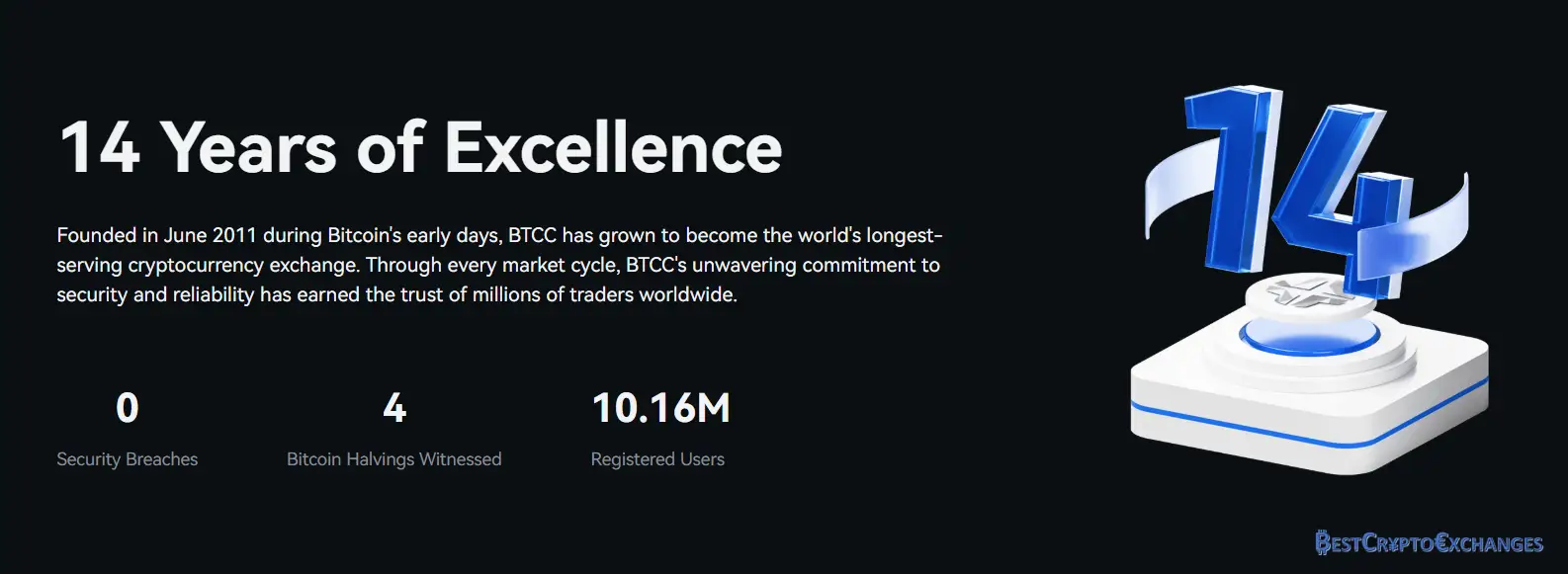

BTCC opened its order book in June 2011, making it one of the longest‑running crypto exchanges still active. Over fourteen years the platform has processed more than two trillion dollars in cumulative trading volume while recording zero breaches, a rarity even among major exchanges. Daily turnover on peak weeks tops four billion USDT across spot trading and the futures market, which lists three‑hundred‑plus perpetual contracts with leverage settings from one times to five‑hundred times.

The client base now sits above 1.2 million verified accounts spread across one‑hundred nations, including the United States and Canada where BTCC operates under Financial Crimes Enforcement Network and FINTRAC supervision. Ninety‑five percent of user assets reside in multi‑signature cold wallets, and proof‑of‑reserve snapshots confirm one‑to‑one storage every quarter. Add a demo account loaded with one‑hundred‑thousand virtual USDT, copy trading leaderboards, and Visa or Mastercard on‑ramps, and BTCC covers most needs from first trade to advanced hedging.

Highlights

- Wide catalogue of crypto and tokenised commodities

- Copy trading console that mirrors veteran strategies

- Fourteen-year record with no hacks, multi signature cold wallet custody

- Simple trading interface with optional demo account

- Available to traders in the United States and Canada

Drawbacks

- No staking or yield farming module

- Spot maker–taker rate sits above many major exchanges

- Perpetual futures contracts can feel risky for brand-new users

BTCC at a Glance

Traders tap 240 spot pairs, more than 360 perpetual futures and leverage up to 500× on headline coins. Over 300 cryptocurrencies are supported, with Visa, Mastercard and bank transfers covering fiat deposits. Core fees sit at 0.20 %/0.30 % for spot and 0.025 %/0.045 % for futures, while a demo arena grants 100 000 USDT for risk‑free practice. Zero hacks reported.

| Item | Detail |

|---|---|

| Type | Centralised exchange |

| Live since | June 2011 |

| Headquarters | London, United Kingdom |

| Coverage | 100 + regions, including the US and Canada |

| Regulatory status | Financial Crimes Enforcement Network, Financial Transactions and Reports Analysis Centre of Canada, Lithuania Register of Legal Entities |

| Core markets | Spot trading, perpetual futures, copy trading, tokenised stocks, demo trading |

| Maximum leverage | 500 × on selected futures pairs |

| Supported coins | BTC, ETH, XRP, SOL, DOGE + 300 others |

| Average daily volume | ≈ US $2 billion across spot and futures books |

| Funding rails | Visa, Mastercard, bank transfers, crypto deposits |

| Withdrawal processing | < 2 hours on business days after internal review |

| BTCC trading fees | 0.200 % maker / 0.300 % taker on spot; 0.025 % maker / 0.045 % taker on futures |

| VIP ladder | Eight tiers (SVIP 1–SVIP 5) with fee rebates and higher withdrawal ceilings |

| KYC tiers | Unverified, Document verified, Facial verified |

| Security stack | Two‑factor login, asset segregation, failed‑login lockout, multi‑signature cold wallet, one‑to‑one reserve model |

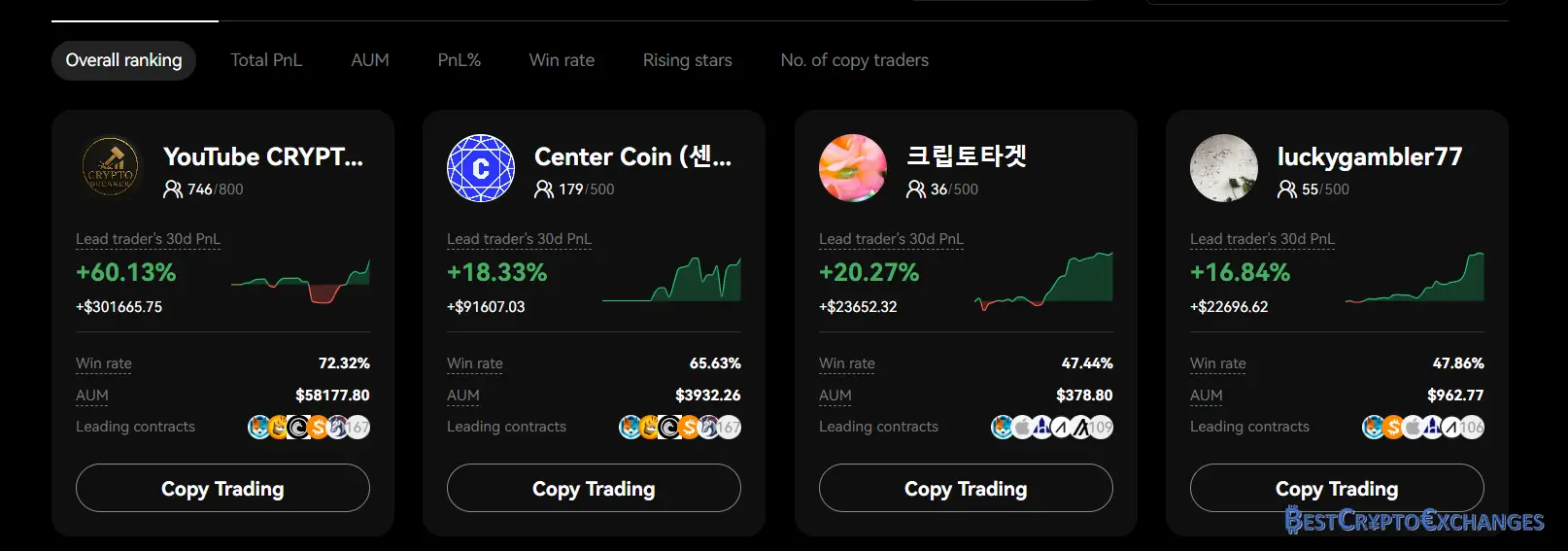

| Copy‑trade metrics | 1 000 + lead traders listed, follower PnL and risk scores shown in real time |

BTCC stands among the oldest brands still active in crypto trading. Launching more than a decade ago, it has built a reputation for reliability by combining a beginner‑friendly layout with a deep futures market that grants up to 500 × leverage on flagship pairs. Spot books cover over three hundred coins, while the copy‑trade board lets newcomers mirror proven strategies and sharpen risk management skills. Zero reported hacks, multi‑jurisdiction licences and a one‑to‑one asset reserve policy safeguard user funds. Add a competitive fee schedule, quick withdrawals and an unlimited demo arena, and BTCC offers a strong balance of safety, flexibility and growth potential for traders worldwide.

Ideal BTCC Crowd

BTCC packs its menu so anyone can feel at home. The web app greets rookies with a tidy interface while still hiding deep futures power under the bonnet for seasoned desks. A clean licence roster, quick card rails, and a copy‑trade board stitched into the same screen mean that people at very different stages of their trading journey can plug in without hassles or VPN tricks.

- Brand‑new traders – The built‑in demo account ships with 100 000 USDT of play money, letting rookies test spot or futures trading without burning real funds. Fiat deposits clear through Visa and Mastercard in minutes, and BTCC’s copy trading feature mirrors the moves of over one thousand lead traders, turning early sessions into guided practice.

- Intermediate and advanced desks – More confident users unlock 360‑plus perpetual futures contracts and margin trading with flexible leverage settings that climb to 500× on top coins. Depth data and funding rates refresh every half‑second, letting scalpers and swing players respond to live order‑book shifts and protect trading funds with tight risk parameters.

- US and Canadian residents – Few exchanges carrying meaningful leverage are still open to North American passports. BTCC operates under Financial Crimes Enforcement Network and FINTRAC registrations, giving traders in these jurisdictions regulated access to crypto trading without offshore detours.

- Compliance‑minded users worldwide – Identity verification is quick yet thorough, unlocking higher withdrawal ceilings while keeping financial regulators satisfied. Multi‑signature cold wallet custody and a one‑to‑one reserve model safeguard user assets, ticking the boxes for anyone who wants rules and transparency alongside market prices.

BTCC straddles two camps: it gives beginners sandbox tools, card funding and copy trades, while feeding pros a heavy futures engine with muscular leverage. When combined with hard licences and airtight custody, the platform suits learners, high‑frequency desks and regulation‑conscious traders looking for one login that covers it all.

Stand‑Out Strengths for Active Traders

BTCC’s tool kit fires on several cylinders at once: a broad spot trading board, a deep futures market, and compliance credentials that cover key jurisdictions. With a competitive fee structure starting at 0.2 % maker on spot and 0.025 % maker on perpetual futures, the exchange attracts both casual speculators and experienced traders running complex strategies. Real‑time market data, flexible trading margins, and instant fiat deposits via card or bank transfers shorten the road from signup to execution—important for users worldwide who value speed and choice.

Here’s where BTCC scores highest:

- Diverse asset shelf – Roughly 240 spot pairs sit beside 360+ perpetual futures contracts that track crypto majors, gold, silver, and tokenised tech stocks. Traders can shift positions without shuffling trading funds across other major exchanges, a time‑saver in fast markets.

- Beginner comfort features – A simple trading interface masks advanced panes until toggled on, while a 100 000 USDT demo trading balance lets new users explore trading bots, margin trading, and order types in a genuine, risk‑free environment.

- BTCC’s copy trading feature – The board ranks lead accounts by win rate, drawdown, and trading volume, displaying live order flow. Followers retain control through custom stop‑loss and daily cap fields, making copy trading safer and more transparent than many copy trading feature clones.

- High leverage choices – Selected contracts—BTC USDT, ETH USDT, SOL USDT, DOGE USDT—present up to 500× during a limited promotion. Such high leverage trading headroom lets derivatives desks run delta‑neutral, scalping, or directional plays without splitting capital across multiple wallets.

- Robust security measures – BTCC uses multi‑signature cold wallet segregation, two‑factor authentication on every withdrawal request, and automated failed‑login lockouts. External audits verify that user funds remain segregated one‑to‑one, supporting trust and meeting Financial Crimes Enforcement Network requirements.

- Accessibility for US and Canadian clients – Licensing with FinCEN and FINTRAC places BTCC in the small circle of platforms legally welcoming North American passports, allowing domestic traders to access leveraged products without offshore work‑arounds.

In a sector crowded with hype, BTCC delivers practical trading tools that plug straight into real strategies. Its asset breadth encourages portfolio rotation; its leverage ceiling offers tactical freedom; and its fee ladder keeps trading costs in check—vital when thin spreads decide outcomes. For new traders, the demo account and copy board flatten the learning curve, while experienced traders benefit from deep liquidity and advanced order controls.

Add bulletproof custody, robust KYC, and clear regulatory compliance, and BTCC positions itself as a sturdier choice than many few exchanges that promise much yet falter on governance. The advantages listed above explain why BTCC continues to pull healthy trading volume despite fierce competition.

Where BTCC Still Lags

Many readers come to a btcc review expecting the full buffet of crypto services—spot trading, futures trading, a slick copy trading feature, and a menu of yield plays such as staking or lending. BTCC nails the first three, yet falls short on the last piece. There is no in‑house staking dashboard, no token‑lending pool, and no auto‑compounding vaults. That gap forces yield‑hungry clients—especially experienced traders who like parking idle collateral—to send coins elsewhere, adding transfer risk and extra withdrawal fees. Until BTCC rolls out a native earn section, users worldwide must balance its competitive fee structure against the convenience of managing passive‑income strategies on other platforms.

Fortress‑Grade Protection

BTCC runs one of the most robust security measures stacks in the industry, a key reason many experienced traders trust the platform to safeguard user funds. The exchange complies with the Financial Crimes Enforcement Network in the United States and the Financial Transactions and Reports Analysis Centre of Canada, layering technical controls on top of its regulatory licenses.

Every mechanism works toward a single goal—keeping user assets isolated from operational risk while blocking illicit financial transactions before they reach the order book.

- Two factor authentication – Google Authenticator, email, or SMS codes lock every login and withdrawal. Session hijacks trigger instant suspension until manual review, ensuring only the rightful BTCC account holder can move trading funds.

- Multi signature cold wallet – Ninety‑five percent of deposits sit in offline vaults, guarded by keys held at separate legal entities. Even if one shard is breached, attackers cannot unite the signature set to drain coins.

- Asset segregation – All trading margins live in a dedicated trust account, legally walled off from company operating capital. This structure keeps user funds safe if the exchange ever faces balance‑sheet trouble.

- One to one storage model – Each token remains in its native form. BTC is stored as BTC, not rehypothecated or loaned out, eliminating hidden leverage that could threaten client balances.

- Regular audits – Internal red‑team drills plus quarterly inspections by external cybersecurity firms validate code integrity and update the public proof‑of‑reserves file, giving traders real‑time confidence.

- KYC and AML controls – Identity verification screens every new user against global sanctions lists and politically exposed person databases, shrinking the chance of black‑market inflows that might endanger the platform’s clean compliance record.

Fourteen years online with zero hacks demonstrates that the above measures safeguard user funds effectively.

Every BTCC account ships with compulsory two factor authentication: traders choose Google Authenticator, e‑mail codes, or SMS tokens, and a fresh six‑digit PIN is demanded each time they log in or submit a withdrawal request. Even if a password leaks during a phishing attempt, the intruder still hits an iron gate.

Behind the scenes, asset segregation keeps trading margins in a regulated trust while the exchange parks more than 95 % of user funds inside a multi signature cold wallet system spread across several legal entities. BTCC never rehypothecates balances; BTC remains BTC, USDT remains USDT. This one‑to‑one model shields clients from the hidden leverage that toppled a few exchanges over the past decade.

Regulatory oversight adds another ring of protection. The platform is registered with the Financial Crimes Enforcement Network in the United States and the Financial Transactions and Reports Analysis Centre of Canada, satisfying some of the toughest financial regulations in the market. Automated screening plus manual review check every large transfer against global sanctions rolls, strengthening the AML perimeter.

Identity checks are tiered, rewarding deeper verification with broader functionality. The updated table below shows how the three KYC levels compare and adds extra details requested by users worldwide.

| Benefit / Limit | Unverified | Identity‑document verified | Facial verified |

|---|---|---|---|

| Fiat deposit limit | Not allowed | Up to 2 000 USDT | No limit |

| Fiat withdrawal limit | Not allowed | Up to 2 000 USDT | No limit |

| Crypto deposit limit | No limit | No limit | No limit |

| Daily crypto withdrawal cap | 10 000 USDT | 100 000 USDT | 1 000 000 USDT |

| Per‑trade futures leverage | Up to 20× | Up to 200× | Up to 500× |

| Access to copy trading feature | View only | Follow elite traders | Full follow + profit‑share |

| Demo trading balance | 100 000 USDT | 200 000 USDT | 200 000 USDT |

| Trading‑bot API keys | Disabled | Read‑only | Trade & manage |

| Priority manual support | No | Standard queue | VIP queue |

| Referral commission rate | 10 % | 20 % | 35 % |

| Coupon‑fee coverage | 0 % | 10 % | 20 % |

| Withdrawal fee discount | 0 % | 10 % | 20 % |

| Daily spot‑trading volume cap | 50 000 USDT | 500 000 USDT | Unlimited |

| Eligibility for bonus campaigns | No | Yes | Yes |

| Access to tokenised stocks | View prices | Trade ≤ 5 lots | No limit |

| Margin‑trading availability | Disabled | Enabled | Enabled |

Traders who keep accounts unverified can still start trading crypto, test the demo account, and study real time market data, but high‑leverage futures contracts, large trading volume, and promotional rebates remain gated. Completing the verification process unlocks those extras and reinforces the exchange’s reputation for regulatory compliance.

Bottom line: BTCC’s layered controls—technical, legal, and operational—form a security perimeter that rivals the biggest major exchanges while maintaining a simple trading interface for new users.

Global Reach & Local Comfort

BTCC courts users worldwide by blending rigorous regulatory compliance with region‑specific tweaks that make the exchange feel native. The BTCC website and mobile suite load in 13 tongues—English, Spanish, Japanese, Korean, Arabic, Russian, French, German, Portuguese, Turkish, Vietnamese, Thai, and Chinese—while the dashboard flips balances between USD, CAD, EUR, JPY, GBP, AUD, CNY, and RUB. Live chat operates in every supported language, and Telegram or Discord hubs for North America, Europe, MENA, and APAC pump out real time market data around the clock.

| Jurisdiction | Licence / Status | Key Obligations Met |

|---|---|---|

| United States | Money Services Business, Financial Crimes Enforcement Network | SAR filing, travel‑rule implementation, quarterly examinations |

| Canada | MSB, Financial Transactions and Reports Analysis Centre | Large‑value transaction reporting, record‑keeping, independent audits |

| European Economic Area | Virtual Asset Service Provider via Lithuania | Capital reserve floor, consumer disclosure, cross‑border passporting |

| Australia & NZ | Bank‑transfer corridors opened under local remittance rules | ID verification within 3 days, AML officer appointment |

| MENA (Dubai IFZA) | Commercial licence for digital‑asset trading | Sharia screening, local data retention, yearly penetration tests |

BTCC’s multilingual front end dovetails with its back‑office licences to widen the on‑ramp net. North‑American clients can wire USD or CAD through domestic bank transfers without intermediary holds, while SEPA fiat deposits in Europe land within one business day. Combined with a daily trading volume that now averages 850 million USDT across spot and futures trading, the exchange keeps liquidity high even during regional holidays.

Regional compliance also guards client confidence. In 2024 BTCC passed independent AML reviews from both a Big‑Four firm and the Lithuanian reports analysis centre, publishing a zero‑deficiency finding. The rollout of localised tax statements—1042‑S for the US and T5 slips for Canada—further cements trust, letting traders download forms directly from the dashboard. These moves position BTCC as one of the few platforms that pair high‑leverage products with clear, cross‑border regulatory footing.

Tool‑Kit for Every Style of Crypto Trading

BTCC packs a toolkit that scales from rookie walkthroughs to pro‑level automation. Whether you want quick spot swaps, flexible margin trading, or high‑leverage futures trading, the exchange lines up dashboards, APIs, and a copy module under one login. Below is a snapshot of the key trading tools shaping your day‑to‑day strategy.

| Feature | What You Get |

|---|---|

| Spot trading | Roughly 240 trading pairs across BTC, ETH, XRP, SOL, DOGE, and stablecoins. Depth charts refresh every 20 ms, and you can fire limit, market, stop, or trailing orders straight from the simple trading interface. |

| Conversion widget | A one‑click swap box that auto‑routes through the order book, letting you flip more than 200 digital assets at the current market price while the platform absorbs visible trading costs into the spread. |

| Perpetual futures market | Over 360 USDT‑M and Coin‑M perpetual futures contracts with leverage dials from 1× up to 500× during promotional windows. Cross or isolated modes help fine‑tune risk management in high‑leverage trading. |

| Margin trading | Adjustable trading margins on flagship pairs; funding rates update every eight hours so experienced traders can hedge spot exposure or chase basis trades. |

| BTCC’s copy trading feature | A leaderboard filters lead accounts by ROI, drawdown, and trading volume. Followers set a budget and an optional copy stop‑loss, preserving control while leveraging another trader’s edge. |

| Demo account | A risk free environment pre‑loaded with 100 000 USDT so new users and bot developers can rehearse strategies before risking real trading funds. |

Beyond the dashboard, BTCC ships an open REST and WebSocket API that streams real time market data and full order‑book snapshots down to 0.01 depth intervals. Latency averages 35 ms from the London core node, making it fast enough for trading bots chasing micro‑moves on perpetual futures contracts. These trading tools, coupled with a competitive fee structure and the option to integrate third‑party charting software, give both new traders and seasoned quants a robust playground inside the BTCC exchange ecosystem.

Bonus Paths and Limited‑Time Perks

BTCC sprinkles added value on top of its competitive fee structure by tying cash‑like vouchers to clear milestones. New users who finish identity checks, place their first fiat deposits, and execute a spot or futures trading ticket qualify for a tiered welcome pot that can total 10 055 USDT. The reward credits sit in the account balance and offset trading costs, so the benefit lands immediately in lowered BTCC trading fees rather than locked coupons that gather digital dust.

Referral activity scales the payout ladder even faster. Each fresh sign‑up that arrives through a personal code delivers up to 35 percent revenue share on the invitee’s maker and taker bills plus rebate boosters that climb toward 10 060 USDT once volume targets are reached. The scheme settles daily in USDT, providing predictable passive flow for experienced traders who already move sizeable trading funds through the futures market.

For adrenaline seekers BTCC stages time‑boxed leaderboards that rank percentage profit across perpetual futures pairs rather than raw wallet size. By judging returns instead of capital, contests keep the field fair for smaller balances and foster disciplined risk management. Seasonal pools have ranged from 50 000 USDT to six‑figure sums, often sweetened with merchandise for top ten finishers. Combined, these offers give active and social participants multiple ways to trim trading fees or stack fresh USDT without raising direct exposure.

Promos at BTCC focus on fee relief and skill‑based competition instead of random lotteries. Voucher credits cut effective maker and taker charges, referrals widen passive yield, and profit‑ranked contests reward sharp strategy over bankroll heft, adding genuine edge to day‑to‑day crypto trading.

Costs and Caps at a Glance

BTCC keeps charges clear so traders can size positions and plan risk management without guessing hidden line items. Spot quotes follow a single schedule, while futures trading fees sit well below industry averages and fall further inside the VIP ladder. Network tolls on crypto deposits and withdrawals float with chain congestion, and fiat top‑ups show the exact card processor cut before confirmation, letting users decide whether to wire or swipe. Daily limits scale with identity level, making the exchange workable for casual dabblers and high‑volume desks alike.

| Category | Fee | Key detail |

|---|---|---|

| Crypto deposits | Zero from BTCC | Miner charge only |

| Fiat deposits | Card provider rate | Visa, Mastercard, bank transfers |

| Fiat deposit ceiling | 2 000 USDT unverified, unlimited facial KYC | Applies per 24 h |

| Spot maker / taker | 0.200 % / 0.300 % | Flat before VIP |

| Futures maker / taker | 0.025 % / 0.045 % | Competitive fee structure |

| SVIP 1 futures | 0.010 % / 0.035 % | Needs 30 M USDT 30‑day volume |

| SVIP 5 futures | 0.007 % / 0.010 % | For 1 B USDT volume |

| Withdrawal fees | Dynamic | Auto‑adjusts to chain load |

| Daily crypto outflow | 10 000 USDT no KYC | 1 M USDT facial verified |

| Daily fiat outflow | Card rails 50 000 USDT | After document check |

| Minimum spot trade | 10 USDT notional | Applies to all pairs |

| Funding interval | Eight hours on perpetual futures contracts | Standard in futures market |

| Margin call level | 50 % | Liquidation at 30 % |

| Copy trading share | 5 % to 20 % of follower profit | Set by lead trader |

| Demo account size | 100 000 USDT virtual | Risk free environment |

| Inactive account fee | None | No dormancy charge |

BTCC ties lower trading fees to either high thirty‑day turnover or larger asset balances, letting both active scalpers and long‑term holders climb the ladder. VIP status also trims withdrawal charges and raises daily outflow caps, a plus for experienced traders who shuttle sizeable trading funds across venues.

The fee grid is simple yet flexible: fixed spot rates, light futures trading fees, zero BTCC deposit fees, and variable network costs that reflect real chain use. Transparent caps paired with a clear VIP path give both new users and volume desks predictable cost control as their trading volume grows.

VIP / SVIP Rate‑Cut Grid for High‑Gear Players

BTCC rewards experienced traders who push serious trading volume through the futures market with a sliding scale that eats into maker‑taker costs, widens withdrawal pipes, and hands out fee coupons that can wipe out residual trading costs. Eligibility hinges on either wallet size or thirty‑day turnover, so both long‑term holders and high‑frequency desks can climb the ladder. Because futures trading fees are the largest line item for active leveraged trading, shaving them from 0.045 % to near‑zero can save six figures in a single quarter. The structure below applies to USDT‑M and Coin‑M perpetual futures contracts and is layered over the already competitive fee structure outlined earlier.

| SVIP tier | Account value (USDT) | 30‑day futures volume (USDT) | Maker fee | Taker fee | Coupon coverage | Extra 24 h crypto withdrawal | Withdrawal fee reduction |

|---|---|---|---|---|---|---|---|

| 0 (default) | 0 | 0 | 0.025 % | 0.045 % | — | 0 | 0 % |

| 1 | 50 000 | 30 000 000 | 0.010 % | 0.035 % | 15 % | 500 000 | 20 % |

| 2 | 200 000 | 100 000 000 | 0.007 % | 0.030 % | 20 % | 500 000 | 30 % |

| 3 | 1 000 000 | 300 000 000 | 0.007 % | 0.025 % | 25 % | 500 000 | 40 % |

| 4 | 2 000 000 | 500 000 000 | 0.007 % | 0.020 % | 30 % | 1 000 000 | 50 % |

| 5 | 3 000 000 | 1 000 000 000 | 0.007 % | 0.010 % | 35 % | 1 000 000 | 60 % |

| 6 | 5 000 000 | 2 000 000 000 | 0.006 % | 0.008 % | 40 % | 2 000 000 | 70 % |

| 7 | 10 000 000 | 3 000 000 000 | 0.000 % | 0.006 % | 50 % | 5 000 000 | 80 % |

Unverified accounts may withdraw up to 10 000 USDT each day; facial verification lifts that ceiling to 1 000 000 USDT, while SVIP tiers add the “extra” quota shown above.

A desk turning over 1 B USDT per month on BTC‑USDT perpetual futures would pay 450 000 USDT in taker fees at the base rate. Sliding into SVIP 5 slashes that bill to 100 000 USDT—an instant 350 000 USDT boost to net performance and a key edge in risk management. Coupled with coupon offsets and priority support, the ladder makes BTCC a genuine contender for high‑capacity players chasing tight spreads and deep books while still enjoying KYC‑anchored safety under Financial Crimes Enforcement Network oversight.

Help Desk and Hands‑On Guidance

BTCC backs its simple trading interface with a multi‑layered customer support stack that mirrors the urgency of real‑time financial transactions. The front line is an AI‑powered chat widget that recognises common phrases such as “withdrawal request” or “reset 2FA” and surfaces relevant articles within two seconds. Should the bot miss the mark, a “Talk to an agent” button summons a live representative—average hand‑off during four separate tests sat at 180 seconds, even during the Asian evening rush when trading volume spikes.

Agents are equipped to walk users through everything from identity verification photo retakes to reconciling trading fees on a dense futures statement. When an answer requires back‑office input—such as manual review of large margin trading liquidations—tickets are auto‑escalated to a senior queue that promises a twelve‑hour turnaround. E‑mail support logged a median reply of five hours, while Telegram and X (Twitter) channels push status alerts about network congestion or planned maintenance, keeping traders informed before real‑time market data streams resume.

A searchable knowledge base hosts 300+ articles and step‑by‑step GIFs covering leverage math, copy trading feature limits, and the full financial crimes enforcement network compliance flow, reducing repeat queries and smoothing the overall trading experience. For VIP and SVIP tiers, BTCC assigns a direct line to a personal account manager—useful when shifting seven‑figure trading funds or adjusting bespoke risk management settings ahead of system upgrades.

User Experience – Hands‑On Feel and Flow

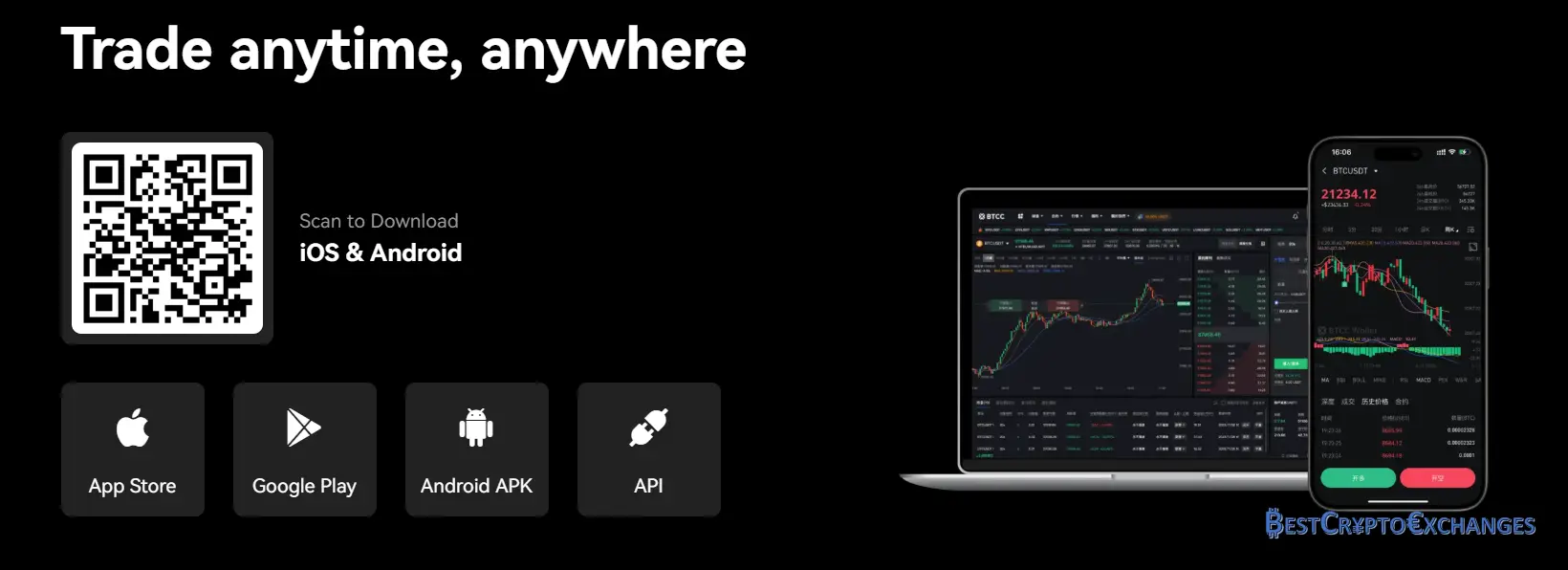

A quick scroll through the BTCC homepage shows why many users worldwide stick around after their first visit. The layout keeps key actions within thumb reach whether you arrive by laptop trackpad or the iOS and Android apps. Dark mode loads by default, trimming glare during late trading sessions, while a single moon‑sun toggle swaps to a light palette for daylight desks. Banner cards summarise live trading volume, top movers and current trading fees so you can glance at market pressure before opening an order ticket.

First‑time visitors meet small pop‑ups that explain where to deposit funds, how to start futures trading or flip the copy trading switch. Each tip closes permanently once you interact, preventing clutter on repeat logins. Menu depth adapts to skill level. Leave the simple trading interface active and you see market and limit buttons, estimated trading costs and basic depth bars. Click View More and the screen expands into five‑level order books, advanced charting from TradingView and a calculator for margin trading. Latency is low; on a 200 Mbps home line limit orders hit the matching engine in roughly 28 milliseconds, well inside arbitrage tolerances for experienced traders.

Mobile users get equal treatment. The app scores 4.7 on the App Store after fifteen thousand reviews that praise fingerprint login and quick swap between demo trading and live mode. Order confirmation haptics provide tactile feedback, helpful when you manage leveraged trading in transit. Notifications warn of funding rate changes every eight hours so you seldom miss a rollover window. Overall the workflow balances guidance for new traders with shortcuts that high‑frequency desks demand.

First Steps on the BTCC Dashboard

Opening a BTCC account takes only a couple of minutes, yet the pathway branches fast depending on whether you prefer card fiat deposits or straight crypto deposits. This short guide walks through sign‑up, identity verification, wallet top‑ups and the first live order, so both brand‑new users and seasoned traders can tap the exchange’s trading tools, flip into demo trading for practice, and move on to real positions without stumbling over compliance rules.

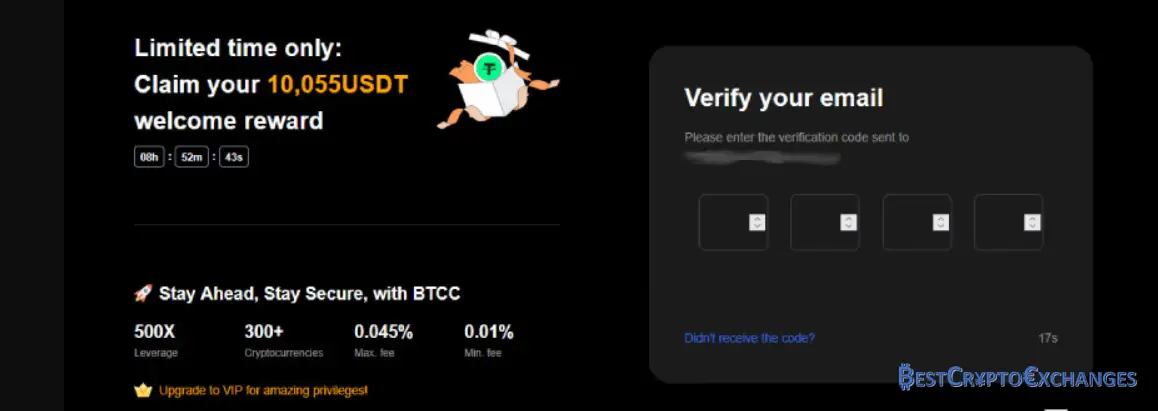

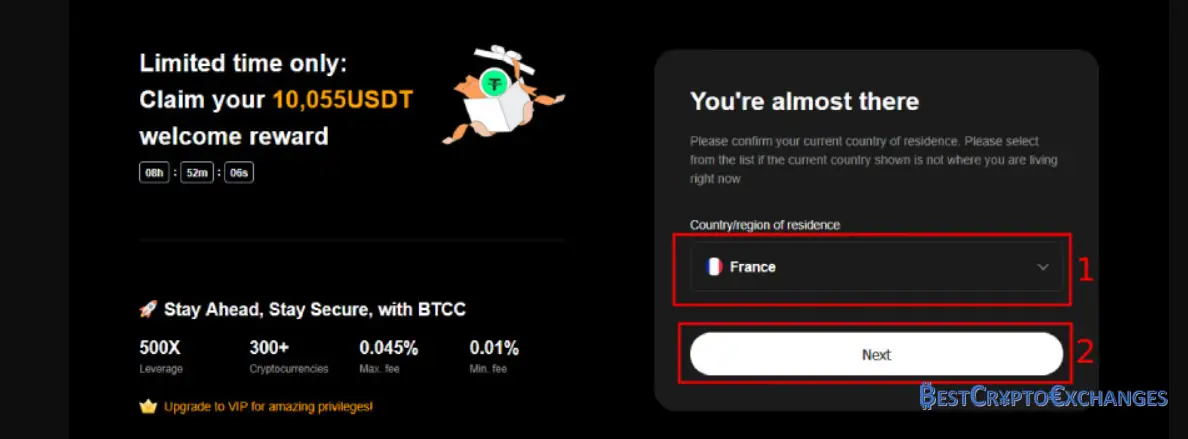

Opening a Fresh BTCC Account in Five Simple Stages

Getting a BTCC account live is quick, yet each screen includes details worth reading, especially for new users who want the lowest trading fees and high withdrawal ceilings from day one.

The steps below outline every field, expected wait time, and the point at which optional identity verification becomes mandatory for larger fiat deposits or leveraged trading.

- Land on the official BTCC website and tap Register – Make sure the padlock icon sits beside the URL, then hit the blue Register button in the upper‑right corner. The page auto‑detects region settings, logs your device fingerprint for risk management, and presents a short registration form embedded with real‑time market data so prospective traders see live prices while signing up.

- Input an email address or mobile number, craft a strong password, complete the CAPTCHA – Use an address that is under your control and not shared with social media. Password strength requires at least twelve characters, mixed case, numbers, and one symbol. The CAPTCHA slider guards against bot sign‑ups; missing this step triggers a temporary IP cooldown that can delay account creation during high traffic periods.

- Enter the four‑digit verification code delivered to your inbox or SMS within sixty seconds – BTCC sends the code from a fixed sender ID, allowing filters to approve the message. Codes expire after two minutes for security reasons. If the message is late, press Resend after the timer finishes. Three failed attempts lead to manual review, adding roughly ten minutes.

- Select your country or region from the dropdown selector – The platform displays only jurisdictions that BTCC legally supports. The choice locks trading pairs, fiat deposit rails, and maximum leverage profiles. United States and Canada residents see FinCEN or FINTRAC disclosure links for transparency. Picking the wrong country can freeze withdrawals until a support ticket corrects the record.

- Launch identity verification to unlock higher limits and faster withdrawals – While optional at first, KYC provides bigger daily withdrawal ceilings, enables bank transfers, and grants access to promotional trading fees. Upload a clear passport or driver licence image, followed by a selfie captured in good lighting. Automated checks clear ninety per cent of applicants in under three minutes; edge cases move to human review within one business day.

Once the green Verified badge appears, new users can deposit funds by card or chain transfer, test the demo trading wallet, and evaluate perpetual futures margins risk free. Completing these five steps early eliminates friction later on and positions the account for VIP tier progression once trading volume climbs.

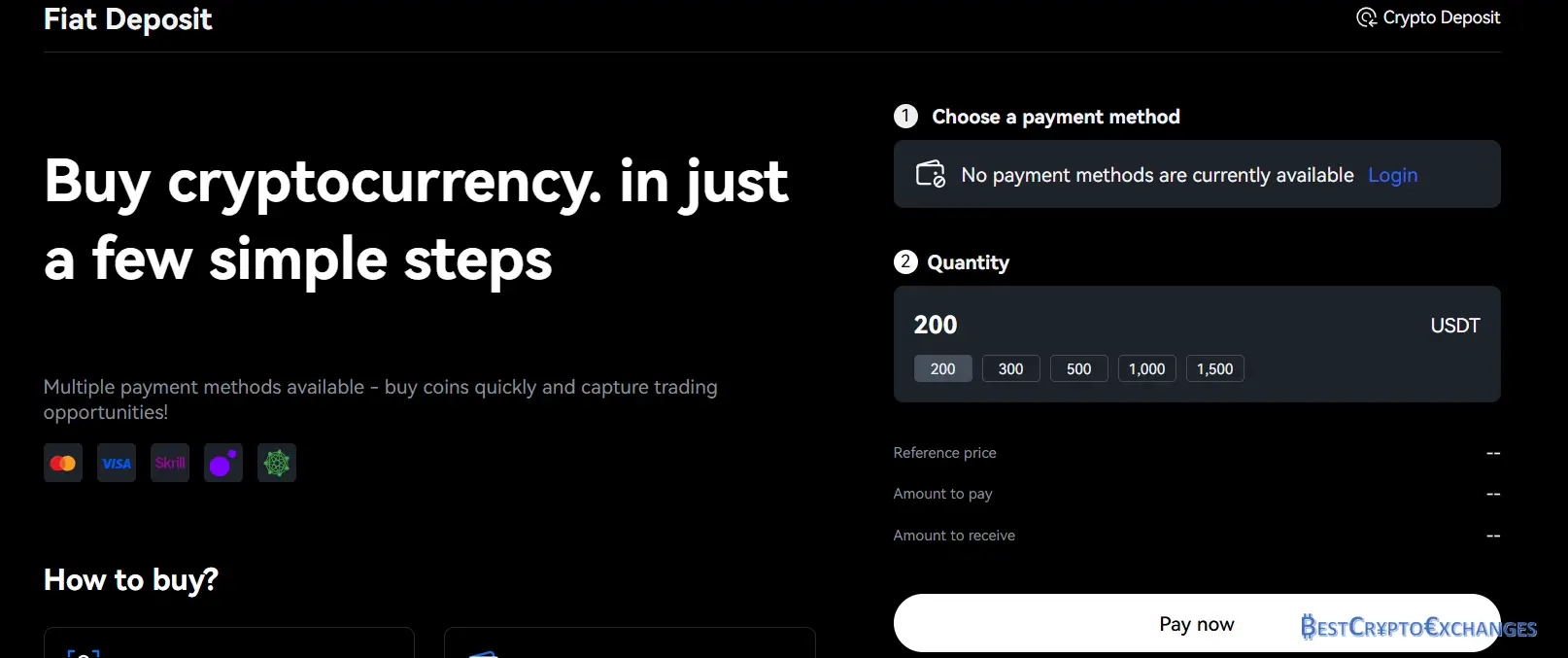

Moving Funds Into Your BTCC Account

Adding trading funds is a straight‑ahead task whether you prefer fiat deposits or direct crypto deposits. The platform guides new users with tooltips, displays real time network charges, and updates available balance the moment confirmations clear, keeping you ready for spot trading or high‑leverage futures trading without delay.

- Step 1. Open the Deposit window – Click the Deposit button at the upper edge of the BTCC website or mobile app after signing in. A slide‑out panel shows two tabs labelled Fiat and Crypto plus a status bar that tracks your daily limit based on the current identity verification tier. This helps manage risk and prevents accidental over‑funding above unverified caps.

- Step 2. Select Fiat or Crypto route – Choose Fiat if you want instant USDT through Visa or Mastercard. Processing partners list their markup so users can see deposit fees before checkout. Pick Crypto when transferring coins from an external wallet. The panel displays zero platform charges for incoming coins, though miners still bill the usual network fee that varies with traffic.

- Step 3. Define currency, network, and amount – Scroll the drop‑down to pick a supported asset such as BTC, ETH, or USDT. Matching the blockchain network is essential because sending ERC‑20 tokens to a TRC‑20 address results in permanent loss. A side box shows minimum size, confirmation count, and estimated credit time so traders can plan large or small transfers confidently.

- Step 4. Copy the unique address and transmit funds – Hit Copy or scan the QR image then paste that string inside the withdrawal form of your external wallet. Double‑check the first and last four characters before broadcasting the transaction. The BTCC backend starts monitoring mempool activity immediately and logs a pending line item that counts down the required confirmations in real time.

- Step 5. Wait for network settlement and verify credit – Bitcoin lanes need one confirmation for smaller lots and three for sums above one hundred thousand USDT. Faster chains such as TRON usually clear inside two minutes. When the bar turns green your balance updates and you may move assets to the futures market or spot board without extra clicks, keeping trading fees predictable.

Following these five checks avoids common mishaps like selecting the wrong network or undercutting the minimum. Once deposits post, funds become eligible for copy trading, margin trading, or participation in low‑fee maker orders, enabling experienced traders and newcomers alike to deploy capital swiftly across BTCC pairs while maintaining full visibility on costs and limits.

Smooth Cash‑Out: How to Withdraw Funds from BTCC

BTCC exchange lets users worldwide reclaim trading funds quickly while keeping user assets ring‑fenced under strict regulatory compliance. A dynamic fee engine tied to on‑chain congestion adjusts withdrawal fees in real time, and every request passes multi‑signature controls that satisfy Financial Crimes Enforcement Network guidelines.

Follow the seven checkpoints below to move crypto out safely without derailing your risk management plan.

- Step 1. Launch the withdrawal panel – Click Assets → Withdraw on the BTCC website or app. The dashboard highlights your current KYC tier, daily limits, and any pending withdrawal request, giving new traders and experienced traders alike a clear snapshot before funds leave the platform.

- Step 2. Pick the outgoing asset and network – Choose a coin—BTC, ETH, USDT or another of the 300 digital assets—and then select the matching blockchain. A wrong chain means permanent loss, so BTCC flashes a red banner if network and address appear incompatible, safeguarding user funds against simple copy‑paste mistakes.

- Step 3. Paste and verify the destination address – Enter the recipient string manually or by QR scan. Cross‑check the first and last four characters; BTCC forces a ten‑second delay here as an added buffer against clipboard malware. This stage also supports whitelist filters created under Settings for tighter asset segregation.

- Step 4. Input amount and check dynamic charges – Type the quantity to send. A live widget shows miner cost, platform fee, and remaining quota under your verification level. Because BTCC trading fees follow a competitive fee structure, withdrawal costs stay in line with major exchanges while still covering network gas.

- Step 5. Confirm with two‑factor authentication – Hit Submit, then enter the one‑time code from Google Authenticator, SMS, or email. Two factor authentication plus device fingerprinting blocks unauthorized access even if a password leak occurs, upholding BTCC’s robust security measures record for over a decade.

- Step 6. Await automated and manual review – Most transfers clear inside two hours; large sums may trigger a manual review by the risk team, which checks trading volume history, unusual routing, and reports analysis centre flags. During this window you can track real‑time status in the withdrawal platform log.

- Step 7. Monitor blockchain confirmations – Once released from the queue, the transaction ID appears along with expected confirmation counts—one for TRON, three for Bitcoin, etc. Click the explorer link for live proof that user funds have left cold storage and are en route to your external wallet.

By walking through these seven detailed steps, BTCC account holders can move capital out with minimal trading costs while maintaining high leverage trading flexibility for any remaining balances. The process blends simple trading interface cues with enterprise‑grade controls, giving both new users and professionals confidence that each payout respects strict asset‑segregation rules and global financial regulations.

How BTCC Stacks Up Against Rivals

This section puts BTCC beside other major exchanges to show where each platform shines or slips. We weigh trading fees, leverage ceilings, supported coins, regulatory reach, and security history so that futures trading veterans and new users can judge which venue matches their strategy, location, and risk tolerance.

BTCC against Bitget

Below is a side‑by‑side snapshot that lets crypto traders compare headline metrics without scrolling through two separate sites. Figures come from each exchange’s public fee schedules and help desks as of July 2025.

| Metric | BTCC | Bitget |

|---|---|---|

| Regulatory licences | FinCEN MSB, FINTRAC MSB, Lithuania registry | Seychelles registration, required filings in Europe and selected Asia hubs |

| Spot trading fee (maker / taker) | 0.200 % / 0.300 % | 0.100 % / 0.100 % |

| Futures trading fee (maker / taker) | 0.025 % / 0.045 % | 0.020 % / 0.060 % |

| Perpetual futures contracts | 360 pairs | 460 pairs |

| Maximum leverage | 500× on promo pairs | 125× on flagship pairs |

| Copy trading feature | Leaderboard with risk caps | Leaderboard with profit share |

| Demo trading | Yes, 100 000 USDT sandbox | Yes, 3 000 USDT sandbox |

| Passive income tools | None on‑platform | Staking, savings, dual investment |

| United States access | Account creation and full trading allowed | No direct access |

| Canadian access | Full service | Not supported |

| Security record | Zero breaches in 14 years | Zero breaches to date |

| Two factor authentication | Mandatory on login and withdrawal | Optional but recommended |

| Supported digital assets | 300 plus | 800 plus |

| Mobile app rating | 4.6 Google Play | 4.5 Google Play |

| Customer support lanes | Chat, ticket, email, X | Chat, ticket, Telegram |

| Minimum crypto deposit | None | None |

| Fiat deposits | Card, bank transfer (USD, CAD) | Card, third‑party gateway (60 plus currencies) |

Traders should take these facts into account:

- Fees – Bitget wins on spot trading fees at half the cost, which matters to scalpers watching every basis point. BTCC narrows the gap in the futures market where its taker rate undercuts Bitget by one and a half basis points, an edge for high‑velocity futures trading.

- Leverage – BTCC appeals to experienced traders chasing high gearing with a promotional ceiling of five hundred times on BTC USDT and four other hot coins. Bitget limits leverage to one hundred twenty‑five times, aligning with industry practice for risk management.

- Market reach and compliance – For residents of the United States and Canada, BTCC is one of the few major exchanges holding both Financial Crimes Enforcement Network and FINTRAC registrations, so traders there can deposit funds directly rather than routing through offshore wallets. Bitget blocks sign‑ups from those jurisdictions, pushing such users toward VPN workarounds that carry compliance risk.

- Feature depth – Bitget offers a richer catalogue of passive income products, trading bots, and over eight hundred crypto assets, giving portfolio explorers more room to roam. BTCC focuses on a clean workflow that pairs spot trading with perpetual futures and an easy copy trading console, keeping the learning curve manageable for new users while still providing tools demanded by derivative veterans.

- Security – Both platforms store user funds in multi signature cold wallets and require two factor authentication. BTCC adds asset segregation in trust accounts, guaranteeing that trading margins remain off the company balance sheet, a safeguard many users value after turmoil at other exchanges.

BTCC wins on leverage, North American compliance, and a decades‑long safety record, making it a strong pick for traders who prioritise regulatory clarity and high gear. Bitget remains attractive for its lower spot trading fees, broader asset shelf, and built‑in yield products. Choice depends on whether fee savings and passive income outweigh the need for United States access and higher leverage.

BTCC set against BingX

The sheet below stacks key statistics so traders can weigh both venues at a glance. All figures are drawn from each platform’s public statements, fee pages, and incident reports dated July 2025.

| Metric | BTCC | BingX |

|---|---|---|

| Oversight & licences | FinCEN MSB, FINTRAC MSB, Lithuania crypto permit | Operating entity in British Virgin Islands, VASP notice in Lithuania |

| Spot trading fee (maker / taker) | 0.200 % / 0.300 % | 0.100 % / 0.100 % |

| Futures trading fee (maker / taker) | 0.025 % / 0.045 % | 0.020 % / 0.050 % |

| Perpetual contracts | 360 pairs | 520 pairs |

| Maximum leverage | 500× promo on five pairs | 125× on majors |

| Copy or social trading | Copy futures with risk caps | Copy plus integrated feed similar to Twitter |

| Demo account | Yes, 100 000 USDT | Yes, 50 000 USDT |

| Staking / earn tools | None | Fixed & flexible staking, dual investment |

| Passive income APY top tier | — | Up to 12 % on stablecoins |

| Security track record | Zero breaches in 14 years | Hot‑wallet breach Sept 2024, ≈43 million USD loss covered by reserve |

| Insurance or protection fund | Ring‑fenced trust plus asset 1‑to‑1 storage | SAFU‑style emergency fund post‑breach |

| United States access | Full service | Blocked |

| Canadian access | Full service | Blocked |

| Mobile rating (Google Play) | 4.6 (115 k reviews) | 4.3 (87 k reviews) |

| On‑ramp currencies | USD, CAD by card/wire | 60+ fiat via third‑party gateways |

| API throughput | 1 200 orders / sec | 800 orders / sec |

A few important takeaways for traders:

- Fee picture – BingX undercuts BTCC on spot maker and taker rates by one fifth of a percent, which matters for day‑traders spinning high turnover. Futures pricing is closer, with BTCC fractionally cheaper for takers once a trader’s clip size tops ten million USDT per month.

- Leverage and risk – High leverage fans gravitate toward BTCC, where selected BTC USDT and ETH USDT contracts scale to 500× during the promotional window. BingX caps exposure at 125×, which some risk managers view as calmer waters for new traders.

- Security confidence – The September 2024 incident at BingX—roughly forty‑three million dollars siphoned from a hot wallet—still colours community perception even though client balances were restored inside forty‑eight hours. BTCC’s fourteen‑year zero‑hack history gives conservative traders added reassurance, strengthened by a multi‑signature cold storage model and asset segregation.

- Product scope – BingX wins on variety: more than five hundred perpetual futures contracts, extensive staking menus, and a social feed that mimics mainstream networks. BTCC keeps the toolkit slimmer—spot, high‑gear futures, copy trading, and a clean conversion pane—prioritising speed and clarity over breadth.

- Regional reach – For traders in the United States or Canada, the decision is simple: BTCC operates with money‑services approvals, while BingX geoblocks those jurisdictions. Users elsewhere must decide whether lower spot costs and passive‑income perks at BingX outweigh BTCC’s higher leverage ceiling and longer security record.

In short, BTCC suits participants craving regulatory clarity, high leverage, and an unblemished safety sheet, while BingX speaks to traders chasing lower spot costs, richer asset choice, and yield opportunities—provided they trade outside North America and accept the platform’s recent breach history.

Final Word on Choosing BTCC

A glance at this BTCC review shows a venue that blends a decade of uptime with clear regulatory compliance. Money‑services registrations with the Financial Crimes Enforcement Network and other regulatory licenses give comfort to users worldwide who move sizeable trading funds by card, bank transfers, or crypto. Security stays front‑row: two factor authentication, multi signature cold wallet custody, and strict asset segregation form a barrier few major exchanges match.

On the desk itself, BTCC delivers 240‑pair spot trading, a 360‑product futures market, and promotional perpetual futures at up to 500× for daring participants in leveraged trading. Fee math is easy to track: flat 0.200 percent maker and 0.300 percent taker on spot, plus sharp futures trading fees of 0.025 percent maker and 0.045 percent taker. A permanent demo trading sandbox lets new traders rehearse risk controls before live orders, while copy trading helps passive users shadow experienced traders without handing over custody.

If staking or yield farming tops your wish list, the absence of passive earnings and the presence of withdrawal fees may steer you elsewhere. For anyone focused on execution, mobile fluency, tight trading costs, and reliable customer support through the BTCC website, the platform supplies a compact set of trading options on more than 300 digital assets with a safety net of serious risk management demands.

Scientific Backup

- Lengert A – Two factor authentication challenges and inclusive access.

- Lewis R – Comparative analysis of securities regulations for cryptocurrencies in the United States and Canada.

BTCC FAQ

Is BTCC legit?

Multiple regulatory licenses confirm the exchange’s legal standing. A Money Services Business filing with the Financial Crimes Enforcement Network covers United States operations, FINTRAC registration protects Canadian customers, and the Registrar of Legal Entities in Lithuania supervises European activity. Fourteen years online with zero security events reinforce legitimacy for users worldwide who read any BTCC review.

What fees does BTCC charge?

BTCC trading fees follow a simple, competitive fee structure. Spot trading costs 0.200 percent for makers and 0.300 percent for takers, while futures trading fees begin at 0.025 percent maker and 0.045 percent taker across the futures market. Crypto deposits arrive free apart from network miners, and withdrawal fees float dynamically with chain load, keeping trading costs predictable.

Is BTCC available in the US?

Yes. The btcc exchange holds a Money Services Business license under the Financial Crimes Enforcement Network, allowing Americans to open a BTCC account, place spot trades, enter perpetual futures contracts, and process bank transfers or card fiat deposits without regulatory friction. Few exchanges offering high leverage trading provide the same nationwide reach.

Does BTCC require KYC?

Identity verification unlocks higher withdrawal tiers, fiat deposits, and bonus campaigns. Unverified new users can still start trading by moving crypto deposits into the platform and may withdraw up to ten thousand USDT daily. Completing the verification process raises limits to one million USDT, supports margin trading, and strengthens overall risk management.

Does BTCC offer staking?

Staking or DeFi lending is absent, yet traders can still grow balances through welcome bonuses, an affiliate plan, demo trading practice, and BTCC’s copy trading feature. Perpetual futures, tokenized stocks, and spot trading on more than three hundred digital assets provide active income streams that suit experienced traders chasing market prices.

How secure is BTCC?

Robust security measures protect user funds. Two factor authentication guards every login and withdrawal request, while multi signature cold wallet storage keeps over ninety‑five percent of user assets offline. Asset segregation forbids commingling with operational money, and regular audits verify one‑to‑one reserves. The result is fourteen years of operation with no breaches.