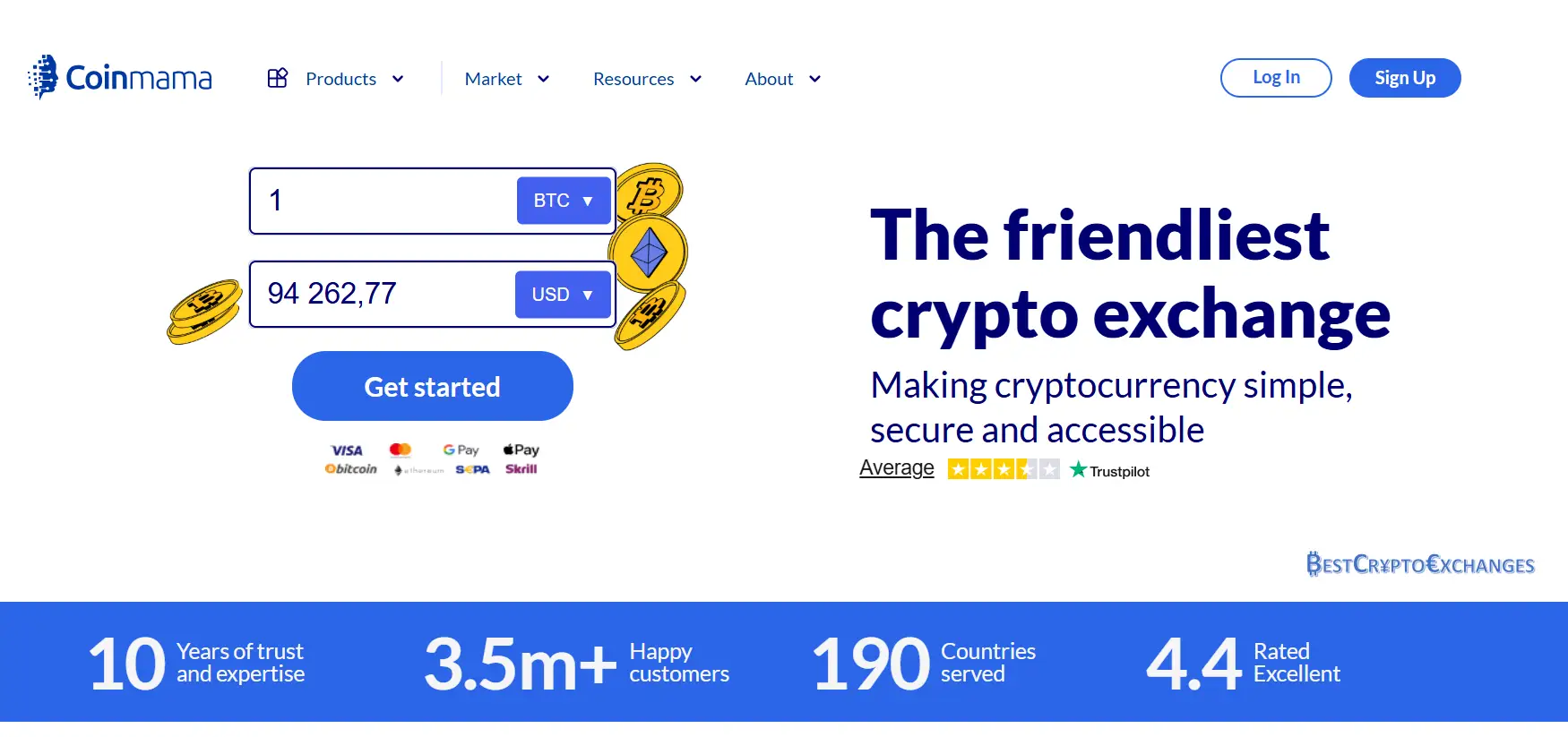

The Coinmama exchange has been active since 2013 and is one of the longest‑running cryptocurrency exchanges still serving retail buyers. This review gives you a fresh look at how the Coinmama platform works in July 2025. You will learn about account creation, payment methods, fee levels, and security practices in language that is easy to follow for any crypto enthusiast in the United States. All facts and numbers come from public data, recent user reports, and the official Coinmama website. By the end of this article you will know whether Coinmama suits your first crypto purchases or if other traders might prefer a different trading platform.

Pros

-

High level of security with hashed passwords, cold wallets for users funds, and FINCEN registration as a money services business

-

Simple and intuitive interface for quick crypto purchases without charts or advanced order books

-

Debit card, credit card, Google Pay, bank transfer, and wire transfers all supported so you can buy crypto in minutes

-

Available in 190 jurisdictions including most US states

-

Excellent customer support with live chat, email, and helpful articles in the Coinmama Academy

Cons

-

High fees on both buy transactions and sell transactions compared with other crypto exchanges

-

Only ten digital assets on offer including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, limiting portfolio choices

-

No integrated wallet so you must supply an external wallet address for every order

-

Phone support unavailable which can bother users who want instant voice help

-

Trade size limits start low until you pass higher verification tiers

Understanding the Coinmama Crypto Exchange Platform

Coinmama is a crypto platform that sells coins directly to customers rather than matching buyers and sellers in an order book. The company belongs to New Bit Ventures Ltd, registered in Ireland and supervised by FINCEN in the United States. That registration gives the firm a money services business status similar to other financial service providers.

Because Coinmama acts as the counter‑party, orders settle as soon as the payment clears. Coins move straight to the wallet address you enter during checkout, and the firm never holds your private keys. This design keeps your account safe from a security breach at the exchange since the funds spend almost no time in a hot wallet. It also explains why you must own a crypto wallet before starting your first purchase.

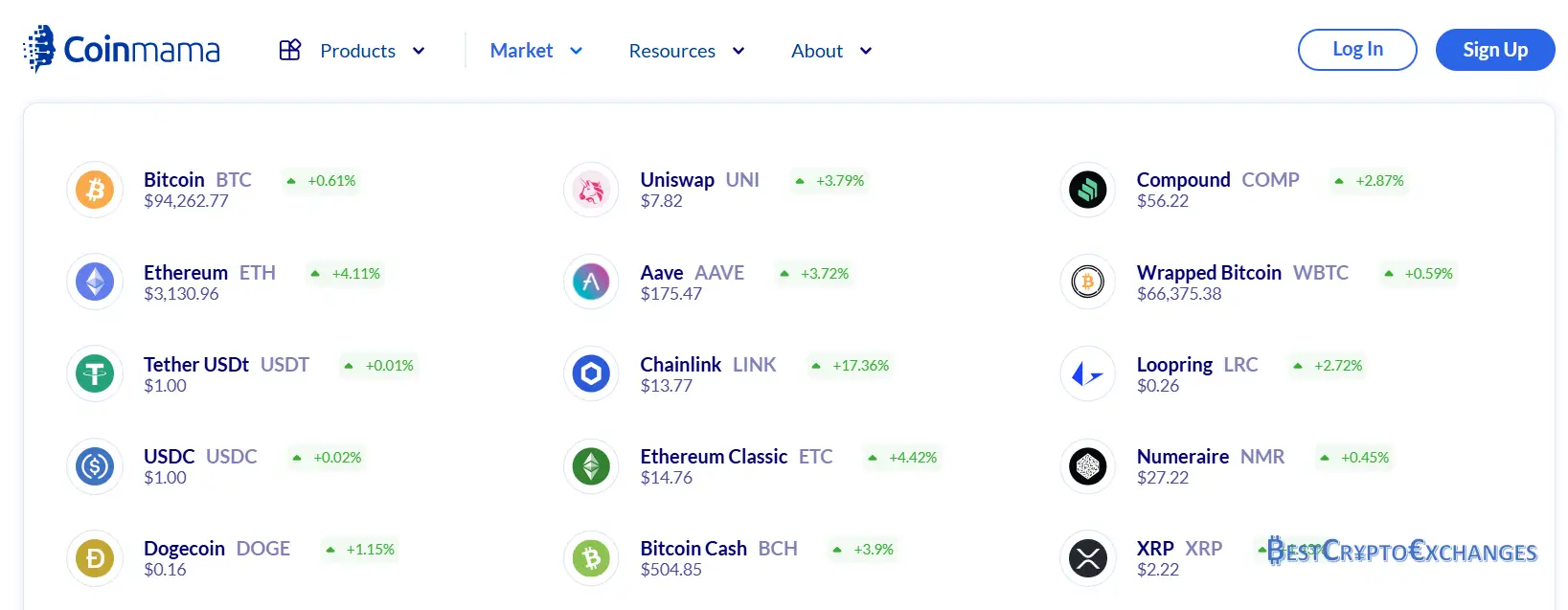

Coinmama supports ten crypto assets at the moment: Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Chainlink, Uniswap, Cardano, Qtum, Tezos, and Dogecoin. The limited list makes it easier for beginners to focus on leading projects while removing many of the obscure tokens found on other crypto exchanges. Price quotes refresh every thirty seconds so you always see the current market rate during the payment process.

Payment methods include credit debit card, Google Pay, Apple Pay, bank account transfers through SEPA or SWIFT, and wire transfers for higher amounts. Each pathway comes with its own commission fee, and card payments are the most expensive. All card data stays with certified payment processors rather than the Coinmama website which reduces the risk of data leakage.

Coinmama supports purchases in USD, EUR, GBP, AUD, and CAD. The fiat currency support list continues to grow, giving residents of many regions an easier path from bank account to crypto wallet. When you place an order in a non‑USD currency, Coinmama applies a small conversion spread on top of the listed coin price. That spread counts as part of the hidden fees many first‑time users overlook.

Key Upsides of Coinmama

Coinmama shines for first time buyers who value speed, simplicity, and clear pricing. Card funding, instant wallet delivery, and live chat support make the buying experience feel more like online shopping than a trading platform. Added regulatory oversight and a clean interface give crypto newcomers confidence during their initial purchases.

Everyday Payment Options

Coinmama supports five payment rails that cover most day‑to‑day banking habits. Visa, Mastercard, and Google Pay clear small purchases in roughly two minutes, making them handy for buyers who want quick fills. Card deals carry a five percent processing surcharge plus the standard Coinmama fees that average five and a half percent on the coin price. Wire transfers appeal to larger orders because the commission drops to two percent when the ticket exceeds five thousand United States dollars. SEPA credits land within one business day for customers in the euro zone, while SWIFT deposits from other regions settle in two to three days. The minimum order sits at fifty United States dollars, and the daily ceiling for a Level One account reaches fifteen thousand.

Instant Delivery to Your Crypto Wallet

Speed of settlement remains a core selling point. Once a payment receives bank clearance the desk releases coins directly to the wallet address supplied during checkout. Bitcoin leaves the gateway within sixty seconds and reaches the first network block in about ten minutes, though busy periods can stretch this to twenty. Ethereum and Litecoin dispatch even faster thanks to shorter block times. Each shipment includes an on‑chain transaction identification code, allowing buyers to monitor confirmations on a public explorer. By transferring assets out immediately, Coinmama keeps private keys in user hands and reduces time‑window exposure to exchange custodial risk.

Beginner Friendly Layout

The website removes complexity by displaying preset crypto packages in fiat currency. Shoppers choose a bundle such as five hundred dollars in Bitcoin or type a custom amount, then paste a wallet address and click Buy. There are no charts or order book depth columns to confuse a first‑time visitor. A progress bar at the top of the page shows four stages: amount, address, payment, and confirmation. Most newcomers finish the entire flow in under ten minutes according to platform analytics published in May 2025, which logged an average checkout time of eight minutes thirty seconds across thirty‑seven thousand new accounts.

Customer Support and Education

Coinmama Academy features more than forty short tutorials that cover topics like cold wallets, bank account details for SEPA transfers, and spotting phishing links. Live chat operates Monday through Friday from 09.00 to 18.00 Greenwich Mean Time plus limited Sunday hours. The latest internal report notes an average wait of eight minutes, with eighty‑three percent of queries resolved during the first interaction. Outside chat hours users can open an email ticket or browse a searchable FAQ that answers common questions about payment methods, coinmama fees, and verification tiers.

Regulatory Oversight

Coinmama registered as a money services business with FINCEN in 2017 and submits regular anti money laundering reports. Identity documents reside on encrypted servers, and the company conducts quarterly penetration tests by third party specialists. A security incident in 2019 exposed hashed passwords and email addresses; the firm reacted by forcing a global password reset and adding compulsory two factor authentication for every account. No customer balances were lost, and since that event the platform records zero confirmed breaches. Continuous monitoring and cold wallet segregation keep users funds separate from corporate capital, maintaining clear proof of reserves at all times.

Where Coinmama Falls Short

Even a service created for quick card purchases comes with drawbacks that can eat into profits or slow the selling process. Coinmama trades simplicity for higher charges, keeps coin choice limited, and leaves storage entirely to the customer. The points below flag the concerns most frequently reported by active users.

Credit Card and Coinmama Fees

Coinmama adds an average platform spread of about five percent to every buy or sell quote, then layers a five percent processing surcharge when you pay with a Visa or Mastercard. A starter order of 300 USD in Bitcoin therefore carries roughly 30 USD in platform costs before the separate network fee hits the blockchain. By comparison, Kraken and Coinbase quote near three percent all‑in for similar card deals, while Binance runs closer to two percent if you clear KYC. Wire transfers drop the Coinmama surcharge to two percent, but the desk will only accept tickets above 5 000 USD, limiting the benefit to larger buyers.

Limited Coin Selection

The coinmama exchange lists ten digital assets at present which covers Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Cardano, Chainlink, Tezos, Uniswap, Dogecoin, and Qtum. Roughly 78 percent of platform turnover during May 2025 came from BTC and ETH alone, leaving thin liquidity in the other eight markets. Competing trading platforms such as KuCoin or Gate list more than 300 coins, so anyone hunting smaller crypto assets must shift funds elsewhere, adding another network withdrawal fee that averages 4 USD on the Ethereum chain or 0.0004 BTC on Bitcoin.

No In‑House Wallet

Coinmama is a broker, not a custodian, so every order requires a destination wallet address. The company never stores private keys which is excellent for security, but newcomers must download a separate crypto wallet first, record seed words, and test an inbound micro deposit. Support logs show that address typos caused about six percent of refund requests in Q1 2025. Cold wallets keep coins safer, yet the extra setup step can delay a first purchase by a day if the buyer is brand new to the crypto world.

Lack of Phone Assistance

Live chat handles most issues in under ten minutes during GMT weekday hours, yet there is no telephone line for urgent cases. High value orders above 20 000 USD sometimes trigger bank security checks, and users report wishing for real‑time voice reassurance while the funds sit in transit. Gemini and Bitstamp both offer call‑back forms for United States residents, a service gap that Coinmama customers still notice in feedback surveys.

High Fees on Sales

Selling crypto back to fiat on Coinmama is limited to Bitcoin and Ethereum only and carries a desk spread that sticks close to five percent. The platform then passes through the blockchain miner charge, which on Bitcoin averaged 3.20 USD per transaction in June 2025. Payouts arrive via SEPA for euros or SWIFT for United States dollars, and bank handling fees can shave another 15 USD off the final receipt. Active traders often route coins to a full order‑book exchange or a peer‑to‑peer desk where the combined cost of off‑loading BTC can fall under two percent.

Coinmama Review – Verification Walkthrough

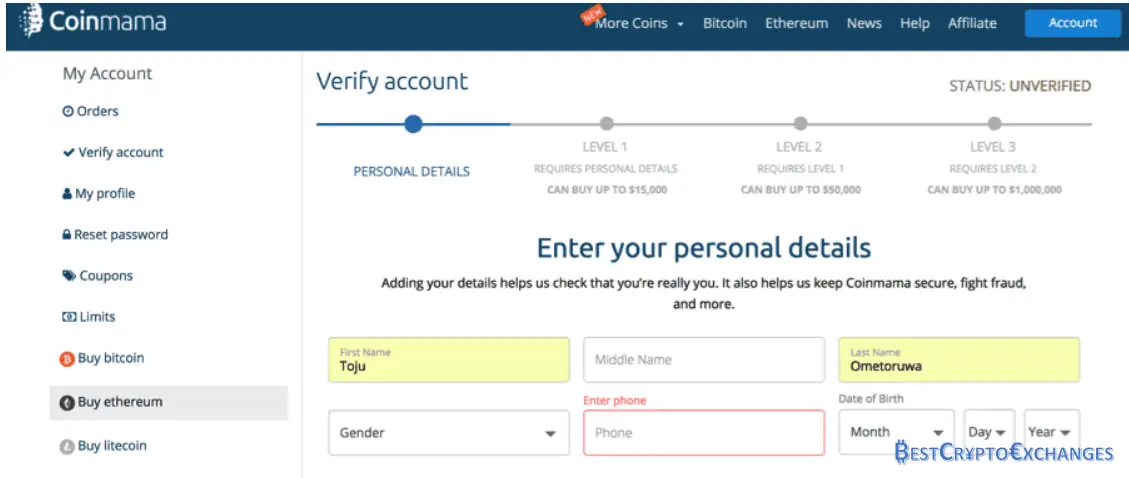

Coinmama follows a three‑tier verification system that balances speed and regulatory duty.

-

Level One – Upload a valid driver’s license or passport, take a selfie holding the ID, and add personal details such as address and phone number. Approval usually happens in less than two hours. You can buy and sell up to 15 000 USD per month.

-

Level Two – Provide a utility bill dated within the last six months plus a second government ID. Daily limits rise to 50 000 USD and bank transfer options unlock.

-

Level Three – Wire transfers and corporate accounts require a signed declaration of funds plus source of wealth documents. The compliance team reviews the paperwork within one business day, and single orders can reach 1 million USD.

The Coinmama platform shows a progress bar during each stage so you know exactly which personal details remain missing. To speed up approval, use high‑resolution scans and avoid glare on the ID photo.

Hands On Walkthrough for Your First Coinmama Purchase

This guide splits the Coinmama purchase flow into fourteen clear steps, covering sign‑up, verification, payment, and wallet delivery. Keep it nearby while buying crypto for a smooth first transaction experience.

Step 1

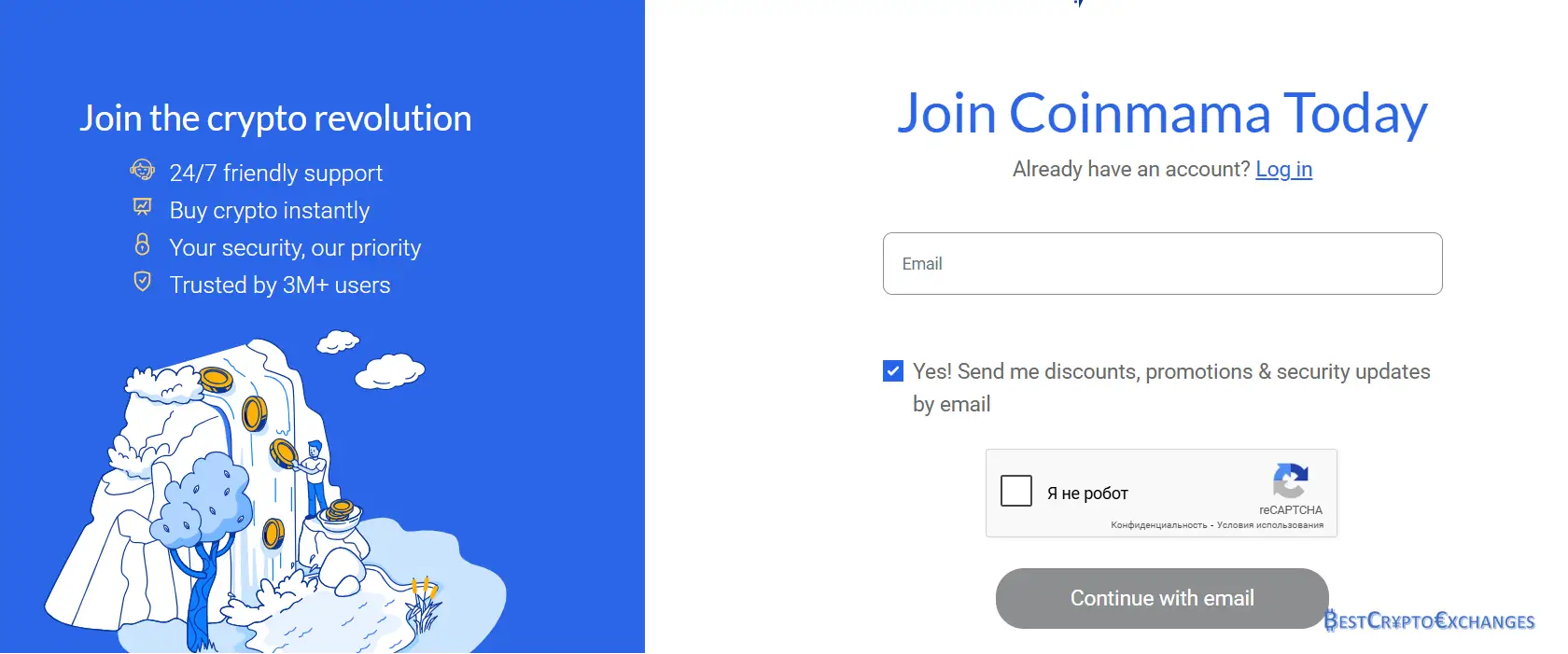

Open the Coinmama website by typing coinmama dot com into your browser address bar. Verify the padlock icon, which shows the HTTPS certificate is valid, so your personal details and payment information travel over an encrypted channel. Using a secure Wi‑Fi network instead of public hotspots lowers the chance of packet snooping during account creation.

Step 2

Click Sign Up in the upper‑right corner and choose whether to register with an e‑mail address or mobile number. Create a twelve‑character password that mixes upper‑ and lower‑case letters, numbers, and a symbol. This action forms your first defence in keeping the new Coinmama account safe from brute‑force attacks and credential stuffing bots.

Step 3

Tick the boxes confirming that you read the user agreement and privacy notice. These pages outline how Coinmama stores hashed passwords, handles personal details under GDPR, and reports suspicious crypto transactions to FINCEN. Skipping the fine print often leads to confusion later when a withdrawal request triggers an identity check.

Step 4

Coinmama sends an activation link to your inbox within thirty seconds. Open the message and tap Activate Account. If you do not see the e‑mail, search the spam folder or request a resend after sixty seconds. Activation locks in your username and allows you to enter the verification portal.

Step 5

Log in for the first time and land on the Level 0 dashboard. Two‑factor authentication with Google Authenticator is highly recommended here; scan the QR code and save the backup codes offline. This extra layer cuts the risk of account takeover if somebody discovers your password later.

Step 6

Fill out the verification form with your full legal name, date of birth, phone number, and residential address exactly as they appear on your driver’s license or passport. Coinmama uses automated address validation software; mismatched data may stall the application and push you back in the review queue.

Step 7

Photograph a government ID, either passport or driver’s license, in good daylight against a plain background. The image should show the document corners and all MRZ lines clearly. Resolution must exceed 150 dpi, and the file size should remain under eight megabytes for the upload system to accept it.

Step 8

Take a selfie holding the same ID plus a handwritten note that says Coinmama and today’s date. Keep your entire face visible, remove headwear, and avoid reflective glasses. The compliance team uses facial‑recognition software to match selfie features with the photo on the document, so clarity, not artistic style, is the goal.

Step 9

Upload the front and back images of the ID, followed by the selfie. Accepted formats include JPG, JPEG, and PNG. A progress bar shows each file reaching the server. If the bar freezes, compress the image slightly or switch to a wired connection to avoid packet loss during transfer.

Step 10

Wait while the compliance desk reviews the documents. Coinmama states that 90 percent of Level One applications finish in under two hours. During peak evenings in the United States, the queue may stretch to six hours, so plan ahead if you aim to catch a specific market dip.

Step 11

Receive an e‑mail confirmation that verification succeeded. Your daily purchase ceiling jumps to 15 000 USD, and the Buy button turns blue. Return to the dashboard, click Buy, and view live prices for Bitcoin, Ethereum, Litecoin, and seven other digital assets supported on the Coinmama platform.

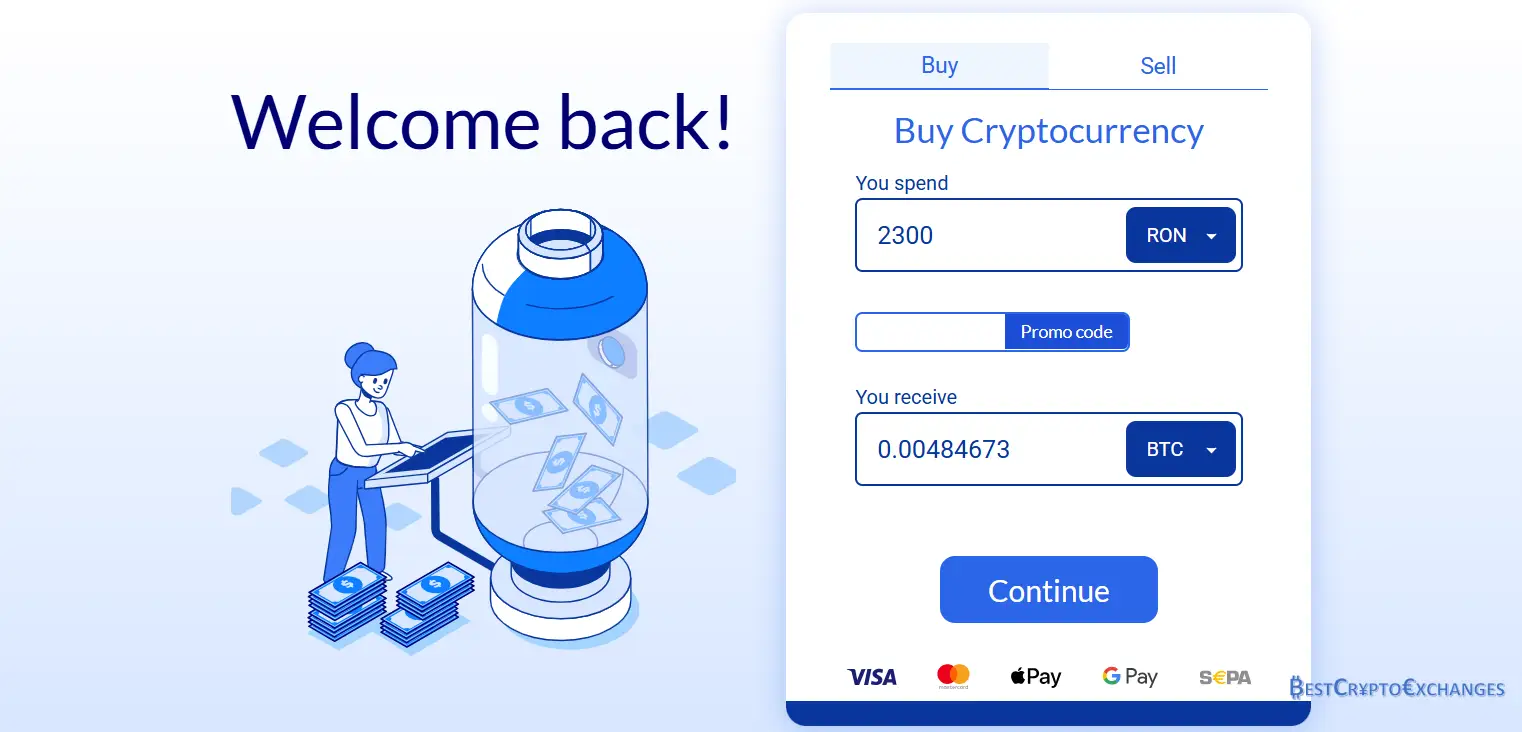

Step 12

Select a preset package such as 300 USD in Bitcoin or type a custom amount. Quotes lock for thirty seconds, and a countdown timer shows how long the rate remains valid. This short window shields you from sudden price changes yet keeps spreads tight compared with slower card gateways.

Step 13

Paste the destination wallet address copied from your crypto wallet app. Triple‑check the first and last five characters before clicking Next; blockchain transfers cannot be reversed. Pick a payment method. Cards clear in about two minutes, SEPA bank transfers cost less but settle in one business day, and SWIFT wires suit five‑figure tickets.

Step 14

Review the order summary that lists the Coinmama spread, card processor surcharge, and blockchain network fee in one view. Enter your card number or bank account details, finish the two‑factor code, and press Pay Now. Once the payment gateway returns a green checkmark, Coinmama broadcasts the on‑chain transaction. You receive an e‑mail with the transaction ID, and the coins appear in your wallet after the first network confirmation, roughly ten minutes for Bitcoin or two minutes for Litecoin.Ideal Users for Coinmama

Coinmama fits beginners who want to buy crypto quickly with household payment methods. The simple and intuitive interface avoids trading charts and jargon which appeals to first‑timers. It also helps residents in regions where other exchanges block card funding.

Advanced traders who require limit orders, staking, or margin trading will likely migrate to other crypto exchanges after making their first buy. Coinmama remains a gateway service rather than a full trading platform.

Final Thoughts

Coinmama earns trust through a long track record, clear regulation, and excellent customer support. High fees and a small coin list are the chief drawbacks, yet many users accept those costs in exchange for speed, security, and multiple payment options. If you seek a direct bridge from a bank account to digital currency without spending time figuring out order books, the coinmama platform delivers. If you need day‑trading tools, deep liquidity, or hundreds of assets, you may prefer other exchanges.

Coinmama Review – FAQ

Is Coinmama safe and legit

Yes. Coinmama keeps user funds out of company wallets, holds a money services business registration with FINCEN, encrypts personal data, forces two factor logins, performs audits, and publishes proof‑of‑reserve snapshots.

Can I trade and sell bitcoins using Coinmama

Coinmama lets verified users sell Bitcoin and Ethereum back to fiat, wiring proceeds via SEPA or SWIFT. Other crypto assets must move to another exchange where sell transactions cost less.

What are the main advantages of Coinmama

Advantages include card Google Pay and bank transfer options, instant delivery to your wallet, clear fee quotes upfront, FINCEN registration for compliance, plus live chat help during daily business hours.

What is the alternative to Coinmama

Buyers seeking lower fees or more coins can open accounts on Coinbase Kraken or Binance. These platforms accept cards, support bank transfers, hold order books, and list hundreds of assets.

How long does Coinmama verification take

Level One verification often finishes in ten minutes if images are sharp. Hours might push times to six hours. Tier Two and Three checks sometimes extend to a business day.

Is Coinmama a wallet

No Coinmama operates as a retailer for crypto assets, not a custody service. Buyers must hold or create their own wallets and provide an address for orders placed on platform.