This bydfi review captures the current state of a crypto trading platform that began in Singapore in 2020 and is now licensed as a money services business in the United States and Canada. BYDFi draws over 1 million active global users and logs daily trading volume topping 1 billion USDT. The exchange lines up 600 plus spot trading pairs, 150 USDT perpetual contracts, five coin‑margined futures markets, and one of the largest leveraged token shelves around.

Experienced traders run margin trading up to 200×, while newcomers flip on demo trading to practice strategies risk free. Copy trading profiles display win rate and eight percent profit share so beginners can mirror advanced trading strategies. Trading fees remain low at 0.10 percent for spot and 0.02 percent for perpetual makers, keeping the platform competitive with established exchanges. Two factor authentication and cold‑wallet custody protect user assets, reinforcing regulatory compliance across volatile markets.

Pros

- Huge trading variety

- Regulation compliant worldwide

- Fair trading fees

- Beginner‑friendly tools

- Copy trading functionality

Cons

- No NFT marketplace

- No staking capability

BYDFi stands out for traders who crave a single sign in for spot trading, leveraged tokens and perpetual contracts yet want fees that stay slim. The array of 600 pairs and copy trading board give beginners a chance to learn from high performing accounts while experienced traders chase 200× gains on coin‑margined futures. Compliance in more than 150 jurisdictions plus two‑factor authentication and reserve cold storage adds confidence that user assets will not vanish during a market storm.

On the flip side collectors who mint or flip JPEGs have to move funds elsewhere because BYDFi still lacks an NFT corner, and passive yield seekers cannot lock coins inside the platform. If the team adds staking pools and an NFT market while keeping fees flat, the exchange could challenge older rivals. For now active traders focused on derivatives, spot liquidity and social trading will find BYDFi a strong driver.

BYDFi at a Glance

Born in Singapore in 2020 under the BitYard brand, the BYDFi exchange positions itself as a crypto trading platform for both beginners and experienced traders. Rebranded to BUIDL Your Dream Finance in 2023, the company now counts more than one million global users and serves over 150 jurisdictions with a money services business status in the United States and Canada. Traders can begin trading through a user friendly interface that merges basic trading with advanced trading features. The platform supports 600 spot trading pairs, 150 USDT perpetual contracts, coin‑margined futures trading, leveraged token trading, and lite contracts that appeal to margin trading fans looking for leverage options up to two hundred times.

BYDFi offers copy trading, grid trading bots, and a dedicated demo trading zone that lets users practice trading before risking digital assets. Low trading fees remain fixed at zero point one percent for spot trading fees and zero point zero two percent for perpetual makers, keeping costs below many established exchanges. Two factor authentication and cold storage protect user assets, while reserve reports show a ratio above one hundred percent. With fiat ramps and competitive fees across derivatives markets, BYDFi combines multiple services into one trading experience.

Key Advantages of BYDFi

The benefits listed here highlight why BYDFi keeps climbing the charts among crypto exchanges for global users in 2025, especially traders from the United States. Each point blends hard numbers, real usage data, and safety metrics so both first timers and seasoned traders can judge the platform fast and easily.

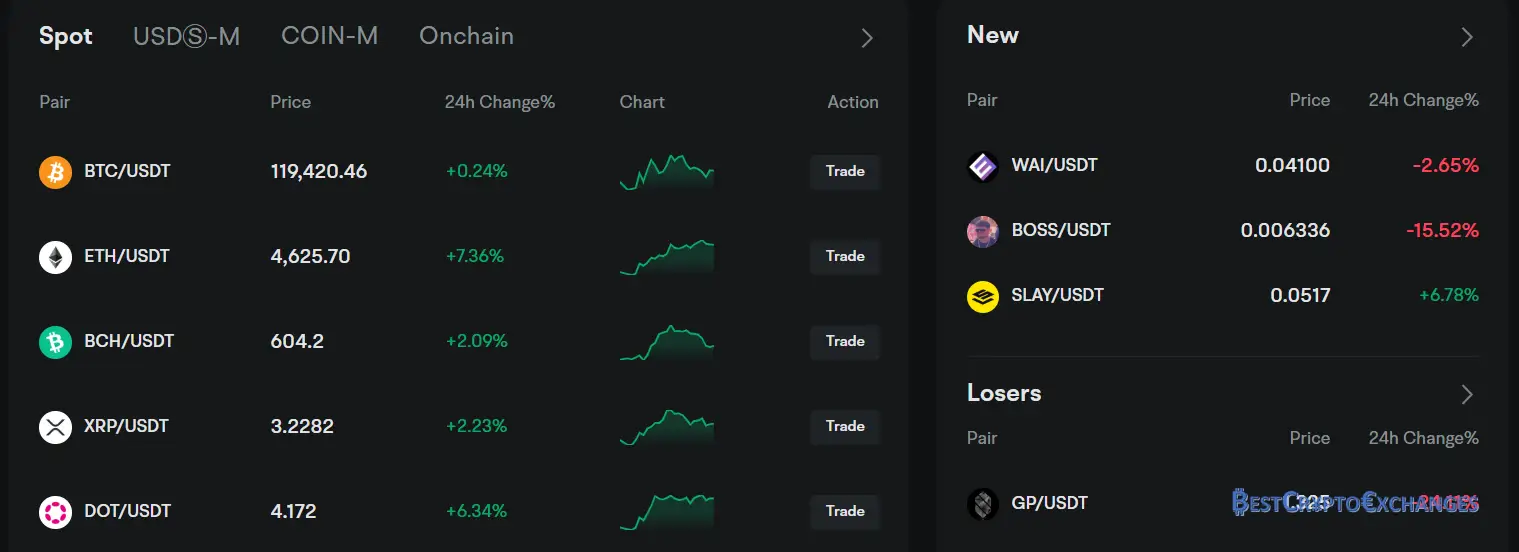

Vast Market Selection

BYDFi exchange has grown into a powerhouse marketplace that covers nearly every corner of cryptocurrency trading. Global users can begin trading more than six hundred spot trading pairs in seconds, flipping between basic trading and advanced trading features inside an intuitive interface that suits both first timers and seasoned traders. High liquidity across BTC USDT and ETH USDT often shows less than 0.02 percent spread during peak trading volume, proving the order books run deep compared with many other exchanges.

Contract trading brings the platform’s biggest crowd. Experienced traders can open over one hundred fifty USDT perpetual futures or five coin margined perpetual contracts with leverage options up to two hundred times on select underlying assets. Every contract follows an eight hour funding rhythm, allowing serious traders to balance long and short exposure without wild premium swings in volatile markets.

Lite contracts give margin trading fans a friendlier entry point. A built in calculator previews liquidation and expected profit before any confirmation, which simplifies trading decisions during hectic sessions. For practice trading the exchange provides ten thousand mock USDT so users can test advanced trading strategies risk free, a feature advertised as BYDFi offer demo trading on the signup page.

Leveraged token trading adds a three times long and three times short instrument for dozens of digital assets, giving leveraged trading without margin calls or complex maintenance rules. Trading options widen further with a grid trading bot that runs twenty four seven, placing staggered buy sell orders to harvest micro swings.

Copy trading turns seasoned traders into open books. Profiles list win rate, thirty day return, and a profit share of eight percent, letting beginners mirror contract trading signals without guessing entry or exit.

All these trading services sit under the same money services business umbrella that covers regulatory compliance in the United States and Canada. Low trading fees stay locked at zero point one percent on spot and zero point zero two percent on perpetual maker orders, keeping BYDFi competitive while it pursues its slogan BUIDL Your Dream Finance.

Social Sync Trading

Copy trading on this crypto trading platform turns market moves into a group activity where global users can shadow real portfolios in real time. The BYDFi board currently lists more than eight hundred signal providers, each ranked by thirty day return on investment, win rate, drawdown, and trading volume. A clear filter lets beginners sort traders by asset, contract trading type, or leverage options, while experienced traders view deeper analytics such as average holding period and maximum consecutive losses. Every profile shows live PNL charts plus a brief trading philosophy, giving followers insight before they commit funds.

The sign‑up flow is simple: pick a trader, set the amount to mirror, and choose a stop loss or daily cap. Positions scale automatically, so a follower with fifty USDT copies percentage moves made by an account running five thousand USDT without slipping out of line. Profit share is fixed at eight percent, lower than most other exchanges, keeping net gains attractive. Followers retain the right to close any position manually, an extra layer of risk control during volatile markets.

Advanced trading strategies, from grid bots on perpetual futures to scalps on spot trading pairs, appear in the catalog alongside plain trend trades, making the system valuable for both practice trading and serious income hunting. Because all trades route through the same low trading fees schedule—zero point one percent on spot, zero point zero two percent on maker perpetuals—copy followers do not face hidden surcharge.

Security stays tight. Two factor authentication protects each order mirror, while cold‑wallet custody guards user accounts and follower funds. The user friendly platform updates statistics every ten minutes, so traders always view fresh data rather than stale snapshots. Thanks to Money Services Business licensing and strict KYC, the copy module is open to United States residents, a rare perk among centralized exchange trading services.

In short, BYDFi’s copy feature blends social insight with established derivatives markets, giving both beginners and experienced traders a fast path to diversified strategies without handing over account control.

Regulation Ready Security Stack

In the wake of multiple exchange failures, traders track licensing and fund custody with laser focus. BYDFi meets that scrutiny with transparent facts. The platform operates under a Money Services Business filing in the United States, number 31000215482431, and a second MSB license in Canada, record M22636235. These registrations demand strict KYC and AML checks on every user account, blocking bad actors at the door.

Each quarter the company posts a proof‑of‑reserve report signed by an independent auditor and linked to on‑chain addresses. The April 2025 filing showed a reserve ratio of 108 percent, confirming every client coin plus an eight‑percent buffer is held on hand for withdrawal rushes. Ninety‑five percent of holdings sit offline in cold wallets that rely on multi‑party computation keys split across three continents.

Account protection starts from day one. Two factor authentication is mandatory for log‑ins and withdrawals, while unfamiliar device access pings an instant email and in‑app alert. All traffic runs behind 256‑bit SSL with HSTS active. Trade data resides in a kdb plus time‑series engine known for sub‑millisecond matching, helping the order book stay steady even when daily trading volume breaks one billion USDT.

On the user side verification to unlock basic limits averages three minutes with auto document scanning, and upgrades reach completion inside one business day after manual review. Because BYDFi carries valid money services credentials, global users—including United States residents—can access spot trading, perpetual futures, leveraged tokens, and copy trading without a VPN. The blend of regulatory compliance, cold‑wallet custody, and live reserve reporting positions this centralized exchange as a safer harbor for crypto assets during volatile markets.

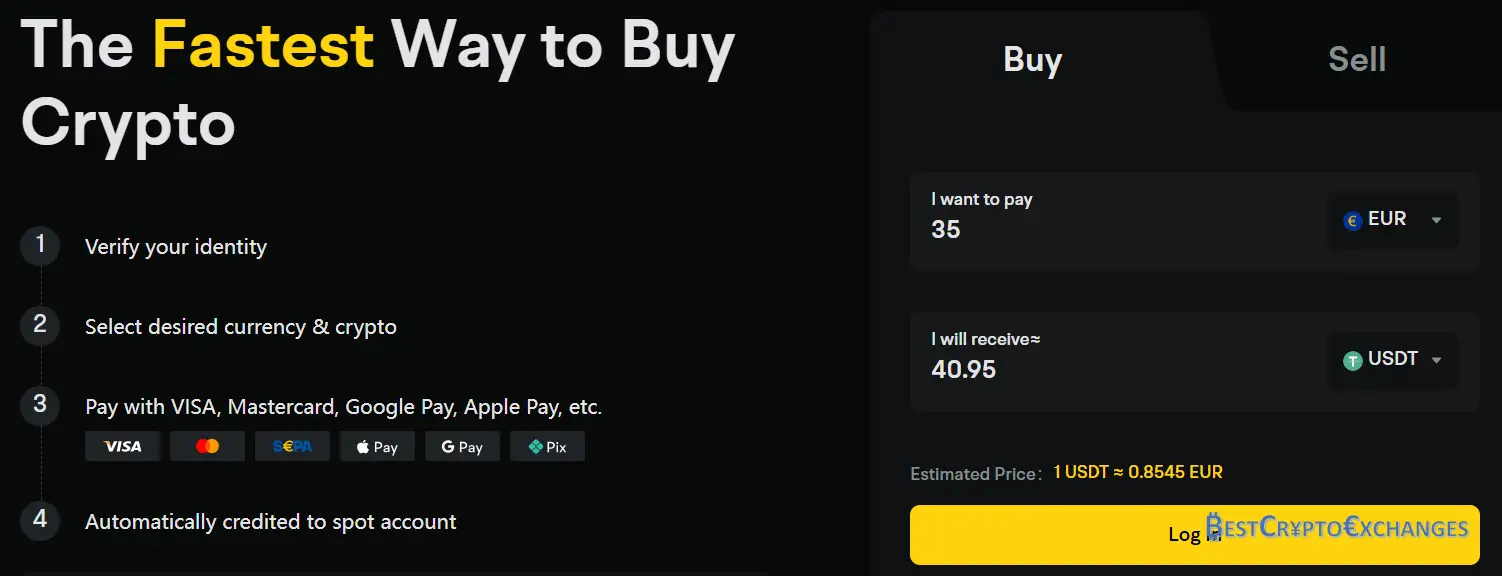

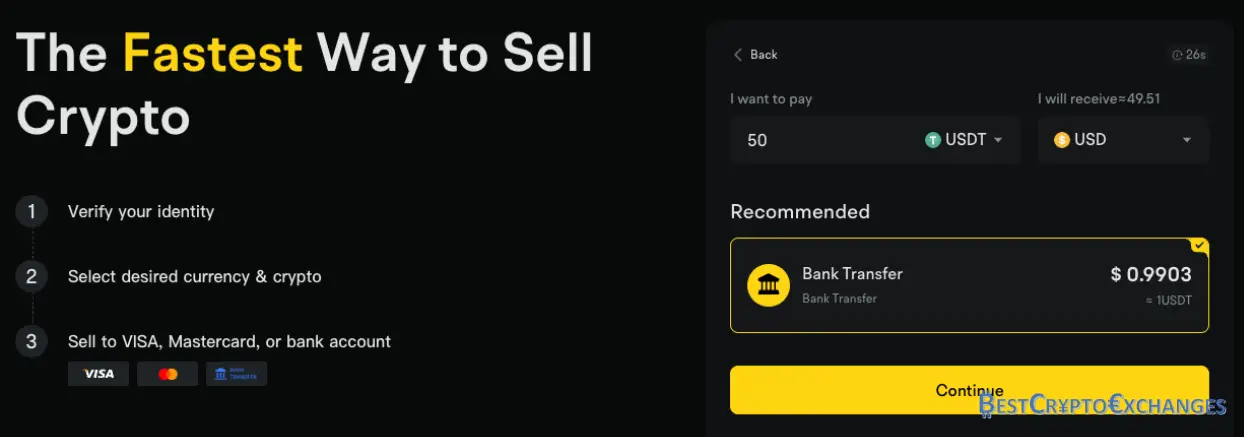

Smooth Fiat Gateways

One key draw for global users is BYDFi’s broad network of fiat on and off ramps that turns the platform into a true bridge between banking rails and digital assets. Buyers can top up balances in more than seventy currencies, including USD, EUR, GBP, AUD, CAD, JPY, and MXN, using trusted payment channels like Transak, Banxa, Mercuryo, Coinify, Apple Pay, and Google Pay. Card deposits clear in seconds with an average fee of 0.99 percent for Visa and Mastercard, while SEPA and Faster Payments settle in two to ten minutes at just 0.3 percent. Daily limits go as high as 15 000 USD per user account once identity checks are finished, giving both casual investors and serious traders plenty of room to move value.

Selling crypto back to fiat is equally direct. The off‑ramp supports AUD, EUR, GBP, and CAD with bank payouts landing the same day when requests hit before noon local time. A flat 0.1 percent withdrawal charge plus network gas applies, but no extra trading fees sneak in. Minimum cash out currently sits at 20 EUR or the equivalent, which suits newcomers converting modest gains.

All checkout pages sit inside the same intuitive interface as spot trading and contract trading dashboards, so users never jump to an outside window. Real‑time quotes show exchange rate, fee, and arrival estimate before confirmation, helping traders avoid hidden costs. Because BYDFi is registered as a money services business in the United States and Canada, these fiat services run under strict regulatory compliance, while two factor authentication protects every transfer.

The end result is a user friendly platform where crypto trading, margin trading, and fiat settlement live side by side, giving BYDFi a practical edge over crypto exchanges that still require third party wallets for basic cash flow.

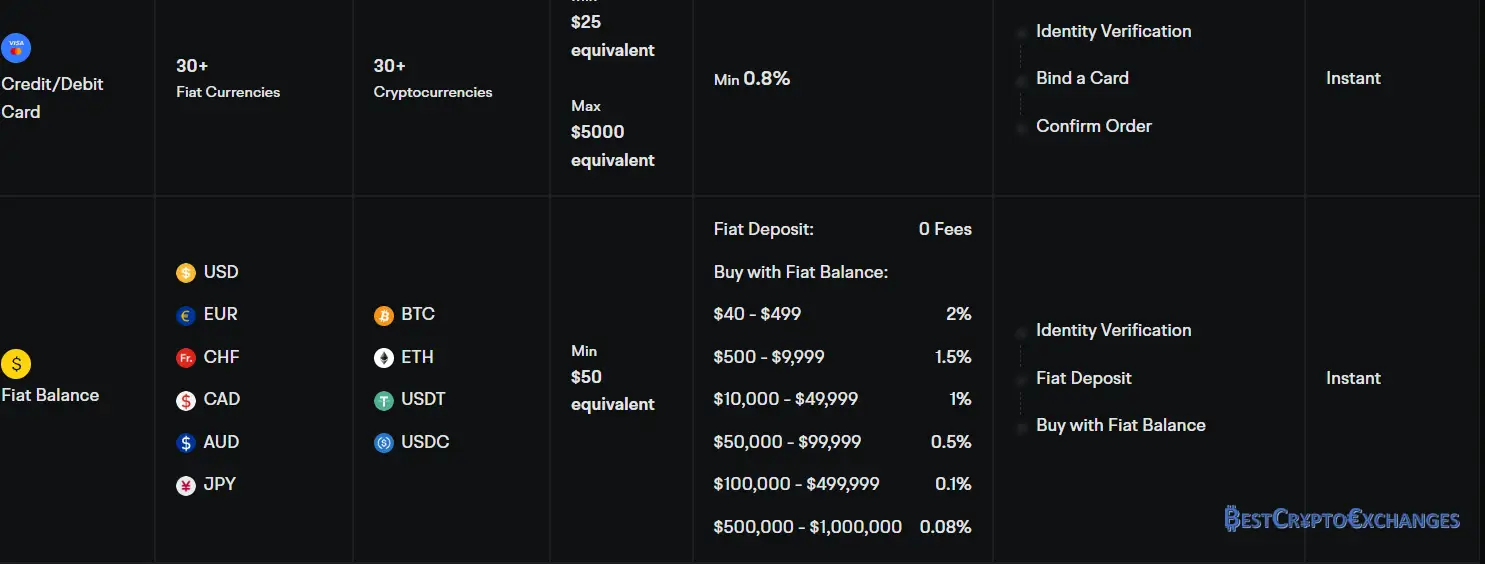

Transparent Cost Structure

BYDFi keeps its pricing plain, flat, and easy to predict, making low trading fees one of the platform’s core selling points. Spot trading fees sit at 0.10 percent on both the maker and taker side, while perpetual contracts reward liquidity providers with a 0.02 percent maker rate and charge 0.06 percent for takers. Leveraged token trading carries a 0.20 percent transaction fee that covers the daily re‑balancing cost built into these ETF‑style products. Futures grid bots follow the same 0.02 percent and 0.06 percent maker‑taker split, so algorithmic volume never triggers surprise costs.

| Market type | Maker fee | Taker fee | Extra notes |

|---|---|---|---|

| Spot trading | 0.10 % | 0.10 % | Flat rate across 600 pairs |

| USDT perpetual futures | 0.02 % | 0.06 % | Up to 200× leverage options |

| Coin‑M perpetuals | 0.02 % | 0.06 % | Five flagship underlying assets |

| Futures grid bot | 0.02 % | 0.06 % | Runs 24 h on adjustable parameters |

| Leveraged tokens | — | 0.20 % | Three‑times long or short exposure |

| Lite contracts | 0.10 % | 0.10 % | Includes built‑in risk calculator |

Deposits in crypto remain free of charge, and fiat top‑ups inherit the small processing fee quoted by each partner at checkout. Withdrawal charges follow network gas only, with minimum thresholds as low as 10 USDT for stablecoin exits. Verified user accounts unlock a 50 000 USDT daily withdrawal ceiling, while newcomers without KYC can still withdraw up to 5 000 USDT.

Because the schedule stays fixed regardless of trading volume, beginners get the same competitive fees that established exchanges reserve for VIP tiers, and advanced users can scale strategies without renegotiating rates. Funding payments on perpetual futures track the eight‑hour global average, so active hedgers know the true cost of holding positions ahead of time. Together, these spot trading fees and derivatives charges give BYDFi one of the clearest pricing menus in the crypto market.

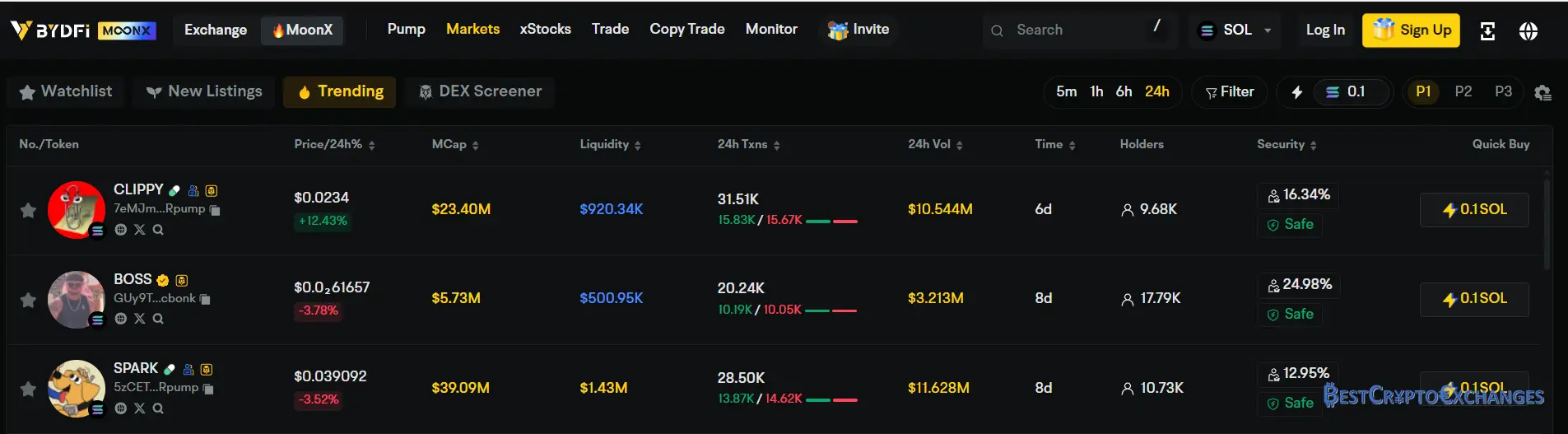

MoonX MemeCoin Terminal

MoonX sits inside the BYDFi interface and gives global users a lane to on‑chain MemeCoin trades without leaving the centralized exchange account. The terminal pulls liquidity from Solana, BSC, Polygon, plus three networks, scanning more than twelve thousand trading pairs in real time. A trending board refreshes every thirty seconds and flags pairs that pass five hundred thousand USD volume within the first hour of listing, letting early birds catch momentum while gas stays under one dollar thanks to batched routing.

Smart money tracking shows wallet labels and entry prices, and one click mirrors the position through copy trading logic that scales to each user balance. Advanced trading features such as limit orders, take profit, and trailing stop work like on the core platform, so digital assets stay under the same two factor authentication and cold wallet policy that protects spot, futures, and leveraged trading funds.

BYDFi Limitations to Consider

Even an exchange that pushes out one billion USDT in daily trading volume carries a few gaps. BYDFi skips NFT tools, holds back on staking yields, and offers narrower fiat sell corridors than its buy channels. Reviewing these limits lets crypto investors set clear expectations before sending funds into BYDFi.

Missing NFT Marketplace

BYDFi exchange gives global users deep spot trading pairs, leveraged token trading, and perpetual contracts, yet the platform supports zero NFT activity. That gap matters because non‑fungible token volume topped twelve billion USD in 2024 and many advanced users like to rotate gains from crypto assets into collectibles during sideways markets. At the moment a BYDFi account holder who flips PFP collections has to move coins off the centralized exchange into a Web3 wallet and then on to OpenSea, Blur, or other exchanges with NFT order books.

Each transfer adds network fees, extra two factor authentication steps, and potential slippage. It also breaks the seamless trading experience that BYDFi markets under the BUIDL Your Dream Finance slogan. While the MoonX terminal proves the team can link on‑chain liquidity to a user friendly interface, no timeline for an NFT hub appears in road map notes or customer support articles. Until that changes, serious traders who want one dashboard for every digital asset must juggle multiple platforms.

No Built In Staking Options

Proof‑of‑stake networks like Solana, Cardano, and Polygon distributed more than 1.6 billion USD in staking rewards during 2024, yet BYDFi account holders cannot tap that passive yield inside the exchange. The wallet section supports storage for hundreds of crypto assets but offers no single click route to delegate tokens or join pooled validators. As a result users who want steady returns on idle digital assets must withdraw to an external wallet or move funds to other exchanges that support on‑platform staking at rates that often range from four to fifteen percent annual percentage yield. Each withdrawal costs network gas and resets two factor authentication limits, which may discourage frequent rotation between trading services and staking strategies.

Industry analysts often cite the ongoing regulatory spotlight in the United States as a roadblock. Since the SEC lawsuits against Kraken and Coinbase over staking programs in early 2023, many centralized exchanges with money services business status have paused plans for integrated pools until clear federal guidance lands. Whatever the reason the absence leaves a noticeable hole for advanced users who prefer a user friendly platform where spot trading, perpetual futures, and passive yield can coexist under one roof.

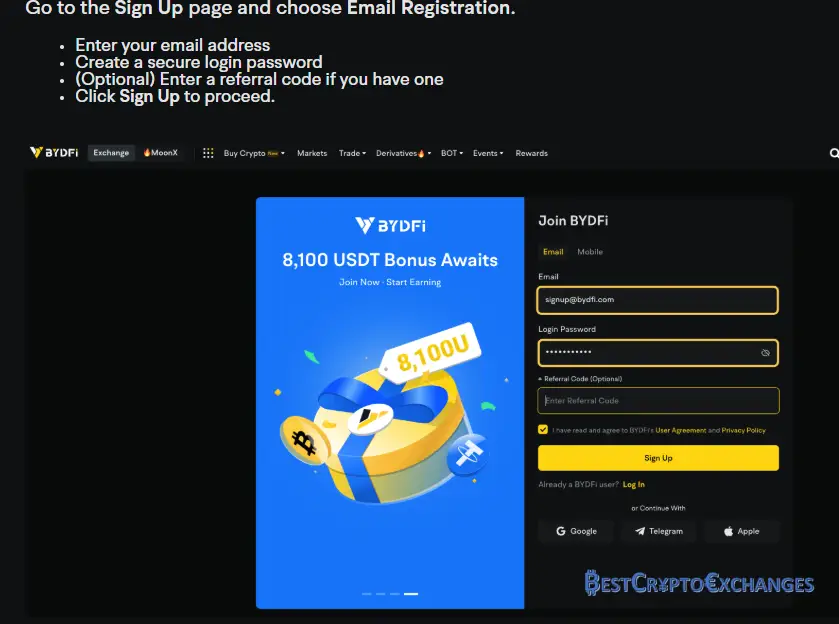

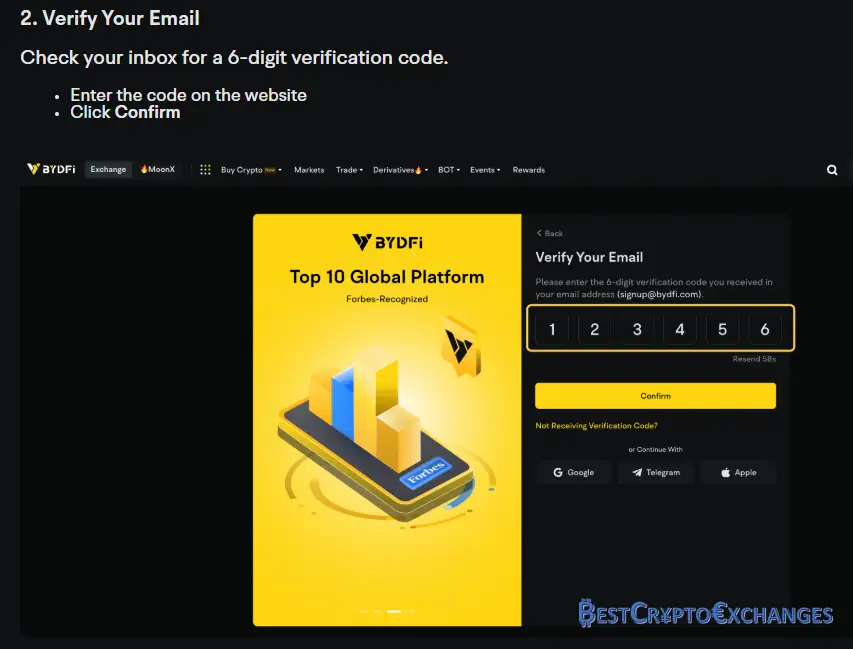

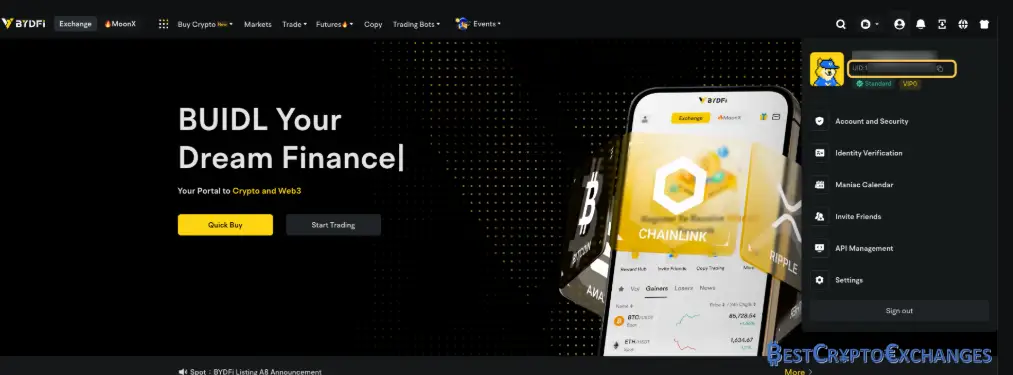

Creating a BYDFi Account in Minutes

Starting on BYDFi is quick, mobile friendly, and costs nothing. The exchange reports that more than eighty percent of new user accounts clear basic verification in under three minutes and finish full KYC within one business day. A new client receives a 288 USDT welcome coupon bundle and instant access to demo trading funds so practice can begin before any deposit.

- Step 1

Navigate to the official BYDFi website using a trusted browser on desktop or mobile. Check the URL begins with https to avoid phishing. Once the landing page loads, scan the upper‑right corner for the Get Started button. Click it to launch the streamlined account‑creation panel where you will input details. - Step 2

Enter a valid email address you monitor daily, because BYDFi will send security alerts and withdrawal confirmations there. Create a password at least eight characters long, mixing symbols, numbers, and both letter cases for stronger defense. Complete the sliding‑block puzzle captcha to prove you are a human, not automated software. - Step 3

Click the Send Code button beside the email field. BYDFi immediately dispatches a six‑digit one‑time password that remains valid for sixty seconds. Open your inbox, possibly the spam folder, locate the message titled BYDFi Verification, copy the code, return to the registration tab, and paste it into the verification box. - Step 4

Once the success banner appears, your profile is live. The dashboard automatically credits a 100 000 demo USDT balance so you can test spot trading, derivatives trading, and grid bots without risk. Check the promotions center, claim welcome coupons worth up to 288 USDT, then configure two‑factor authentication before depositing real funds.

Anyone aiming to lift withdrawal limits above 5 000 USDT should finish identity checks straight away. KYC needs a passport or driver’s license plus a selfie, and AML screening usually clears inside five minutes during business hours.

BYDFi Review – Final Take

This bydfi review confirms that the BYDFi exchange has grown into a robust crypto trading platform that delivers real utility for both first timers and seasoned traders. Global users can begin trading across six hundred spot trading pairs, one hundred fifty perpetual futures, and a fleet of leveraged tokens while paying low trading fees that stay flat at zero point one percent for spot trading fees and zero point zero two percent for maker perpetuals. Money services business licensing in the United States and Canada, plus quarterly proof‑of‑reserve reports, underline strong regulatory compliance and keep user assets safeguarded in cold storage with two factor authentication on every withdrawal.

Experienced traders gain advanced trading features such as up to two hundred times leverage options, margin trading, contract trading, and grid trading bots. Beginners can hit BYDFi offer demo trading to practice trading strategies risk free or copy trading to mirror seasoned traders. This mix of basic trading and advanced tools inside a single intuitive interface gives the platform a seamless trading experience that many other exchanges still chase.

Key takeaways BYDFi still lacks staking and NFT tools, yet its competitive fees, fast customer support, and expanding derivatives trading catalog make it a serious contender among centralized exchanges for anyone seeking a user friendly platform to handle volatile markets and diverse digital assets.

Academic Sources

- J. Hossinzadeh, “Mechanics of Perpetual Futures Contracts in Digital‑Asset Markets” — an in‑depth study of pricing, funding rates, and the role perpetual swaps play in managing leverage and liquidity across major crypto exchanges.

- D. Griglani & S. W. Thakre, “Reclaiming Fungibility: How NFTs Convert Back into Tradable Tokens” — research that outlines the process and market effects when non‑fungible tokens are fractionalized or reverted to standard crypto assets for broader trading use.

BYDFi Review – FAQ

Is BYDFi legit?

Yes. The platform operates under Money Services Business registrations in the United States and Canada, files quarterly proof‑of‑reserve statements, and applies KYC plus AML checks on every user. Two‑factor authentication guards withdrawals, and over ninety‑five percent of assets sit in cold wallets with public addresses, strengthening client protection.

Does BYDFi have a wallet?

BYDFi provides a custodial exchange wallet linked to each account where users may store Bitcoin, stablecoins, altcoins, and leveraged tokens for trading or short‑term holding. Funds are protected by multi‑level security, cold‑storage separation, and monitoring. However the company has not released a standalone non‑custodial wallet application.

How to pick the best crypto exchange for yourself?

Start by checking whether the exchange holds recognized registrations or licenses in your region, then read security audits and proof‑of‑reserve snapshots. Compare spot fees, derivatives fees, and fiat ramp costs. Evaluate trading pairs, liquidity depth, order‑execution speed, and customer‑support response times. Finally test with small deposits.

Which cryptocurrency exchange is best for beginners?

New traders usually prefer an interface that feels uncluttered, offers demo‑trading balances, and shows clear fee labels. BYDFi fulfills those points, yet platforms like Coinbase, Kraken, or KuCoin are praised for simple purchase flows and helpful help centers. Watch tutorial videos, open trial accounts, and select the easiest dashboard.

What is the difference between a crypto exchange and a brokerage?

A crypto exchange operates an open order book where independent buyers and sellers post prices, creating visible depth and live market discovery. A brokerage quotes its own buy and sell rates sourced from inventory or external liquidity providers, giving instant fills but hiding spread. Each model suits different trading styles.

Are all the top cryptocurrency exchanges based in the United States?

Definitely not. Binance maintains corporate registration in the Cayman Islands with major hubs in Dubai and Paris, OKX is headquartered in Seychelles while servicing Asia, and Bitstamp has roots in Luxembourg. Regional licensing allows these brands to serve traders globally while operating under varied legal frameworks beyond the United States.