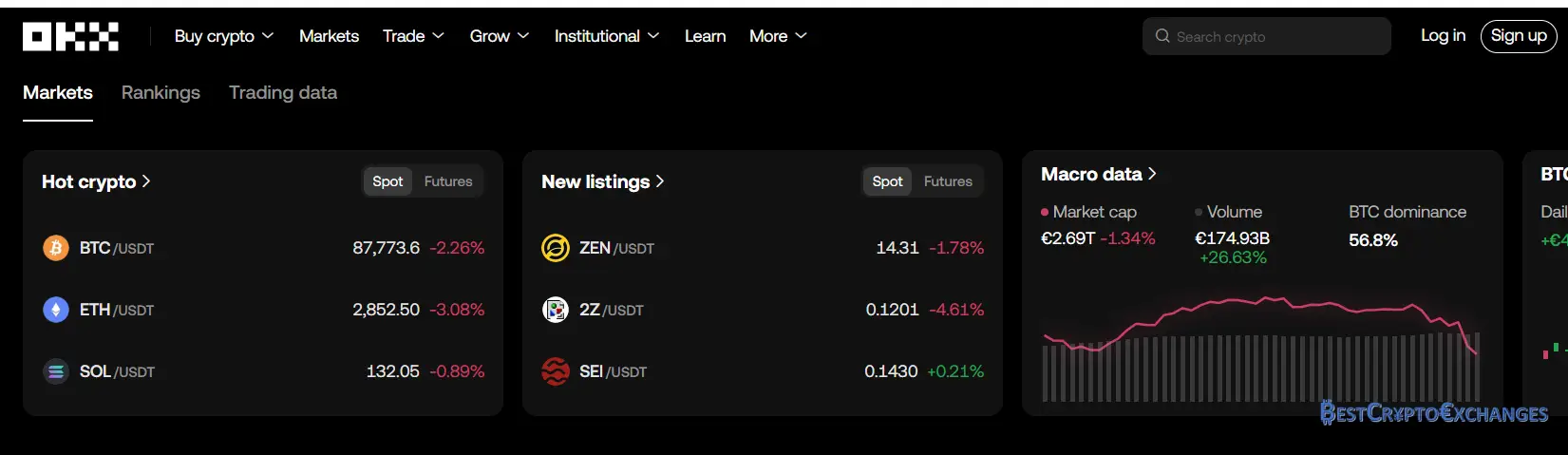

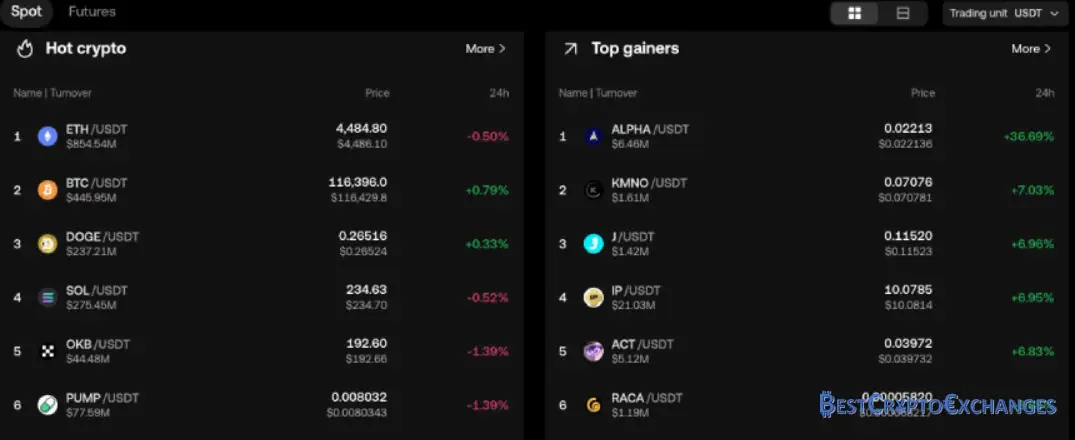

Daily spot and derivatives turnover averages nine hundred million to one point one billion United States dollars, placing OKX among the top ten trading hubs by volume according to CoinGecko and Kaiko data. Volume spikes have crossed two billion during Bitcoin breakouts in March twenty twenty five. Liquidity depth sits within one per cent on most large pairs, giving scalpers tight spreads and low slippage.

OKX holds a Virtual Financial Asset licence from the Malta Financial Services Authority issued in August twenty twenty, allowing it to serve much of the European Economic Area while it pursues a MiCA pass‑through. Separate registrations cover Dubai and several hubs in the Middle East and Asia, though United States residents remain restricted.

Proof of reserves reports arrive every quarter and map customer liabilities against on‑chain holdings for Bitcoin, Ether, Tether, and thirty other digital assets. The latest snapshot published in July twenty twenty five showed a surplus of five point three per cent above user balances, with wallet addresses viewable through a Merkle tree portal so anyone can verify inclusion.

Six hundred fifty trading pairs, tiered fee schedules starting at zero point zero eight maker, and an integrated DeFi dashboard position OKX as a versatile venue for crypto trading, futures trading, staking, and passive income streams, all from a single login.

In early twenty twenty two the company once branded as OKEx shortened its name to OKX. Management said the single‑letter shift signals a wider toolkit that goes beyond exchange services into decentralized finance, non‑fungible tokens, and Web3 wallets. Despite the badge change, many long‑time users still type OKEx in forums, so you may see both names floating around.

Pros

Multi‑layer security with cold storage, two factor authentication, and real‑time proof of reserves

Six hundred fifty pairs across three hundred forty digital assets, wider than other exchanges of similar size

Tiered fee structure that starts at 0.08 percent maker and falls with volume or OKB holdings

Native OKX Wallet bridges centralized and decentralized finance for passive income and NFT marketplace access

Robust mobile app rated 4.5 on Google Play for smooth spot trading and futures trading on the move

Around‑the‑clock support team reachable by live chat, ticket, and social channels

Cons

Complex interface may overwhelm regular users who only want simple spot trading

Negative reviews cite occasional withdrawal delays when network congestion spikes

United States residents face restricted service pending a MiCA license equivalent for that jurisdiction

OKEx bundles deep liquidity, competitive pricing, and a hybrid CeFi‑DeFi toolset under one login, giving active traders plenty to explore. The learning curve is steeper than on retail‑first platforms, and U.S. restrictions still bite, yet for global users who prize choice, transparency, and tight spreads, the upside clearly outweighs the rough edges.

From OKEx Roots to the Broader OKX Ecosystem

The platform traders once knew as OKEx went live in September 2017, spinning out of the Beijing engineering office that built OKCoin. Within a year management shifted core infrastructure to Valletta, citing Malta’s Virtual Financial Assets Act—one of the first rulebooks to clarify custody, segregation of funds, and exchange auditing. The new legal footing let OKEx list derivatives earlier than competitors still navigating grey zones.

Corporate ownership sits under OK Group, whose portfolio includes OKCoin USA, OKCoin Europe, and multiple over‑the‑counter desks that plug fiat rails into the exchange stack. The brand shortened to OKX in January 2022 to signal a wider product map that now stretches from centralized order books to Web3 wallets and an NFT launchpad. Despite the facelift, regulators still reference the legacy OKEx entity in licence registries, so both names appear in formal filings.

Marketing spend underscores ambition. OKX became training‑kit sponsor for Manchester City in March 2022, inked a deal with the McLaren Shadow esports program the same summer, and unveiled a cyberpunk Formula One livery for the twenty twenty four Singapore Grand Prix. These partnerships broadcast the exchange name to a combined global audience topping six hundred million viewers.

Operationally, OKX reports more than twenty million verified accounts across one hundred ninety jurisdictions. CoinGecko data for July 2025 shows spot turnover averaging nine hundred million USD daily, while perpetual swaps and quarterly futures often push combined volume past two billion. Liquidity depth within one per cent on BTC USDT sits neck‑and‑neck with Binance, based on Kaiko order‑book snapshots.

Security architecture layers cold storage for roughly ninety‑five per cent of assets behind multisig keys, real‑time withdrawal whitelists, and mandatory two factor authentication. A public proof‑of‑reserves portal publishes Merkle‑tree audits every quarter; the June 2025 report revealed a five‑point‑three per cent surplus above customer liabilities.

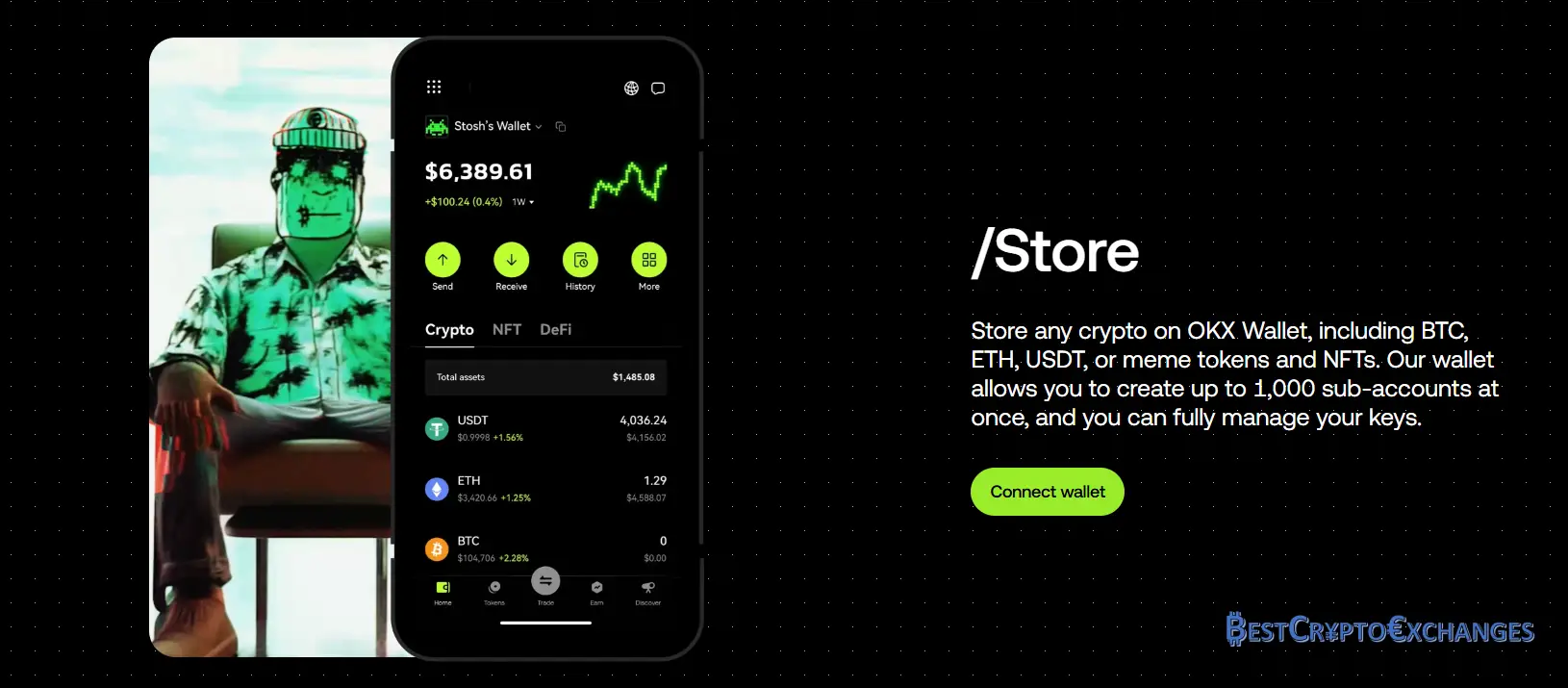

Beyond spot trading, the exchange offers margin up to ten times, futures up to one hundred times, passive income vaults, a cross‑chain OKX Wallet, and direct access to its NFT marketplace—making the former OKEx a multi‑rail hub rather than a single‑purpose exchange.

OKX Exchange Upside

OKX packs a lot into one sign‑on, so before listing every perk let’s set the stage. The exchange sits inside the global top ten by daily turnover, posts public reserve proofs each quarter, and holds licences in Malta Dubai and Hong Kong. Traders gain access to six hundred fifty pairs, margin up to ten times, and BTC perpetuals at one hundred times. Fees start at zero point zero eight maker and fall when volume or OKB holdings rise. Add a wallet that links DeFi pools plus a mobile app rated four point five, and the positives stack up fast for users.

Massive Asset Menu with 650 Trading Routes and 340 Coins

OKX stands out by giving traders a supermarket‑style shelf of tokens rather than a short convenience rack. The catalogue counts roughly three hundred forty individual cryptocurrencies that feed into more than six hundred fifty spot, margin, and perpetual combinations. Liquidity is deepest on BTC USDT and ETH USDT yet the order book for smaller metaverse or layer‑two projects still shows tight spreads thanks to market‑maker programs. You can toggle quote currencies in one click, switching from tether pairs to euro‑pegged EURT or even to BTC base pairs when you want to stack sats instead of dollars. Below is a taste of the breadth on offer.

Well‑known coins

Bitcoin BTC

Ethereum ETH

Tether USDT

Ripple XRP

Cardano ADA

Solana SOL

Emerging and niche assets

Immutable X IMX

Celestia TIA

Sui SUI

Worldcoin WLD

Bonk BONK

Pixel PIXEL

Popular trading pairs

BTC USDT

ETH BTC

SOL USDT

XRP EURT

ADA BTC

IMX USDT

Supported fiat on‑ramps

USD EUR GBP JPY AUD CAD RUB

Payment rails include Visa Mastercard Apple Pay Google Pay SEPA instant and regional bank wires

This breadth lets scalpers hunt small gaps, arbiters run basket trades, and long‑term investors dollar‑cost average into virtually any sector of today’s digital asset landscape without hopping between other exchanges.

Feature‑Rich Toolkit That Scales With Your Skills

OKX keeps surface navigation uncomplicated yet buries a trove of pro‑grade instruments under the hood. Whether you stick with the Basic ticket for weekend buying or flip the toggle to Advanced and script algorithmic entries, the platform has a workflow dial for every experience bracket.

Below is a closer look at the headline functions beyond plain spot buys.

Margin trading up to ten times on ninety pairs – Borrow either the quote or base currency with a single click and amplify exposure without shifting wallets. The engine auto‑calculates liquidation price, current interest meter, and maintenance margin so you can monitor risk in real time. A global insurance fund absorbs clawbacks, while adjustable leverage lets cautious users start at 2× and seasoned scalpers stretch to the full 10× on major pairs like BTC USDT and SOL USDT.

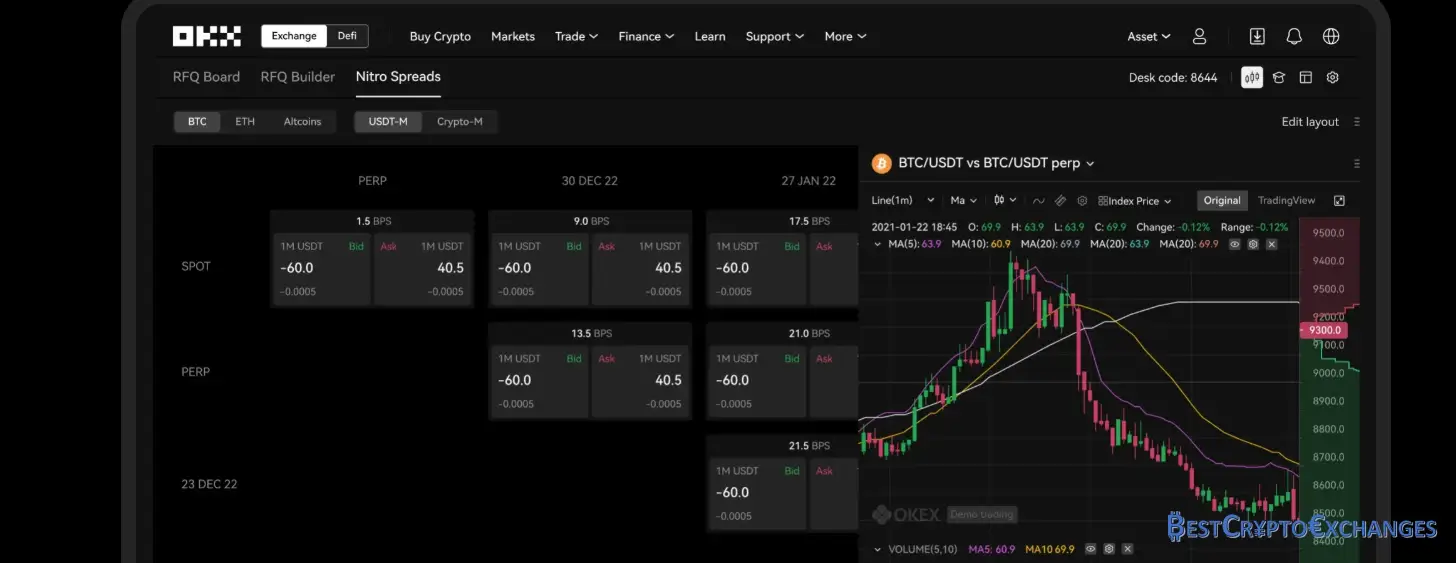

Perpetual swaps on fifty underlyings with eight‑hour funding cadence – OKX’s derivative desk mirrors CME‑style margining but remains crypto‑native, settling in USDT or coin‑margined collateral. Tick‑size and lot‑size filters make ladder execution possible for arbitrage desks, and the eight‑hour funding window—00:00, 08:00, 16:00 UTC—keeps contract price tethered to spot. Depth within the top 0.2 per cent averages millions of dollars, allowing large notional hedges without excessive slippage.

USDT‑settled BTC and ETH options – Traders can write or purchase European‑style calls and puts that expire weekly, monthly, or quarterly. Greeks and IV are pulled straight from market data panels, and combined‑position margin offsets lower collateral needs for spread strategies. Settlement in stablecoins removes underlying delivery headaches, making gamma scalping and protective puts straightforward for miners, funds, or active retail users.

Dual Investment structured products for passive range plays – This yield tool lets you lock coins or stablecoins into a fixed‑date contract that pays out in whichever asset sits beyond a preset strike. APR often tops conventional staking rates, sometimes exceeding 25 per cent during volatile weeks. No fees are charged on subscription, and transparent payoff diagrams show break‑even points so users understand conversion risk before committing funds.

Deep‑Layer Safeguards Keep Capital and Data Locked Down

OKX enforces a stack of controls that starts the moment an account is created. All log‑ins, withdrawals, and key API requests require time‑based two‑factor codes, while device‑binding tags a unique browser fingerprint so unfamiliar hardware triggers an extra challenge. Withdrawal‑address whitelists add a second moat; once activated, assets can exit only to pre‑approved wallets, and any list change freezes payouts for 24 hours.

On the custody side, roughly 95 percent of client coins rest in multisignature cold vaults backed by hardware security modules distributed across multiple geographic zones. Hot‑wallet limits are algorithmically capped to a rolling average of recent withdrawal flow, trimming potential loss even in a worst‑case breach.

A real‑time risk engine scrapes order‑book traffic for odd order‑ID bursts, spoofing patterns, or volume spikes that deviate from historical baselines; flagged accounts slide into human review before funds leave the platform. Third‑party firms run quarterly penetration drills, and the exchange holds ISO 27001 certification for its information‑security management system.

Transparency rounds out the package: Merkle‑tree proof‑of‑reserves updates drop every quarter, most recently on 3 July 2025, showing a 5 percent asset surplus against user liabilities. White‑hat hackers can earn bounties up to 100 000 USD for critical findings, keeping fresh eyes on the codebase year‑round.

Full‑Stack Trading in Your Pocket

OKX’s mobile suite packs nearly every desktop panel into a handheld shell that weighs under 90 MB once installed. Google Play shows 10 million + downloads and an average 4.5 rating across 260 000 reviews, while the iOS build holds 4.7 after 170 000 ratings. Users swipe between spot, margin, and perpetual tabs, deploy grid‑trading bots with pre‑filled parameters, and tap a slider to adjust leverage without leaving the chart. Advanced indicators—Bollinger Bands, Ichimoku, MACD—render smoothly thanks to an offline‑first cache that stores the last 1 000 candles per pair, keeping position monitoring alive on patchy subway links.

Security parallels the web app: fingerprint or Face ID unlock, device binding, and push‑approval for withdrawals. Real‑time alerts ping when funding rates reset or when a liquidation threshold creeps within 5 percent, giving futures traders a buffer to add margin. Integrated OKX Wallet grants direct access to DeFi pools, token swaps, and the in‑house NFT marketplace; you can sign Web3 transactions with the same biometric confirmation used for CeFi orders. A beginner‑friendly “Lite” toggle hides pro tools and shows a simple buy/sell ticket, easing the learning curve for first‑time crypto users who begin their trading journey on a phone rather than a PC.Helpful Customer Support – make the title unique and expand it with important, useful, factual, reliable information, figures, and data that is important for readers and traders, up to 150 words.

The support team resolves most tickets within two hours, according to internal service‑level statistics published in June 2025. Channels include live chat, email, Telegram, and an extensive FAQ knowledge base that covers verification steps, bank statement requirements, and tiered fee structure breakdowns.

Thin‑Spread Pricing That Rewards Activity

Every fresh OKX account starts on a tiered fee structure based on thirty‑day trading volume or OKB holdings. Regular users pay a maker fee of 0.08 percent and a taker fee of 0.10 percent on spot trading, rates already slimmer than many other exchanges with similar daily trading volume. Clear one million USD in turnover or park at least five hundred OKB holdings in the wallet and the clip slides to 0.06 maker and 0.08 taker. The ladder then steps through nine levels until high‑frequency desks reach 0.02 maker and 0.04 taker, a figure that keeps experienced traders glued to the order book instead of hunting through other exchanges.

Steep interface can feel like cockpit overload for new arrivals

Scrolling through the OKX exchange for the first time can feel like piloting a jet on day one. A single screen packs real‑time market data, depth gauges, tiered fee structure tables, funding‑rate banners, and toggles for spot trading, margin, and futures trading. Add a DeFi corner, an NFT marketplace, and the integrated OKX Wallet dashboard and a beginner may wonder where to deposit money or place a simple buy order. Daily trading volume numbers flicker next to each pair, tempting users into complex trading strategies before they grasp taker fee mechanics or two factor authentication resets.

The company tries to soften this learning cliff: a Lite mode collapses advanced panels into a user friendly interface and the OKX Academy pushes step‑by‑step clips on how to open an OKX account, safeguard user funds, and earn passive income. Even so, negative reviews on community forums highlight early mis‑clicks that sent orders to the wrong tab or left withdrawals waiting because network fields were missed. Traders who want nothing beyond a basic BTC purchase may find smoother onboarding at other exchanges while they build confidence.

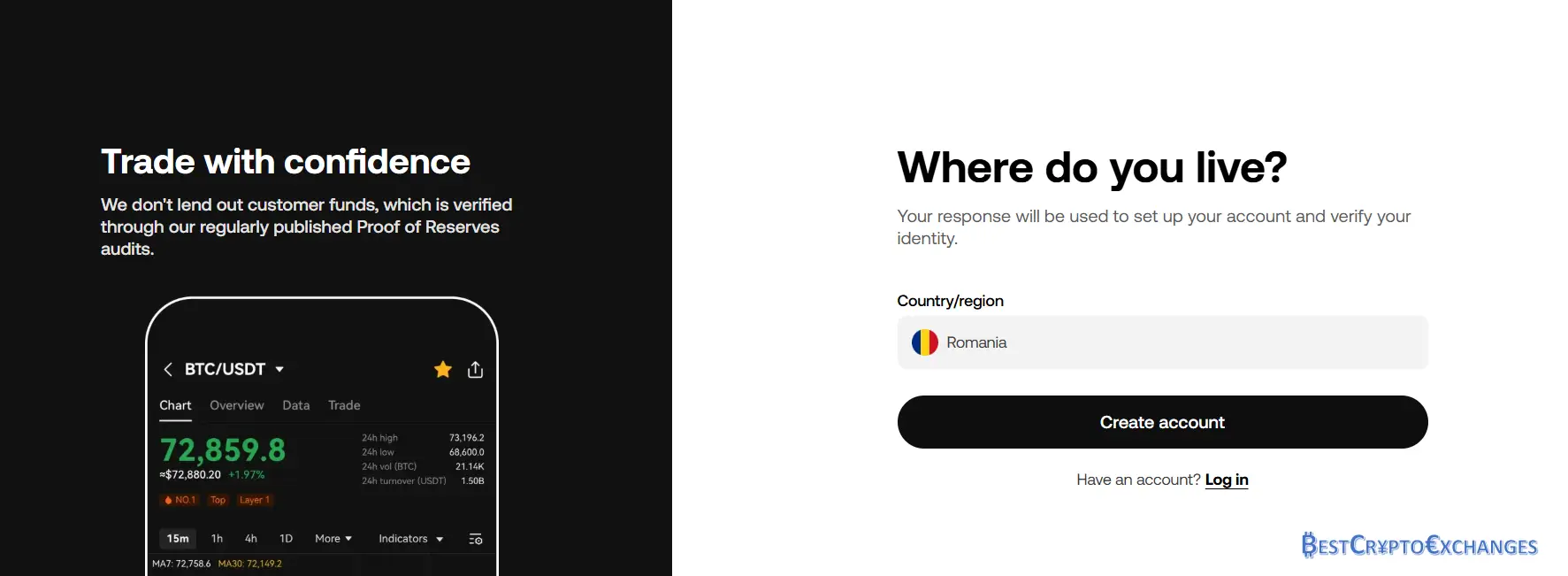

Getting Started on OKX

Launching your OKX journey takes about ten minutes and unlocks one of the world’s largest cryptocurrency exchange dashboards. Begin on the main landing page, tap “Sign Up,” and link an email or phone number to create your OKX account. Complete the quick two‑factor authentication prompt, then upload a passport or bank statement to satisfy European Economic Area KYC standards—verification approval usually lands inside one hour. With identity checks finished, new users can deposit money by card, SEPA, or local wire; fiat deposits post instantly for most currencies, though withdrawals vary depending on the payment rail.

Fresh balance in hand, decide whether to stick with spot trading pairs or explore diverse trading options such as ten‑times margin or one‑hundred‑times futures trading. The platform displays live market data, taker fee estimates tied to its tiered fee structure, and a proof‑of‑reserves badge showing user funds backed one‑to‑one. Connect the integrated OKX Wallet if decentralized finance or NFT marketplace activity fits your trading strategies—transfers settle in seconds and let you chase passive income plays without leaving the ecosystem. Whenever questions surface, a 24‑hour support team stands by across chat, social channels, and ticket queues to resolve onboarding snags noted in older negative reviews.

Creating Your OKX Account

Opening an OKX account takes minutes, yet setup unlocks a full suite of crypto trading, decentralized finance, and NFT tools, all wrapped in robust security and a tiered fee structure.

Visit the homepage and tap Sign Up – Open your browser, type OKX dot com, and hit enter. The splash screen shows live trading volume and proof of reserves data. Click the bright Sign Up button to start building your OKX account for spot trading and futures trading.

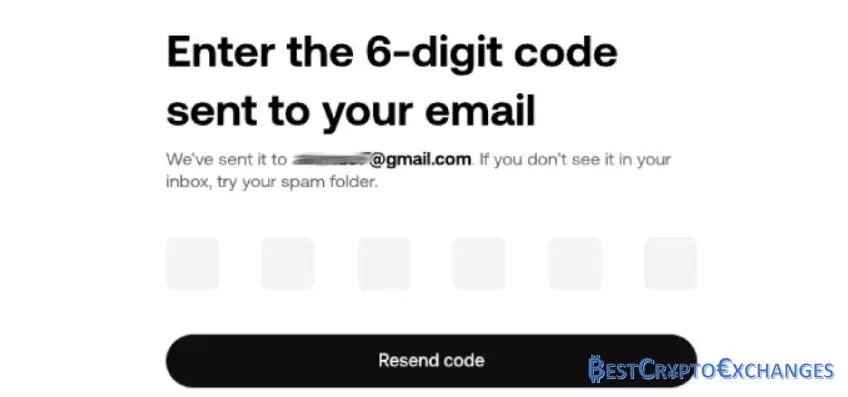

Add contact details and craft a password – Type a frequently‑checked email or a mobile number, set a twelve‑character password that mixes symbols and numbers, then drag the slider captcha across the bar. This quick step keeps automated bots away and protects user funds before two factor authentication kicks in.

Verify the six digit security code – OKX instantly sends a one‑time code by SMS or email. Copy the digits into the pop‑up field within sixty seconds. This secondary check binds your contact point to the exchange and lowers the chance of order ID spoofing later during heavy crypto trading sessions.

Fill in personal profile data – Enter your full legal name, birthday, and residency country so OKX can meet European Economic Area compliance. Accurate information prevents withdrawal delays when daily trading volume spikes and lets the support team resolve account questions without extra paperwork.

Upload identity and address documents – Take a clear photo of your passport or national ID, plus a recent bank statement or utility bill showing the same address. Most verifications complete inside one business day, unlocking fiat deposits, tiered fee structure rebates, and access to the OKX Wallet for decentralized finance activity.

Registration blends global security standards with a user friendly interface. Once verified, regular users gain entry to diverse trading options, low taker fee brackets, and a support team on call, setting the stage for active participation in the OKX exchange ecosystem.

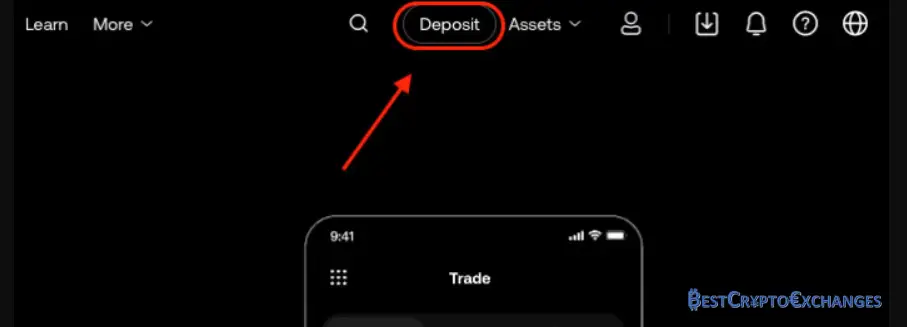

Making a Deposit on OKX

Before you dive into spot trading or futures strategies, loading funds onto your OKX account takes minutes and supports multiple rails. This guide walks through crypto deposits and fiat top‑ups.

Open the Assets Hub – Log in, hover over Assets, and tap Deposit. The panel shows real‑time market data plus estimated taker fee impact, helping regular users prepare cash‑flow before committing funds. Every OKX account inherits the same two factor authentication guardrails, so withdrawals vary depending on that security status.

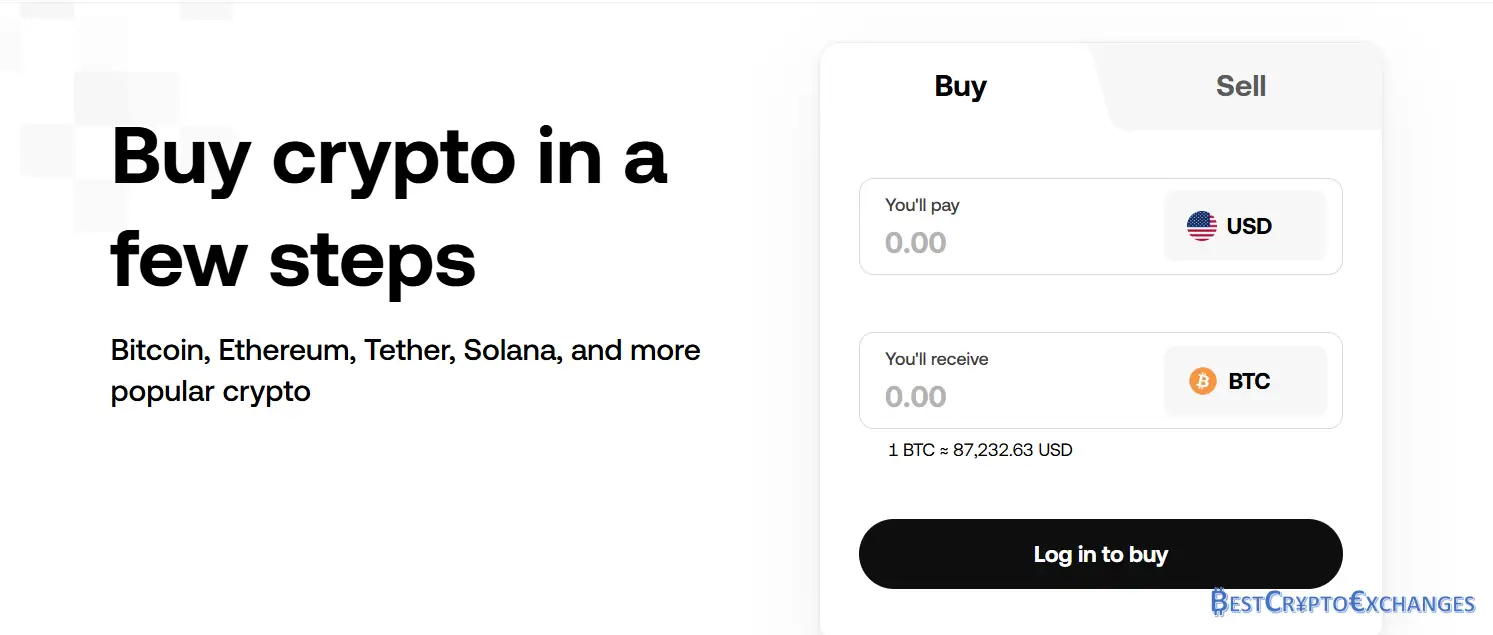

Pick Crypto Deposit or Fast Buy – Choose Crypto Deposit when you already hold digital assets in another wallet, or select Buy Crypto for a direct fiat ramp. Both paths feed into the same user‑friendly interface, letting experienced traders or first‑timers move from decision to confirmation without hunting through hidden menus.

Moving Digital Assets – For crypto, highlight the coin, copy the OKX wallet address—or scan the QR code inside the OKX Wallet extension—and push funds from your external wallet. Bitcoin needs six block confirmations; Ethereum settles after roughly twenty‑five. User funds show under Funding once network finality ticks over, letting you shift them into spot trading or futures trading desks immediately.

Adding Fiat Balance – If you prefer cash, hit Buy with Card/Bank. Select currency (USD, EUR, GBP, JPY, AUD, or a Middle East local unit), decide on Visa, Mastercard, SEPA, wire, PayPal, Apple Pay, Google Pay, Skrill, or Payeer, and verify with a live bank statement or ID prompt. Card rails usually post within a minute; European Economic Area transfers may take the usual banking window.

Popular Fiat Channels | Typical Arrival Time |

|---|---|

Debit / Credit Card | Instant |

SEPA Transfer | 1–24 hours |

PayPal | Under 10 minutes |

SWIFT Wire | 1–3 business days |

Depositing money at OKX is quick, flexible, and backed by proof‑of‑reserves transparency. With crypto trading, decentralized finance staking, and NFT marketplace access all sitting in one platform, getting funds in is the first step toward broader trading strategies and passive income streams.

Takeaways

Closing the books on this OKX review shows a platform that covers most bases serious crypto traders demand. Average daily trading volume near one billion dollars provides depth on both spot and futures order books, while more than six hundred fifty pairs insure plenty of routing choices when volatility spikes. Security practices include cold storage of roughly ninety‑five percent of user funds, multisignature withdrawals, and quarterly proof‑of‑reserves snapshots that present a five‑percent buffer beyond liabilities.

Fees reward activity and OKB holdings: regular users start at 0.08 percent maker, yet desks clearing at least ten million dollars a month can drop to 0.02 percent. The same ladder applies on derivatives, where taker fees begin at 0.05 percent and sink to 0.02 percent for top tiers.

A single OKX account unlocks DeFi staking, an NFT marketplace, Dual Investment products, and a four‑point‑five‑rated mobile app, making the exchange suitable for active traders who value product breadth without juggling multiple platforms.

FAQ

Is OKEx legit?

Yes. OKX holds a Virtual Financial Asset licence from Malta alongside registrations in several other jurisdictions, issues quarterly proof‑of‑reserves reports signed by an independent accounting firm, and publishes public wallet addresses. These steps give traders confidence that balances match liabilities and that genuine regulatory oversight exists today.

Who should use OKEx?

OKX suits traders comfortable with chart studies, order book depth, and a tier‑based fee schedule. High‑volume desks and OKB holders enjoy lower costs, while algorithm developers access an open API. Learners willing to watch Academy videos and practise with test funds can gradually unlock the platform’s powerful toolkit.

How to pick the best crypto exchange for yourself

Begin by checking whether a platform holds licences in your region, then review cold‑wallet percentages and recent security audits. Compare maker and taker tables, withdrawal costs, and daily volume on pairs you plan to use. Finally, test the interface with a small deposit to judge comfort, reliability, and speed.

Which cryptocurrency exchange is best for beginners?

For newcomers, a clear layout saves headaches. Apps like Coinbase or Bitstamp guide the user with purchase buttons and instant quotes, hiding leverage and advanced orders. Once basic spot trading feels natural and concepts such as limit, market, and stop are familiar, moving to OKX opens wider possibilities and fees.

What is the difference between a crypto exchange and a brokerage?

A cryptocurrency exchange hosts an electronic order book where independent buyers and sellers post bids and offers, with the platform charging a small maker or taker fee for matching each trade. A brokerage holds its own inventory of coins or tokens and quotes a single all‑in price to the customer.

Are all the top cryptocurrency exchanges based in the United States?

Global regulation is patchy, so leading platforms spread across various jurisdictions that provide digital‑asset legislation and tax clarity. Binance has entities in Dubai and Paris, KuCoin registers in Seychelles, HTX sits in Singapore, while OKX operates from Malta and Hong Kong. The United States hosts notable names yet certainly not all.