it reaches one hundred percent.

- Turn the document over and capture the reverse side. Again, confirm security features such as holograms, micro‑printing, and the issuing authority’s seal are legible. For driver licenses, focus the lens so the signature strip remains sharp. JPEG files under five megabytes transfer fastest, so resize overly large images if your internet connection stutters. When both sides pass the preliminary check, Kraken moves you to the selfie stage.

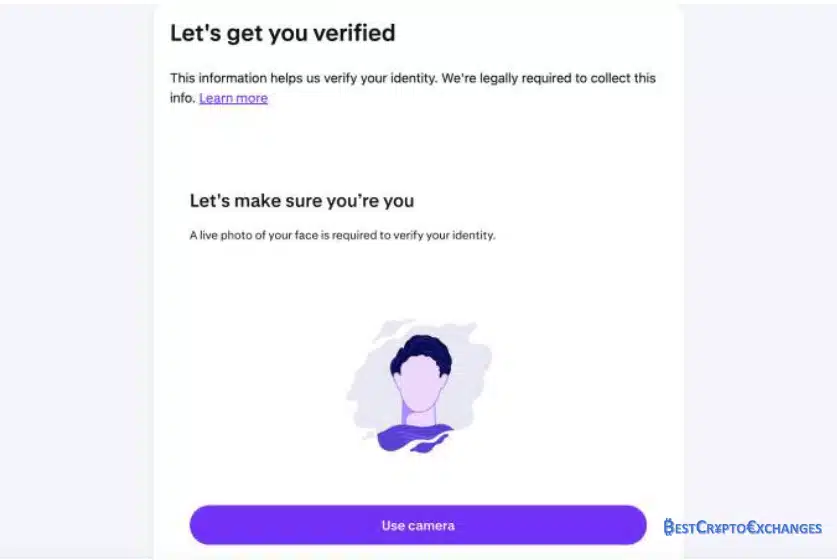

- Grant temporary camera access, frame your entire face within the oval guideline, and hold steady until the software snaps a picture automatically. Remove hats, double‑eyeglass layers, or heavy makeup that could confuse the biometric match. If you wear prescription glasses, tilt them slightly to avoid reflections. The system compares facial geometry against the ID photo; maintaining a neutral expression increases match probability.

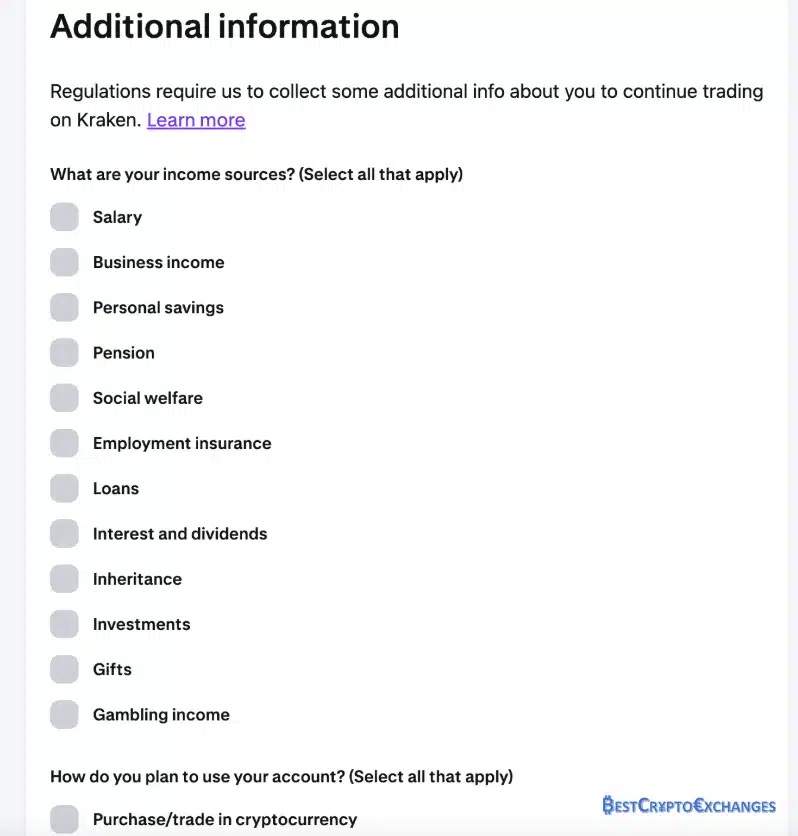

- Complete a short funding questionnaire: select main bank accounts you will use, estimate monthly trading volumes in U.S. dollar equivalents, and tick boxes for products you intend to access such as spot trading, margin trading, or staking. These answers do not lock you into strict limits but help Kraken gauge expected flow and flag anomalous activity. Under‑reporting by wide margins may trigger later compliance requests, so input realistic ranges.

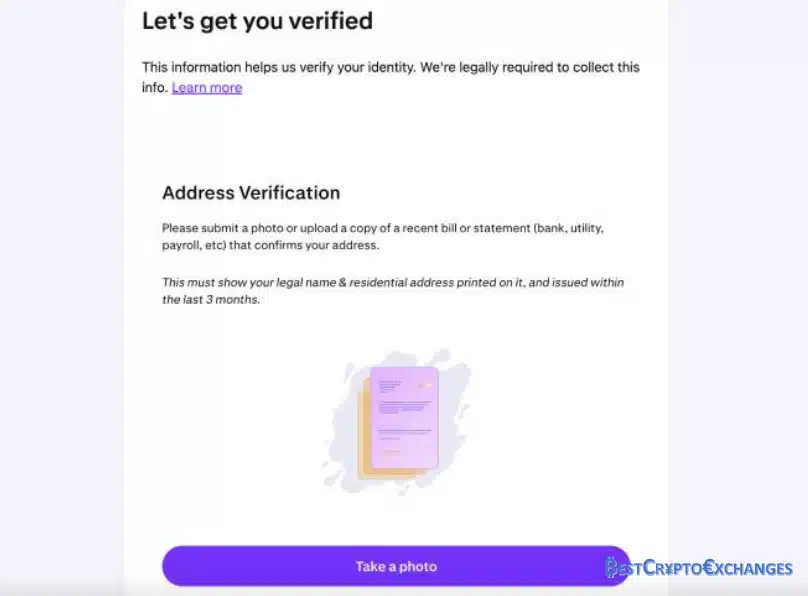

- Upload a PDF or image of a utility bill—electricity, water, broadband—or a bank statement dated within the last ninety days. Ensure your name and the exact street address typed earlier appear clearly. Crop out transaction details if desired; Kraken cares only about the header. Unsupported files or statements older than three months rank among the top reasons Intermediate reviews stall.

- Wait for the Intermediate badge to show on the Account Overview page. Automatic systems handle most submissions, and in quiet periods approval arrives within fifteen minutes. If anything fails, the support team emails specific correction instructions rather than outright rejection, so monitor the inbox you registered.

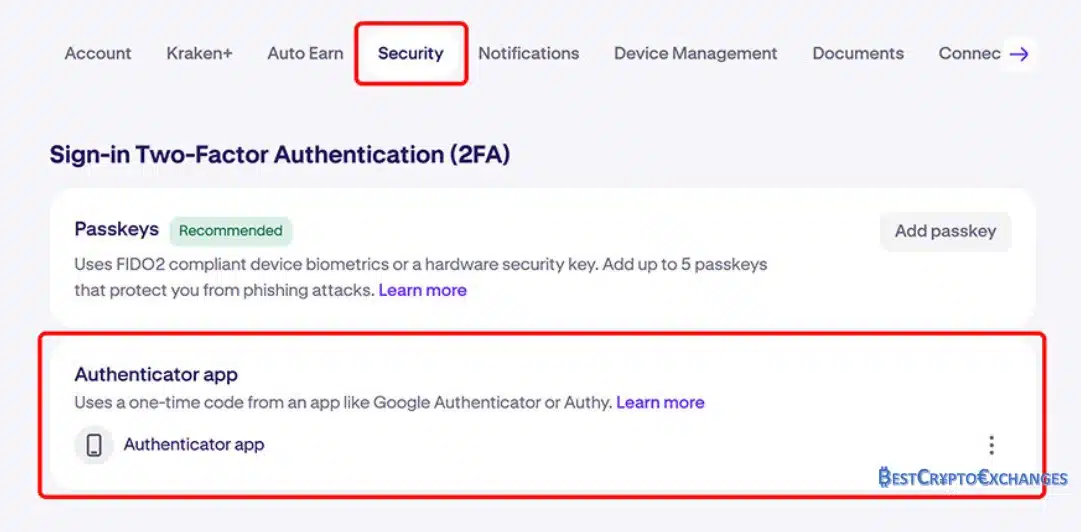

- Open the Security tab, click Enable Two‑Factor Authentication, and scan the QR code with Google Authenticator or your preferred app. Write the backup codes on paper and store them offline; they restore access if the phone is lost. For extra defence, generate a separate passkey or add a YubiKey later. With 2FA active, your Kraken account stands guarded, deposits can flow, and you are ready to place the first trade.

- Go to Kraken.com and tap Sign Up. Enter the email address you monitor daily, craft a twelve‑character password with upper‑ and lower‑case letters plus a symbol, and pick the nation that issued your government ID. Avoid work inboxes that might later change, and refrain from recycling an old password—compromised credentials remain a leading cause of lost funds across crypto exchanges. The country field controls which fiat rails appear later, so double‑check before you continue. Finish the page and press Create Account to trigger the confirmation sequence.

Takeaway: following each step in sequence—careful data entry, clear photos, honest funding estimates—reduces friction and keeps verification under half an hour for most Kraken users. Once Intermediate status is live, you gain access to all core features except OTC and Business APIs, enough to start trading crypto confidently.

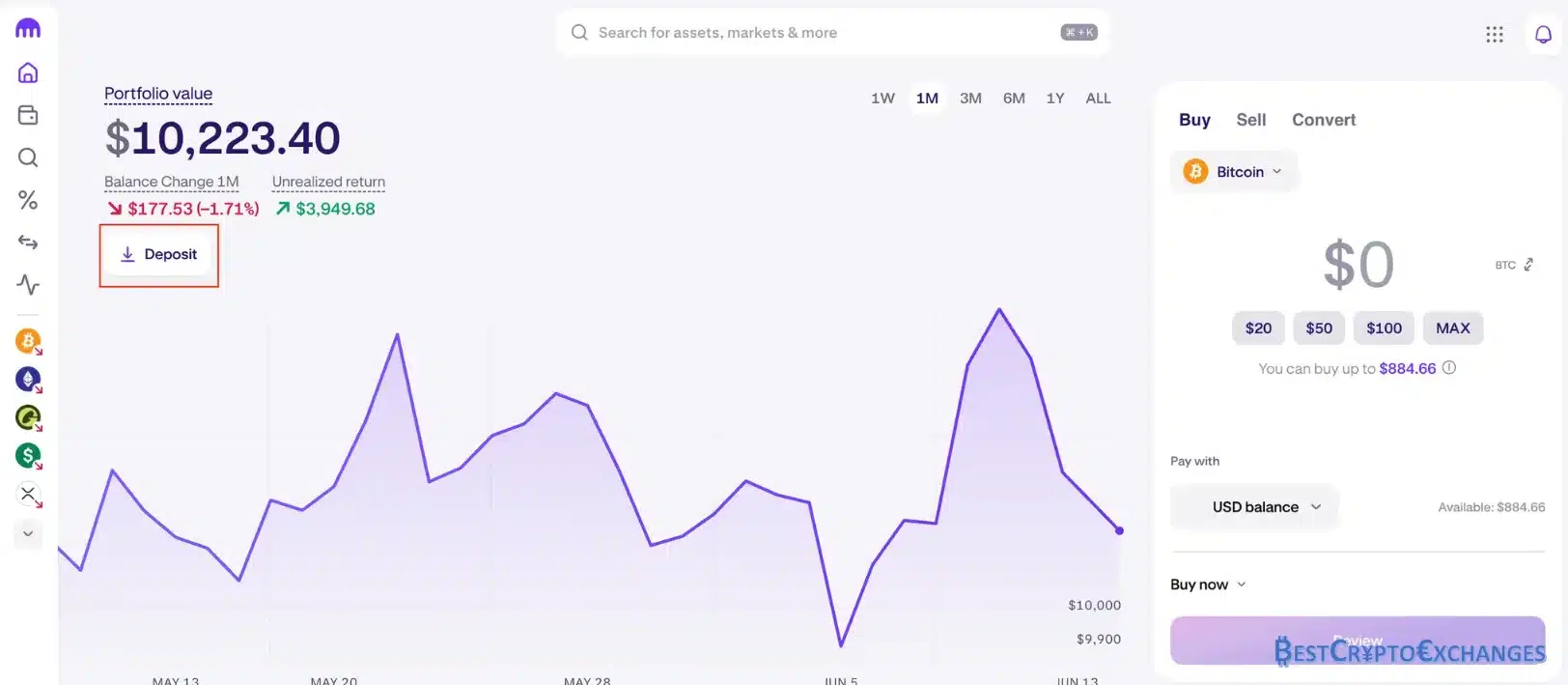

How to Deposit Your Kraken Account

Depositing funds on Kraken is quick once you know the sequence, yet every blockchain rail is unforgiving toward typos. Always match the asset ticker, verify the network string, and, where relevant, include the tiny destination tag that links the transfer to your Kraken account.

One missed character can send digital assets into limbo for good, so slow down, review every screen twice, then hit send:

-

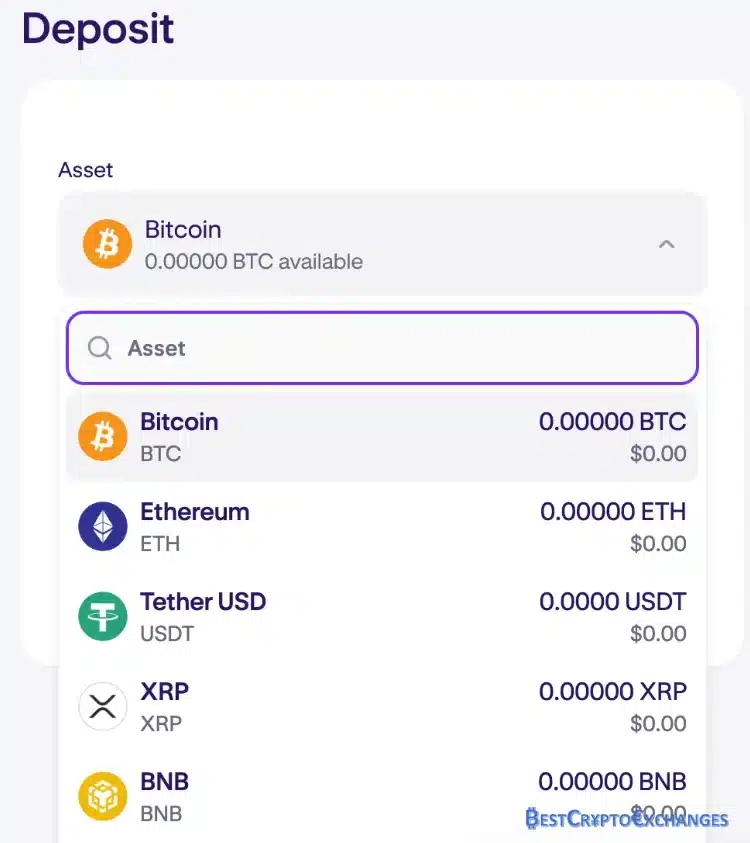

- From the left‑hand Portfolio panel click the green Deposit button and a dual window appears that separates fiat rails from crypto rails. The fiat side lists bank wires, SEPA, Faster Payments, and Interac, each with its own cut‑off time, while the crypto side shows every listed coin alphabetically. Hovering over any fiat option reveals minimum and maximum limits tied to your verification tier, while crypto items display real‑time network fees sourced from the underlying blockchain mempool.

- In the search bar at the top of the crypto column type the ticker you plan to move, for example USDT, so the list shrinks to that asset alone. Selecting USDT opens a modal that prompts you to choose among several blockchains. Using the search filter prevents accidents such as clicking USDC or UST by mistake, a mix‑up that regularly fuels support tickets from distracted first‑time depositors.

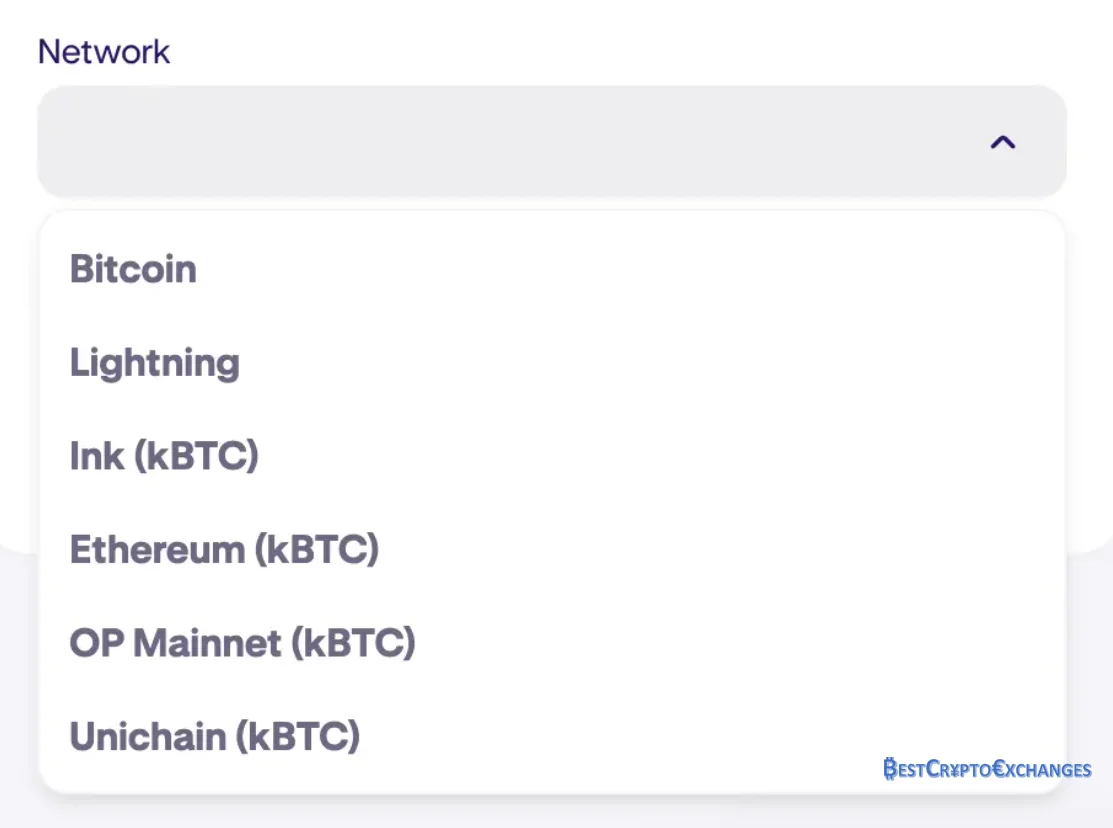

- A network picker now displays choices like TRC20, ERC20, Polygon, and Arbitrum along with a fee and estimated confirmation time for each. Read those lines closely. ERC20 typically costs more money yet enjoys deeper wallet compatibility, whereas TRC20 is cheaper but unsupported by some exchanges. Choose the chain that your external wallet can actually send. Kraken cannot credit tokens that arrive on an unexpected rail.

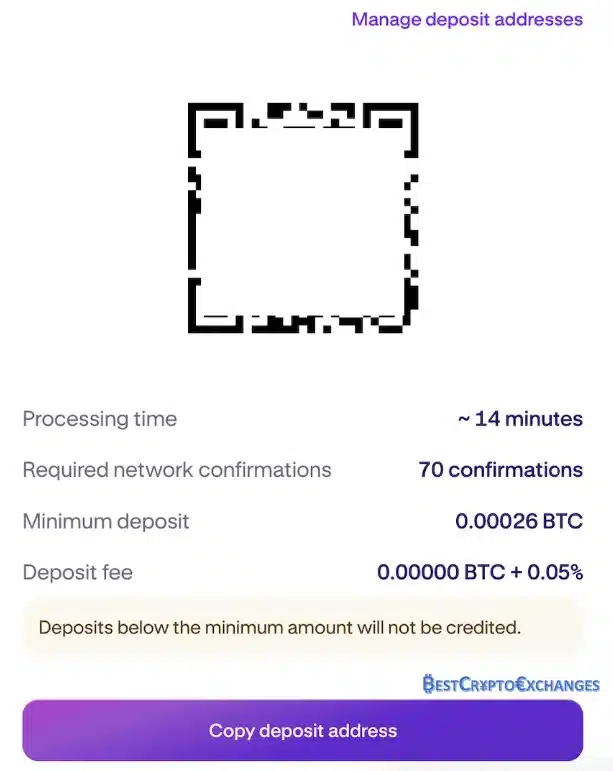

- Copy the alphanumeric wallet address that Kraken generates and, if the screen shows an additional memo, destination tag, or note, copy that as well. Paste both elements into the withdrawal form at the sending service, whether it is another cryptocurrency exchange or a personal wallet. Double‑check the first six and last six characters of the address on both sides before you click confirm. For coins that need a tag, omitting it means funds land in a holding pot that requires manual recovery and extra fees.

- Return to Kraken and open Funding. A status line appears within seconds showing the transaction hash and the number of block confirmations still required. Bitcoin needs one, Ethereum based tokens need up to twelve, and TRC20 usually clears after just one. When the status flips to Success the new amount migrates from Pending to Available. At that point you can head straight to Trade and deploy the deposit on spot, margin, or futures markets.

- From the left‑hand Portfolio panel click the green Deposit button and a dual window appears that separates fiat rails from crypto rails. The fiat side lists bank wires, SEPA, Faster Payments, and Interac, each with its own cut‑off time, while the crypto side shows every listed coin alphabetically. Hovering over any fiat option reveals minimum and maximum limits tied to your verification tier, while crypto items display real‑time network fees sourced from the underlying blockchain mempool.

Takeaway. Careful ticker selection, network matching, and tag inclusion turn deposits into a routine task instead of a rescue mission. Follow the checklist above, keep screenshots of each stage for your records, and most Kraken users will see funds reflected in the Available column inside fifteen minutes for most chains.

How to Trade on Kraken With Ease

Kraken splits its interface into Simple and Pro. The Simple tab focuses on clean swap tickets that let a new account holder convert dollars into bitcoin in seconds, but the deeper Kraken Pro workspace unlocks margin trading, advanced charting features, and full depth‑of‑market tools.

To ease into the platform, place one straightforward market order first—this teaches fee visibility, slippage math, and order‑history tracking without the extra variables that come with limit grids or stop triggers:

-

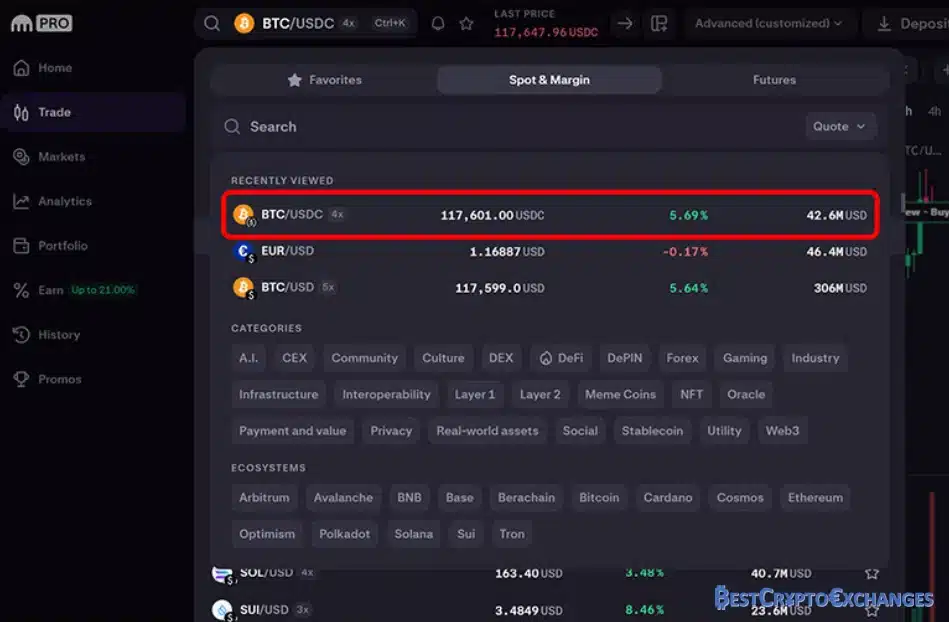

- Click the Trade icon in the sidebar, then enter “BTC / USD” in the pair search bar and hit Enter. The central panel populates with a live order book, last‑trade blotter, and candlestick chart powered by TradingView. Colored histograms on the left show buy walls and sell ladders, giving visual clues about near‑term support and resistance. Confirm the green “Buy” and red “Sell” buttons correspond to the correct pair—mistaking BTC / USD for BTC / USDT is a common rookie error flagged in customer service Kraken logs.

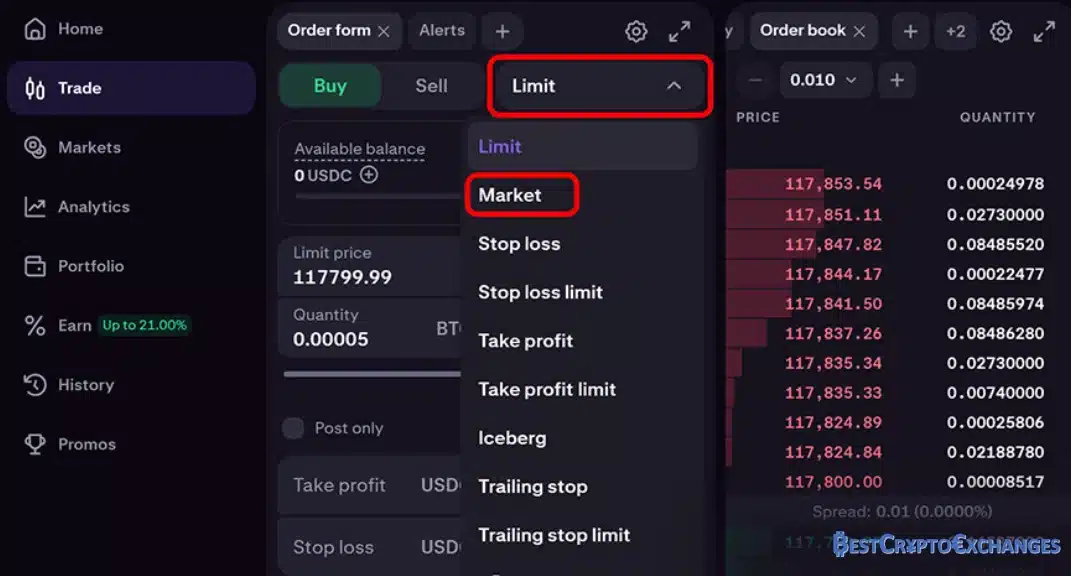

- Near the order ticket locate the drop‑down that reads “Limit” by default. Tap it and pick “Market.” In market mode the Kraken engine matches your trade against the best available liquidity, guaranteeing fill but accepting the spread. A yellow warning banner reminds margin trading users that leverage introduces significant risk during high volatility; ignore that for now if you are staying spot.

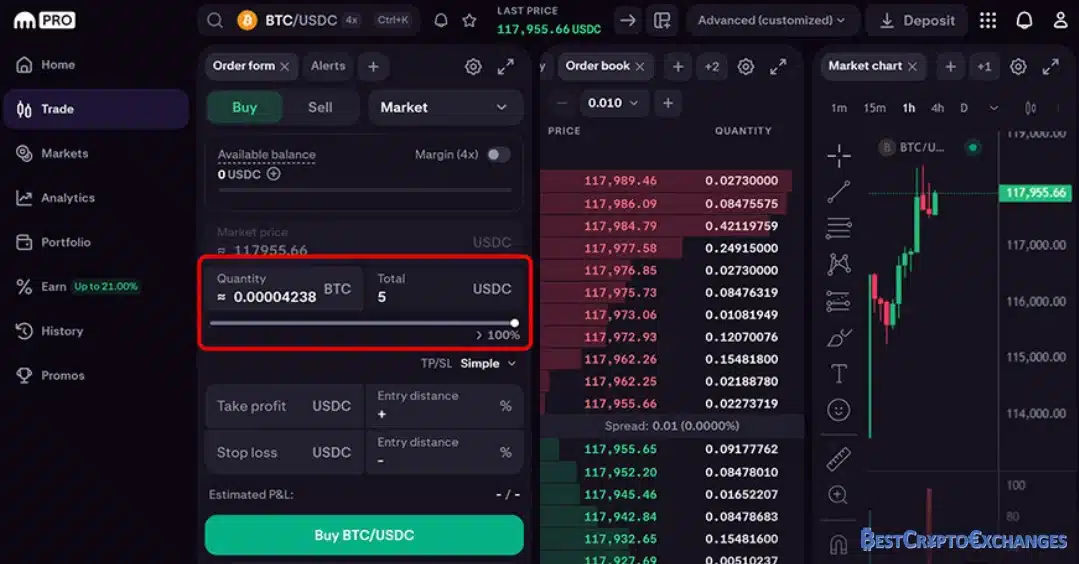

- Inside the Amount field you can type either the number of bitcoins you want or the fiat dollar figure to spend; the other box updates automatically. A fee line below shows the taker charge—0.40 percent if thirty‑day trading volumes remain under ten‑thousand dollars. Review that number because taker fees are higher than maker fees. When satisfied press the green Buy or red Sell. Kraken locks price for a split‑second while routing the match.

- A modal appears summarizing pair, side, size, displayed fee, and estimated execution price. Read each row: mismatching side or decimal places tops the list of support ticket number causes. Click Confirm. The window closes, and a toast notification reports “Order Filled.” Navigate to Order History and you’ll see a timestamped entry with fill price, total fee, and trade ID, useful for bookkeeping or tax software exports.

- Click the Trade icon in the sidebar, then enter “BTC / USD” in the pair search bar and hit Enter. The central panel populates with a live order book, last‑trade blotter, and candlestick chart powered by TradingView. Colored histograms on the left show buy walls and sell ladders, giving visual clues about near‑term support and resistance. Confirm the green “Buy” and red “Sell” buttons correspond to the correct pair—mistaking BTC / USD for BTC / USDT is a common rookie error flagged in customer service Kraken logs.

Takeaway: Running through a single market order teaches newcomers how spreads, taker fees, and settlement timestamps work on Kraken. Once this flow feels natural, traders can graduate to limit entries, stop losses, and eventually margin or trade futures, confident they understand the core mechanics that underpin every more advanced strategy on the exchange.

Who Is Kraken For

Kraken attracts several tribes inside the cryptocurrency market. First‑time crypto investors who value steady accumulation can open a new Kraken account, link bank accounts, and schedule recurring Instant Buy orders that follow dollar cost averaging, helped by push price alerts on the Kraken app. Day‑to‑day swing traders and advanced users focus on the order book: once trading volumes increase beyond fifty‑thousand dollars in a rolling month, maker rebates kick in, shaving trading fees and giving those users a huge relief when margins are tight.

Margin trading up to five times leverage lets experienced crypto investors hedge spot exposure without wiring more money to other platforms. For derivatives fans, trade futures on BTC, ETH, LTC, or XRP settle in cash and clear through a low‑latency engine that advanced traders praise during volatile sessions. Institutions and high‑net‑worth investors rely on Kraken’s OTC desk for private blocks that will not disturb market price, while security‑first customers prefer the exchange’s proof‑of‑reserve audits, ninety‑five percent cold storage policy, and strict security measures that exceed many crypto exchanges.

Kraken Review: Takeaway

Across the crowded field of crypto exchanges, Kraken keeps its edge by combining strong security measures, wide investment options, and responsive customer support Kraken staff in several languages. The platform charges high taker fees on Instant Buy and remains in discussion with the Securities and Exchange Commission regarding unregistered securities questions, yet the core operation still delivers tangible value: low maker charges, deep trading pairs, regulated cash rails, and transparent proof‑of‑reserve checks.

Whether the goal is simple crypto trading, margin positions, or institutional‑grade OTC settlement, Kraken offers a single login that unites spot trading, trade futures, staking, and multi‑chain wallet storage. For users who base financial decisions on verifiable data, audited balances and a decade without a successful hot‑wallet breach weigh heavily. As long as traders remain mindful of fee tiers and legal updates, Kraken continues to serve as a reliable hub for building, managing, and safeguarding digital assets.

Scientific Refs

-

- Chainalysis Exchange Security Report 2025, Section 4 Cold Storage Ratios

- Armanino LLP Attestation for Payward Group, January 2025

- European Securities and Markets Authority Consultation, March 2025

FAQ

Is Kraken a good crypto exchange?

Most online research ranks Kraken near the top of global crypto exchanges because it pairs strict security measures—PGP‑signed mail, quarterly proof‑of‑reserve audits, and ninety‑five percent cold storage—with practical features such as seven fiat ramps and 24 / 7 customer support Kraken operators. Instant Buy taker fees are steep, yet order‑book trades fall to 0.25 percent maker, 0.40 percent taker, and even lower once trading volumes increase, giving active traders comparatively low fees over time.

Who is Kraken best for?

Kraken’s dual‑interface design means one platform scales across skill levels. Simple mode offers instant buy, price alerts, and dollar cost averaging for first‑time crypto investors who want a quick path from bank accounts to digital assets. Toggle to Kraken Pro and advanced users gain margin trading up to 5 ×, trade futures with cross or isolated collateral, API keys for bots, and OTC desks that quietly execute six‑figure blocks without moving the market price.

What fiat currencies does Kraken accept?

Clients may deposit money in seven government‑issued units: United States Dollar, Euro, British Pound, Canadian Dollar, Australian Dollar, Swiss Franc, and Japanese Yen. Funding rails include domestic wire, SWIFT, SEPA, Faster Payments, Interac, and debit card or Google Pay where regional rules allow. Direct fiat support removes hidden spreads that arise when traders must hop through other exchanges simply to acquire stablecoins before they start trading.

How many cryptocurrencies does Kraken offer?

As of July 2025, Kraken lists more than four‑hundred‑thirty crypto assets, covering large‑caps like Bitcoin and Ether plus newer layer‑two tokens, DeFi governance coins, and NFT infrastructure plays. Kraken announced quarterly listing rounds, each vetted for liquidity and legal status, so experienced crypto investors can diversify without opening extra accounts. Spreads on flagship pairs remain tight, while exotic pairs still hold respectable depth for swing trades.

Does Kraken offer margin trading?

Yes. Kraken Pro unlocks leverage up to five times on approved pairs such as BTC‑USD, ETH‑EUR, and ADA‑USD. Margin fees accrue every four hours based on the borrowed asset, with rates posted in advance under the fees section. Liquidation engines use maintenance margin triggers to cut losses, so advanced traders should monitor positions and set price alerts to limit significant risk during fast cryptocurrency market swings.

How long do Kraken withdrawals take?

Blockchain withdrawals usually leave the hot wallet moments after approval and credit once the first network confirmation lands—about ten minutes for Bitcoin, under two minutes for Solana. Fiat timelines depend on rail: domestic USD FedWire reaches most bank accounts same business day, SEPA euros clear within hours, and SWIFT transfers can take one to three days. Kraken notifies users by email once funds exit the platform.