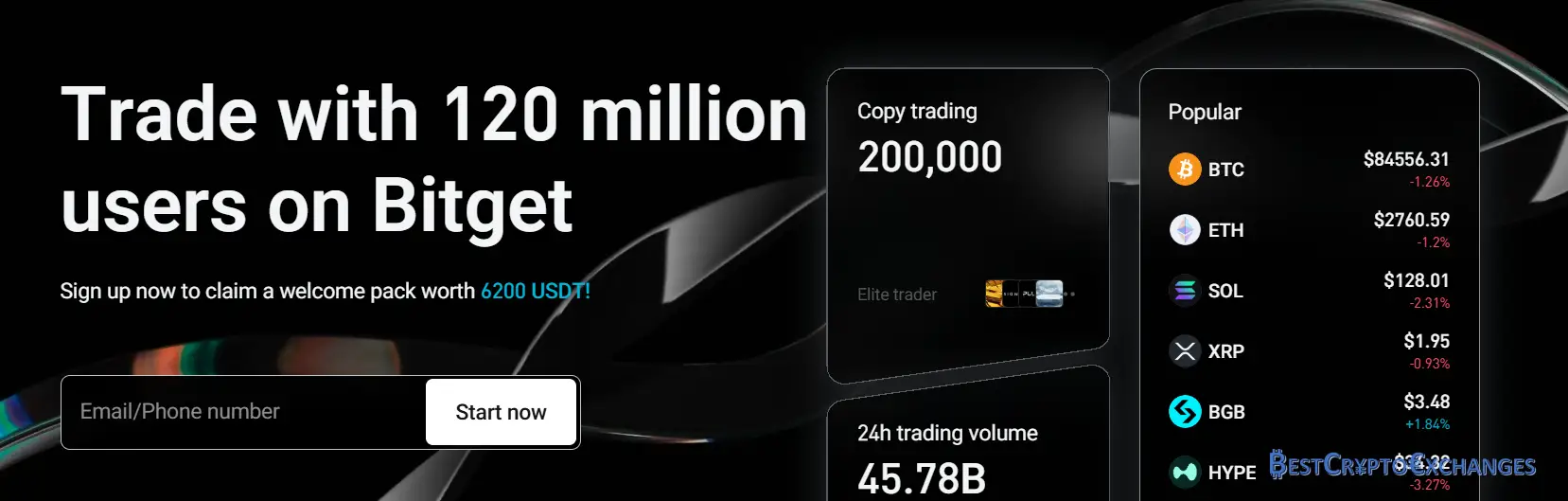

The crypto arena rewards traders who pick tools that match their goals, fee tolerance and learning curve. This Bitget review explores a platform that has risen quickly by blending futures trading horsepower with a social copy desk that lets newcomers shadow seasoned strategies. Founded in 2018, Bitget has grown into a global trading platform serving more than twenty million verified accounts and posting combined daily volume that often breaks ten billion dollars.

Users gain access to spot and futures markets, margin, trading bots, and a Learn2Earn hub that turns tutorials into token rewards. Security stands out with cold storage for nearly all user assets, monthly proof of reserves, two factor authentication and a seven hundred seven million dollar protection fund. Add in low standard trading fee tiers that shrink further when paying in the native BGB token, plus a web wallet and credit card, and Bitget positions itself as an all‑in‑one hub for both first‑time buyers and experienced traders seeking deeper features.

Pros

Strong security setup with multi layer cold storage and regular proof of reserves updates

Futures and options desks plus spot, margin and copy trading in one hub

Copy trading console with thousands of elite traders and transparent leaderboards

Earn section with savings, staking, Shark Fin and loan markets for passive income

Web3 wallet, crypto credit card and in‑house BGB token for fee rebates

User interface polished for desktop, web and mobile with English and nine other languages

Twenty four hour live chat and ticket desk with under five minute median response

Cons

Tool set can overwhelm first time buyers who only need quick purchases

Limited direct support for residents in the United States

Fiat deposit list covers sixteen currencies which may force USD users toward third party ramps

Bitget suits traders hungry for depth, low costs, and social features, yet demands a learning curve. Security and yield tools shine, but US residents face hoops and pure‑fiat shoppers may need extra steps. Evaluate goals, jurisdiction, and comfort with complexity before committing funds to this otherwise well‑rounded ecosystem thrives.

Bitget at a Glance

Launched in 2018, Bitget exchange positions itself as a popular cryptocurrency exchange focused on giving new users and experienced traders equal access to every major corner of the crypto market. A single bitget account unlocks spot trading, margin trading, and a powerful futures trading arena branded as Bitget Futures, plus a copy trading network where advanced traders broadcast strategies and new traders can mirror them in real time. Daily turnover in the combined spot and futures markets frequently breaks ten billion USD, fuelled by more than twenty million members and hundreds of liquid trading pairs.

Security remains the primary focus. The platform stores a significant portion of user funds in cold storage, enforces two factor authentication, and publishes a monthly reserve ratio report so anyone can confirm that client liabilities match on‑chain assets. These robust security measures underpin strong customer satisfaction scores and rebut most negative reviews that surface online.

Fee design is straightforward. The standard trading fee on spot market trades sits at 0.1 percent maker and taker, with discounts for holding BGB or hitting volume milestones. Bitget charges 0.02 percent maker and 0.06 percent taker in the derivatives arena, keeping overall trading fees lower than many other major exchanges. Published withdrawal fees vary by chain and asset, while minimums for crypto deposits and fiat currencies are small enough that there is no painful minimum deposit barrier to start trading.

Beyond charts, Bitget rolls out a bitget wallet for DeFi, a Visa card that lets holders withdraw money at point‑of‑sale, and a suite of bots that handle limit orders, market order execution, and grid algorithms. All tools run through a sleek web platform, a desktop client, and a Play Store mobile app that promises a smooth trading experience.

Licences in Lithuania, Australia, Canada, and Dubai prove the exchange is bitget safe. A 707 million USDT protection fund, constant liaison with bitget affiliates, and 24 hour customer support reinforce confidence that the company can resolve issues and help traders make informed decisions. Whether your goal is high‑speed derivatives trading, long‑term staking, or simply low‑stress crypto trading, Bitget offers enough trading options to rival major exchanges while keeping transaction fee friction light.

Why Many Traders Gravitate to Bitget

Before drilling into line‑item advantages, it helps to see how the pieces fit together. Bitget’s designers set out to compress a full stack—spot trading, aggressive futures markets, hands‑off copy trading, passive‑yield vaults, and a Web3 wallet—into one login without bloating the interface. Add a flat 0.1 percent headline fee, visible proof‑of‑reserves, and a 707 million USDT protection fund, and you have a platform that checks the must‑have boxes for both risk‑aware institutions and retail newcomers who simply want quick access to Bitcoin. The bullet points below spotlight the strongest pillars propping up Bitget’s growing share of global crypto flow.

Multi‑Layer Shield Around User Assets

Bitget publishes a simple promise: one wallet, one hundred ten cents on every dollar. Recent Merkle‑tree snapshots (July 2025) show client liabilities of 5.6 billion USDT matched by 6.2 billion USDT‑equivalent coins held on‑chain—an over‑collateralisation rate of roughly 110 percent.

Cold‑Storage Dominance – About 98 percent of customer assets are held offline. Private keys are sliced with Shamir secret‑sharing and stored inside hardware security modules housed in Singapore, Iceland, and Canada. Even if one site went dark, withdrawal signing would still require a quorum from the other two.

Hot‑Wallet Circuit Breakers – The warm wallet float is capped at 2 percent of total assets (≈112 million USDT at current market price). Any single withdrawal request above 0.2 percent of the float halts processing until two independent operations desks sign off.

Real‑Time Threat Filters – Chainalysis KYT screens every inbound hash within milliseconds, blocking tokens tied to sanctions, exploits, or darknet addresses. Internally, Bitget’s velocity engine scores order‑id behaviour; a sudden jump from 5 BTC daily volume to 200 BTC triggers an account cool‑down and live agent call‑back.

User‑Facing Guards – Mandatory two‑factor authentication shields both login and payout actions, while a personal anti‑phishing code stamps every official email. Address‑whitelist mode forces all withdrawals to pre‑saved wallets, stopping SIM‑swap thieves in their tracks.

$707 Million Protection Pool – The insurance chest currently contains 42 000 BTC, 320 million USDT, and 160 million USDC. Funds sit in publicly viewable addresses and can be tapped to reimburse users if an exploit pierces the primary defences.

Together, these measures put Bitget’s security stance on par with other major exchanges while giving traders transparent tools to verify that their coins remain exactly where they should be—under their own control.

Nearly Every Market Under One Roof

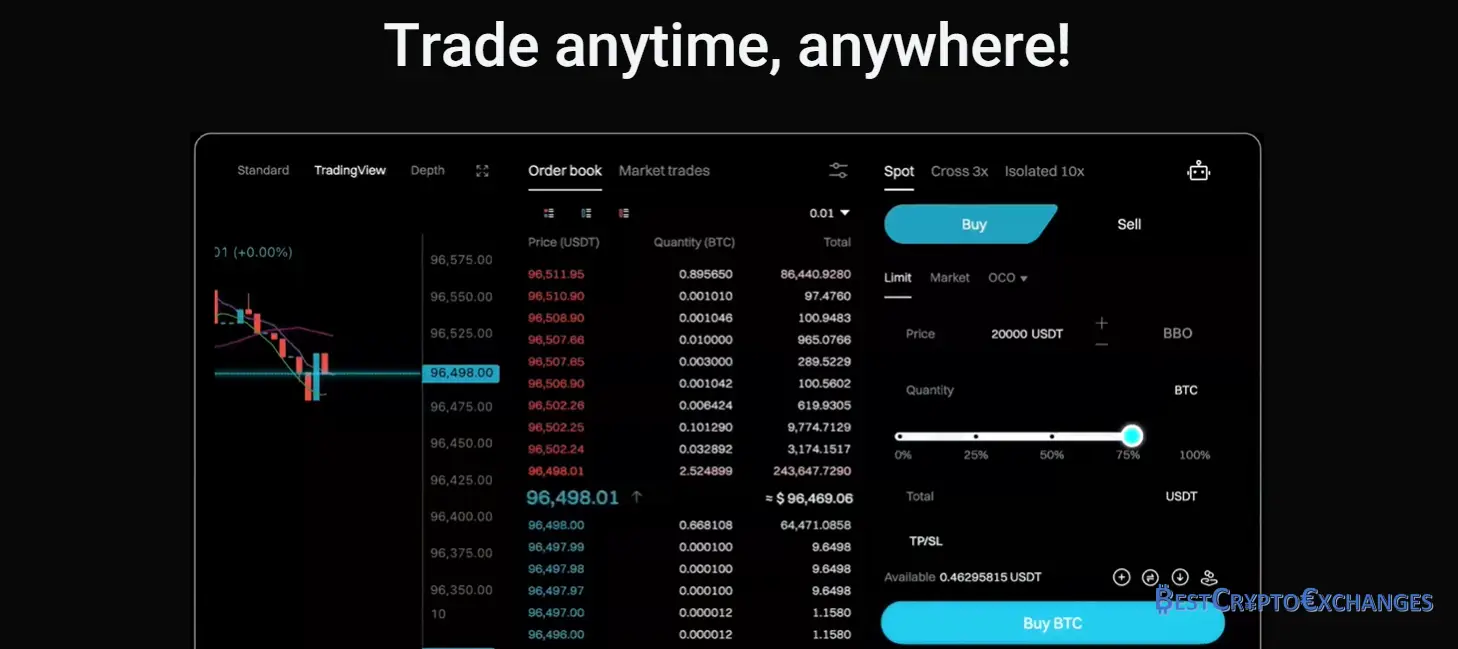

Bitget positions itself as a one‑stop trading platform, knitting together high‑liquidity spot books, leveraged derivatives, social copy feeds, and an OTC window into a single dashboard. Whether you scalp minute‑charts, hedge long‑dated exposure, or dollar‑cost‑average into blue chips, the exchange delivers the rails. Order‑book depth often ranks among the top five global cryptocurrency exchanges, with daily trading volume in futures markets alone passing $10 billion during volatile sessions. Advanced traders appreciate granular controls—cross versus isolated margin, bracket orders, take‑profit/stop‑loss chains—while new users can toggle “lite” view for a stripped‑down interface. The same Bitget account links to a web platform, iOS/Android apps, and API keys for algo scripts, giving investors a seamless, smooth trading experience across devices and network conditions.

Product | Core Details |

|---|---|

Spot trading | 800+ cryptocurrencies quoted against USDT, USDC, BTC, and ETH. Supports market, limit, OCO, iceberg, trailing‑stop, and post‑only orders. Maker/taker trading fees start at the standard trading fee of 0.1 % and fall with VIP tiers or BGB payment. |

Margin trading | Up to 10× leverage on 100+ pairs. Funding interest recalculated every eight hours; borrowers may repay anytime without penalty, allowing traders to pivot quickly as the crypto market shifts. |

Futures markets | USDT‑M, USDC‑M, and Coin‑M contracts. Leverage ceilings: 125× on BTC, 100× on ETH, 50× on many altcoins. Risk tools include auto‑deleverage rank and adjustable maintenance margin. |

Options | European‑style BTC and ETH options settled in USDT, with expiries from 24 hours to three months. Greeks and volatility term structure charts aid complex trading strategies. |

OTC & Instant Swap | Request‑for‑quote module sources liquidity from market‑making partners for block trades at the current market price; settlement supports bank wire, stablecoins, or selected fiat currencies. |

Bitget lines up a buffet of trading options, letting crypto traders shift from instant spot deals to high‑gear futures, margin hedges, copy books, and OTC liquidity without leaving one browser.

Fiat | Rail | Processing Time* |

|---|---|---|

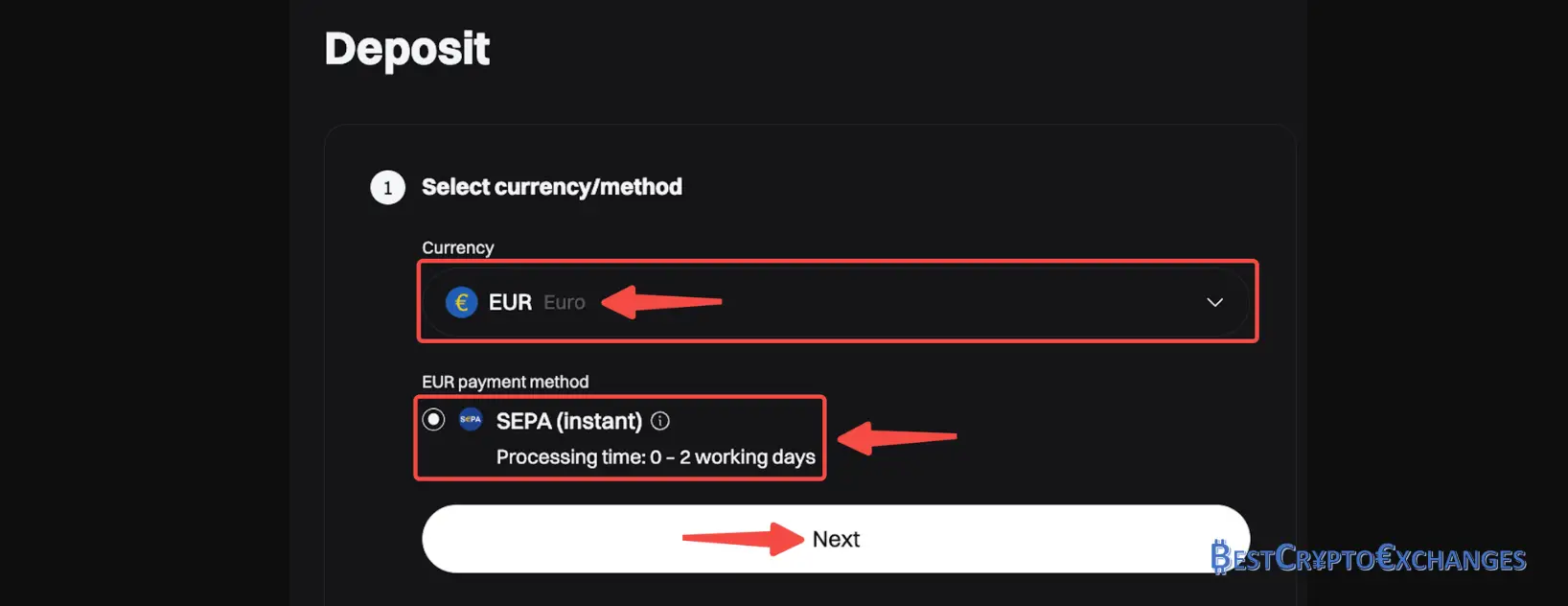

EUR | SEPA | 5–30 min |

AUD | Instant after KYC | |

CAD | Instant after KYC | |

BRL | Pix | < 1 min |

VND | VietQR | < 5 min |

Times reflect typical credited speed once a linked bank statement passes verification; withdrawals vary depending on local banking cut‑off.

Bitget folds spot, margin, futures, options, and OTC desks into one login, backed by low fees and robust security measures. The breadth rivals other major exchanges, letting crypto traders run virtually any strategy without juggling multiple venues. For active participants, fewer transfers mean lower withdrawal fees and tighter risk control.

Mirror Traders in Real Time

Bitget’s Copy Trading arena has grown into the largest social desk among major exchanges, boasting 12 000+ signal providers—the platform calls them Elite Traders. Each profile displays transparent analytics: 30‑day ROI, lifetime PnL, win ratio, average drawdown, traded futures pairs, and the standard trading fee they pay. A traffic‑light risk badge highlights aggressive leverage versus conservative swing styles, helping new users filter a list that can update every five minutes.

Ranking Metric | Default Weight | Data Window |

|---|---|---|

Monthly ROI | 40 % | 30 days |

Win Rate | 25 % | 100 trades |

Drawdown | 20 % | 30 days |

Follower PnL | 15 % | rolling total |

Scaling rules keep the ecosystem stable. An Elite Trader with 50 000 USDT in their Bitget account can accept 1 000 followers; those who hold over 500 000 USDT unlock room for 5 000 seats. The exchange freezes capacity whenever account equity slips below threshold, protecting follower allocation.

Once linked, followers choose between spot copy or Bitget futures copy (USDT‑M and Coin‑M contracts). They may also subscribe to Bot Copy, where algorithm builders list grid or DCA bots for a flat monthly fee—no revenue share applied. The default profit split is 80 % to followers, 20 % to the Elite Trader, settled daily in USDT; Bitget charges zero additional transaction fee on copied trades.

Safety toggles include:

Daily loss ceiling – pause copying if the master account drops by a user‑defined percentage.

Equity stop – auto‑close all mirrored positions once cumulative loss equals the cap.

Asset whitelist – follow only selected trading pairs, useful for keeping exposure limited to BTC or ETH.

Bitget review data shows that more than $350 million in follower capital tracks Elite strategies every month, providing deep liquidity without slippage spikes. Copy slots often sell out within seconds when a top performer posts triple‑digit returns, so the platform offers a priority reservation queue to VIP fee‑tier users.

Copy Trading on Bitget compresses the learning curve: rookies shadow high‑ranking pros, set personal risk brakes, and keep the bulk of gains. Elite signal providers earn a steady revenue stream, while the exchange boosts daily trading volume without raising maker or taker rates—a win across the board.

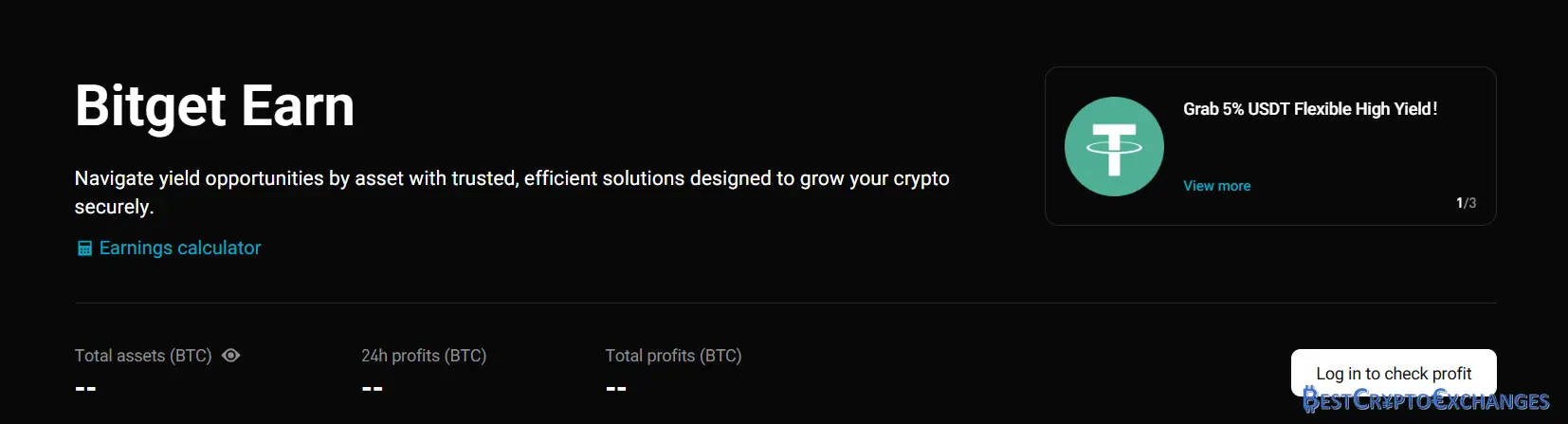

Beyond Trading: Earn, Train & Spend

Bitget stretches past charts with a three‑pillar toolkit. Bitget Earn funnels idle coins into flexible savings, fixed staking, Dual‑Invest and Shark Fin notes that guarantee principal and float yields up to 18 % APR when price bands hit. The Academy packs 300+ bite‑size lessons, quizzes and Learn‑to‑Earn modules that drop token rewards straight into a Bitget account once passed. On the spending side, the Bitget Wallet (130 chains, built‑in NFT market) pairs with the Bitget Card, a Visa product that auto‑converts crypto at checkout with zero annual fee and up to 2 % BGB cashback—turning portfolio gains into everyday purchases.

Bitget Earn

Bitget treats depositors like short‑term lenders rather than idle spectators, paying yield in multiple styles so every risk taste finds a slot.

Flexible savings – Place spare USDT, BTC, ETH or stablecoins in an overnight pool. Interest settles every day, compounding automatically. Annualised rates float between 2 percent and 5 percent, adjusted each Monday to mirror funding demand across spot and futures markets.

Fixed staking – Commit network tokens such as SOL, DOT, ATOM, ADA or AVAX for set windows of 7, 30, 60 or 90 days. Yields currently sit at 3 percent on week‑long locks and step up to 12 percent on ninety‑day commitments. Early exit is possible yet forfeits pending rewards, keeping the schedule fair for everyone.

Shark Fin notes – Subscribers park USDT while Bitget sells covered options against BTC or ETH. Principal stays intact. The holder earns a base 3 percent if price drifts outside the target band and a bonus ladder that climbs to 9 percent when candles stay inside the corridor at expiry.

Dual Investment – A higher gear for yield hunters. Users pick a strike level above or below current market price. If the asset finishes beyond the strike on settlement day the deposit converts into that coin at a discount, and the depositor keeps return rates that can top 20 percent; otherwise funds return in their original currency with the advertised yield.

Smart Trend baskets – Bitget’s quant desk screens for on‑chain velocity, new wallet count and headline sentiment, then allocates deposits across a rotating list of mid‑cap coins. Performance reviews publish weekly so participants can gauge real results against the white paper.

Bitget Academy and Research Hub

Education sits beside order books on Bitget’s road map. Its Academy hosts more than 220 bite‑size articles and video explainers, grouped into Beginner, Intermediate, and Pro playlists. Topics run from “Spot vs Futures margin math” to “Reading on‑chain liquidity pools”. Twice each week certified instructors stream live webinars; average attendance tops 4 700 viewers, and recordings land in the archive within 24 hours for anyone who missed the session.

The exchange sweetens study time with a Learn‑2‑Earn track. Complete a lesson set, score at least 80 percent on the follow‑up quiz, and the system airdrops token coupons worth 1–5 USDT or fee‑rebate vouchers into the student’s Bitget account. Since launch, more than 320 000 users have claimed rewards, logging a combined 2.1 million course completions.

For deeper due diligence, Bitget Research circulates a 40‑page market report every month. Sections break down reserve ratios at major exchanges, funding‑rate shifts in bitget futures, and tokenomics stress tests on upcoming listings, arming traders with hard data instead of social‑media rumors.

Bitget Wallet & Bitget Card

Bitget’s self‑custody wallet—reborn from Bitkeep—is a multi‑chain cockpit rather than a simple vault. It already plugs into 130 blockchains, auto‑detects assets, and routes swaps through the lowest‑slippage bridge it can find, whether that is Stargate, cBridge, or Jumper. An embedded NFT bazaar lists more than 420 000 collections and quotes floor prices in real time, while the gas tracker flags congested networks so you can postpone an on‑chain move and save money. For extra safety, the mobile app pairs with Ledger Nano X or Trezor T over Bluetooth or USB, letting users sign without ever exposing seed phrases.

The Bitget Card, released in Q1 2024, taps into the Mastercard network in over 50 million shops. It draws directly from your Bitget account balance, converting BTC, ETH, or USDT at the point of sale with a 0 percent markup above the current market price. There is no issuance or annual fee, and cash‑back lands daily: 1.2 percent in BGB for standard holders and 1.7 percent once your BGB stack passes 100 tokens—a practical perk that turns everyday spending into an effortless stacking strategy.

The Bitget Token BGB

BGB, the native asset of the Bitget exchange, underpins an entire incentive system designed to reward trading activity, long‑term holding, and ecosystem participation. Launched with a total supply of 2 billion tokens, BGB follows a deflationary model, with quarterly token burns linked directly to exchange revenue. The end goal is to cap supply at 1 billion, reducing float and tightening long‑term supply metrics.

One of the most popular use cases is the 20% trading fee discount for spot market participants who toggle the “Pay With BGB” option. This alone makes the token attractive for high‑frequency traders and users engaging in scalping or low‑margin strategies.

BGB also plays a direct role in Bitget’s VIP tiering system. Holding just 5,481 BGB unlocks VIP 1, granting reduced spot fees at 0.08% and futures maker fees as low as 0.018%. Higher VIP tiers unlock further savings, especially for large‑volume desks.

Beyond trading, BGB integrates with Bitget Launchpad, where snapshot balances determine access to token presales and exclusive listings. It also feeds into Bitget Earn, with staking yields between 5% and 8% APR, depending on duration and market demand.

Bitget Card users receive up to 1.7% cashback in BGB for retail purchases, making the token a spendable and earnable asset within the Bitget economy. From fee relief to earning to launch access, BGB isn’t just a logo—it’s an engine inside Bitget’s growing crypto exchange model.

BGB carries multiple utilities inside the Bitget exchange.

Fee rebate: Pay trading fees in BGB to save twenty per cent on spot maker and taker costs.

VIP tier: Holding at least five thousand four hundred eighty one BGB unlocks VIP 1, lowering spot fees to zero point zero eight per cent and futures maker to zero point zero one eight per cent.

Launchpad: New token sales allocate tickets based on BGB balance snapshots.

Cashback: Bitget Card holders receive extra rewards when redeeming BGB at checkout.

Staking: Lock BGB in Bitget Earn for yields between five and eight per cent.

Supply began at two billion tokens with quarterly burns tied to exchange revenue until circulating supply hits one billion.

Areas Where Bitget May Fall Short

While Bitget ranks among the fastest‑growing cryptocurrency exchanges with over 20 million registered users and daily trading volume that often surpasses $10 billion, the platform isn’t without its drawbacks. Some features may feel too complex for beginners, especially with access to futures trading, margin trading, and copy trading dashboards all visible by default. Certain fiat ramps remain restricted, supporting just 16 fiat currencies, and the platform lacks direct operational licensing in the United States, which means users in that region face service limitations. Let’s take a closer look at the common concerns expressed by users and analysts.

Not Ideal for First‑Timers Seeking Simplicity

Bitget’s expansive interface, while a strength for advanced traders, can be a hurdle for newcomers. The main trading dashboard displays margin, spot, and futures trading tools side by side, with contract tickers like BTCUSDT-P and COIN-M appearing by default. For users unfamiliar with terms like maintenance margin, funding rate, or isolated vs. cross leverage, the learning curve can feel steep.

According to feedback collected on the Google Play Store (where the app is rated 4.5), some negative reviews mention interface clutter and confusion during first use. A lack of simple “Buy BTC” paths—without order books or leverage sliders—makes spot market trades feel technical instead of intuitive.

Bitget has responded with a Lite Mode that simplifies trading options and hides futures by default. Tooltips, help icons, and glossary pop‑ups now assist with onboarding. Still, traders looking for a pure beginner experience—like instant swaps or one‑click buys with fiat—might consider starting on platforms such as Coinbase or Kraken before graduating to Bitget’s feature‑rich terminal.

Bitget Fee Structure: Competitive Rates with Volume-Based Rewards

Bitget follows a transparent, volume-driven pricing model that appeals to both casual crypto traders and professional desks. The standard trading fee across the spot market starts at 0.1% for both maker and taker orders, which is on par with other major exchanges. However, users who choose to pay trading fees in BGB, Bitget’s native token, receive an instant 20% discount, dropping costs to 0.08%—a solid advantage for regular users executing high-frequency spot market trades.

Bitget’s tiered fee structure based on VIP levels provides additional reductions. To enter VIP 1, users must either reach $500,000 in 30-day spot trading volume or maintain a BGB balance of at least 5,481 tokens (or ~$1,200 as of July 2025). At this level, both maker and taker fees drop to 0.08%.

There are seven VIP levels in total. High-volume desks clearing over $100 million in 30-day spot trades can unlock VIP 7, where maker fees drop to 0% and taker fees reach just 0.03%.

On the futures markets, fees start even lower. Entry-level makers pay 0.02% and takers pay 0.06%. With higher trading volumes, VIP 7 traders enjoy maker rebates of 0.0072% and taker fees of just 0.028%—some of the most competitive rates in the industry.

In short, Bitget offers a flexible and fair fee schedule that rewards active users, BGB holders, and experienced traders looking to minimise costs across both spot and futures markets.

Take a look at this table for more details:

VIP Level | 30‑Day Spot Volume (USDT) | 30‑Day Average BGB Balance | Maker / Taker Fee | Extra Benefits |

|---|---|---|---|---|

VIP 0 | > 0 | > 0 | 0.10 % / 0.10 % | Full platform access at the standard trading fee |

VIP 1 | > 500,000 | > 5,302 | 0.08 % / 0.08 % | 20 % fee rebate when paying with BGB, Launchpad eligibility |

VIP 2 | > 2,000,000 | > 8,837 | 0.065 % / 0.070 % | Higher copy‑trading follower limits |

VIP 3 | > 8,000,000 | > 44,188 | 0.050 % / 0.060 % | Priority in new listings and customer‑support queues |

VIP 4 | > 30,000,000 | > 132,564 | 0.040 % / 0.050 % | Custom OTC quotes and larger withdrawal limits |

VIP 5 | > 50,000,000 | > 353,505 | 0.030 % / 0.040 % | Invitations to exclusive trading events and AMAs |

VIP 6 | > 75,000,000 | > 355,272 | 0.020 % / 0.035 % | Elevated API rate limits and strategy‑bot allowances |

VIP 7 | > 100,000,000 | > 357,040 | 0.000 % / 0.030 % | Zero maker fees, top‑tier placement in Bitget Earn and Launchpad pools |

Depositing crypto is free apart from network gas. Fiat on ramps via card or third party gateways include processor costs shown on the checkout page before confirmation. Withdrawal fees depend on asset and chain: Bitcoin at zero point zero zero zero two BTC, Ethereum on ERC‑20 at zero point zero zero five ETH, USDT on Tron at one USDT. Internal transfers between Bitget and Bitget TR settle instantly with no charge.

How to Use Bitget

Before you can explore Bitget’s 800‑plus trading pairs, copy‑trading leaderboards, or its 0.10 % standard trading fee, you’ll need a verified Bitget account. The sign‑up flow is lean—Bitget cites an average completion time of three minutes, with 90 % of KYC checks auto‑approved in under 40 seconds. A valid email or mobile number, government‑issued ID, and two‑factor app are mandatory; once verified, new users can deposit up to $50,000 USDT daily and unlock futures trading with up to 125× leverage.

How to Sign up on Bitget

Follow the steps below to join more than 20 million Bitget traders across 120 regions.

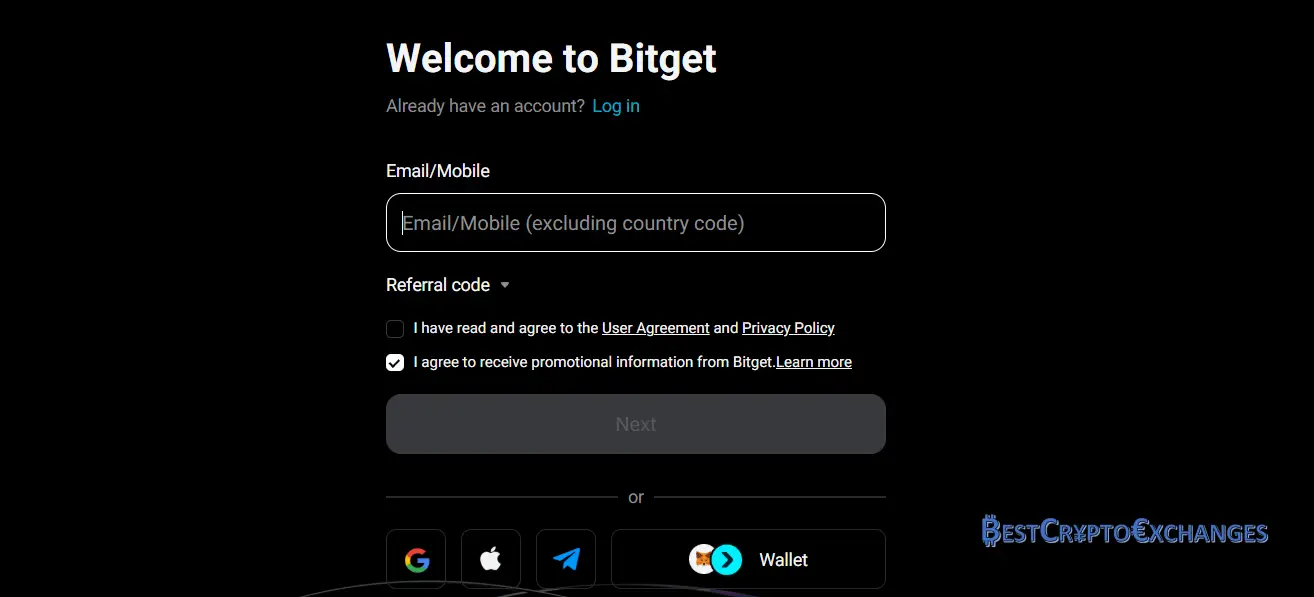

Step 1 – Create Login Credentials – On the Bitget home page click Sign Up. Choose email or phone, then craft a 12‑character password that mixes letters, numbers, and symbols. Solve the slider captcha to prove you’re human.

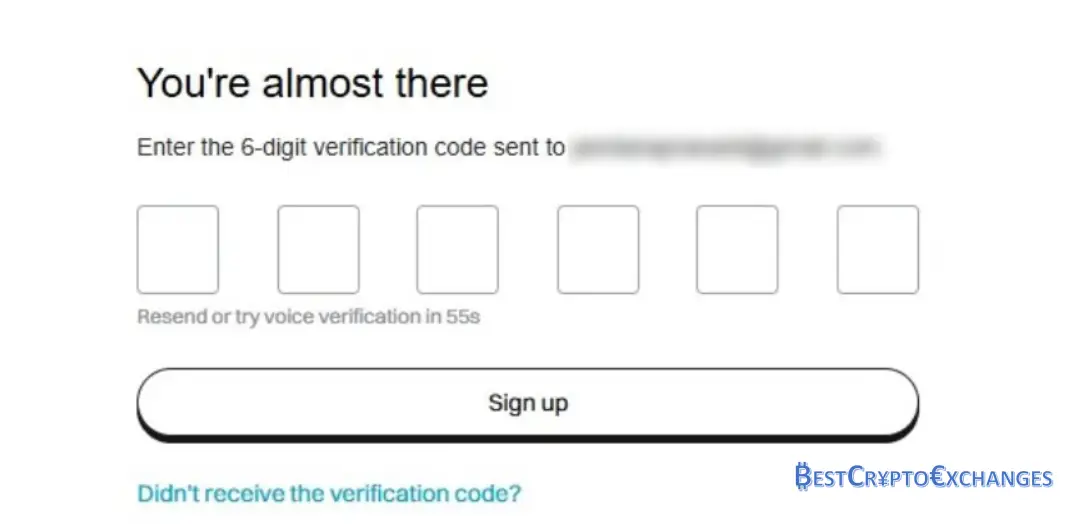

Step 2 – Enter the Verification Codeм – Bitget sends a six‑digit code via email or SMS. Input it within ten minutes to activate your Bitget account.

Step 3 – Fill in Personal Details – Select your country, and enter your legal name and birth date exactly as they appear on your ID.

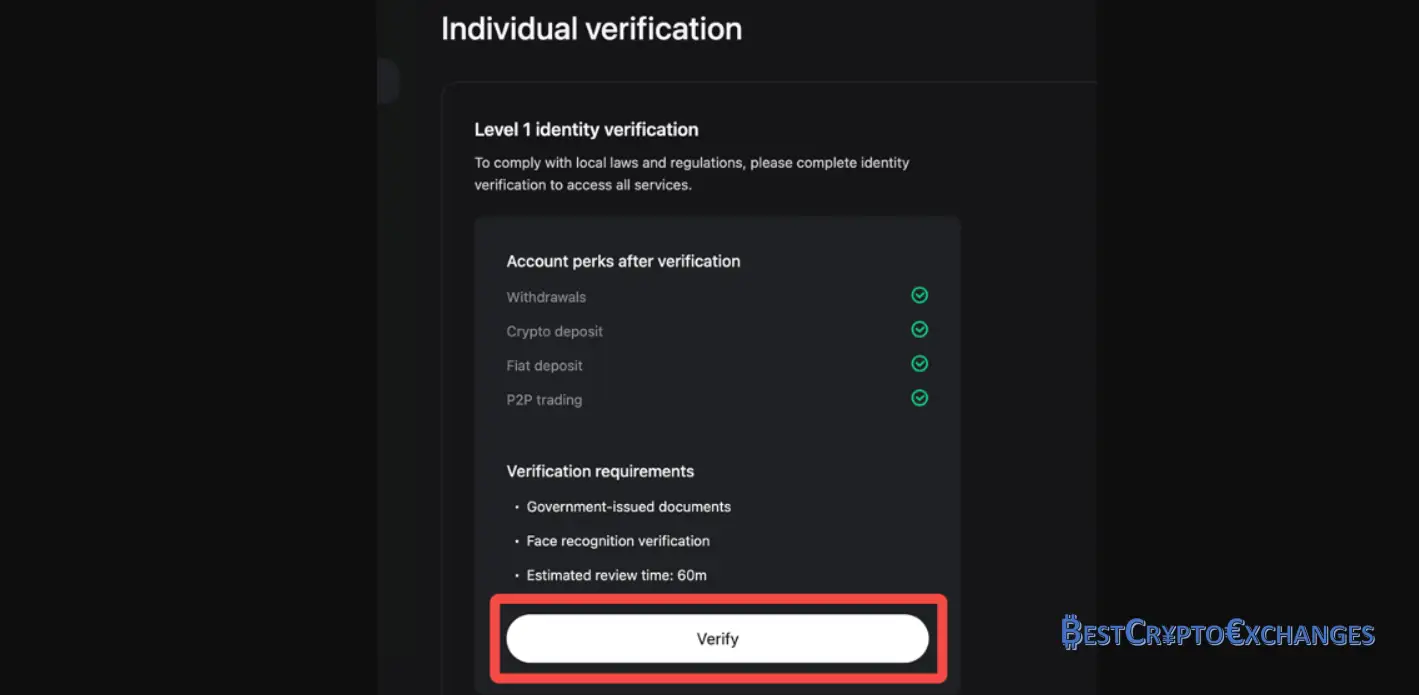

Step 4 – Complete KYC – Upload the front and back of a passport or national ID, then take a live selfie. Automated checks clear 90 % of applicants in under 40 seconds; manual review may take up to one business day.

Step 5 – Lock Down Security – Navigate to Security Settings, bind Google Authenticator, and create a six‑digit trading password. This code is required for every withdrawal, API‑key creation, or leverage adjustment, ensuring your funds stay protected.

When the KYC badge lights up green, your Bitget journey truly begins. A fully verified profile removes withdrawal caps, opens deposit channels for more than 200 crypto assets, and unlocks fiat on‑ramps in sixteen currencies. You can move USDT or BTC into the wallet in minutes, then dive straight into spot trading at the standard 0.10 % maker‑taker rate—or pay in BGB and cut that to 0.08 %.

From there, a single click transports you to the Copy Trading hub, where over 12,000 elite strategies—scalping robots, swing‑trade grids, USD‑margined futures setups—are ranked by win rate, drawdown, and 30‑day ROI. Prefer self‑direction? Head to the USDT‑M or Coin‑M futures desks and run leverage up to 125× on BTC and 100× on ETH, all under the watchful eye of auto‑deleverage and dual‑price risk controls. With savings vaults, Shark Fin notes, and a Web3 wallet only a tab away, a green KYC tick is your passport to Bitget’s full trading ecosystem.

Loading Cash: Bringing Fiat Onto Bitget

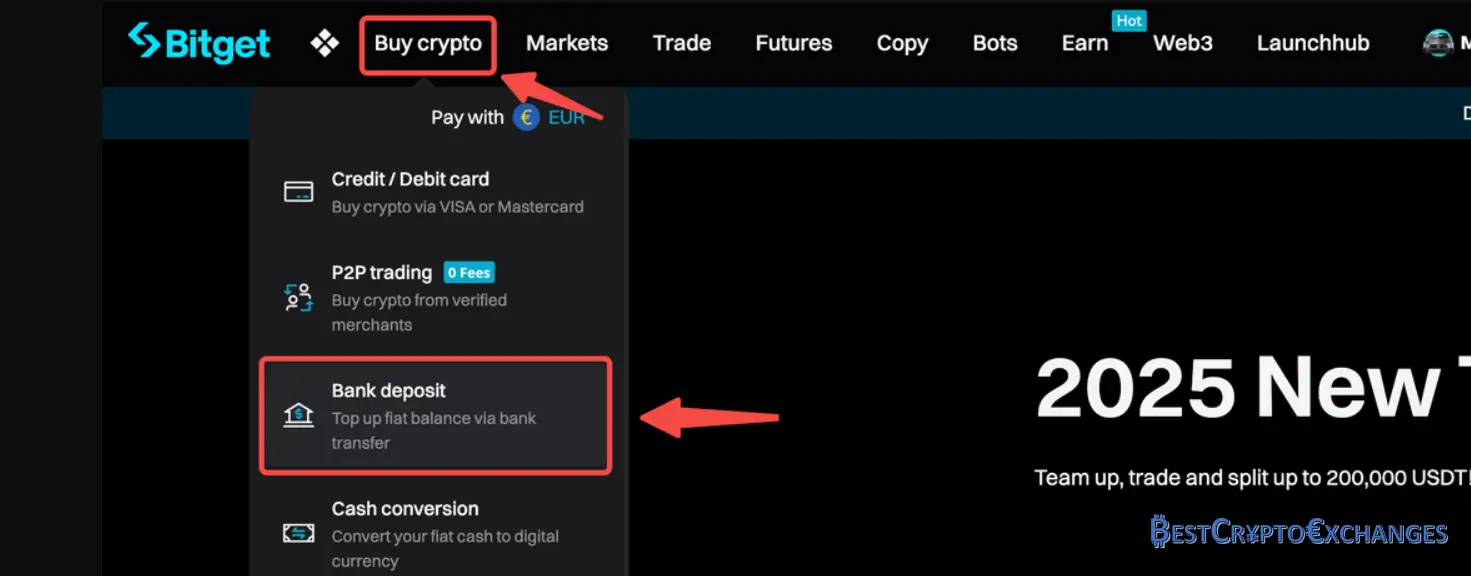

Bitget’s gateway supports sixteen fiat currencies, letting newcomers slide euros, reais, lira, and more straight into their bitget account instead of paying swap spreads on another crypto exchange first.

Step 1 – From the dashboard hover over Wallet, choose Deposit, then click Fiat to open the funding panel.

Step 2 – Pick your currency—EUR, BRL, TRY, or another—and decide between credit/debit card, bank transfer, or an integrated provider such as Banxa or Simplex.

Step 3 – Type the amount, inspect the processor’s markup plus Bitget’s transparent transaction fee, and confirm. Visa and Mastercard usually credit within five minutes; SEPA wires land the same business day if sent before the evening cutoff, while Brazil’s PIX network posts in under a minute.

Step 4 – The cash appears in your Fiat wallet, ready to convert into USDT, purchase BTC at the current market price, or plug straight into copy‑trade allocations.

Topping up with fiat removes one of the biggest frictions in cryptocurrency trading: jumping through multiple platforms just to secure starter coins. By wiring euros via SEPA or flashing reais through PIX, traders sidestep blockchain withdrawal fees and settlement delays that plague cross‑exchange transfers. The money sits inside Bitget’s protected fiat ledger—segregated from user assets held in cold storage—so it can be swapped into stablecoins at a tap, deployed as margin on high‑liquidity bitget futures, or parked in a flexible USDT savings vault for passive yield until the next setup appears. One deposit, zero external hops, maximum trading uptime.

Final Takeaway

Bitget has grown far beyond its 2018 derivatives roots and now resembles a Swiss‑army platform for the wider crypto market. Copy‑trade leaderboards, one‑click grid bots, Shark Fin notes, and an on‑chain wallet sit side‑by‑side, giving both advanced traders and passive investors room to manoeuvre without juggling multiple logins. The standard trading fee of 0.10 percent already undercuts many other major exchanges, and dropping to zero‑maker at VIP 7 turns the venue into a cost‑efficient playground for high‑frequency desks.

On the risk side, the exchange backs words with numbers: a $707 million user‑protection fund, 98 percent cold‑storage ratio, and monthly Merkle‑tree proofs that anyone can verify. Two‑factor authentication is enforced by default, and withdrawal whitelists prevent fat‑fingered blunders.

Yes, the dashboard can feel crowded, but interactive modules, Academy walkthroughs, and demo balances quickly bridge that gap. For traders who crave deep liquidity, social signals, and layered earning products under one roof, Bitget delivers a compelling, low‑fee hub worth serious consideration.

Bitget Review – FAQ

Is Bitget safe?

Bitget employs two factor authentication, address whitelists, cold storage for a significant portion of assets and a seven hundred seven million dollar protection fund. Monthly proof of reserves shows that customer funds remain fully backed on chain, helping build trust comparable to other major exchanges.

Is Bitget available in the US?

Bitget does not currently hold licences to serve retail customers in the United States. Residents may view the website but cannot complete the KYC verification process. American traders often choose regulated platforms such as Kraken or Coinbase instead.

Can I buy crypto with my credit card on Bitget?

Yes. After passing KYC, users in supported regions can purchase Bitcoin, Ethereum and many altcoins with Visa or Mastercard. A three dimensional secure step confirms ownership, and coins typically arrive in the spot wallet within two minutes. Card processors add a small transaction fee displayed before payment.

What is the BGB token?

BGB is the exchange utility coin that grants twenty per cent spot fee discounts, entry to Launchpad sales and cashback on the Bitget Card. Token burns tie to exchange revenue, reducing supply over time and potentially rewarding long term holders.

Is KYC mandatory on Bitget?

Since September 2023 all new and existing customers must complete level 1 identity verification to deposit, withdraw or trade. Requirements include government ID, selfie and residence details. Higher withdrawal limits demand proof of address.

What is Bitget copy trading?

Copy trading on Bitget allows users to mirror the trades of elite futures or spot traders in real time. Followers allocate a budget, set risk caps and automatically replicate openings and closings, keeping most of the profit while the trader earns a performance share.