Bybit stands among the most active cryptocurrency derivatives venues. Launched in 2018, the exchange now clears daily trading volume that often tops ten billion United States dollars. A matching engine capable of one hundred thousand transactions each second, combined with a dual price protection model, shields traders from sudden price movements.

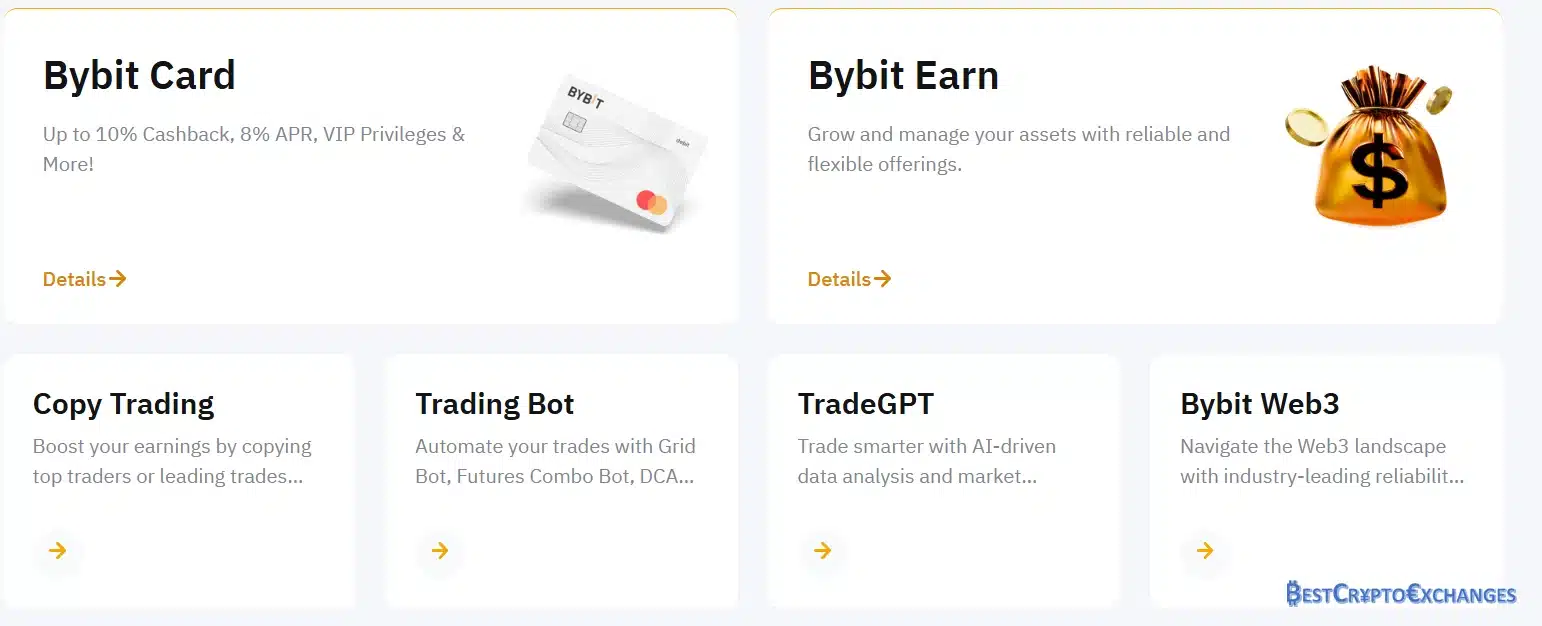

The platform provides an extensive menu that embraces spot trading, margin trading, perpetual contracts, options, copy trading, and even liquidity mining. Bybit maintains segregated user funds through threshold signature schemes stored in a trusted execution environment, while two factor authentication and anti‑phishing codes add daily account safety. The Bybit mobile app mirrors the desktop site, letting traders watch market trends, place orders, and track asset balance on the move. All material below relies on up‑to‑date information verified in July twenty twenty‑five.

Bybit Review – Quick Glance of Pros and Cons

A side by side snapshot helps readers decide if opening a Bybit account makes sense given their trading style, regional rules, and appetite for derivatives risk in twenty twenty five.

What we liked

• Very low maker and taker fees across spot and derivatives

• Wide set of trading pairs and advanced trading tools including grid bots

• Round the clock customer support that answers within minutes

• Mobile application rated above four point seven stars on both major stores

What we did not like

• Interface can confuse first timers who jump straight into high leverage products

• Service remains blocked in the United States and a short list of other territories

Maker fees start at zero point ten percent on spot and two basis points on perpetual contracts, dropping to zero when thirty-day trading volume passes one billion dollars. Depth often exceeds eight hundred million dollars on BTC USDT, allowing experienced traders to exit positions without moving the current market price. The Bybit app pushes order fills in less than one second thanks to an ultra fast matching engine that logs one hundred thousand transactions every second. Regional blocks affect eight percent of global traffic, yet more than one hundred sixty jurisdictions remain open, bringing fresh liquidity and competitive spreads daily.

Pros

- One thousand plus trading pairs across spot and derivatives that fit both dollar cost averaging and advanced strategies.

- Ultra fast order book helps manage risk during periods of price volatility.

- Competitive trading fees that drop in nine tiers as thirty‑day volume grows.

- Copy trading and trading bots provide passive exposure for busy Bybit users.

- Insurance fund cushions unplanned liquidation price spikes.

Cons

- Less experienced traders may feel lost when they first open a Bybit account.

- Some user reviews mention frozen withdrawals pending extra identity checks.

Bybit shines on costs and speed, but newcomers must respect leverage and check regional rules before funding an account today.

Bybit Origins, Licenses, and Corporate Footprint

Bybit Fintech Limited registered in the British Virgin Islands during early 2018 and switched on its order-matching cluster just months later. From day one the bybit exchange focused on derivatives trading, launching BTC-USDT perpetual contracts that permit leverage up to one-hundred-times, a figure that quickly attracted considerable trading volume from advanced traders migrating off rival desks. Today the crypto exchange oversees satellite offices in Dubai, Hong Kong, and Singapore, allowing regional compliance teams to follow local financial rules. Robust security measures include cold-storage segregation of user funds, threshold signature schemes, and public insurance-fund addresses published on chain for real-time monitoring by independent analysts.

Bybit Review: Strengths at a Glance

One secure Bybit account unlocks spot trading on almost nine hundred coins, ten-times margin on liquid pairs, and a busy derivatives pit where perpetual contracts, options, and grid bots all run side by side. Competitive trading fees, heavy trading volume, and quality customer support combine to give the exchange a reputation many crypto investors rank above larger rivals.

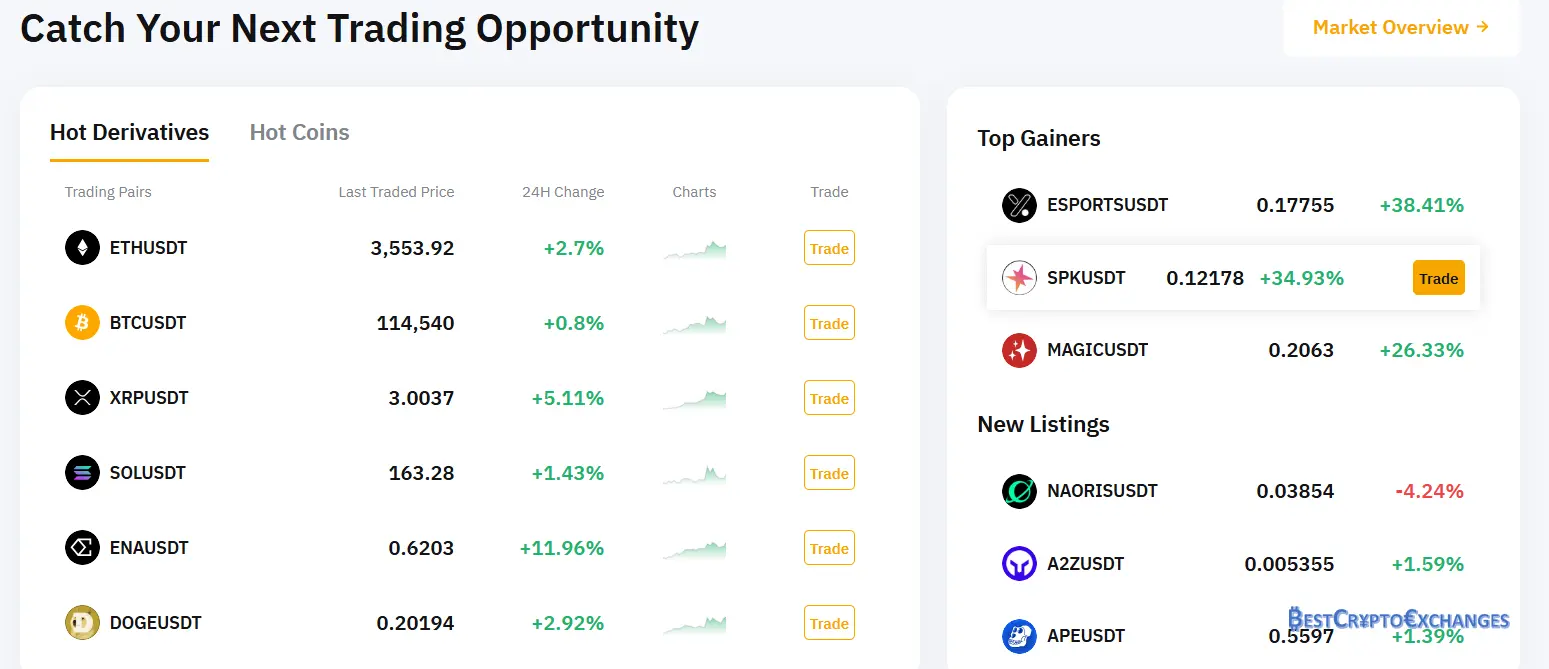

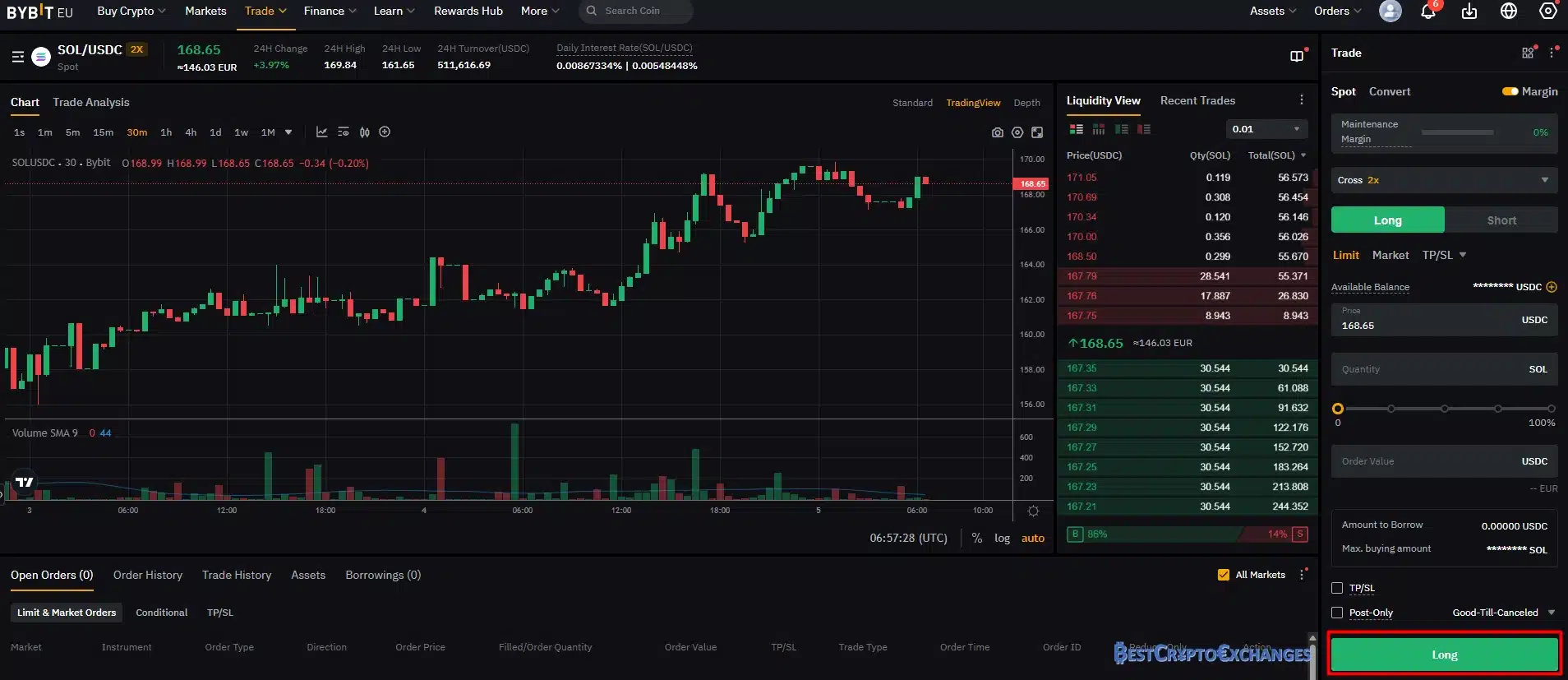

Bybit Trading Options: Versatile Market Access on One Platform

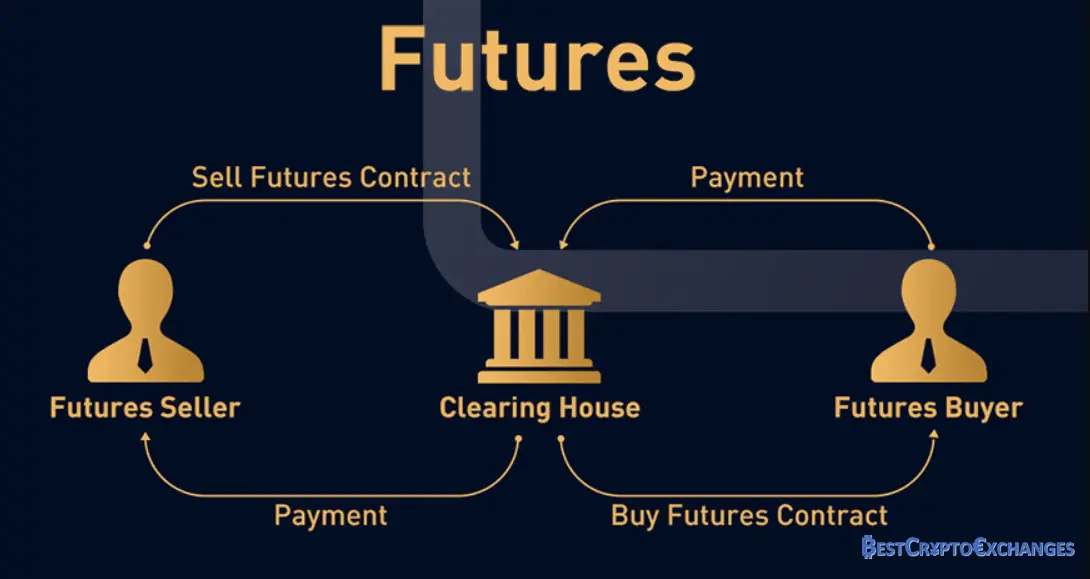

Bybit supplies multiple instruments so traders can shape positions around any market sentiment. Spot trading delivers direct ownership of digital assets at the current market price, suitable for dollar cost averaging or quick arbitrage. Margin trading multiplies buying power up to tenfold, yet protective risk management tools display liquidation price in real time. The derivatives arena lists USDT-margined perpetual futures, coin-margined inverse contracts for longer hedges, and USDC European options that let advanced traders balance potential profits against downside risk.

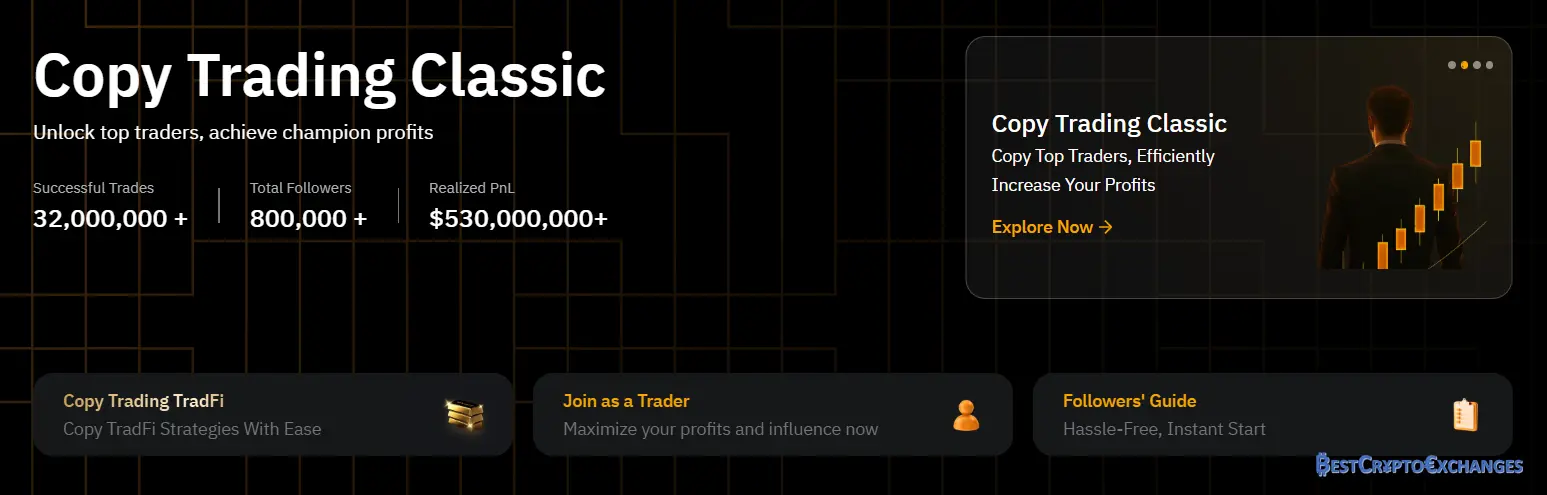

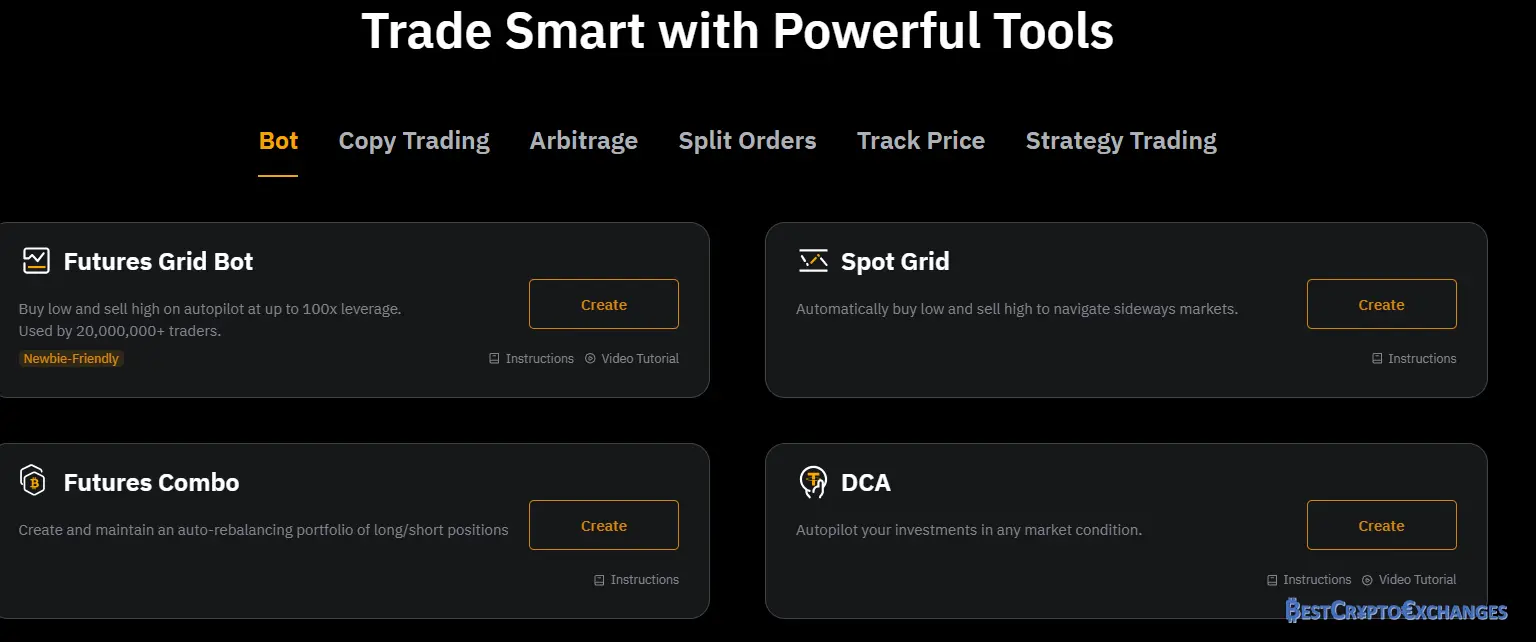

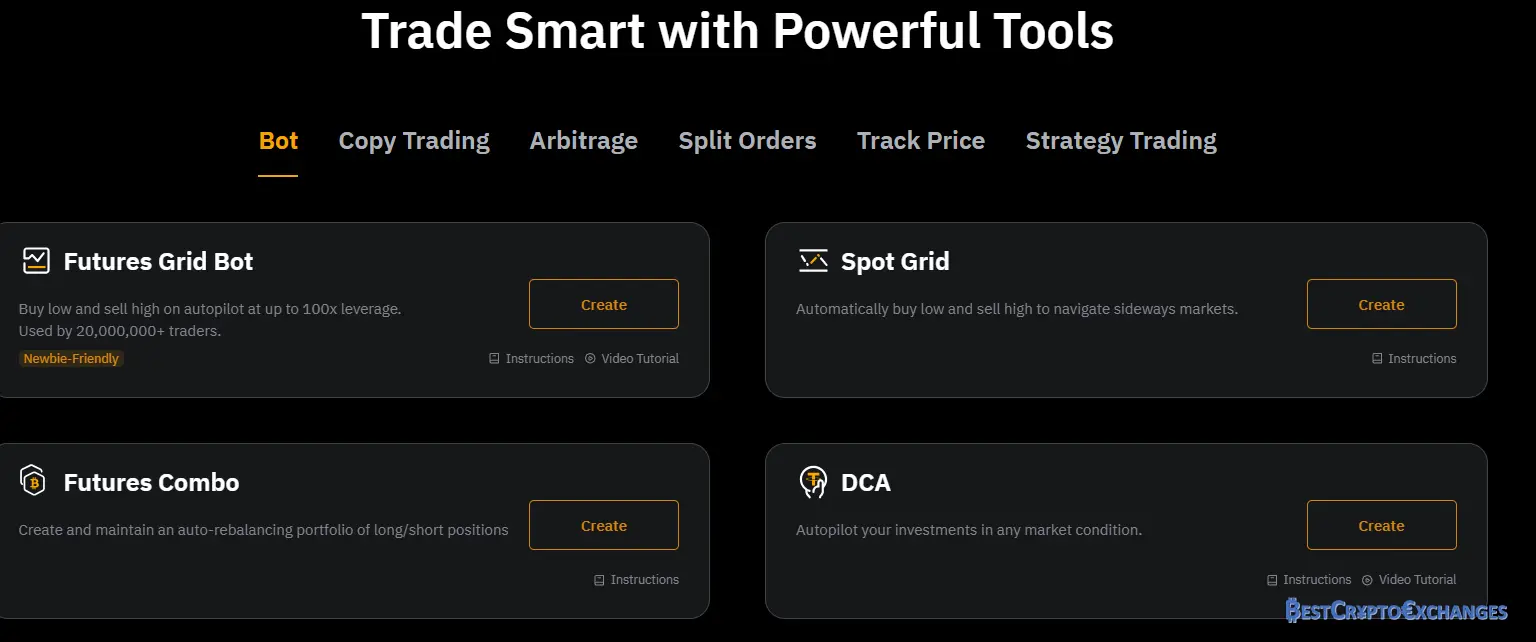

A pre-market board opens before formal listings, granting early access to tokens that may ride price volatility on launch day. Newer participants can lean on copy trading to shadow seasoned Bybit users, while algorithm fans deploy a futures grid bot that reacts to price movements twenty-four hours a day. The engine matches orders at up to one-hundred-thousand transactions per second, maintaining smooth execution during spikes in trading volume.

| Instrument Class | Relative Risk | Max Gear | Fixed Maturity? | Forced Settlement | Typical Objective |

|---|---|---|---|---|---|

| Futures (standard) | Elevated | up to 100 × | Yes | Yes | Lock-in a later purchase/sale price or run time-boxed directional trades. |

| Perpetual Swaps | Very elevated | up to 100 × | No | Yes | Round-the-clock speculation or hedging without contract rollovers. |

| Vanilla Options | Moderate | — (leverage comes from premium outlay) | Yes | No—holder decides | Earn from price swings or cap downside while keeping unlimited upside. |

Beyond the derivatives pit, Bybit keeps an entire toolbox for cash-based or assisted strategies so participants can shift among market modes without leaving the same login.

• Spot trading – buy or sell coins at the going rate, with ownership delivered to your wallet the moment the match engine fills the order.

• Margin trading – borrow additional capital and lift exposure up to ten times, a quick route for magnifying gains or losses on liquid pairs.

• Copy trading – link your Bybit account to a ranked leader board and mirror positions opened by veteran operators, a shortcut to learning their risk management style in real time.

• Trading bots – set grid or dollar-cost-averaging scripts that run around the clock and follow parameters you define, useful when price volatility keeps you away from the screen.

• Pre-market venue – place bids and offers on new tokens hours before the official listing window, allowing early price discovery in a controlled book.

All of these paths are available inside a simulation room that uses test coins, giving newcomers a chance to rehearse strategies without risking actual funds.

Whether you prefer straightforward spot trades, hedged perpetual futures, or automated grid bots, Bybit supports nearly every strategy on a single screen, reducing the need to shuffle funds between multiple crypto exchanges.

Low-Cost Fee Schedule

Bybit sets charges with a transparent maker–taker ladder that shrinks as either your thirty-day trading volume or on-platform asset balance climbs. Entry-level users pay just 0.10 percent on spot orders and 0.02 percent to provide futures liquidity—already cheaper than many rival crypto exchanges. The moment monthly turnover clears one million dollars, spot maker drops to five basis points, while futures taker falls to four. Crossing the ten-million tier removes the futures maker charge entirely, rewarding desks that keep order books thick and price discovery smooth. Those who hold sizable balances inside a Bybit account can access the same tiers even if volume is lower.

Fee Ladder — Spot and Futures

| Thirty-day volume (USD) | Spot maker | Spot taker | Futures maker | Futures taker |

|---|---|---|---|---|

| 0 – 250 k | 0.10 % | 0.10 % | 0.02 % | 0.055 % |

| 250 k – 1 m | 0.08 % | 0.09 % | 0.015 % | 0.050 % |

| 1 m – 10 m | 0.05 % | 0.08 % | 0.010 % | 0.040 % |

| > 10 m | 0.03 % | 0.07 % | 0.000 % | 0.030 % |

Beyond VIP 5 lies the Pro bracket, where futures taker slips again and rebates increase, giving frequent traders a meaningful edge while still leaving casual participants with inexpensive execution.

Adaptive Functionality Across the Platform

Bybit equips members with an intelligent trading suite that wraps risk controls, automated tools, and redundant systems into a single interface. Order tickets let you pre-define take-profit and stop-loss exits, and the dual-reference pricing model—one internal, one external—guards against unfair liquidations during wild price swings.

A matching engine rated at one-hundred-thousand transactions per second partners with real-time health monitors to prevent overload when trading volume surges.

• Dual price protection limits cascading liquidations by cross-checking each fill against a composite external index, giving traders time to react before sudden spikes drain margin.

• The insurance fund absorbs gap losses after extreme events, covering positions that slide below zero so user funds are not tapped for clawbacks, a key layer of confidence during high volatility.

• Threshold signature protocols split private-key control across multiple hardware modules, keeping cold-wallet assets isolated from the live network and lowering single-point-failure risk.

• Identity verification integrates two-factor codes plus a personal anti-phishing phrase shown on every Bybit email, reducing attack vectors such as spoofed logins and credential stuffing.

• Market analysis comes via TradingView charts embedded with dozens of technical indicators, depth overlays, and position widgets, allowing detailed examination without leaving the order pane.

• Copy-trading pages rank lead traders by risk score and return history; followers can allocate fixed capital or percentage mirrors, then monitor performance through transparent dashboards updated in real time.

• A futures grid bot automates range strategies by placing ladders of limit orders above and below the current market price, harvesting small moves around a defined median while the user sleeps.

Behind these tools, an intelligent alert engine pings you when margin usage rises or liquidation price approaches, helping manage risk before trouble strikes. Web and Bybit mobile app share a uniform layout, so muscle memory transfers across devices.

Supplementary products include liquidity-mining pools, interest accounts that park idle USDT in short-term loans, and a wealth-management section that diversifies balances into low-duration yield notes—yet keeps principal instantly withdrawable. System availability averaged 99.99 percent during the last twelve months, demonstrating durable engineering that advanced traders demand.

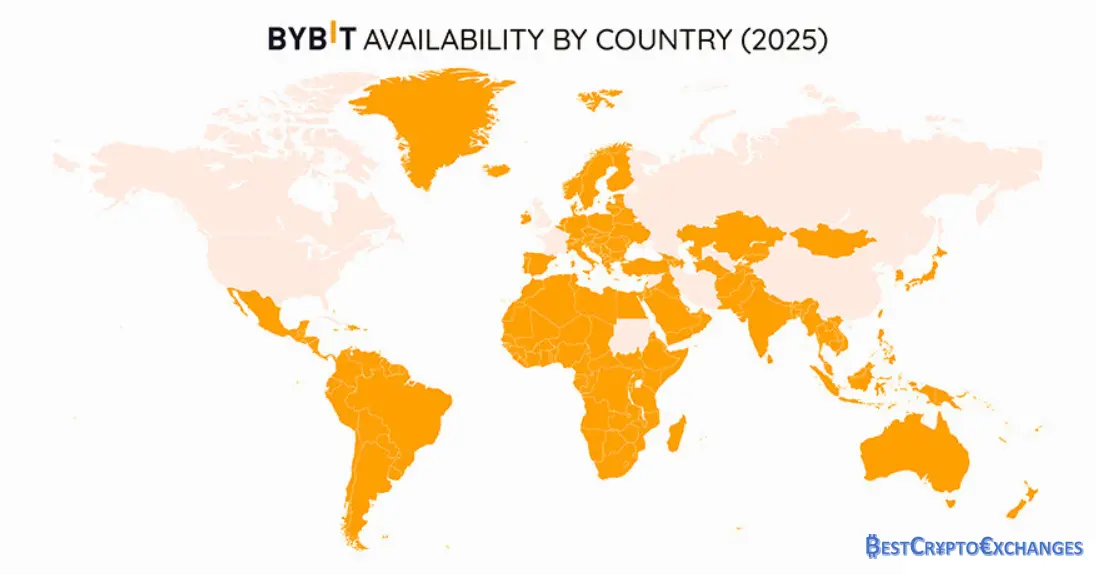

Global Reach Across Most of the Map – Supported Regions

Bybit operates on a truly international scale, welcoming account openings from more than 160 jurisdictions. Localized portals appear in English, Spanish, Portuguese, Turkish, Vietnamese, Korean, Russian, and additional languages under development, so traders can view the interface and support articles in their native tongue. Fiat on-ramp partners in Europe, Latin America, and parts of Asia simplify deposits, while regional market-making nodes keep order-book latency low even during heavy trading volume.

A concise exclusion list—United States, Canada (including Québec), Singapore, mainland China, Cuba, Iran, North Korea, Sudan, Syria, Crimea, and Sevastopol—reminds prospective clients to check residency rules before starting identity verification. Beyond those locations, the Bybit exchange continues to secure licenses or submit applications, indicating the company remains committed to widening its legal footprint as regulatory clarity improves.

For traders based in the EU, U.K., Brazil, Mexico, Nigeria, India, Australia, Japan, or dozens of other permitted territories, creating a Bybit account usually requires no more than a government ID and a selfie. Combined with real-time monitoring systems that automatically detect regional network congestion, this worldwide coverage lets users follow market trends and execute dollar cost averaging plans around the clock without worrying about VPN workarounds or sudden service interruptions. The result is a smoother trading experience that matches the platform’s ultra-fast matching engine and robust security measures, cementing Bybit’s status as a go-to crypto exchange outside the small group of blocked regions.

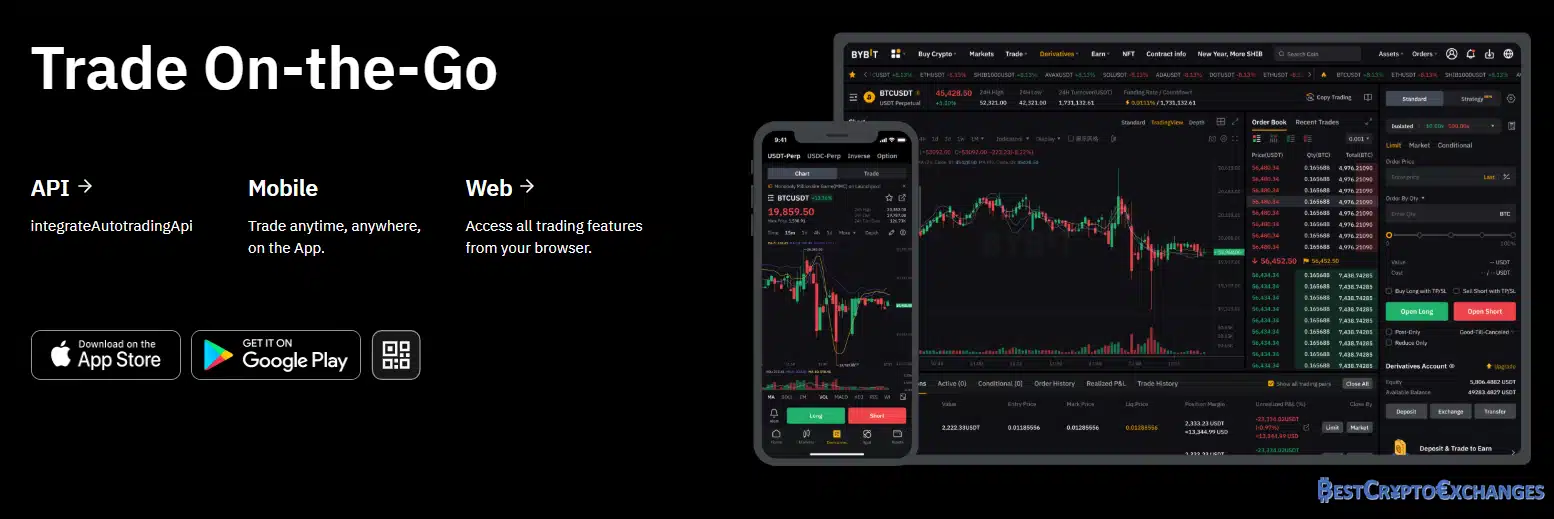

Trading in Your Pocket – Bybit Mobile Suite

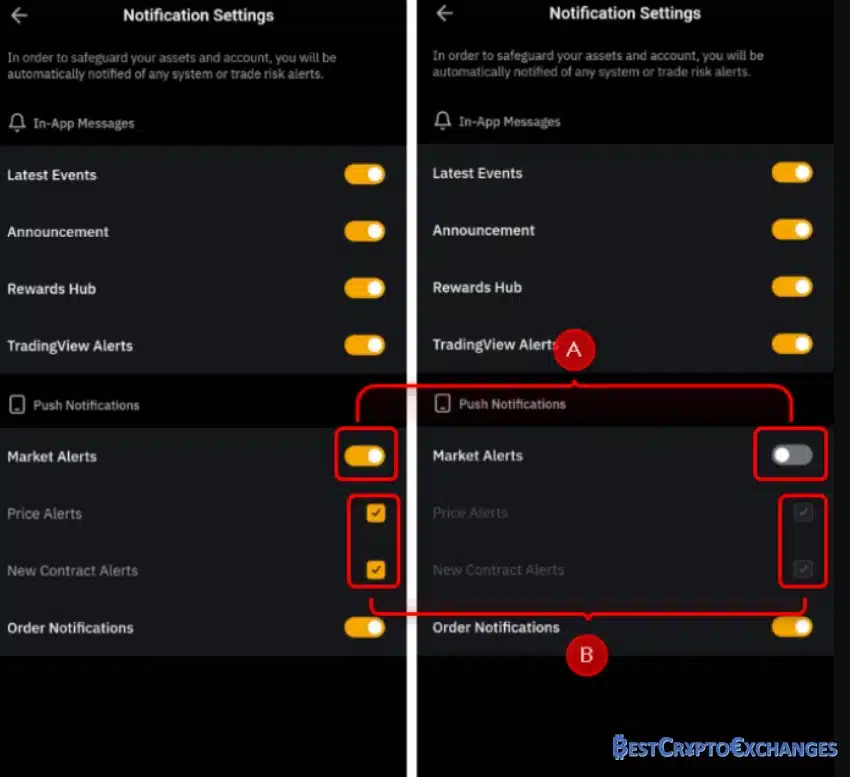

The Bybit mobile app replicates almost every desktop feature and layers touch-first convenience on top. From the main dashboard, traders can jump between spot trading, derivatives trading, or wealth-management products with a single swipe. Real-time monitoring systems feed depth charts that update every 20 milliseconds, and an adjustable leverage slider lets you set margin up to 100 × on supported perpetual contracts. Copy-trading leaderboards and an intuitive futures grid bot are fully functional on handheld devices, giving less-experienced traders access to advanced strategies without opening a laptop.

Push notifications deliver price alerts at the exact current market price you specify, and built-in liquidation price warnings help manage risk. Two factor authentication supports biometric sign-in, while optional anti-phishing codes appear on every in-app message. Store reviews average 4.8 / 5 after more than 500 000 ratings, with Bybit users repeatedly praising low latency order entry, clear display of competitive trading fees, and the ability to move asset balance between spot and derivatives wallets in seconds.

Round-the-Clock Human Help – Bybit’s Support Framework

Bybit positions quality customer service as a core differentiator in a crowded crypto-exchange field. Live chat icons follow you across both web and Bybit mobile app interfaces; tap one and a human agent typically greets you within two minutes, according to internal metrics shared in May 2025. These first-line specialists resolve most everyday questions: resetting two factor authentication, locating a missing withdrawal hash, explaining dual price mechanism logic, or clarifying how initial margin interacts with liquidation price during high volatility. Should an inquiry involve account-level security, liquidation disputes, or threshold signature schemes on cold-wallet transfers, chat shifts you to an advanced team that can provide detailed log files and screen captures to back its decisions.

Email tickets are issued a tracking number, and median resolution time sits under four hours. For lighter issues, a searchable knowledge base covers everything from futures grid bot parameters to anti-phishing code best practices. Community channels on Telegram and X offer real-time announcements about maintenance windows and market analysis posts from the in-house research desk. Trustpilot feedback has trended upward—many reviewers note that even when Bybit fell victim to network overload, staff remained polite, transparent, and quick to follow up.

Altogether, this multilayered support approach underscores Bybit’s pledge to protect user funds, reinforce robust security measures, and keep advanced traders and newcomers alike on track toward potential profits.

Where Bybit Still Shows Friction

Bybit remains committed to a smooth trading experience, yet two weak points persist in community discussions. First, interface depth can swamp new traders who confuse margin trading fields with spot market tickets. Second, scattered negative reviews cite account freezes and withdrawal holds that briefly overshadow the platform’s otherwise robust security measures and generally good customer support.

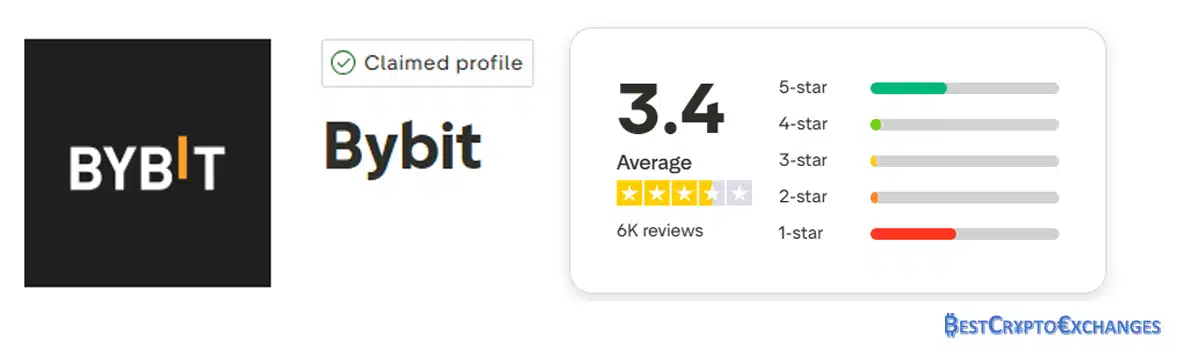

Listening to the Crowd – Mixed User Comments

TrustPilot posts a 3.4 rating that blends praise for ultra-fast matching engine performance with frustration over compliance checks. The most common gripe involves pending withdrawals when real time monitoring systems flag outbound transfers as atypical for the user’s normal trading volume. Support staff then request extra identity verification or updated bank statements, prompting delays that spur heated forum threads.

A few advanced traders recount forced position closures during volatile price movements, claiming the dual price mechanism lagged a fraction of a second and triggered liquidation before the insurance fund could cushion slippage. Bybit countered with detailed audit notes, publishing liquidation price paths and funding rate data to show margin calculations were consistent with published rules. These cases highlight the need for conservative initial margin, diligent risk management, and prompt response to compliance emails. Overall sentiment suggests that while Bybit maintains strong security of user funds, strict monitoring can feel intrusive to clients unaware of background checks required in a modern crypto exchange.

Stepping Up the Learning Ramp – Complexity for First Timers

Derivatives trading on Bybit offers up to one hundred times leverage on perpetual contracts, a feature that draws experienced traders and confuses many beginners. A new account holder might see potential profits advertised in platform tutorials, open a heavy BTC long without setting stop loss, and discover the position liquidated after a two percent dip because initial margin evaporated.

The interface provides advanced trading tools such as trailing stops, partial take profit, cross or isolated margin modes, and a futures grid bot, yet each element demands study of funding rate, liquidation price, and insurance fund mechanics. Bybit offers extensive educational materials, a demo net with simulated asset balance, and copy trading leaderboards, but the responsibility for own research rests on the individual.

Traders who ignore market sentiment, price volatility alerts, and risk management prompts can quickly lose all the money deposited. As a result, the exchange encourages small size practice, progressive leverage, and enabling two factor authentication before live orders. With patience and careful reading, the steep curve flattens, allowing users to unlock advanced strategies without falling victim to sudden liquidation.

Platform Flow – How Bybit Operates

Before live orders, a trader must glide through registration, KYC, and interface familiarisation; the sequence below maps each station so market newcomers understand how Bybit’s smart trading system fits together.

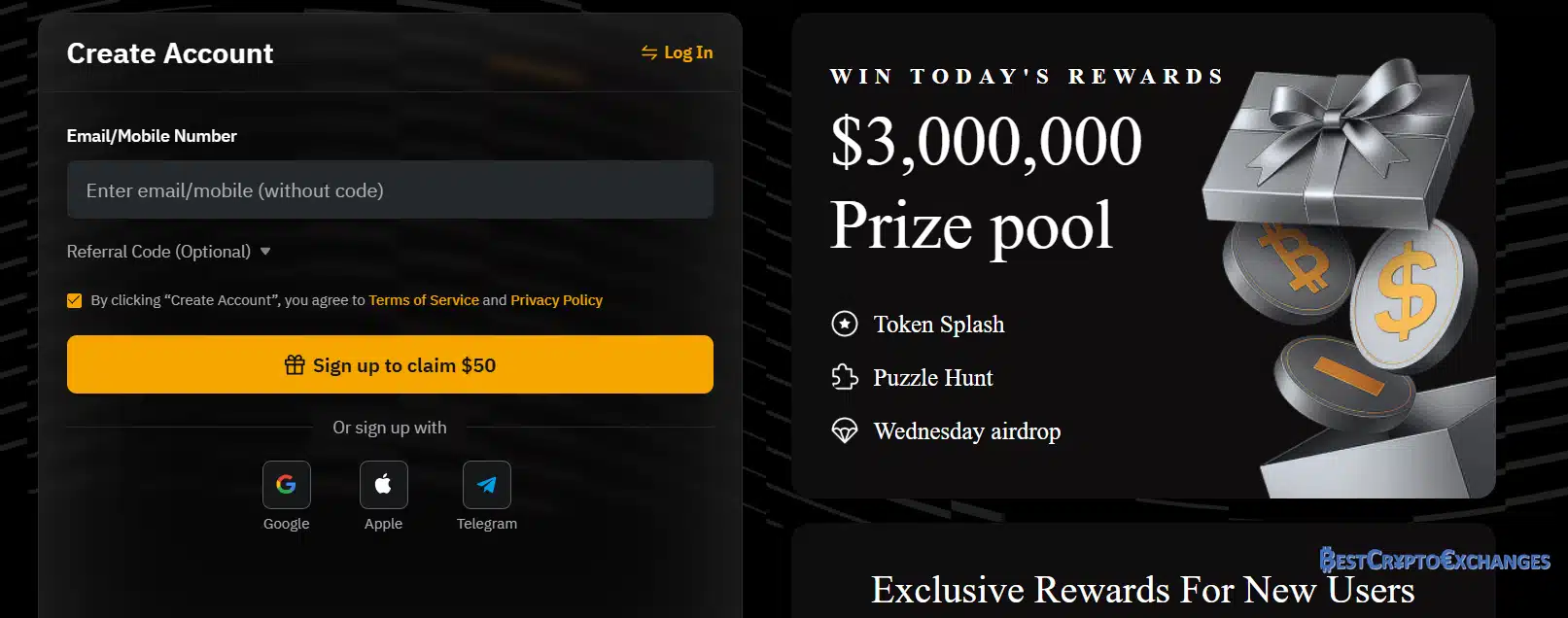

Opening a Bybit Account

Creating a Bybit account is simple; the exchange reduced friction so traders can reach the order book quickly while still meeting security rules demanded of a global cryptocurrency exchange operator.

Registration takes about three minutes.

- Step 1 – Email and Password

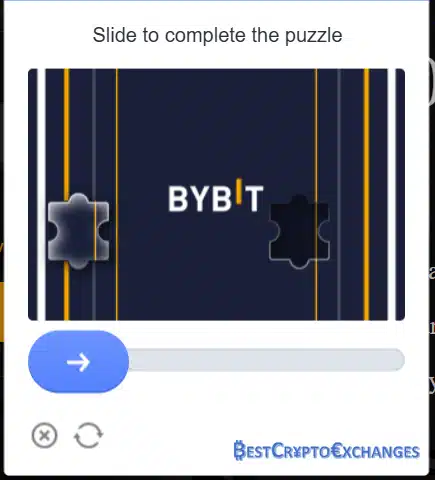

Navigate to Bybit.com, hit the bright Sign Up button, type a current email address, craft a strong password with upper-case, lower-case, numbers, and symbols, then choose your country of legal residence. - Step 2 – Captcha

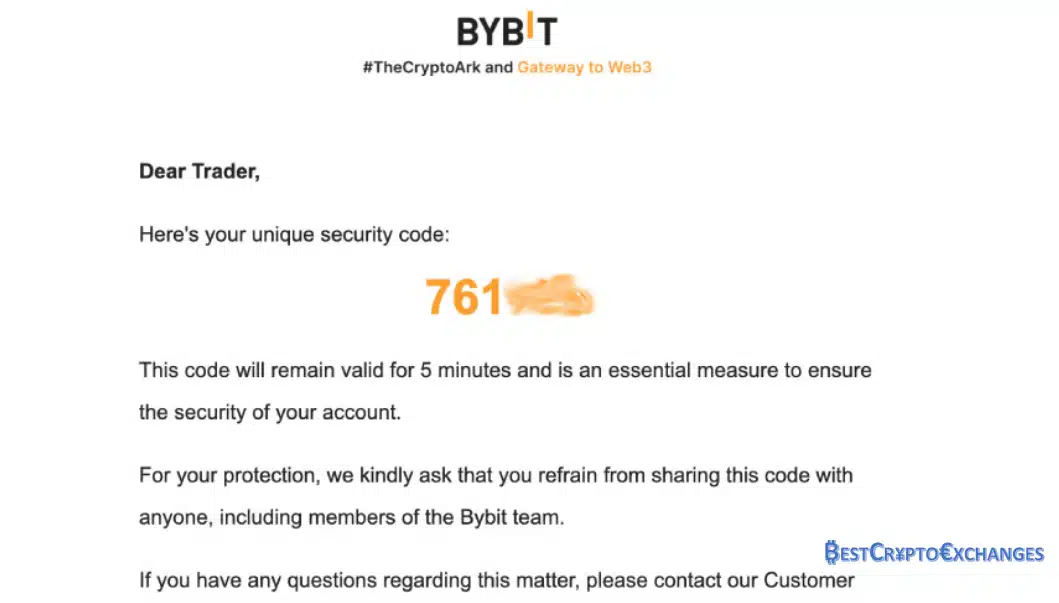

Solve the sliding-tile captcha that appears; this puzzle blocks automated bots and confirms human interaction, protecting volume statistics from spam account inflation while preserving the platform’s fast matching engine resources. - Step 3 – Mailbox Code

Open your email inbox, locate the Bybit verification message, copy the six-digit security code, switch back to the registration window, paste the code, and click Confirm to finalise mailbox ownership. - Step 4 – Terms and Region Check

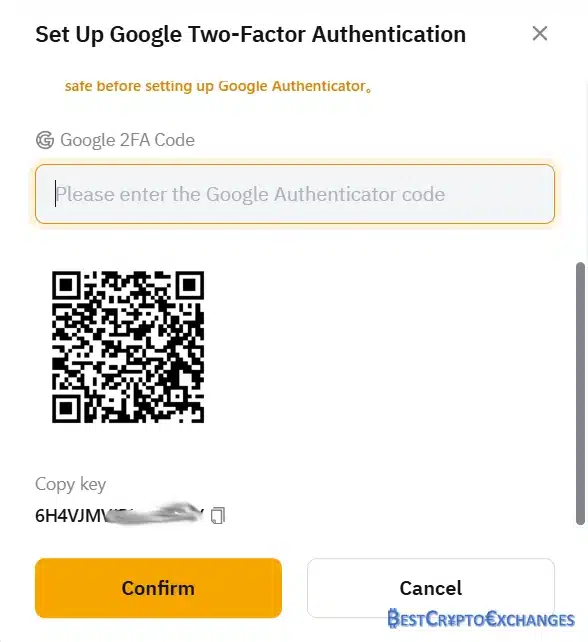

Tick the acknowledgment box agreeing to user terms, confirm you reside outside prohibited regions like the United States, then press Activate Account so credentials become eligible for cryptocurrency exchange services. - Step 5 – Two-Factor Setup

Head over to the Security centre, scan the on-screen QR code with Google Authenticator, store backup keys offline, and set SMS or email alerts to track every login and withdrawal request.

These five actions finish registration in three minutes, after which new Bybit users can explore the interface, research trading pairs, and practise on the demo net before risking asset balance.

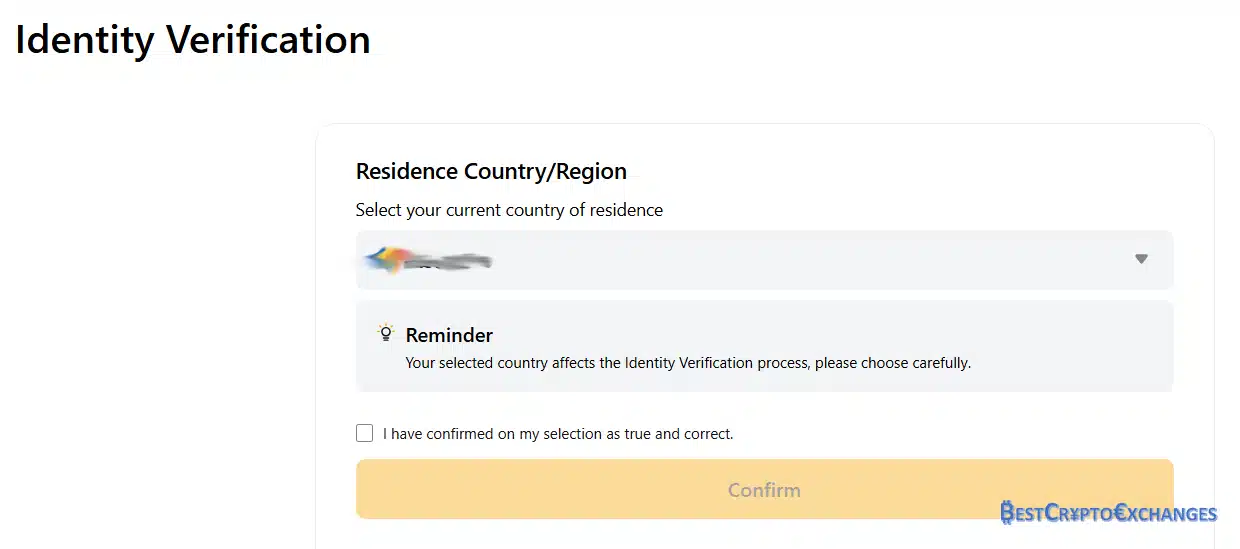

Clearing KYC on Bybit

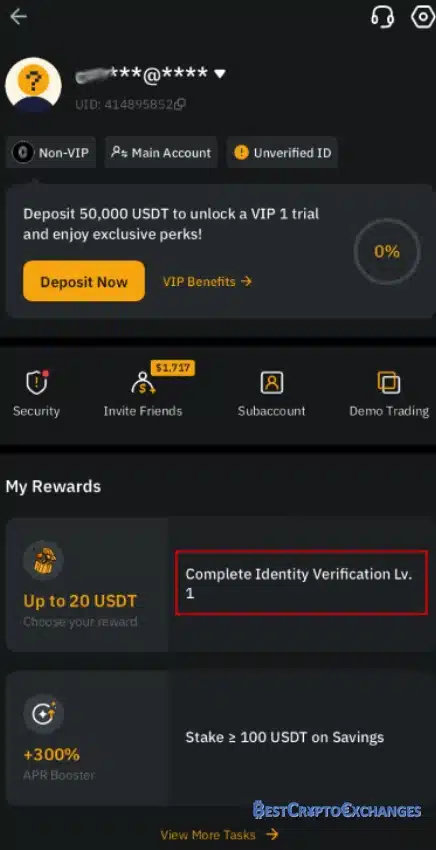

Regulators demand that a crypto exchange confirm customer identity, and Bybit meets those requirements with a two-level KYC flow. Level 1 unlocks fiat gateways, higher withdrawal caps, and copy trading access; completing it on a smartphone is fastest because the app guides the camera through each snapshot with real-time prompts.

- Step 1 – Launch Verification

Launch the Bybit mobile app, sign in, tap your avatar, and hit the yellow Verify link; a status page appears showing current tier and the perks that arrive once Basic identity verification clears.

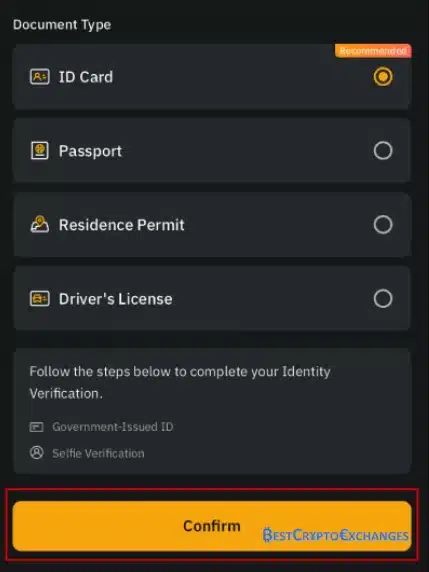

- Step 2 – Choose Document

Select the issuing country of your identification and decide whether to submit a passport, national identity card, driver’s licence, or residence permit; Bybit supports documents from every jurisdiction in which it operates.

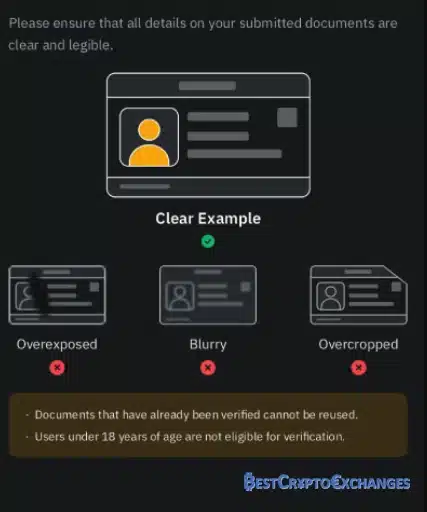

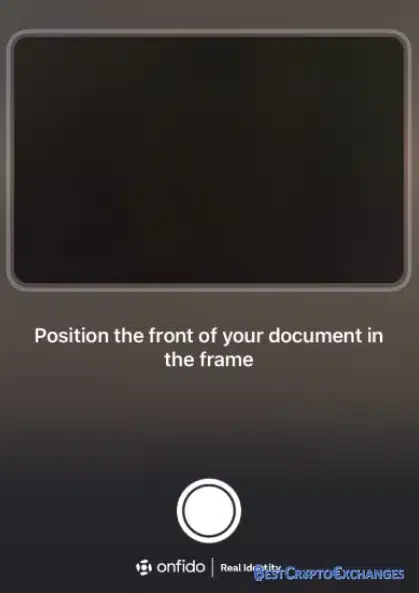

- Step 3 – Front Image

Position the front side of the document in the on-screen frame; check that edges are visible, hologram shines, and no fingers obscure text, then press the shutter icon to upload the high-resolution image.

- Step 4 – Back Image

Flip the document, align the rear within the guide, verifying signature panels and barcodes remain sharp, and capture a second photograph; blurry submissions trigger a retake prompt immediately for users.

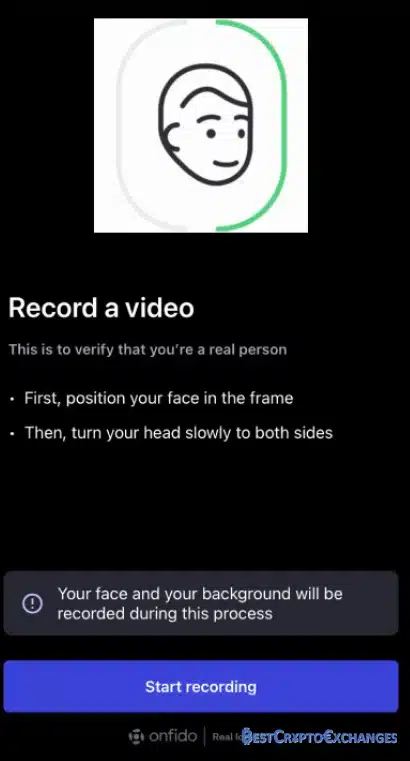

- Step 5 – Liveness Test

Grant camera permission for biometric liveness test; steady your phone at eye level while a circle instructs you to turn slowly right then left, confirming facial features match the ID just provided.

- Step 6 – Economic Profile

Complete a short financial profile: choose estimated monthly trading volume bracket, tick income source—salary, mining, investment returns—and declare whether you will use margin trading or futures contracts so Bybit can calibrate risk warnings.

- Step 7 – Address Proof

Upload one supporting address document such as a bank statement or utility bill issued within the last ninety days; ensure your name and street appear exactly as typed earlier to avoid manual rejection.

Once these elements pass automated checks the profile flips to Verified in under five minutes for most applicants. Completion lifts withdrawal cap to two hundred fifty thousand dollars equivalent and enables fiat rails. Remember to enable anti-phishing codes and set withdrawal whitelist to keep user funds insulated from social-engineering attacks.

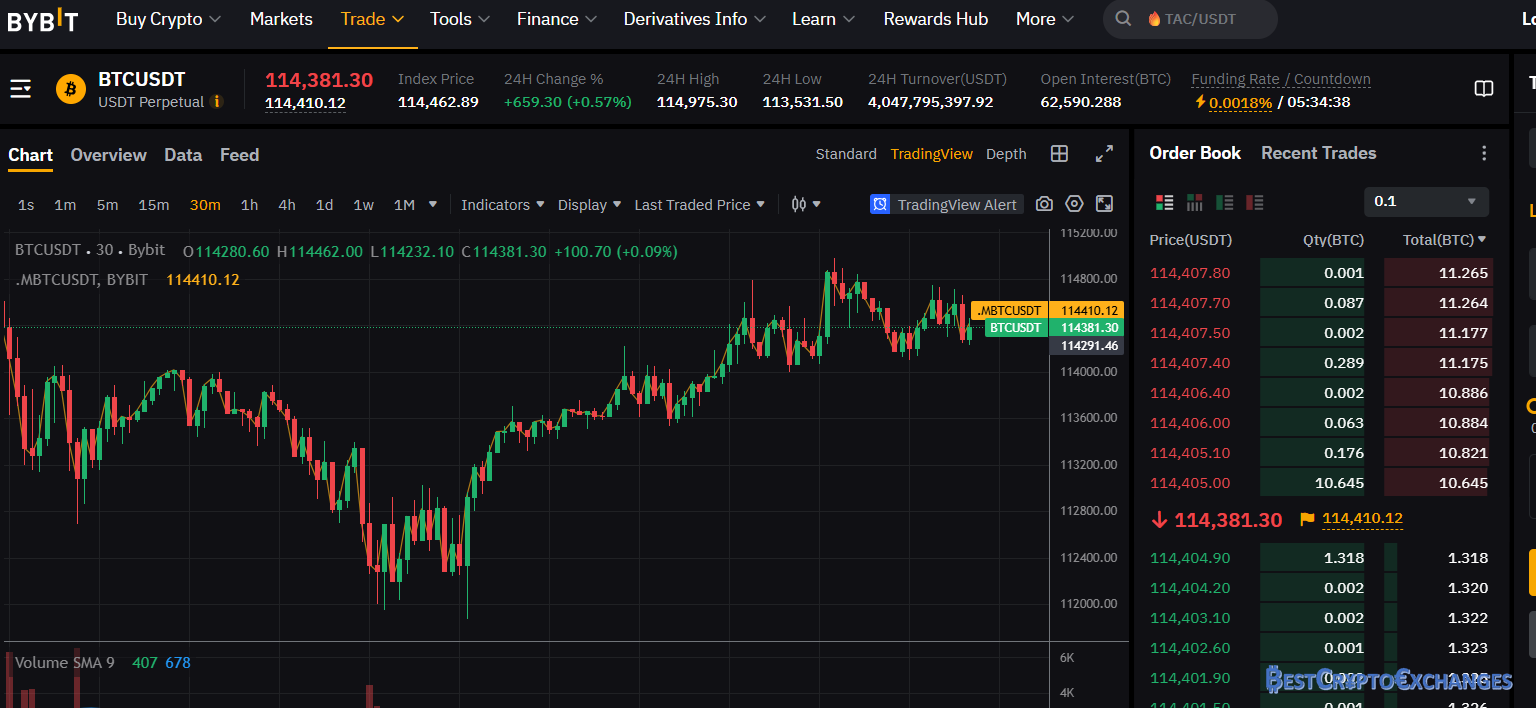

Executing a Perpetual Trade on Bybit

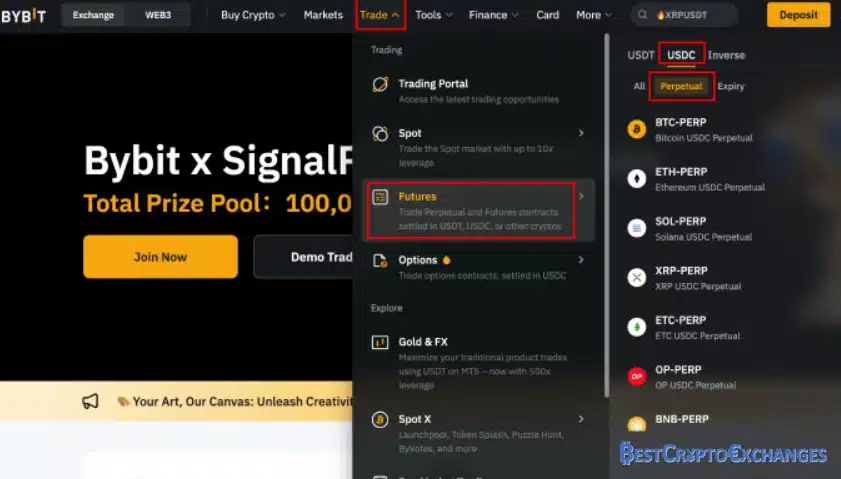

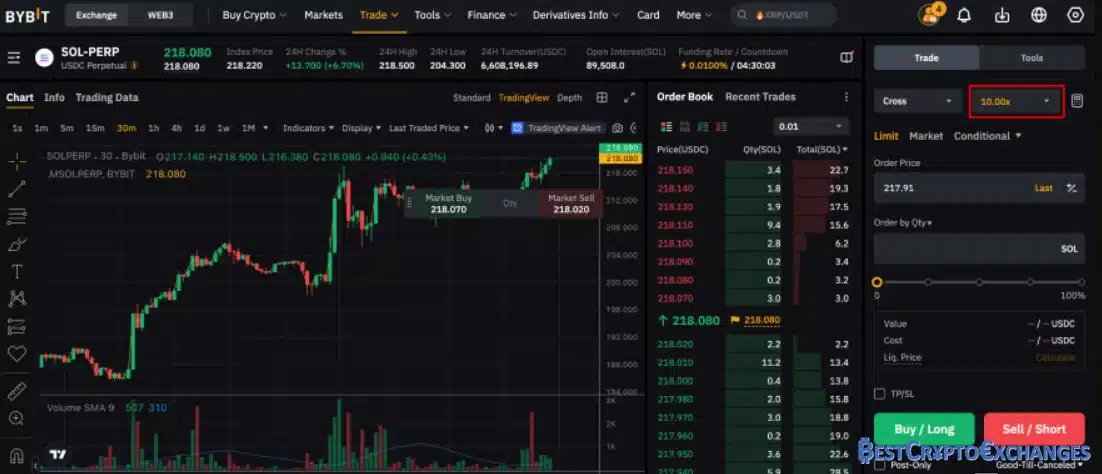

Bybit’s derivatives screen blends TradingView charts with order controls; the walkthrough below shows how to initiate an ETH-USDT perpetual contract using ten-times leverage while applying sensible risk parameters for exposure.

- Step 1 – Load Pair

Click the Trade tab atop the dashboard, select USDT Perpetual from the dropdown, scroll the pair list until ETHUSDT appears, and load it. The central panel displays real-time candlesticks, order-book depth, funding timer, and market sentiment gauges so you can judge liquidity before committing margin and potential slippage estimates.

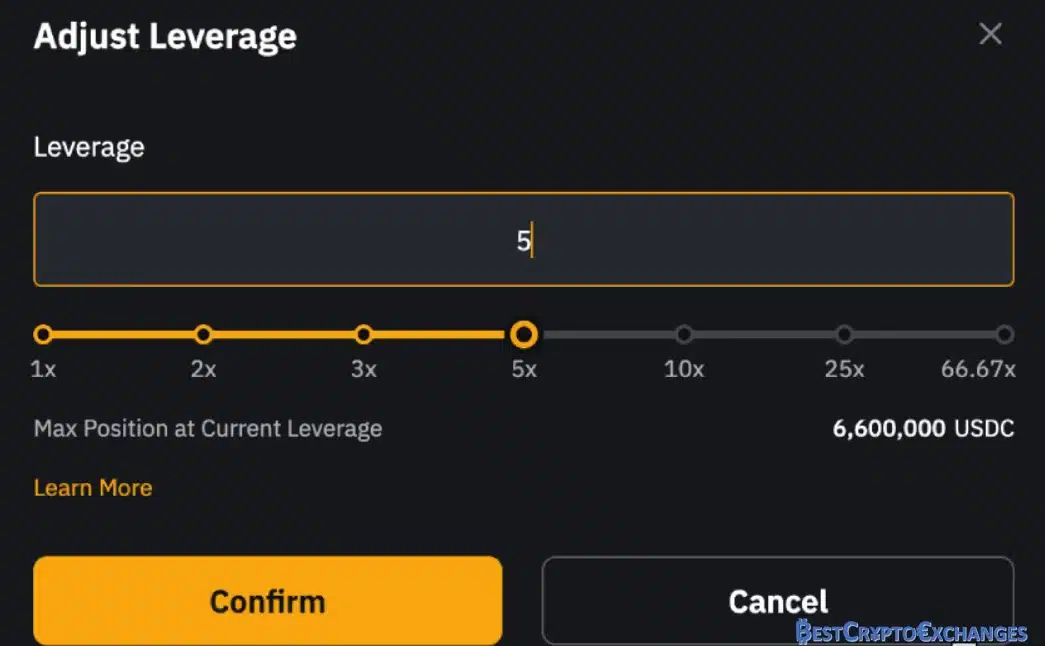

- Step 2 – Set Leverage

Locate the leverage slider on the right margin console, drag it to 10x, and watch the initial margin requirement update beneath. A yellow banner warns that liquidation price moves closer with higher leverage, reminding traders to manage risk rather than chase potential profits blindly during heightened price volatility periods.

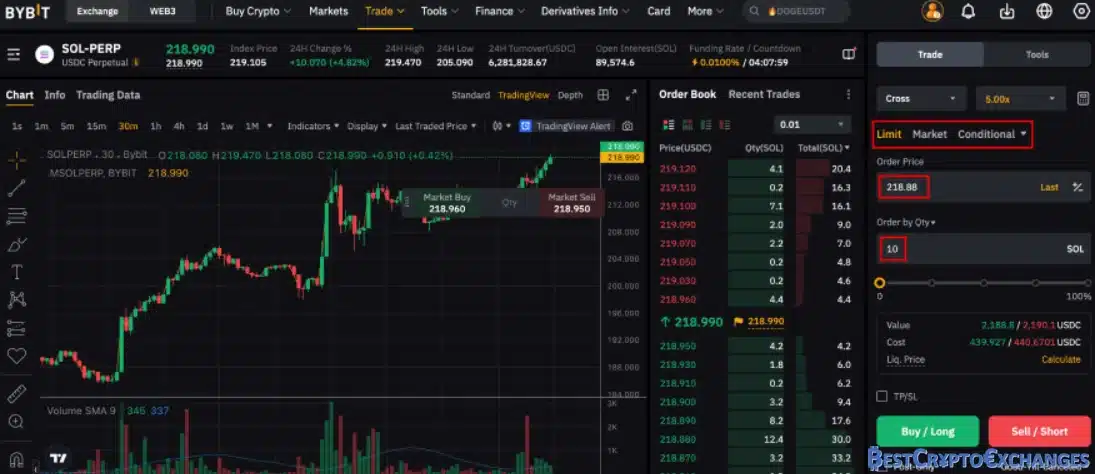

- Step 3 – Configure Limit Order

Switch the order type selector from Market to Limit for tighter entry control, enter a buy price two dollars below current market price, and specify contract quantity—say 0.5 ETH—balancing desired exposure with remaining asset balance shown under the quantity box before clicking the green Buy button to create submission preview window.

- Step 4 – Add TP/SL

Tick the TP/SL checkbox, setting stop loss at five percent under entry and take profit at ten percent above. These parameters transmit to servers immediately, allowing the smart trading system to execute exits even if you lose Internet connectivity during sudden price volatility or mobile app downtime events as backup.

- Step 5 – Confirm Order

Press Buy Long, read the confirmation pop-up displaying mark price, liquidation price, and fee estimate; verify figures align with your market analysis, then approve. A toast notification appears indicating order placement and you can monitor status in the Open Orders panel or cancel quickly if market moves unexpectedly against setup immediately.

- Step 6 – Monitor Position

Once filled, the position migrates to Positions tab where real-time PnL, funding impacts, and margin ratio update each second. You may place a hedge by opening a small short on the inverse perpetual to offset funding if negative rate bleeds your account during sideways price stagnation on low volume days. - Step 7 – Exit Safely

To exit, click Close, choose percentage of contracts, review the estimated maker or taker fee, and submit. The insurance fund automatically covers any residual gap if mark price slips beyond your final liquidation threshold during intense volatility, protecting user funds from unfair loss when market trends whipsaw sharply overnight sessions.

Takeaway: Monitor margin bar, funding timer, and market trends; disciplined exits protect user funds better than chasing sky-high leverage every time.

Scientific References

- Ruan Q and Streltsov A Perpetual Futures Contracts and Cryptocurrency Market Quality twenty twenty‑four

- Svogun D and Bazán‑Palomino W Technical Analysis in Cryptocurrency Markets twenty twenty‑five

Bybit Review: Final Verdict

Bybit positions itself as a versatile venue for both spot market enthusiasts and derivatives specialists. Tight maker and taker fees, an engine tested at one hundred thousand matches per second, and a visible insurance fund give active traders confidence when placing large tickets or running a futures grid bot overnight. Risk controls such as dual price protection, adjustable leverage, and take profit or stop loss at entry reduce the likelihood of abrupt liquidation, yet new arrivals still need patience while learning order types and margin math.

Copy trading, demo balances, and clear mobile charts help shorten that learning phase. For residents of the one hundred sixty plus supported jurisdictions, a single Bybit account unlocks perpetual contracts, USDC options, dollar cost averaging tools, liquidity mining, and interest bearing wallets. When combined with twenty four hour chat support, the overall package justifies Bybit’s growing share of global trading volume despite limited access in the United States and a few other regions.

FAQ

What is Bybit?

Bybit is a cryptocurrency exchange with emphasis on derivatives markets, including perpetual contracts and European style options, yet it also lists hundreds of spot pairs. The platform serves more than fifty million registered users, operates an ultra fast matching engine, and separates client funds in cold wallets with threshold signature protection.

What are the main Bybit features?

Highlights include up to one hundred times leverage on perpetual futures, USDC settled options, grid and futures bots, a copy trading leaderboard with transparent statistics, a dual price mechanism that shields against unfair liquidations, and a mobile application that mirrors every desktop function for convenient risk management while away from a computer.

How to pick the best crypto exchange for yourself?

Evaluate fee tiers, supported fiat onramps, available instruments such as margin or options, geographic availability, withdrawal speed, and real time support responsiveness. Confirm the exchange publishes proof of reserves and offers two factor authentication so you can match its safeguards and costs with your individual trading plan and appetite for risk.

Which cryptocurrency exchange is best for beginners?

Newcomers usually prefer services with simple buy buttons, card deposits, and plain language tutorials. Coinbase, Bitstamp, and similar platforms meet those needs. Bybit can still suit beginners if they start in demo mode, keep leverage off, and rely on copy trading while reading the extensive help articles before moving to complex products.

What is the difference between a crypto exchange and a brokerage?

An exchange operates an open order book where users post bids and offers, and the platform matches them at the current market price, showing depth and volume. A brokerage sells directly from its own inventory, quotes a fixed rate, and absorbs market movement risk, often charging a spread for that simplicity.

Are all the top cryptocurrency exchanges based in the United States?

No. Binance began in East Asia, Bybit is incorporated in the British Virgin Islands with offices in Dubai and Hong Kong, Bitstamp is headquartered in Luxembourg, and several rising venues work from Singapore and the Middle East. Kraken and Coinbase are American, yet many leaders thrive under other regulatory flags.