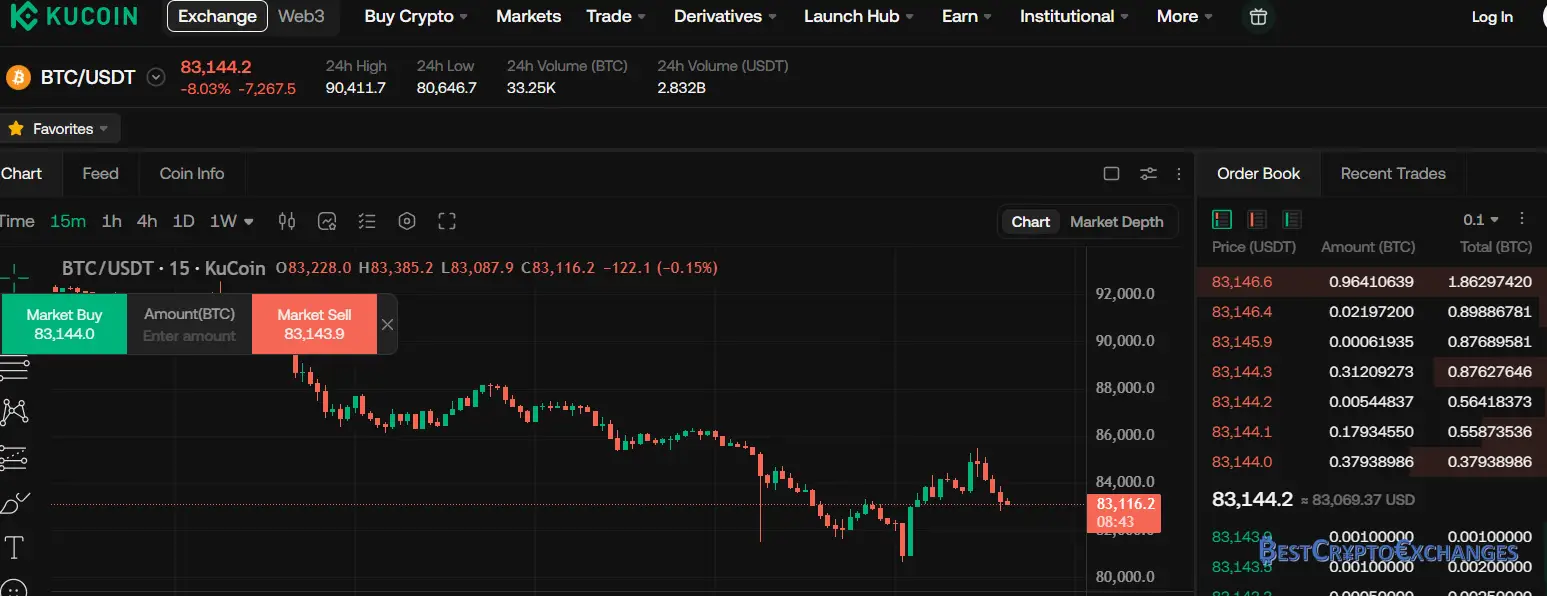

KuCoin opened its doors in 2017 and has since grown into a heavyweight that serves roughly forty million verified accounts across more than two hundred countries. Daily spot trading averages hover near one and a half billion US dollars, while perpetual futures add another two billion during peak Asian hours. The platform lists more than nine hundred individual cryptocurrencies and twelve hundred spot pairs, positioning it among the richest catalogs in the centralized crypto exchange space. KuCoin users can on‑ramp with over sixty fiat currencies, and the order book is powered by matching tech capable of clearing up to one hundred thousand trades per second without system overloads. A September 2020 breach led the team to reinforce security: today ninety percent of client funds rest in cold wallets under multisig control, and an insurance fund worth two hundred million US dollars stands ready for incidents. This review walks through fees, features, and real‑world limitations so traders can gauge whether a KuCoin account fits their strategy.

AI algorithms inside KuCoin’s risk engine scan roughly twenty million events per day pulling wallet history price tick data and behavioral fingerprints. A sudden burst of small deposits followed by a single large withdrawal triggers a higher risk score. Machine learning models flag the account, pause the transfer, and alert the fraud desk. Similar logic hunts market manipulation by comparing order book depth shifts against typical volatility bands. If a wash trading pattern appears, the engine throttles API keys linked to the operator and forwards evidence to compliance auditors. By placing pattern recognition in front of human staff, the system cuts reaction time from minutes to seconds and keeps user funds stored safely.

Pros

Multi‑layer security structure and live anti phishing defenses

More than nine hundred supported cryptocurrencies and twelve hundred spot pairs

Over sixty fiat currency on ramps with two hundred payment routes

Built in spot, margin, futures trading plus passive income tools

KuCoin Shares KCS holder rewards and trading fee rebates

Cons

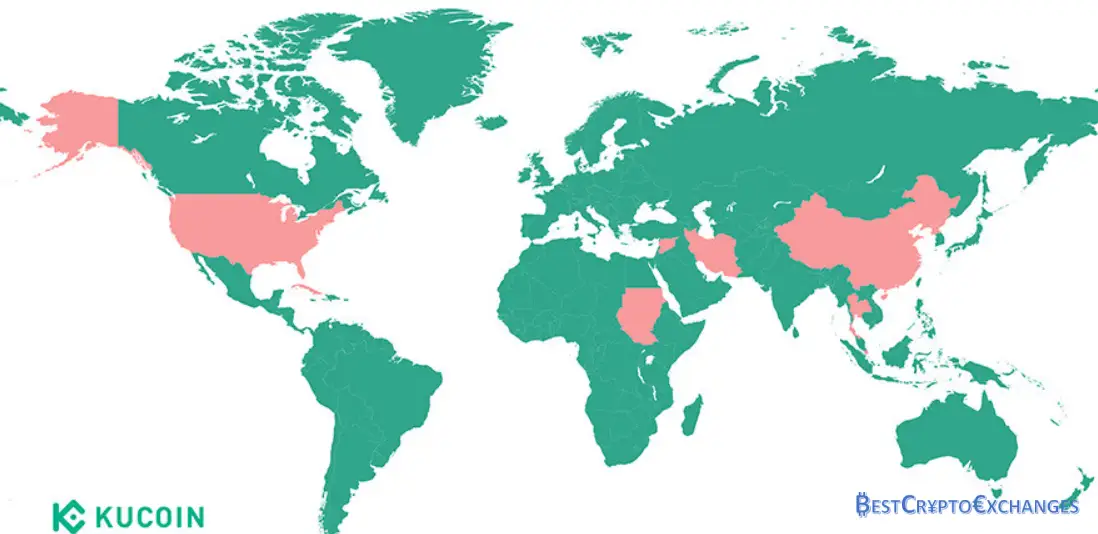

Platform blocks direct service to United States residents under current regulations

Sheer number of menus can feel heavy for first time traders

KuCoin pairs a vast coin list with competitive fees and tight security, giving experienced traders nearly every feature in one place. Newcomers may need time to learn the interface, and U.S. users must look elsewhere, yet for global accounts the exchange delivers depth, liquidity, and constant product expansion.

KuCoin at a Glance

Launched in 2017 by a development team previously involved with Ant Financial, the KuCoin crypto exchange set out to give retail traders early access to emerging tokens overlooked by larger venues. Headquartered in Seychelles with operational hubs in Hong Kong and Singapore, KuCoin now serves more than forty million verified accounts spread across two hundred jurisdictions. According to data aggregator Kaiko, daily spot trading averages around $1.5 billion, equal to roughly three percent of global spot trading activity, while perpetual and quarterly futures contracts add up to $2 billion in turnover during Asian and European market overlap sessions.

KuCoin lists over 900 individual cryptocurrencies—one of the most extensive catalogues among centralized exchanges—and quotes about 1 200 spot trading pairs. Users can pick between spot trading, margin trading with up to 10× leverage, and futures trading offering as much as 100× on flagship contracts. The platform also features free trading bots, a peer‑to‑peer desk, and KuCoin Earn staking options. Fiat on‑ramps accept more than sixty local currencies through bank transfer, cards, and third‑party gateways, bringing newcomers straight into the market without extra hops.

Security rests on a multi‑layer stack that keeps about ninety percent of user assets in cold wallets, backed by an insurance fund currently valued near $200 million. These fundamentals make KuCoin a serious contender for traders seeking both depth and variety in 2025.

Why KuCoin Commands Attention

With more than 900 tradable cryptocurrencies, 60‑plus fiat gateways, and a matching engine clearing 100 000 orders per second, KuCoin gives retail and professional traders deep access to the crypto market. Ninety percent of client assets rest in cold storage, protected by a $200 million insurance pool and reinforced by live anti‑phishing controls.

Security stack built for the current threat model

Online exchanges remain juicy targets for hackers. KuCoin learned the hard way in September twenty twenty when thieves walked away with two hundred eighty one million worth of coins. Recovery efforts, an insurance fund, and quick law enforcement coordination clawed back eighty four percent of the haul, while shareholders covered the rest.

Since that wake‑up call KuCoin has built a hardened security perimeter that starts with 256‑bit TLS across every endpoint, moves to cold storage custody for roughly ninety percent of user assets, and ends with a bug bounty program that pays up to one million dollars for critical zero days. Two factor login is mandatory for withdrawals, and every KuCoin account can lock a withdrawal address list so coins will refuse to exit toward unknown destinations. A dedicated risk desk tracks real time data streams using anomaly scoring to freeze sudden large transfers that break normal behavioral patterns.

KuCoin Security Highlights:

End‑to‑End Encryption – KuCoin’s front‑end forces every browser session and mobile handshake through 256‑bit TLS with Perfect Forward Secrecy, meaning that even if an attacker later gains the server’s private key, past traffic remains impossible to decode. Strict HSTS instructions prevent protocol downgrades, while Content Security Policy headers stop injected scripts from loading rogue domains. Combined, these measures keep passwords, API secrets, and KYC uploads unreadable while they travel across public networks.

Layered Login Controls – Two‑factor authentication starts with email or SMS codes, yet KuCoin adds a separate six‑digit trading passphrase stored only on the client side. Withdrawals, futures funding, and API key creation insist on that second credential, neutralizing credential‑stuffing bots that brute regular passwords. Devices must also pass a browser fingerprint test; unfamiliar agents trigger a one‑time confirmation link, adding another ring of steel around each KuCoin account.

Granular Withdrawal Locks – Traders can pre‑approve an unlimited list of personal wallet addresses. Any attempt to withdraw coins to a destination outside that list forces a 24‑hour cooldown, during which an automated SMS and push notification alert the owner. If no response arrives, the request auto‑cancels, eliminating the risk of a thief quietly siphoning funds to freshly generated external addresses.

Continuous Risk Scoring – A dedicated ML cluster ingests order flow, login cadence, IP geolocation, and device fingerprints in real time. If an account that usually signs in from Paris suddenly uses 30 micro‑deposits from six unrelated wallets and requests a six‑figure withdrawal to a new address, the system freezes the session and escalates it to the human fraud desk before any coins leave hot storage.

Cold‑Hot Split with Multisig – About ninety percent of customer assets dwell in offline hardware vaults requiring three‑of‑five key shards spread across different continents. Hot wallets never exceed a predefined hourly float sized to routine withdrawals. Any larger transfer needs multisig approval from separate network segments, making single‑point compromise mathematically improbable and keeping user funds outside hacker reach.

Proof‑of‑Reserves Audits – Every quarter KuCoin publishes a Merkle‑tree checksum of its cold and hot wallets along with an anonymized liability snapshot. Users can place their own account hash into an open‑source verifier to confirm inclusion, ensuring that aggregate reserves exceed customer balances without revealing individual holdings—a transparency layer seldom matched by other platforms.

Bug‑Bounty Incentives – Security researchers who uncover flaws receive tiered rewards topping out at one million dollars for exploits capable of draining critical infrastructure. Payments ship in USDT or BTC within 30 days of validation, and the hall‑of‑fame board lists winners publicly, encouraging a global army of white hats to keep scanning KuCoin’s codebase for blind spots before black‑hat actors do.

Mandatory Identity Checks – Since the August‑2023 policy shift, both fresh sign‑ups and legacy profiles must clear Level‑1 KYC by submitting a government photo ID and selfie plus address proof. Optical character recognition and liveness detection drive automated vetting that averages under 24 hours. The extra layer blocks mule accounts, aligns KuCoin with FATF travel‑rule guidance, and unlocks higher withdrawal caps once approval lands in the inbox.

These combined layers aim to keep user funds and personal data safe while maintaining quick access for day‑to‑day trading.

Massive Asset Line‑Up and Pair Flexibility

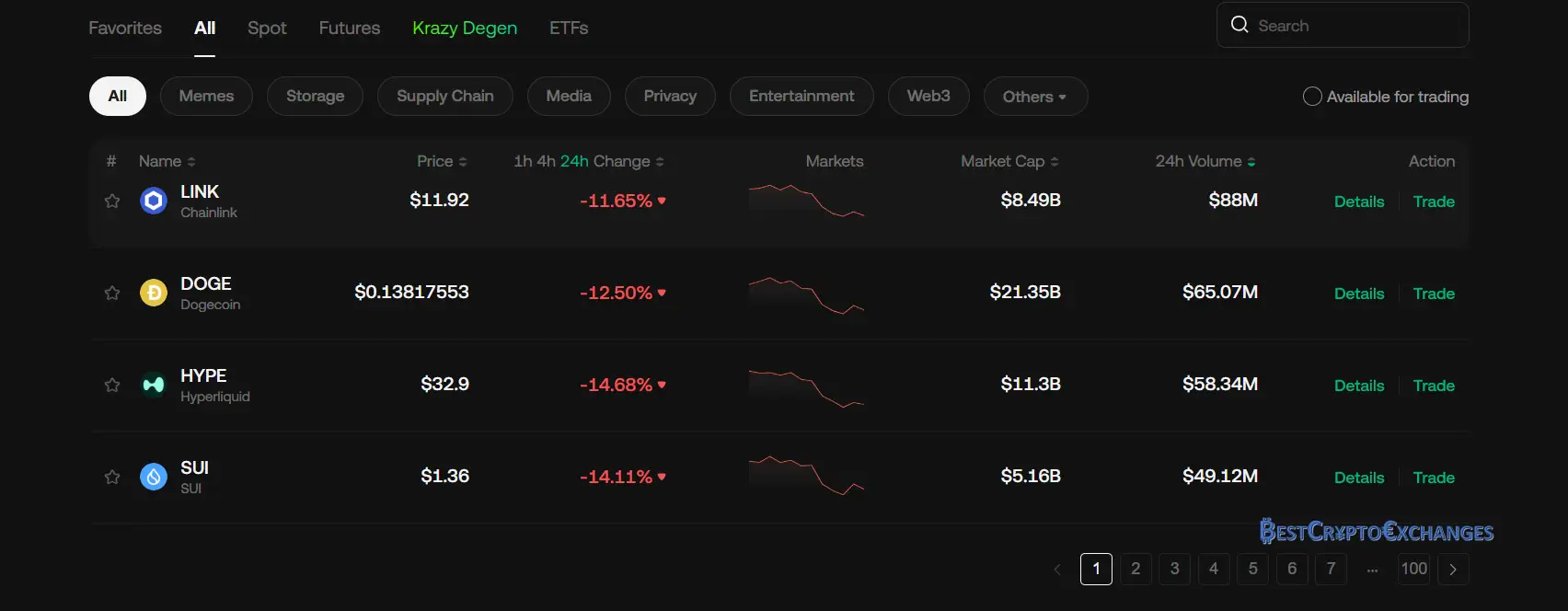

Variety is where KuCoin flexes real muscle. At the time of writing, the platform shows 907 supported cryptocurrencies on its spot trading board, stretching from heavyweight names such as BTC and ETH to niche GameFi projects that only completed an IDO weeks ago. These listings combine into 1 235 live trading pairs, so experienced traders can route capital through cross assets like ADA / SOL or AVAX / USDT without first swapping back to Bitcoin. Roughly forty new coins appear every calendar quarter, thanks to KuCoin’s policy of vetting promising emerging tokens months before other exchanges green‑light them.

Depth is not limited to spot trading. More than one hundred of these assets carry margin trading support, and sixty of them anchor perpetual futures contracts with leverage up to one hundred times. Arbitrage desks appreciate the choice, as they can hedge exposure by shifting between spot, margin, and futures within a single KuCoin account. Liquidity statistics from CoinMarketCap show that 80 percent of pairs maintain at least fifty thousand dollars in twenty‑four‑hour volume, strong enough for most retail positions. For traders who pursue early access, KuCoin remains a launchpad gateway; tokens often list here first before rolling out to other platforms, giving users a head start in their trading journey.

Sixty‑Plus Ways to Enter With Cash

A key selling point for KuCoin in 2025 is how quickly a new trader can jump from local cash to live crypto without visiting another exchange first. The Fast Buy hub now recognises sixty‑four fiat currencies, covering every G‑20 economy plus regional units such as the Nigerian naira, Philippine peso, and Czech koruna. Supported payment methods exceed two hundred, split across credit or debit card rails, Apple Pay, Google Pay, domestic bank transfers, and real‑time options like PIX in Brazil or Faster Payments in the United Kingdom. Card transactions clear in under sixty seconds once 3‑D Secure approval lands, while SEPA and ACH credits usually appear the same day if submitted before afternoon cut‑off.

KuCoin partners with Banxa, Simplex, and PayMIR to handle local compliance checks, limiting the personal data the exchange itself needs to store yet still delivering coins straight into the main account wallet once settlement completes. Minimum ticket size sits at twenty US dollars or local equivalent, and single‑day caps climb as high as one hundred thousand after full account verification. Traders who prefer peer‑to‑peer deals can open the P2P plaza, where zero‑fee listings quote stablecoins in everything from Argentine pesos to Vietnamese dong; escrow smart contracts release funds once both sides confirm receipt.

Each fiat route displays a final all‑inclusive quote before the user taps Confirm, combining processor markup and network fee so there are no hidden extras. This transparency, coupled with wide currency support, makes KuCoin one of the most convenient launch pads for first‑time crypto buyers worldwide.

All‑In‑One Trading Desk and Yield Suite

KuCoin compresses a complete trading stack into a single dashboard. Spot deals use a tiered maker taker ladder that begins at 0.1 percent and drops to zero at volumes above one hundred million USDT per month, keeping costs predictable for both casual traders and algorithm desks. Verified accounts unlock margin on ninety headline pairs with leverage up to ten times, while derivatives fans trade quarterly and perpetual contracts that reach one hundred times on BTC USDT and fifty on leading alts such as SOL and ADA.

Strategy automation comes free of charge: users spin up grid bots, martingale loops, smart rebalancers, or rolling DCA engines in a few clicks, then monitor performance from the Trading Bot tab. Idle balances do not sit still either. KuCoin Earn funnels coins into flexible savings, fixed staking, and peer lending pools where yields float between three and eighteen percent annualised depending on utilisation, letting holders collect passive returns without leaving the exchange.

KuCoin Shares (KCS) Token Perks

Holding six KuCoin Shares tokens qualifies the wallet for a daily fee dividend paid out of trading fees the exchange collects. Heavy KCS stacks elevate a profile through twelve VIP tiers, chopping maker taker costs to almost zero and unlocking early access to Spotlight token launches. KCS can also pay trading fees directly at a twenty point five percent discount and grants cashback when loading the KuCard Visa debit card.

• Daily payout pool – Holding at least six KCS qualifies the wallet for a slice of KuCoin’s fee revenue, distributed once every twenty‑four hours. Half of all trading fees flow into this pot, so the reward scale rises as overall platform activity climbs.

• Trading cost relief – Building a larger KCS balance moves the account through twelve VIP ranks, trimming maker and taker charges step by step. You can also use KCS itself to settle spot fees, shaving an extra 20.5 percent off the already reduced rate.

• Priority on Spotlight sales – Wallets containing KCS jump the queue when new tokens debut on KuCoin Spotlight, letting holders buy fresh projects at launch prices rather than in secondary markets where premiums often appear within minutes.

• KuCard cashback – Spending crypto through the KuCard Visa debit earns 1.2 percent back in KCS for regular users, while balances above one hundred KCS raise the rebate to 1.7 percent.

March 2025 added a four‑tier Loyalty Program: staking one or more KCS increases the account’s ratio score, unlocking extra fee cuts and higher referral rebates as the tier climbs.

KCS reaches beyond exchange perks: holders can route the coin through Web3 dApps for payments, stake it as gaming credit on BetProtocol or PlayGame, or pledge tokens on Constant to secure USD or VND loans. A March 2025 rollout added the four‑tier KCS Loyalty ladder—stake a single token to enter, raise your staked‑to‑asset ratio to climb tiers, and unlock progressively richer fee rebates and bonus drops.

Areas Where KuCoin Falls Short

No exchange is flawless, and KuCoin shows a few cracks that traders should weigh before committing large balances. Chief among them is regional access: tighter U.S. oversight forced the platform to block official service to American residents, slicing away roughly 14 percent of potential volume. The interface, while powerful, layers dozens of menus that can overwhelm beginners. Finally, variable withdrawal fees and occasional customer‑support delays spark scattered negative reviews on community boards.

Barred From the US Market

KuCoin’s global footprint stops at United States borders because of mounting state and federal scrutiny. The breaking point arrived on 31 December 2023, when a New York investigation into unlicensed money‑transmission services led the exchange to switch off all fiat rails and identity verification portals tied to American IP ranges. From that moment KuCoin officially geofenced every ZIP code; sign‑ups that list a US address now show a rejection banner, and existing accounts lost card top‑ups, ACH credits, and SEPA substitutes.

Blockchain access still functions at the protocol layer, so tech‑savvy users have bypassed the geo‑block with VPN tunnels and continue to swap crypto‑to‑crypto pairs. This grey‑area activity carries real risk: balances are excluded from the insurance fund, fiat withdrawal buttons stay disabled, and KuCoin support agents remind ticket writers that the terms of service prohibit US residency. Data firm SimilarWeb estimates these shadow logins account for about 4 percent of monthly site traffic, a drop from more than 12 percent before the cut‑off.

Management has floated the idea of a fully regulated American offshoot similar to Binance US, hinting at 2027 as a target once FinCEN money‑service licensing and individual state approvals line up. Until that subsidiary arrives, traders who require full compliance must look to exchanges like Coinbase or Kraken for spot and futures exposure inside US jurisdiction.

Interface overload for brand new users

KuCoin packs spot, margin, futures, bots, earn, staking, lending, and crypto card menus into one vertical navigation bar. The abundance of charts and sliders may intimidate someone whose entire trading journey to date was a single Bitcoin buy on a mobile wallet. The exchange does publish tutorial videos and interactive tours; however, first timers seeking one‑click simplicity may find a smaller venue more comfortable for their first month in crypto.

KuCoin Fee Guide for 2025

Fees sit near the top of any trader’s checklist, and KuCoin keeps its schedule competitive by publishing an exact grid, updating it quarterly, and offering several ways to slash costs even further. Below is an extended breakdown that covers every stage of the trade lifecycle—from getting money on‑platform to funding futures positions and finally cashing out to an external wallet.

Moving Money In

Before you trade, the first hurdle is funding your KuCoin account. The exchange supports crypto deposits, card payments, local bank rails, and peer gateways, each route carrying different speed‑cost trade‑offs.

Crypto deposits – Always free apart from miner gas. KuCoin does not charge a separate line for crediting coins.

Fiat on‑ramps – Card, Apple Pay, Google Pay, and local bank methods route through partners such as Banxa, Simplex, and PayMIR. These processors fold their spread into the final quote you see before pressing Confirm. KuCoin itself adds nothing. Settlement times vary from seconds (card rails) to several hours (SEPA and ACH).

Choose the rail that matches priorities: cards deliver instant balances, SEPA saves on spreads, and crypto transfers remain gas‑only. Preview processor quotes so landed amounts align with your trading plan.

Withdrawal Charges and Limits

Getting crypto out of KuCoin involves two variables: the network fee and your verification tier. Caps scale sharply after KYC, while individual coin charges follow real‑time blockchain congestion and costs.

Verification Level | Crypto Limit (24 h) | Fiat Limit (24 h) | Notes |

|---|---|---|---|

Unverified | 0–30 000 USDT eq. | Not available | Sliding cap depends on how many basic ID steps are complete |

KYC Level 1 | 1 000 000 USDT eq. | 125 000 USDT eq. | Suitable for most retail users |

KYC Level 2 | 999 999 USDT eq. | 500 000 USDT eq. | High‑volume desks and OTC clients |

Verify early to unlock nearly a million USDT per day and lower frictions. Always check the on‑chain quote; pulling funds during peak traffic can triple costs versus off‑peak windows periods.

Network‑linked fee – Each coin carries a fixed component tied to on‑chain congestion. For example, withdrawing BTC on the native chain costs 0.00015 BTC plus standard miner priority; pulling the same value over Lightning costs less. Stablecoins on Ethereum follow gas swings, while cheaper chains such as TRON cost a fraction of a dollar. KuCoin updates these rates four times per day.

Spot Trading – Token Class Matrix

KuCoin splits assets into four liquidity groups and applies a maker/taker ladder that tightens as your 30‑day volume or KCS balance rises.

Token Group | Start Maker | Start Taker |

|---|---|---|

Top 25 | 0.100 % | 0.100 % |

Class A | 0.100 % | 0.100 % |

Class B | 0.200 % | 0.200 % |

Class C | 0.300 % | 0.300 % |

Paying fees in KuCoin Shares shaves 20.5 % off the above numbers, instantly dropping a Class A taker trade at VIP 0 from 0.100 % → 0.079 %.

VIP Ladder Thresholds (30‑Day Volume or KCS Holdings)

KuCoin rewards activity through a twelve‑tier VIP ladder tied to either rolling thirty‑day trade volume or KuCoin Shares holdings. Climbing tiers shrinks maker rates and unlocks extra platform perks for users.

VIP Tier | Volume (USDT) | KCS Held | Maker (Top/Class A) | Taker (Top/Class A) |

|---|---|---|---|---|

Tier 0 | < 50 000 | < 1 000 | 0.100 % | 0.100 % |

Tier 5 | ≥ 8 000 000 | ≥ 40 000 | 0.035 % | 0.055 % |

Tier 9 | ≥ 80 000 000 | ≥ 150 000 | 0.000 % | 0.040 % |

Tier 12 | ≥ 400 000 000 | ≥ 500 000 | –0.005 % (rebate) | 0.025 % |

Rebates appear in real time and are denominated in the quote asset of the trade. Even small KCS accumulations accelerate tier growth; higher ranks flip maker fees negative, earn daily dividends, and provide priority Spotlight access, turning passive holdings into concrete savings and high‑value opportunities.

Futures Contracts – Uniform Class A Schedule

Perpetual and quarterly futures exist only for assets in the “Class A” pool.

VIP Tier | Maker | Taker |

|---|---|---|

Tier 0 | 0.020 % | 0.060 % |

Tier 5 | 0.006 % | 0.048 % |

Tier 9 | –0.002 % | 0.033 % |

Tier 12 | –0.008 % | 0.025 % |

Futures fees cannot be settled with KCS, but volume alone is enough to push maker costs into negative territory, letting large desks earn rebates for posting liquidity.

Hidden‑Cost Checkpoints

Beyond headline maker–taker numbers, KuCoin hides a few corner‑case costs. Check dormancy rules, fiat refund quirks, sub‑account moves, and volatility surcharges before you structure large positions or schedule daily withdrawals.

Inactivity – KuCoin does not levy dormancy fees.

Fiat refunds – Failed card top‑ups return funds minus processor spread; no KuCoin surcharge.

Internal transfers – Moving coins between sub‑accounts or margin wallets is free.

Bottom line: Deposits remain free, withdrawal fees scale with network load, and trading costs begin low then tumble through a mix of KCS usage and tiered volume milestones. Always preview the order ticket—certain emerging tokens may carry promotional zero‑fee windows or higher safeguards during extreme volatility.

Getting Started: Navigating KuCoin

Opening, funding, and executing a first trade on KuCoin takes less than ten minutes when you know where to click. The exchange funnels new sign‑ups through a four‑panel wizard that handles email or phone registration, a six‑digit verification code, and password creation. Once inside, the main ribbon splits tasks by color: green for deposits, blue for markets, orange for bots, and purple for Earn products. A dashboard widget shows 24‑hour P&L in your base currency, while a shortcut toggles between basic and pro chart views. Follow the quick‑start flow below to move from zero balance to live order execution.

Opening a KuCoin Account

The sign‑up funnel runs on five screens and usually takes under five minutes. You provide contact details, set credentials, clear identity checks, dial in extra security, and load your first funds.

Follow the expanded steps below to turn a brand‑new profile into a trade‑ready wallet without missing an important safety checkpoint.

Create contact record – Visit KuCoin dot com, tap Create Account, choose email or mobile, then type the address. Solve the sliding captcha and paste the six‑digit confirmation code that lands in your inbox or SMS. This handshake links your contact point to the exchange and prevents bots from spinning disposable placeholders.

Build a hardened password – Craft a string of at least twelve characters mixed with upper‑lower letters, numerals, and symbols. Skip dictionary words. Copy it onto paper and store offline. A strong passphrase stops credential stuffing attacks that scrape leaks from unrelated sites and test them against major exchanges.

Complete primary verification – After the welcome splash, KuCoin shows a grey badge beside your user ID. Click Verify Now. Upload a passport or driver licence plus a utility bill dated within three months. Finish with a live selfie through your webcam. Approval usually posts within one business day, unlocking full deposit and withdrawal quotas.

Activate multi‑factor guards – Inside Settings pick Security and flip on Google Authenticator. Scan the QR code, save the sixteen‑character backup, and enter a one‑time code to pair the device. Next, create a six‑digit trading password. KuCoin will request it for every withdrawal, API key, or futures funding event.

Add balance – Choose Crypto Deposit or Fast Buy. Crypto deposits show a wallet address and confirm on chain once miners sign blocks. Fast Buy supports cards, Apple Pay, Google Pay, SEPA, ACH, and dozens of locals. Card rails deliver USDT or stablecoins within sixty seconds; bank transfers settle same day in most regions.

Place the first order – Open Markets, click the coin pair such as BTC USDT. On the right, switch the order ticket to Market for instant execution or Limit for a set price. Enter the amount, press Buy, and watch the fill line appear in Orders Filled. Funds reflect immediately in your Main Account tab.

Following these six checkpoints provides a secure launch. You exit with verified status, multi‑factor protection, fresh funds, and a trade history entry. Keep the trading password private, record authenticator backup codes, and you will be prepared for larger positions and advanced features like margin or futures when ready.

Instant Purchase with KuCoin Fast Trade

Fast Trade is KuCoin’s point‑and‑click ramp that converts local money to crypto in under a minute. The module supports sixty‑plus fiat units and more than thirty headline coins, quoting an all‑inclusive rate before you spend a cent. Because third‑party processors handle settlement, KuCoin can show real‑time availability for Apple Pay, Google Pay, PayPal, SEPA, and dozens of regional rails without juggling separate screens.

Follow the five expanded checkpoints below and you’ll move from cash to confirmed coins faster than a typical card swipe at a coffee shop.

Open Fast Trade from the home banner

Log in, tap the green Buy Crypto icon, and select Fast Trade. The widget auto‑detects your country and lists supported payment channels, cutting out guesswork and hidden region locks. A progress bar tracks each stage so newcomers know exactly how many clicks remain.Choose the cash you’re spending and the coin you’ll receive

Click the fiat drop‑down, scroll to your currency—EUR, USD, JPY, or one of sixty others—then pick your target asset such as ETH, BTC, or USDT. Live FX feeds convert the ticket into your home unit so you view the purchase in familiar terms.Select a payment lane

Options update in real time based on amount and location. Card rails suit sub‑€5 000 bites, PayPal covers small tests up to €1 000, SEPA handles bulk loads with lower spreads, while local instant methods like PIX in Brazil or iDEAL in the Netherlands appear where available.Inspect the all‑in quote

Before confirming, you see a breakdown: processor markup, network fee, and KuCoin’s own zero‑fee stamp. Timer rings show how long the quote remains valid—usually two to three minutes—giving ample room to rethink without price slippage.Press Confirm and wait for delivery

Card and PayPal transactions credit the matching wallet in roughly sixty seconds, while SEPA or ACH funds drop once the bank clears settlement, typically within hours. A push notification and email receipt arrive the moment the balance updates.

The module strips away order‑book complexity, perfect for newcomers who want exposure without learning limit tickets. Keep processor spreads in mind—bank rails cost less than plastic—and remember that larger sums may trigger extra verification steps with the payment partner.

Who Thrives on KuCoin

KuCoin suits several profiles. High‑frequency desks and experienced traders enjoy 900‑plus trading pairs, 10× margin trading on majors, and 100× futures contracts that clear through a matching engine pushing 100 000 orders per second. Tier‑9 and above users—those moving at least 80 million USDT in 30 days or holding 150 000 KCS—see maker fees fall to zero and grab early access to Spotlight launches. Passive‑income hunters park idle assets in flexible or fixed KuCoin Earn pools, lend coins through P2P desks, or test auto‑yield tools such as Shark Fin without transferring funds off‑platform.

Algo builders spin up free grid bots and DCA scripts straight from the Trading Bot tab, letting code work around the clock. Learners tap KuCoin Learn videos, quizzes, and demo accounts to climb the curve at their own pace. The main holdouts are U.S. residents—blocked by policy—and minimalists who prefer a cleaner, stripped‑down interface.

Final Reflections on KuCoin

KuCoin remains a heavyweight in the crypto exchange landscape because it combines massive coin choice, competitive trading fees, and an ever expanding menu of earn and Web3 services. The absence of official United States coverage and the memory of the twenty twenty hack still draw negative reviews, yet the insurance fund payout and subsequent security hardening provide a road map for how an exchange recovers from adversity. With forty million KuCoin users and rising activity in both spot and futures trading, the platform offers a full trading journey from first buy to complex automated grid strategies. Traders seeking early access to emerging tokens and features beyond basic swaps will likely keep KuCoin on their short list in twenty twenty five.

Scientific References

Chainalysis Crypto Crime Report twenty twenty three

Chainalysis Crypto Crime Report twenty twenty four

KuCoin Review – FAQ

Is KuCoin good?

KuCoin combines a vast coin roster, deep liquidity on core pairs, and an aggressive fee ladder that drops maker costs to zero for high‑volume desks. Add in free trading bots, task‑based rewards, and a sleek mobile app, and you have a venue that satisfies both veteran traders and curious newcomers chasing variety.

Is KuCoin safe?

After the 2020 breach, KuCoin overhauled its defenses: ninety percent of customer funds now rest in multisignature cold vaults, every login funnels through two‑factor prompts, and a quarterly proof‑of‑reserves audit lets users verify balances on‑chain. A standing insurance pool near two‑hundred‑million dollars underwrites remaining hot‑wallet exposure.

How many cryptocurrencies does KuCoin support?

The exchange lists roughly nine‑hundred‑plus individual assets, stitching them into more than twelve‑hundred spot pairs. That catalog ranges from Bitcoin and Ether to freshly minted GameFi tokens, giving portfolio builders one of the widest shopping aisles among centralized platforms and plenty of cross routes for arbitrage strategies.

Does KuCoin accept fiat currency?

Yes. Sixty‑four local currencies plug into Fast Trade, P2P, and third‑party channels. Users fund accounts with Apple Pay, Google Pay, Visa, Mastercard, SEPA, ACH, PIX, iDEAL, and many regional rails. Processor spreads appear up front, and coins land directly in the main wallet once settlement clears.

Who is KuCoin going to be best for?

Power users chasing early listings, 100× futures leverage, and passive‑yield instruments fit naturally on KuCoin. New traders willing to study tutorials can grow from basic spot orders to automated bots without leaving the ecosystem. U.S. residents, however, will need a compliant alternative until a licensed offshoot arrives.

What are the main KuCoin features?

KuCoin offers spot, margin, and perpetual futures trading; zero‑cost grid, martingale, and DCA bots; KuCoin Earn savings, staking, and lending; KCS fee rebates; an integrated Web3 wallet; NFT fractions; and a Visa debit KuCard that converts crypto to fiat at the point of sale while earning cashback.